CV industry bottoms out in Covid 19-hit March; FY2020 numbers slide 27%

The onset of the coronavirus pandemic and the result lockdown has come as a bodyblow to the CV sector, after what is a cocktail of growth-impacting factors

The global automotive industry is witnessing one of the most challenging periods on the back of the ongoing Covid-19 pandemic. For the Indian automobile industry, the situation has been worsening with each passing month and, most probably, will result in one of the worst fiscal year performances.

The commercial vehicle segment is known to be the barometer of a country’s economic progress and therefore it comes as no surprise that the last month of FY2020 has seen one of the biggest sales declines in recent times.

The CV segment has been hit with a number of growth-impacting factors such as revised axle load norms, the shift to BS VI emission norms and also a demand crunch due to a prolonged economic slowdown. CV OEMs were fervently hoping for a decent uptick in BS VI-compliant vehicle sales in the last month of FY2020 but Covid-19 pandemic has put paid to those hopes. OEMs have shuttered their factories, dealers have closed operations and any hopes of discounted truck and bus sales were also dashed. Now, some dealers who still hold unsold BS IV stock will be battling to sell that or face losses.

A segment that's awash in red ink

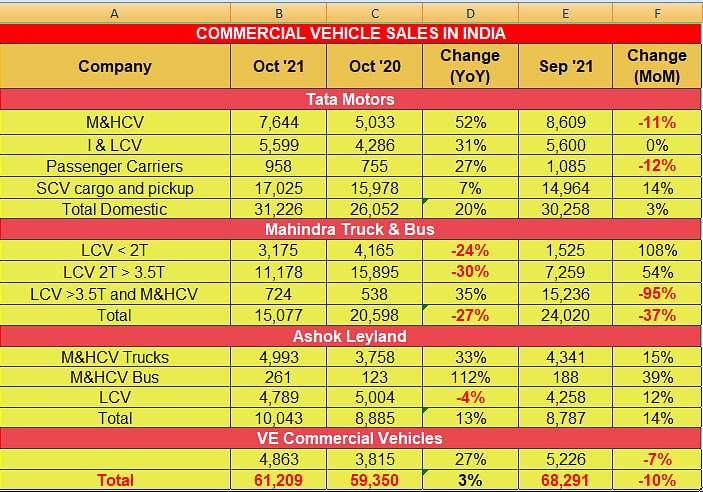

Take a look at the sales details provided by four CV manufacturers -- Tata Motors, Ashok Leyland and Mahindra & Mahindra -- and you get an idea of the magnitude of the decline. March 2020 sales of 12,644 units are a massive 88% down year on year (March 2019: 108,809). And the 12-month FY2020 statistics are gutting for an industry which was hopeful of an uptick from January: 698,504 units, down 27% (FY2019: 10,15,176).

CV market leader Tata Motors' sales numbers spell the story of the overall market. According to Girish Wagh, President, Commercial Vehicles Business Unit, Tata “Cumulatively, commercial vehicle domestic sale for FY2020 at 310,855 units was -34% lower than FY2019. Retail was 16% higher than the offtake for the entire year. Domestic sales in March 2020 was 5,336 units, deeply impacted by the COVID-19 lockdown as well as the planned transition to BS VI. Retail sales were significantly ahead of wholesales (>300%). Almost all BS IV vehicles in the ecosystem have been retailed, however some await registration which was halted due to the lockdown. This will be cleared in the window provided. Productionisation of BS VI vehicles was on track and we have wholesaled the initial few BSVI vehicles.

Our focus is to secure the extensive business continuity plan including ensuring full support to all our customers in need, particularly those who are transporting the essential goods during this challenging period."

Ashok Leyland, the second-largest CV player, reported significant drop in sales last month. The company reported sales of 1,787 units (-91%) in March 2020, compared to 20,521 units for the same month last year. In FY2020, the company sold 116,333 units (-37%), compared to 185,065 units for the same period last year.

Mahindra & Mahindra sold 2,235 commercial vehicles, which includes 4 M&HCVs, and 2,321 units of LCVs in March. For FY2020, the company sold 199,135 CVs (-20%), compared to 248,601 units for the same period last year.

Commenting on the performance, Veejay Ram Nakra, CEO, Automotive Division, M&M said, “Our performance in March has been muted on account of the impact of the current lock-down related to Covid-19 and the disruption in our BS VI ramp-up plan. The latter was planned between February and March but was affected due to the challenges of parts supply from global and local suppliers. We have been able to clear our BS IV inventory, but for fewer than 100 vehicles. However, there are many vehicles that are sold, but not yet registered because of the closure of RTOs.”

Volvo Eicher Commercial Vehicles too reported drop in wholesales with 1,409 units being sold in March, compared to 7,329 units for the same period last year. For FY2020, the company’s domestic sales total 40,036 units (-30.3%), compared to 61,733 units in FY2019.

The cause of concern for the automotive industry especially at the dealership front would be to ensure that the dealers are left with zero BS IV inventory or face huge loss. According to FADA's interlocutory appeal, a total of 105,000 two-wheelers, 2,250 passenger cars and 2,000 commercial vehicles were left unregistered before the country went into a total lock-down on the night of March 24. The appeal also stated that 700,000 two-wheelers, 15,000 passenger vehicles and 12,000 commercial vehicles are still lying unsold with various dealers across the country.

READ MORE Passenger Vehicles sales analysis: March & FY2020

2Wheeler sales analysis: March & FY2020

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Apr 2020

01 Apr 2020

21714 Views

21714 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal