Creta sells 80,476 units in April-November but Ertiga, Brezza closing in fast

Top 5 UVs make up 41% of segment sales and 19.5% of PV numbers; Ertiga and Brezza set to do better with new-gen models in 2022.

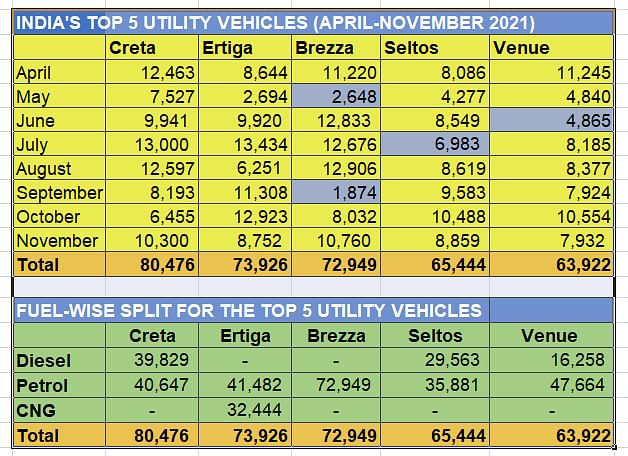

When the top five models in a specific vehicle sub-segment account for 41% of total sales and also for nearly 20% of total passenger vehicles sales in India, then you know they are special. We are referring to the booming utility vehicle (UV) category, which has saved the blushes for the passenger vehicle industry. Between April-November 2021, UVs have sold a total of 870,894 units, accounting for nearly 20% of total PV sales of 18,29,693 units and were just 14,971 units shy of the passenger car total of 885,865 units.

These top five UVs comprise two Hyundais, two Marutis and one Kia – the Hyundai Creta, Maruti Ertiga, Maruti Vitara Brezza, Kia Seltos and Hyundai Venue. The Creta is the No. 1 UV but club the two-model Maruti sales count – 146,875 units – and it’s Maruti which is ruling the segment, ahead by 2,477 units (Hyundai: 144,398 units). And what’s creditable here is that Maruti Suzuki does not have a diesel model and is also the sole CNG player in this five-pack.

Top 5 UVs (356,717 units) contributed 41% to total UV sales of 870,894 units (April-November 2021). Ertiga Just 6,550 units behind the Creta and Brezza 7,527. Sales of Maruti slowed down due to shortage of semiconductors and reduced production.

Let’s take a closer look at these five market movers and shakers.

No. 1 Hyundai Creta – 80,476 units (11.63%)

Hyundai’s Creta, the longstanding UV market leader, continues to top the rankings and along with the Maruti Ertiga has been a regular in each of the first eight months of the year. Its best monthly performance came in July (13,000 units).

Its April-November 2021 tally of 80,476 units is an 11.63% YoY growth (April-November 2020: 72,091) split between 40,647 petrol and 39,829 diesel variants. Delving for more details reveals that in sync with the consumer shift to petrol, the Creta diesel sales are dropping – they are down 6.65% over the year-ago’s 42,669 units. Meanwhile, petrol power amply shows through in the increase of 38% over the year’s ago petrol Creta sales of 29,422 units.

Nonetheless, the Creta’s importance can be seen in its contribution of 49.66% to Hyundai’s total UV sales of 162,031 units in April-November 2021, which in itself are up 35.45% YoY (April-November 2020: 119,619). But there’s a fresh charge from two arch Maruti rivals who are both aiming for the UV crown – the Ertiga MPV and the Vitara Brezza SUV.

No. 2 Maruti Ertiga – 73,926 units (45%)

Just 6,550 units behind the Creta is the Maruti Ertiga with 73,926 units, which constitutes solid YoY growth of 45% (April-November 2020: 50,752). The fuel-wise split is 41,482 petrol and 32,444 CNG variants but clearly Maruti is benefiting hugely from the surge in demand for the CNG variant, what with sky-high petrol and diesel prices. While the petrol model has seen YoY growth of 23% (April-November 2020: 33,643), the CNG model has chalked all of 89.63% YoY growth (April-November 2020: 17,109).

At 73,926 units in the first eight months of FY2022, the Ertiga has contributed 40% to Maruti’s total UV sales of 186,734 units, with sibling Brezza providing another 39% to the overall UV total. Like the Creta, the Ertiga has been a regular in the Top 5 chart for all eight months – in fact, its July 2021 tally of 13,434 units is the best for any UV in the fiscal year to date.

Therefore, it is not surprising that the Ertiga has driven past the 700,000-unit sales milestone, news revealed by Autocar Professional. The MPV’s best annual sales came in FY2020 – 90,543 units sold but it looks like the Ertiga will better that in FY2022. Having averaged monthly sales of 9,240 units in the April-November 2021 period, Maruti Suzuki should see this popular MPV model cross the 100,000-unit sales mark for the first time in fiscal, with four months left for FY202’s closure.

No. 3 Maruti Vitara Brezza – 72,949 units (49%)

Just 977 units behind its sibling Ertiga and 7,527 behind UV market leader Creta, the Vitara Brezza has maintained its growth trajectory. Admirably, in this lot, it is the only one with a single fuel option – petrol. With sales of 72,949 units, the Brezza has recorded robust 49% YoY growth (April-November 2020: 48,902) and contributed 39% to Maruti’s total UV sales of 186,734 units.

Like the Ertiga, the Brezza too has notched its personal milestone – 700,000 sales in less than 7 years, news which Autocar Professional broke on December 10.

Now, Maruti Suzuki is getting ready to launch the MY2022 model. The new Vitara Brezza (codename: YTA) will be the first SUV from Maruti’s new model offensive to be launched in India. The new SUV has been spied without camouflage. And in a move which could add more wind in the Brezza’s sales is that Maruti Suzuki is considering bringing the Brezza into its CNG stable of models.

No. 4 Kia Seltos – 65,444 units (19%)

At fourth place in the pecking order is the Kia Seltos with 65,444 units in the first 8 months of FY2022, which marks 19.34% YoY growth over the year-ago sales of 54,834 units. The fuel-wise split for the Seltos’ sales is 35,881 petrol (up 13% YoY: 31,686 units) and 29,563 diesel (up 27% YoY: 31,686 units). The fuel wise split is 55:45 in favour of petrol.

The Seltos, Kia’s first product in India, has sold a total of 236,333 units since launch in August 2019 till end-November 2021.

No. 5 Hyundai Venue – 63,922 units (36%)

Hyundai’s compact SUV has sold a total of 63,922 units, which is a 36% increase over the year-ago sales of 46,934 units. The fuel-wise split is 47,664 petrol and 16,258 diesel which makes for a 74:26 ratio overwhelmingly in favour of the petrol Venue.

Growth outlook: SUV-ival of the fittest in 2022

Maruti Suzuki and Hyundai Motor India, with UV market shares of 21.44% and 18.61% respectively, together have a 40% share. Mahindra is third is 15% and Kia India with 13.66%. All four OEMs, along with some other players, would have sold more in past eight months of FY2022 had it not been for the crippling impact of the semiconductor shortage on their production and resultant stocks with their dealers. They even lost out of potential high sales in the festive season in November when purchase of new vehicles is high on consumer agenda. Given that Maruti Suzuki, which has an estimated 250,000 bookings across its PV range, It wouldn’t be wrong to hazard a guess that in normal times the company would have been ahead of Hyundai in the overall UV numbers.

What’s more, with Maruti Suzuki readying to launch the next-generation models of the Ertiga and the Brezza, expect these two models to be among the newsmakers on four wheels in the new year.

The SUV market, which has seen an inflow of new models like the Mahindra XUV700, MG Astor, Skoda Kushaq ad Volkswagen Taigun will see some more additions in the early part of 2022.

With every OEM worth its wheels wanting to ride the surging wave of SUV demand, this is one segment where the action can turn even more exciting.

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

19 Dec 2021

19 Dec 2021

9796 Views

9796 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi