Commercial vehicles swept away in May mayhem

May 2021 sees commercial vehicle sales crash to 20,001 units, 47 percent lower than in April.

May 2021 saw sales of commercial vehicles crash to 20,001 units, 47 percent lower than the preceding month.

With the second wave of Covid-19 spreading its reach in rural India, most states went in for lockdowns which brought economic activity to a screeching halt. The biggest casualty in the process was the CV segment.

In addition, availability of funds, low-capacity utilisation in M&HCVs and revised axle load norm continue to dog purchase decisions for many customers. On the flip side, the growth in home deliveries is the best piece of news for pickups. This will also mean a fillip to electric mobility which is seen as the best bet for last-mile connectivity in cities.

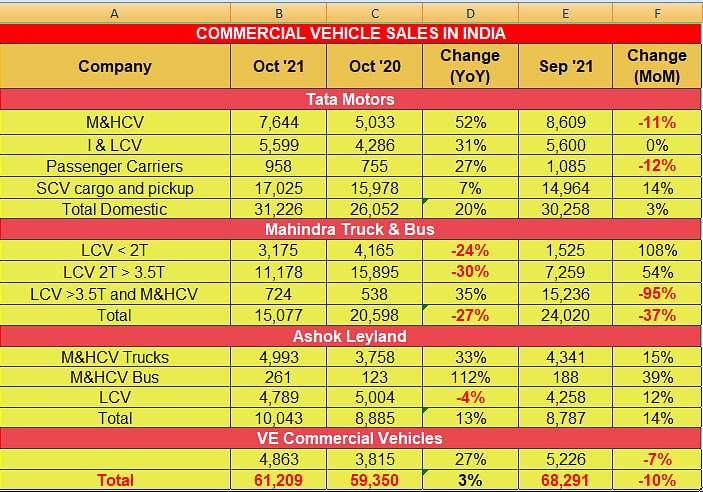

Tata Motors sold 9,371 units, down 35 percent from April 2021. In the case of Ashok Leyland, numbers plummeted 66 percent to 2,738 units from the preceding month. With the double whammy of weak demand and lockdown in the states where its plants are located, the Chennai-headquartered company has announced that its plants will be operational for only 10 days in June.

Mahindra & Mahindra's tally was 7,236 units, a fall of 49 percent from 14,104 units in April 2021. The company’s sub-2-tonne LCV segment was unsurprisingly the only segment to report positive growth. “We are seeing strong growth momentum for our entire product portfolio. With the cases coming and gradual reopening of markets, we foresee strong demand rebound,” said Veejay Nakra, CEO, Automotive Division.

VE Commercial Vehicles did a little better reporting sales of 656 units in May, down 58 percent from 1,555 units in April 2021. Clearly, the CV industry faces tough times ahead with high diesel prices only adding fuel to the fire. Yesterday, the first fuel price hike of June saw diesel cost Rs 92.69 a litre in Mumbai. Diesel prices have increased by Rs 4.50 a litre through 17 hikes in 26 days and by Rs 27.50 a litre since BS VI kicked in from April 2020.

Observers believe the real revival could only begin gradually from September but even this will depend on the Centre pumping in more money into the economy apart from an aggressive vaccination drive to keep the third wave of the pandemic at bay.

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

02 Jun 2021

02 Jun 2021

11744 Views

11744 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi