CNG vehicle sales jump 38% to 940,000 units in FY2024, CNG price cut by Rs 2.50 per kg

Sharp rise in demand for compressed natural gas-powered three-wheelers, passenger vehicles, goods carriers and buses in the first 11 months of FY2024. The recent price cut by Rs 2.50 per kg will act as a catalyst and further accelerate sales.

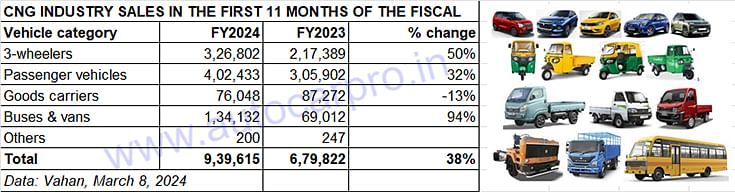

Demand for alternate fuels from vehicle buyers is growing and along with the transition to electric mobility, the CNG vehicle industry is currently witnessing strong double-digit growth. As per retail sales data from Vahan, as of March 8, 2024, a total of 939,415 CNG-powered vehicles have been sold in the first 11 months of the current fiscal year. This constitutes strong 38% year-on-year growth (April 2022-February 2023: 679,575 units).

CNG Passenger Vehicles: 402,433 units, up 32% YoY

CNG Passenger Vehicles: 402,433 units, up 32% YoY

Maruti Suzuki's strong grip on the market, Tata ahead of Hyundai

With a 43% contribution to overall CNG vehicle sales between April 2023 and February 2024, the passenger vehicle industry with 402,433 units and 32% YoY growth has the largest share of the CNG vehicle industry.

With this, CNG PV sales have raced past FY2023’s record sales of 327,820 units. At this pace, and with March 2024 still to be counted, India CNG PV Inc is likely to register its best-ever fiscal sales of around 450,000 units and more.

What has helped accelerate sales is the rollout of new models and SUVs. The launch of the Tata Punch CNG compact SUV (Rs 710,000-Rs 968,000 ex-showroom) was Tata Motors’ response to the introduction of the Hyundai Exter CNG compact SUV (Rs 824,000-Rs 897,000, ex-showroom). In early February 2024, Tata Motors launched the Tiago and Tigor CNG AMT. While the Tiago iCNG AMT is priced between Rs 790,000 and Rs 880,000, the Tigor iCNG AMT ranges from Rs 885,000 to Rs 955,000.

This takes the total number of CNG cars and SUVs sold in India to 23 models. There are only four CNG carmakers in India. Maruti Suzuki India, with all of 13 models (Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Swift, Wagon R, XL6, and the Fronx), understandably, has a vice-like grip on the market. In the ongoing fiscal, Tata Motors is ahead of Hyundai Motor India. While Tata Motors has four models (Altroz, Tigor, Tiago, Punch), Hyundai Motor India’s CNG range has expanded to three models now (Aura, Grand i10 Nios, Exter) and Toyota Kirloskar Motor has three CNG-powered passenger vehicles (Glanza, Hyryder, Rumion).

CNG 3-Wheelers: 326,802 units, up 50%

CNG 3-Wheelers: 326,802 units, up 50%

Bajaj Auto market share grows to 87%

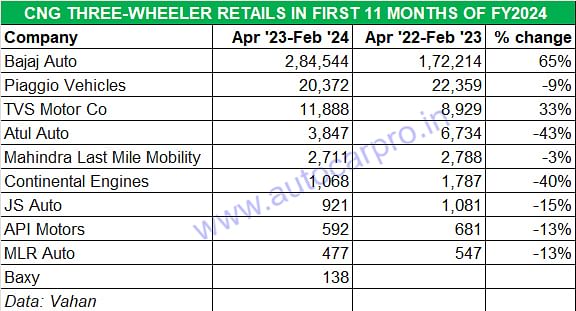

Like PVs, the CNG-powered three-wheeler market is also witnessing a strong run and the 284,544 units in the first 11 months of FY2024 are up 50% YoY. Bajaj Auto, with 284,544 units, up 65% YoY, has a stranglehold with an 87% market share, leaving the others to battle it out for the remaining 13% share of the pie. As per the Vahan data, Bajaj Auto and TVS Motor Co are the only ones to record growth, reflecting the fact that they have eaten into their rivals’ market share.

Piaggio Vehicles, the No. 2 player in this segment, has sold 20,372 units for a 6.23% market share. TVS Motor Co, with 11,888 units, has recorded 33% YoY growth and currently has a 3.63% market share. There are three OEMs with four-figure sales: Atul Auto (3,847 units), Mahindra Last Mile Mobility (2,711 units) and Continental Engines (1,068 units).

Piaggio Vehicles, the No. 2 player in this segment, has sold 20,372 units for a 6.23% market share. TVS Motor Co, with 11,888 units, has recorded 33% YoY growth and currently has a 3.63% market share. There are three OEMs with four-figure sales: Atul Auto (3,847 units), Mahindra Last Mile Mobility (2,711 units) and Continental Engines (1,068 units).

CNG Goods Carriers: 76,048 units, down 13%

CNG Goods Carriers: 76,048 units, down 13%

Tata Motors maintains leadership but sales down 22%

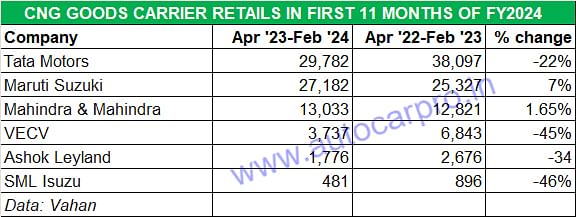

The CNG goods carrier market, comprising light, medium and heavy goods carriers, continues to be down. In terms of numbers, particularly for light goods carriers, has been impacted by the transition to electric vehicles,where the lower cost of ownership, compared to CNG, is driving demand from last-mile mobility and logistics operators.

A year ago, CNG-powered goods carriers across categories (small, medium and large), accounted for 13% of the overall CNG vehicle market – that has now reduced to 8% in the April 2023-February 2024 period with sale of 76,048 units, down 13% on year-ago sales of 87,272 units.

As per Vahan data for the 11-month period under review, four OEMs have seen their sales decline year on year. Tata Motors, which has a fairly large range of commercial vehicles ranging from the Ace through to the Ultra, remains the market leader with a 39% market share with 29,782 units. However, this number is down 22% YoY.

At No. 2 is Maruti Suzuki India, which sold 27,182 Super Carrys to register 7% YoY growth and a 36% market share. Mahindra & Mahindra, with 13,033 units, has recorded 2% growth and has a 17% share of the goods carrier market. VE Commercial Vehicles, with 3,737 units, sees its numbers down 45% year on year,

And Ashok Leyland with 1,776 units saw demand down by 34% YoY SML Isuzu with 481 units versus 896 units a year ago sees sales down 46% year on year.

Overall, the demand for CNG vehicles continues to be driven by the lower cost of ownership mantra that the greener fuel offers in the face of high petrol and diesel prices. The latest price cut will only serve to spur demand in FY2024.

MAHANAGAR GAS CUTS CNG PRICE TO Rs 73.50 PER KG

On March 6, Mahanagar Gas reduced the price of CNG (compressed natural gas) by Rs 2.50 to Rs 73 per kilogram from Rs 76 per kg as of March 6, 2024 in and around Mumbai. This is the first CNG price reduction in CY2024 by the company which had reduced prices three times in CY2023.

The last one – a similar Rs 2.50 price cut – in CY2023 was on October 1, 2026, which had taken the price to Rs 76 per kilogram. CNG price had hit its all-time high of Rs 89.50 per kg in November 2022, following eight price hikes in the first 10 months of CY2022.

The latest March 6, 20024 price reduction of Rs 2.50 per kg is attributed to a reduction in gas input costs. According to Mahanagar Gas, CNG at Rs 73.50 per kg offers savings of 53% when compared to petrol (Rs 106.29 a litre on March 6) and 22% versus diesel (Rs 94.25 per litre).

From a consumer’s point of view, other than the environment-friendliness of CNG, a CNG-powered vehicle provides considerable savings compared to its petrol or diesel-engined siblings. What’s also driving the consumer shift to CNG models is the high price of petrol (Rs 106.31 a litre in Mumbai) and diesel (Rs 94.25 a litre in Mumbai on March 8, 2023), which have remained unchanged since around May 2022.

Following Mahanagar Gas' latest price cut of CNG, tanking up on CNG is Rs 32.81 cheaper than petrol and Rs 20.75 cheaper than diesel in Mumbai. It is learnt that other CNG producers have also reduced their prices across India. This recent price cut should to give a fillip to sales of CNG vehicles in FY2024, which is set to break a slew of sales records across segments and fuels.

ALSO READ:

CNG car and SUV sales jump 29% in current fiscal, Maruti share at 69%, Tata ahead of Hyundai

Electric two-wheeler sales exceed 800,000 units in first 11 months of FY2024

Electric 3-wheeler sales to surpass 600,000 units in FY2024

Electric PV sales soar to 79,550 units in first 11 months of FY2024

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

09 Mar 2024

09 Mar 2024

23800 Views

23800 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi