Auto retails up 10% YoY in July, all segments log YoY growth but three-wheelers shine

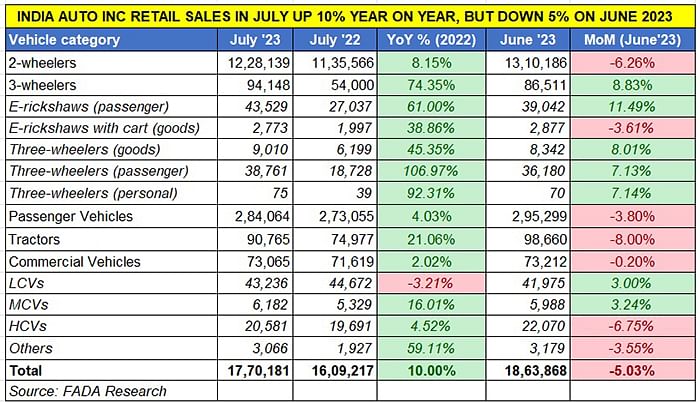

July 2023’s 1.77 million units sees YoY growth for all vehicle categories – two-wheelers (up 8%), three-wheelers (up 74%), PVs (up 4%), tractors (up 21%) and CVs (up 2%). However, compared to June numbers, other than 3Ws, all see a decline indicative of a short-term slowdown.

The real-world, retail sales numbers for India Auto Inc are out and they look to be a mixed bag. The good news is that overall sales of five vehicle segments at 17.70 million units are up 10% on July 2022’s 16.09 million units. The not-so-good news is that this number is down 5% on June 2023’s 1.86 million units, indicating a marginal slowing down on a high month-ago base.

As per the data released by the Federation of Automobile Dealers Associations of India (FADA), as depicted below, all five vehicle segments – two- (up 8%) and three-wheelers (up 74%), passenger vehicles (up 4%), tractors (up 21%) and commercial vehicles (up 2%) – and their sub-segments other than LCVs have registered growth.

However, when seen on a month-on-month basis, four vehicle segments other than three-wheelers have shown a decline over June 2023 retails. Compared to what they sold in June 2023, two-wheeler retails in July 2023 are down by 6%, three-wheelers by 9%, PVs by 4%, tractors by 8% and CVs by a marginal 0.20 percent.

Commenting on India Auto Inc’s market performance in July 2023, FADA president Manish Raj Singhania said: "Auto retail grew 10% YoY in July, mirroring last month's trend. However, the month-on-month decline continued, highlighting short-term slowdowns.”

TVS, Royal Enfield, Suzuki increase market share

Despite challenges like heavy monsoons and a tilt towards EVs due to high petrol prices, sales of two-wheelers showed resilience in July 2023, with increased demand and trust in reputable brands. The total retails of 12,28,139 units were an increase of 8.15% YoY (July 2022: 11,35,566 units). Hero MotoCorp with flat sales of 361,291 units maintains its leadership with a 29.42% market share, albeit that stands reduced from the 31.85% it had a year ago. Honda Motorcycle & Scooter India, with 299,090 units, posted 9.45% YoY growth (June 2022: 273,260) but maintains status quo on its 24% market share.

TVS Motor Co, with 213,101 units, has clocked 18% YoY growth (June 2022: 180,707), a performance which is reflected in its improved market share of 17.35% versus 16% a year ago.

Likewise, Suzuki Motorcycle India with 62,204 units, recorded 26% YoY growth (June 2022: 49,483), bettering its year-ago share of 4.36% to 5.08 percent in July. Royal Enfield continues to see demand surge for its popular models, selling 55,478 units, up 26.51% (June: 43,852) and sees its market share improve to 4.52 percent. Seventh in the two-wheeler OEM rankings is India Yamaha Motor with 45,746 units, up 5% (June 2022: 43,512). India’s best-selling electric two-wheeler OEM Ola Electric is next with 19,263 units, which gives it a 1.57% share of the overall ICE and EV market. Ola has achieved a near-400% YoY increase in sales in July. Similarly, Ather Energy with 6,620 units saw demand rise by 413% (July 2022: 1,289). Sales of these two EV OEMs is reflective of the maturing Indian consumer who, despite product prices rising after the FAME subsidy, have gone ahead with their purchase decision.

Of July’s 94,148 three-wheeler sales, EVs (46,302 units) accounted for 49%, growing handsomely by 59% YoY (July 2022: 29,034).

Of July’s 94,148 three-wheeler sales, EVs (46,302 units) accounted for 49%, growing handsomely by 59% YoY (July 2022: 29,034).

Three-wheelers hit record sales of 94,148 units, EV share grows to 49%

The three-wheeler segment is firing on all cylinders and July 2023 numbers are its best-ever monthly sales at 94,148 units, up 74% YoY and up 9% on June’s 86,511 units, indicating that there is considerable potential for growth. July sales beat the previous high of March 2023: 86,857 units.

While the FADA president points out that “addressing issues like OEM support and dealer engagement remains crucial”, the fact is that this segment is set to notch a new high for the calendar year and the fiscal.

What is providing a new charge is the sustained demand for electric three-wheelers in the face of high petrol, diesel and CNG prices. Of July’s total 94,148 units, EVs (46,302 units) accounted for 49% of them, growing handsomely by 59% YoY (July 2022: 29,034). The EV share of the three-wheeler market has risen by 6% from the 53% they had in July 2022.

The rapid growth of the electric three-wheeler market can be gleaned from the retail sales data from the government of India's Vahan website. This sub-segment, which sells passenger-transporting e-rikshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Cumulative e-three-wheeler retails in the January-July 2023 period have clocked 300,099 units, up by a strong 79% YoY, indicating that demand remains strong. Mahindra Last Mile Mobility, with 28,443 units and a 9% market share leads the 440-odd OEMs in this segment.

Passenger Vehicle retails up 4% in July, Maruti, M&M, Toyota make strong gains

Like the three-wheeler segment, the passenger vehicle industry is another growth driver and July retails at 284,064 units were up 4% on July 2022’s 273,055 units. The top 6 OEMs account for 256,022 units or 90% of total PV retails in India last month.

Riding on the surging demand for its new SUVs like the Grand Vitara, Jimny, Fronx and the just-launched Invicto MPV, Maruti Suzuki registered sales of 117,571 units, enabling it to increase its market share to 41.39% from 39% a year ago. In comparison, No. 2 player Hyundai Motor India, with 40,945 units, saw sales decline 6% (July 2022: 43,499 units) and its market share also down to 14.41% from 16% a year ago.

Tata Motors, with 39,033 units, posted a 6% YoY increase (July 2022: 36,852) which gives it a 13.74% PV market share. Mahindra & Mahindra, with strong 36% YoY growth through 28,778 units, has increased its market share to 10.13% from 7.76% a year ago. Toyota Kirloskar Motor too has seen a good July – 15,357 units make for 16% YoY growth and improve its PV share to 5.41%. Kia India, with 14,338 units, however, sees its July sales down 21% (July 2022: 18,127 units).

Commenting on PV retails last month, Manish Raj Singhania said: PV sales in July 2023 were a mix of challenges and triumphs. The month saw a surge in orders and timely OEM supplies, especially with the introduction of new products. However, severe monsoons and flood-like situations especially in North India, impacted sales. SUVs continued to remain a popular choice.”

CV sales up by a marginal 2%

The commercial vehicle segment saw total retail sales of 73,065 units, up marginally by 2% (July 2022: 71,619 units) and just 0.20% on June 2023’s 73,212 units. LCVs with 43,236 units were down 3% YoY but up 3% on June’s 41,975 units. Medium CVs, at 6,182 units, saw 16% YoY growth as well as 3% growth over June 2023: 5,988 units. The critical heavy CV sub-segment with 20,581 units witnessed a 4.52% increase over year-ago sales of 19,691 units albeit it was down 7% on the year-ago sales of 22,070 units.

According to the FADA president, “The CV segment showed mixed dynamics. Despite robust stock availability and growth in areas like school buses, challenges from erratic weather and high vehicle costs affected demand. However, infrastructure project boosts remain a silver lining."

Market leader Tata Motors sold 26,635 units, down 6.38% (July 2022: 71,619 units) which is reflected in its overall CV market reducing to 36.45% from 40% a year ago. Mahindra & Mahindra remains in second place by dint of its strong Bolero Pikup volumes – the company sold a total of 17,582 CVs, which makes for 1.6% YoY growth but also sees its market share stay static at 24 percent.

Ashok Leyland, which is seeing better traction, sold 11,600 units, improving upon its year-ago sales by 8% and increasing its overall CV share to 16% from 15% in July 2022.

FADA's near-term growth outlook

FADA remains optimistically cautious about growth and believes that the two-wheeler industry’s better fortunes will be driven by upcoming festivals, a harmonious supply-demand equilibrium and the rollout of new models. Three-wheelers, as detailed above, are witnessing a surge in interest, particularly towards electric variants. For the CV sector, the upcoming festive season, the gains from a bountiful monsoon across the country and pent-up demand set the stage for potential growth. Similarly, the PV segment is likely to benefit from festive euphoria and new product introductions coupled with high-demand for SUVs.

But along with these tailwinds also loom some challenges to future growth. According to FADA, demand for entry-level motorcycles, which constitute the bulk of demand for two-wheelers, continues to be a cause for concern. In CVs, there are apprehensions regarding streamlined loan disbursements for buyers. Meanwhile, the inventory level in PVs has breached the 50-days’ mark in anticipation of upcoming festival season even as the slowdown in demand for entry level cars persists. A larger concern though is the IMD's projection of a below-average rainfall in August, potentially leading to lower crop yields. This could impact people’s purchasing power, especially in rural India. While the industry has experienced a tepid trend over the past two months, FADA states that it “remains watchful in the short term” even as there is optimism about a rise in retails as the industry drives towards the festive season.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

07 Aug 2023

07 Aug 2023

9322 Views

9322 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal