Exports sustain the drive for global carmakers in India

Sales in overseas markets of their made-in-India passenger vehicles are helping Ford, Nissan, Volkswagen and GM combat the pressure of a slowing India market. Shobha Mathur reports.

In a time of demonetisation, the Make-in-India mantra is paying dividends, particularly on the export front for four global OEMs – Ford, Nissan, General Motors and Volkswagen.

The Indian automobile industry threw up some surprises in 2016 before the cash crunch turned into a speedbreaker in November in the domestic market, which was beginning to see sales accelerate as a result of a better monsoon, infrastructural development and an uptick in the rural economy.

While India is fast developing as a hub for small car manufacturing, it is also evolving into a major export hub for small cars wherein Hyundai leads as the largest car exporter from India. Contributory factors to the fast-growing small car exports is an abundance of skilled labour force, low cost of manufacturing compared to global markets and upskilling of the supply chain that can now meet international quality standards. As India enters into more Free Trade Agreements with global powers, additional new markets are set to be opened up that will offer a vista of new opportunities for the passenger vehicle industry.

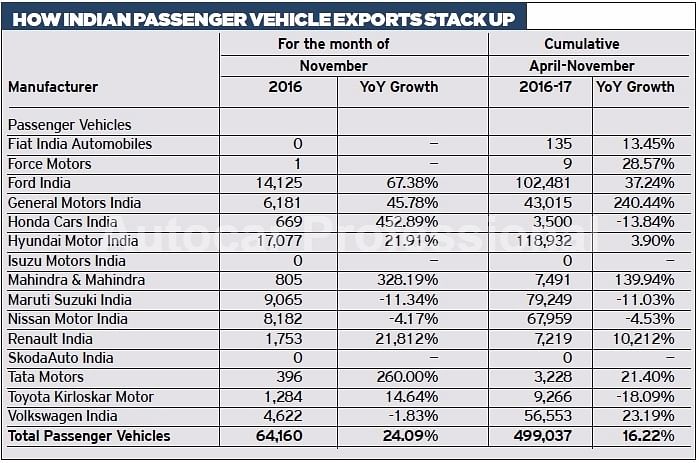

A close look at April-November 2016 export numbers shows Ford India to be second in the pecking order to leading exporter Hyundai Motor India in volumes followed by Maruti Suzuki India, Nissan Motor India and Volkswagen India. All this while the international markets of Europe are still gaining steam and Latin America and Africa have been embroiled in currency volatility along with economic and political issues.

For the eight-month period under review, total shipments of passenger vehicles (PVs) were 499,037 units, which mark a year-on-year rise of 16.22 percent. The big gainer is Ford India which has exported 102,481 units (+37%), thanks to demand for the new Figo which is sold as the Ka+ in the UK and Europe. Volkswagen India has notched 23 percent year-on-year gains with despatches of 56,553 units. GM India has also seen a surge in its exports, particularly of the left-hand-drive Chevrolet Beat to many countries including Mexico, Chile, Peru, Central American and Caribbean Countries, Uruguay and Argentina. The company exported 43,015 units, a massive 240 percent YoY growth albeit on a very low base. Nissan Motor India, which shipped a record 11,999 cars in September 2016 (+20%), however, has seen a 4.53 percent YoY decline in its overall numbers for the eight-month period under review – 67,959 units.

These four carmakers typically see higher sales for these made-in-India cars in export markets than their sales in the Indian market. Between April-November 2016, Ford India has sold 60,806 units (+13.68%), Volkswagen India 32,877 (15.68%), GM India 17,868 units (-18.65%) and Nissan Motor India 39,123 (53.86%). Meanwhile, export biggies like Hyundai Motor India and Maruti Suzuki India are seeing fluctuating fortunes on the export front, but that could be largely due to manufacturing capacity constraints. Both carmakers are running at near-peak capacities and with surging domestic demand, exports have taken a hit. Hyundai has exported 118,932 units in April-November 2016 (+3.90%) while Maruti Suzuki India’s exports at 79,249 units have seen a decline (-11%) for the first eight months of FY2016-17. The Creta has been a large export volume driver for the Korean carmaker in India along with the Grand i10. Meanwhile, the Baleno hatchback has been the largest driver of exports for Maruti Suzuki in the ongoing fiscal.

Nissan stays bullish on exports

If August 2016 saw Ford overtake Hyundai, then September was witness to the Nissan Micra surging ahead as the most exported car brand, followed by the Ford EcoSport and the Chevrolet Beat. Since Nissan commenced operations in India at Chennai in 2010, it has clocked exports of around 650,000 cars. Its Chennai plant has evolved into an export hub exporting around 100,000 cars annually to 106 countries, thereby catapulting Nissan onto the world stage as among the top five car exporters in the country with its made-in-India brands. The Micra, manufactured at its Oragadam plant near Chennai, is exported to over a hundred countries and is quite popular there. “We aim to remain one of the largest automotive exporters from India as part of our commitment to support the Make-in-India vision. By using our manufacturing plant in Chennai, which is one of the largest Renault-Nissan Alliance plants, we are well positioned to cater to the demands from overseas as well as future markets,” Guillaume Sicard, president of Nissan India Operations, told Autocar Professional.

Nissan has been receiving a good response worldwide to its India-made models manufactured at its Oragadam plant. From April to October 2016, the Japanese carmaker exported around 45,000 Micra cars. During the last fiscal, Nissan had shipped 75,450 Micras to overseas markets. Earlier this year, Nissan also announced the start of exports of the Datsun Redigo to Sri Lanka and Nepal, in addition to the Datsun Go and Go+ MPV to South Africa indicating its thrust on exports. Today Nissan has a large bouquet of offerings in the local market including its latest model the Redigo and its sport variant, Sunshine Orange Micra, Terrano six-speed Advance Auto Drive to choose from.

Sicard says Nissan has a focused approach for the domestic market in India and a long-term growth plan for India. The carmaker aims to achieve a five percent market share by 2020 from the current two percent share. To reach this target, it plans to introduce eight new cars by 2021. It also visualises a huge potential in rural areas, Tier 2 and 3 markets and will capitalise on them by establishing more touch points. Starting FY2017-18, Nissan aims to go the full hog to roll out one new model every year in India. The first product in this new model journey will be launched at the Auto Expo 2018.

GM sees an uptick

Between April-October 2016, GM India has more than tripled its exports of the made-in-Talegaon Chevrolet Beat.

For GM India, Talegaon in Maharashtra is one of the global manufacturing locations for the Chevrolet Beat-badged Spark outside of India. The carmaker began exporting the Beat from India to Chile in September 2014. The company manufactures and exports the left-hand-drive Beat to Mexico, Chile, Peru, Central America and the Caribbean countries (CAC), Uruguay and Argentina.

“We always assess possible export markets, within the context of GM’s global manufacturing footprint and the potential for sustainability and profitability,” says Kaher Kazem, president and managing director of GM India.

Meanwhile, the made-in-India Chevrolet Beat leads its segment and is the third most popular vehicle in Mexico by sales volumes. Overall, it has received a positive response in export markets globally. For GM India, 2,000 percent of its growth in exports came between 2014 and 2015, while it grew 251 percent between 2015-16, claims the company.

This year the American carmaker has exported 54,643 units of the Chevrolet Beat. Last year the company exported 20,995 Beats. Between April-October 2016, GM India has more than tripled its exports of the hatchback. While not ready to disclose its future export targets, Kazem maintains that exports will continue to play a critical role in their business.

Unlike other carmakers, GM exports only cars at present. But its engineering centre based at Bangalore works on global programs. The American carmaker has not fared too well in the Indian market. Starting with its small hatchback and diesel portfolio late, it was unable to cash in on the growth in this market unlike Maruti Suzuki India and Hyundai Motor India, which had their fingers firmly placed on the pulse of the Indian consumer right from the word go.

Last year GM announced a slew of growth plans for India including a $1 billion investment till 2020, with plans to shut down its Halol operations in Gujarat by 2016 to trim costs. The fresh investment was to be used primarily to expand the capacity at its Talegaon plant in Pune from 1,30,000 units a year to 220,000 by 2025. Ten new models over the next five years was another goal. But in mid-2016, GM indicated that it was relooking at its India investments and putting on hold a new car platform for the country.

Despite these hiccups, the company claims that Chevrolet is moving fast to respond to changing trends and customer demand in India. Earlier this year, GM announced that the all-new Chevrolet Beat Activ soft-roader will go into production. The Beat Activ was introduced as a Chevrolet concept vehicle at the India Auto Expo in February. The next wave of Chevrolet product line-up to hit the Indian market will be the new Beat, Essentia and Beat Activ. “These models were distinctly developed for the Indian market.

However, there is no doubt they will have a global appeal,” elaborates Kazem.

Many of Chevrolet’s Indian component suppliers are part of the global supply chain. The company says that along with its partners it is leveraging the best technology and service levels to achieve world class quality levels at the most optimised cost.

Mexico buys big from VW India

Apart from fully built cars, Volkswagen’s Pune facility also exports components of its Polo and Vento cars to Malaysia.

Volkswagen India is another global OEM which is benefitting from its export strategy. The German major exports cars from its Pune plant to over 35 countries across the four continents of Asia, Africa, North America and South America. Mexico is its biggest export market, contributing over 80 percent of its overseas volumes.

Volkswagen further plans to continue pushing its products in the same markets in the coming year. However, it is mulling various options for exports and evaluating which of its products would find wider acceptance and demand in varied markets. “Volkswagen follows the philosophy of manufacturing the same quality cars across the world. Hence, the products that we manufacture here in India maintain the same quality with no compromise on safety and construction, which in return creates opportunities for us in the global markets,” says Dr Andreas Lauermann, president and managing director, Volkswagen India.

For Volkswagen, which was bogged down by the emissions scandal for most of the past year, its made-in-India cars that have been exported have found wide acceptance in several global markets. “The consumers appreciate Volkswagen cars for their robust build quality, safety features, ride and handling amongst many other attributes. Our customers in the export markets get all of this from the India cars, that is why we have increased our export numbers every year since 2012,” says Dr Lauermann.

The brand has continued to see growth in the domestic market and the launch of the Ameo compact sedan just prior to the Auto Expo 2016 has been incremental to this progress. The Volkswagen brand witnessed a growth of 70 percent during the festive month of October over the same period in the previous year and is bullish of continuing with this momentum.

“We are currently on track for our growth trajectory in 2017 and want to be present across segments to cater to all types of customer needs. Our two products, Volkswagen Passat and Tiguan are planned for the year 2017,” adds Dr Lauermann. The carmaker is firming up plans to grow substantially during CY2017, both in the domestic market and on the export front.

Volkswagen India celebrated five years of car exports from India in March 2016 and its export programme has become a key growth driver for it. Apart from fully built cars, Volkswagen’s Pune facility also exports components of its Polo and Vento cars to Malaysia where they are assembled for the local market.

The company is now focusing on localisation in a big way and several of its first-time Indian suppliers developed for the local market have been successful in bagging business from its different global manufacturing facilities within the Volkswagen Group.

Ford begins exporting the Ka+

Ford India is another American carmaker that was unable to read the Indian consumer early on and began operations with large cars. It entered the small car segment with the Figo hatchback many years later. Both GM and Ford were more successful in exports during CY2016.

Ford commenced exports of the Chennai-made Figo to Africa and other markets along with engines and other components. Next in line was the EcoSport compact SUV which has found a positive response globally.

After kicking off operations at its second facility at Sanand in Gujarat, Ford rolled out second-generation Figo and Aspire sedan. Located within close proximity to the Mundra Port, the carmaker’s future export performance would hinge on the new Figo. It is now being sold as the Ka+ in Europe. The new Figo gave a fillip to Ford’s exports in end-July when it started shipments to European countries.

In another testament of the growing importance of India as an export hub for global car manufacturers, it is learnt that Ford Motor Co will sell its made-in-India EcoSport in the US. The Detroit-based auto major unveiled the facelifted version of the EcoSport at the Los Angeles Motor Show in mid-November. The compact SUV, a first for the North American market by Ford, will make its debut in the US by early 2018.

Confirming the news, USA Today, an American daily, said, “EcoSport is going to be made in India and imported into the US,” adding that “the car will be manufactured in Chennai before it goes on sale in 2018.” Speaking to the newspaper, Michael O’Brien, Ford’s marketing manager for SUVs, said: “We build EcoSport in six locations around the globe. We sell it in 100 markets, and so, just like we make Explorers and export from here into other global markets, we are going to export EcoSport from Asia Pacific, and we are going to sell it here in the US.”

More drive needed

So what further incentives are required from the Indian government to boost exports? The incentive for exports under the Merchandise Export from India Scheme (MEIS) has been slashed from three percent to two percent for exports to Mexico. Carmakers like Volkswagen India feel that the MEIS rate should be reinstated at three percent as the objective of the scheme is to offset infrastructural inefficiencies and associated costs and provide exporters a level playing field. Also, the exports to the Ivory Coast and Gabon require a cargo tracking note (CTN) which is provided only by identified agencies at a cost.

Carmakers want the requirement of the CTN to be done away with. Further, the anti-dumping duty on iron steel that has been levied shores up the average cost per car and adversely affects export prospects.

A suggestion from the industry is that this anti-dumping duty for special steel grades required by the automotive industry be withdrawn or a reference price be introduced. The steel that is imported at a price higher than the reference price should not attract any anti-dumping duty.

The government’s implementation of its key initiatives like Make in India, Digital India and Skill India have helped the country emerge as a low-cost manufacturing hub of quality compact cars. Most of the carmakers support similar initiatives that could further ease exports as well as ease of doing business.

Seen overall, the made-in-India export strategy of these four global OEMs is helping them derisk their domestic market business while at the same time improving capacity utilisation at their manufacturing plants. For most carmakers in India, including Ford, Nissan, Volkswagen and GM, exports have become an intrinsic part of their manufacturing game-plan. If anything, they would be looking at even more incentives to keep their plants humming.

You may like:

RELATED ARTICLES

TVS Motor: The New King of India's Electric 2-Wheeler Market

January 2026 sees TVS Motor solidify its position with 34,558 units Bajaj struggles to keep pace.

Electric PV Sales Stabilize after GST Hit

Fresh FADA data shows January 2026 registrations surging 55% year-on-year, with Tata, JSW MG, and Mahindra all posting s...

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

By Shobha Mathur

By Shobha Mathur

26 Dec 2016

26 Dec 2016

64745 Views

64745 Views

Angitha Suresh

Angitha Suresh

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi