Eleven of 13 carmakers in 2023’s Top 100 Global Brands have retail presence in India

Though technology brands continue to dominate Interbrand’s’ Top 100 Best Global Brands list, the automobile industry with 13 carmakers and US$ 365 billion of combined brand value maintains its strong showing. Eleven of them currently retail their cars in India and should turn 12 soon when Tesla plugs into the India growth story.

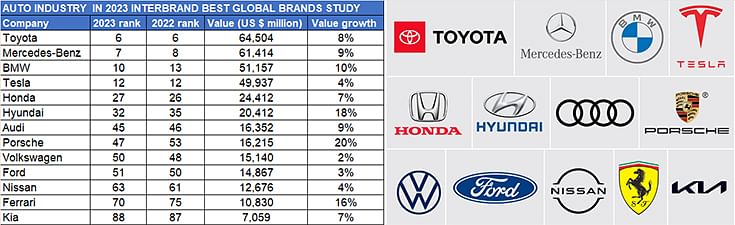

Automobile companies have, once again, stamped their dominance when it comes to global brand power. The latest 2023 Interbrand Study sees 13 vehicle manufacturers – all of them carmakers – confirm their presence in the list of the best of best global brands.

The findings of the Interbrand Best Global Brands study, now in its 24th year, reflect a slowdown. In 2023, the cumulative value of the world’s 100 most valuable brands grew by 5.7% – compared to 16% growth in value in 2022 – taking the total brand value to $3.3 trillion ($3.1 trillion in 2022). Interbrand cites lack of growth mindset, conservative brand leadership and uncertain forecasting behind the slowdown. Companies that operate across multiple sectors continue to dominate the top of the table – making up 50% of the total value. Data shows a stronger focus on brand enables these companies to unlock rapid growth vs the competition.

While Airbnb (#46) is the fastest riser in value (+21.8%) despite only entering the table last year, Apple remains the longstanding No. 1 brand for the 11th year in a row and is the first brand to rise above half-a-trillion US$ in brand value. The Top 10 highest brand value riser is Microsoft (+14%). Zara (#43) and Sephora (#97) are the two retail stars of the table with brand value rising 10% and 15% respectively. Nespresso is this year’s new entrant (#98).

Automotive industry maintains its strong performance

The strongest performing sectors this year are automotive and luxury with sector value rising 9% and 6.5% respectively. The combined value of the 13 automotive brands is $364,975 million (nearly $365 billion) and constitutes 11% of the total value of the Top 100 global brands put together. What’s more, it has bettered CY2022’s value of $#47 billion by around 5 percent.

Of automotive-specific brands, BMW (#10) entered the Top 10 for the first time, recording 10% year-on-year growth. Porsche (#47), Hyundai (#32) and Ferrari (#70) all achieved a double-digit rate of growth and accounted for three of the top five fastest-growing brands.

Tesla held its position in the table this year (#12), but its rate of growth was the slowest among the automotive brands with its brand value increasing 4.0% compared to BMW and Mercedes which grew 10.4% and 9.5% respectively.

“Automotive brand top risers have increased scores across Affinity, Trust, Presence and Participation – key drivers of brand value – ultimately increasing their connection with customers,” says Greg Silverman, Global Director of Brand Economics at Interbrand.

At the top of the automotive ladder, Toyota and Mercedes-Benz are the only two carmakers in the Top 10 best global brands in the world, with a ranking of sixth and seventh on the Best Global Brands Report, respectively. While the Japanese automaker maintains its 2022 ranking with a value of $64,504 million, up 8% YoY, Mercedes‑Benz remains among the top ten most important brands in the world for the eighth time in a row, moving up to seventh place and remains the most valuable luxury automobile brand in the world. Valued at $61,414 million, up 9% on CY2022, the Germany luxury carmaker moves up one rank this year (see ranking table above) benefiting from its consistent transformation into an iconic brand that impresses with its exceptional aesthetics, innovative technologies and integrated sustainability.

“The latest increase in our brand value is a first‑class achievement by the entire Mercedes‑Benz team, which makes us all very proud. The result is both a confirmation and an incentive for us: we are continuously building on our brand heritage to shape the future – with the goal of creating the most desirable cars in the world,” said Bettina Fetzer, Vice-President Communications & Marketing Mercedes‑Benz AG.

The nine other carmakers in the 2023 Top 100 list include Honda, Hyundai, Audi, Porsche, Volkswagen, Ford, Nissan, Ferrari and Kia. Land Rover and Mini, which were in the 2022 ranking, have moved out this year. Germany tops the list with 5 carmakers (Mercedes-Benz, BMW, Audi, Porsche and Volkswagen). It is followed by Japan with three (Toyota, Honda and Nissan), Korea with two (Hyundai and Kia) and US with two (Tesla and Ford).

The combined value of the 13 automotive brands is $364,975 million and constitutes 11% of the total value of the Top 100 global brands put together.

The combined value of the 13 automotive brands is $364,975 million and constitutes 11% of the total value of the Top 100 global brands put together.

Who’s up and who’s down in 2023

When it comes to their ranking in the latest Global Top 100 list, two brands – Toyota (#6) and Tesla (#12) – see no change from the performance last year. Six brands have bettered their 2022 rankings. Mercedes-Benz (#7) is up one rank, BMW (#10) has risen by two ranks and entered the Top 10, Hyundai (#32) is up by three, Porsche (#47) by six ranks, Audi (#45) by one position and Ferrari up by all of five ranks to #70. With growth of 20% in 2023, Porsche is the brand with the maximum growth in value – currently at around US$16.2 billion, an increase of $2.7 billion on CY2022.

Five brands’ ranking has reduced this year. While Honda (#27) is down from #26 last year, Volkswagen is at #50, down two ranks from 2022. Ford (#51), Nissan (#63) and Kia (#88) are all down on their year-ago rankings.

From India’s perspective, 11 of these 13 carmakers – other than Tesla and Ford – currently retail their models in the Indian passenger vehicle market, which is among the fastest growing in the world. While Ford quit India operations a few years ago, the all-electric Tesla brand could soon be plugging into the India growth story.

While Hyundai Motor India is the longstanding No. 2 player in the Indian car and SUV market, Kia India is in fifth position. Toyota, which has just announced plans to set up a third manufacturing plant in Karnataka, is currently ranked sixth in market share in India. Of the luxury carmakers, Mercedes-Benz India maintains its market leadership, and is followed by BMW India and Audi India while Porsche and Ferrari continue to have a strong fan following.

What’s common to all the 13 automobile brands in this year Top 100 Global Brands list is that all have made a transition towards electrification, a trend which has enveloped the world which is battling severe climate change. At present, Ferrari is the sole carmaker without an EV but is set to roll out its first zero-emission model 2025.

Criteria of the Best Global Brands study

The US brand consulting company Interbrand has been researching and analysing the most valuable brands in the world since 1999. The top 100 are included in the annual ‘Best Global Brands’ study, which examines all candidates according to three criteria: ‘Financial performance of the brand's products or services’, ‘Role of the brand in the purchase decision process’ and ‘Strength of the brand with regards to securing the company’s future earnings’. Interbrand was the first company to develop a brand evaluation method that was certified according to ISO 10668. The international standard set benchmarks for evaluation and meets the requirements for precise monetary brand classification.

To be included in Best Global Brands, a brand must be truly global, having successfully transcended geographic and cultural boundaries. It will have expanded across the established economic centres of the world and entered the major growth markets. In specific terms, this requires that:

- At least 30% of revenue must come from outside of the brand’s home region.

- The brand must have a significant presence in Asia, Europe, and North America, as well as geographic coverage in emerging markets.

- There must be sufficient publicly available data on the brand’s financial performance.

- Economic profit must be expected to be positive over the longer term, delivering a return above the brand’s cost of capital.

- The brand must have a public profile and sufficient awareness across the major economies of the world.

- The brand’s ‘Brand Strength Score’ must be equal to 50 or above.

According to Interbrand, these requirements – that a brand be global, profitable, visible, and transparent with financial results – explain the exclusion of some well-known brands that might otherwise be expected to appear in the ranking.

All data: courtesy Interbrand

Lead image: representational company logos

RELATED ARTICLES

TVS Motor: The New King of India's Electric 2-Wheeler Market

January 2026 sees TVS Motor solidify its position with 34,558 units Bajaj struggles to keep pace.

Electric PV Sales Stabilize after GST Hit

Fresh FADA data shows January 2026 registrations surging 55% year-on-year, with Tata, JSW MG, and Mahindra all posting s...

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

23 Nov 2023

23 Nov 2023

29724 Views

29724 Views

Angitha Suresh

Angitha Suresh

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi