Two-wheeler OEMs continue to feel the DeMo heat

The cash crunch-hit segment reported total domestic sales of 12,62,141 units, down 7.39 percent year-on-year (YoY) in January 2017 albeit the rate of decline is slowing down; the YoY growth in December 2016 was -22.04 percent.

Although the two-wheeler segment in India is inching back to normalcy, the consolidated domestic sales in January 2017 remained negative. The segment reported total domestic sales of 12,62,141 units, down 7.39 percent year-on-year (YoY) in January 2017 albeit the rate of decline is slowing down; YoY growth in December 2016 was -22.04 percent.

On the cumulative front, the segment, with sales of 1,47,55,890 units between April 2016-January 2017, continues to grow at 8.29 percent YoY. But it’s poor compared to the cumulative growth of 16.01 percent for the April-October 2016 period. Clearly, demonetization eroded the growth momentum of the two-wheeler segment by nearly 8 percentage points.

Negative growth in January came from scooters as well as motorcycles. While total scooter sales stood at 373,382 units (-14.50%), the motorcycle category reported sales of 819,386 units (-6.07%). The sterling performer in the two-wheeler segment was the humble moped. TVS Motor Company, the sole only retailer in this category, reported sales of 69,373 units (+28.83%).

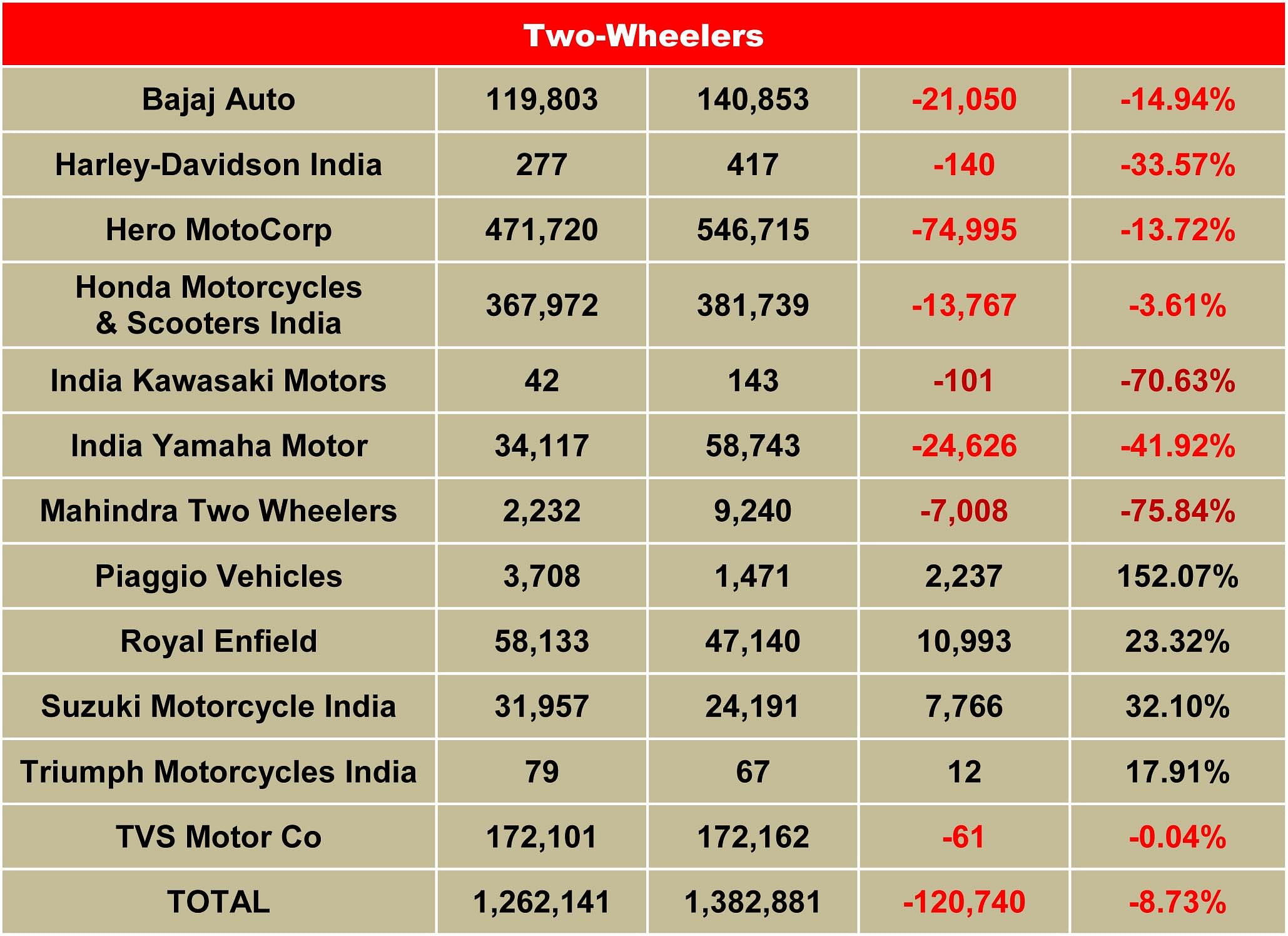

Among the major OEMs, while Hero MotoCorp, Bajaj Auto, India Yamaha Motor, Harley-Davidson and India Kawasaki Motors reported negative growth, Honda Motorcycle & Scooter India (HMSI), Royal Enfield, Suzuki Motorcycle India, Piaggio Vehicles and Triumph Motorcycles India clocked positive YoY numbers. TVS Motor Co’s sales remained flat with a marginal decline of -0.04 percent YoY in January 2017.

Industry leader Hero MotoCorp, which sold 471,720 units in January witnessed a YoY decline of 13.72 percent. On the cumulative front, however, it has retailed 53,85,114 units, which marks its slowed-down performance of 1.57 percent growth YoY. Hero is working on a bunch of new models that are being developed at its in-house R&D facility in Kukas, near Jaipur. It is learnt that the company plans to launch an all-new 125cc scooter model later this year. Also scheduled is the single-cylinder, 200cc Hero Xtreme, first revealed at the Auto Expo last year.

India’s second largest two-wheeler maker Honda Motorcycle & Scooter India reported sales of 367,972 units in January (+1.72%). It is learnt that after the announcement of demonetisation on November 8, 2016, the company moved swiftly to equip its network with digital payment facilities and also focussed on boosting its exports to grab the overseas orders in the wake of the temporary fall in domestic demand. HMSI’s strategy to steer through the cash crunch has paid off well as it has bounced back faster than its top three rivals.

On the cumulative front, HMSI has sold 40,16,089 units thereby posting a double-digit growth of 12.60 percent YoY. Honda has just launched the refresh of its existing models including Activa 125, and CB Shine. Both 2017 edition models are BS IV compliant and are expected to boost the sales for the company in the remaining months of this fiscal.

Number three player, TVS Motor Company retailed 172,101 units (-0.04%). Cumulatively, it has sold 21,00,167 units between April-January this fiscal, which is an impressive growth of 15.02 percent YoY. TVS plans to introduce an all-new scooter later this year. Sources say the new model could be a 125cc scooter positioned under an all-new brand name.

Bajaj Auto clocked total sales of 119,803 units in January (-14.94%). However, on the cumulative front, the company has done well by reporting growth of 8.70 percent YoY with total sales of 17,07,655 units in the past 10 months.

Autocar Professional had earlier estimated that Bajaj Auto would end FY2016-17 with total volumes of close to the two-million units mark. Although the company is down with its month-on-month sales over the past three months, recovering markets may help it bounce back to cross the annual volume of two million units for the first time.

Royal Enfield, which has moved up the rank and has become the fifth largest two-wheeler retailer overtaking Yamaha in January, sold 58,133 units last month. The midsize motorcycle brand marked a YoY growth of 23.32 percent. Cumulatively, RE has sold 535,821 units over the last 10 months thereby reporting YoY growth of 33.57 percent.

At number six is India Yamaha Motor, which sold 34,117 units, down by 41.92 percent YoY. The fast growing company has registered cumulative growth of 20.67 percent YoY at 644,857 units over the past 10 months of this fiscal.

While Suzuki Motorcycle India sold 31,957 units last month (+32.10%), Piaggio Vehicles clocked sales of 3,708 units (+152.07%) all thanks to the aggressively priced Aprilia SR150.

Among the premium motorcycle retailers, while Harley-Davidson India reported sales of 277 units (-33.57%) and India Kawasaki sold only 42 units (-70.21%) in January, Triumph Motorcycles India clocked sales of 79 units (+17.91%).

The two-wheeler industry expects market demand recovers soon and the lost growth momentum restored. It’s what the auto industry is also hoping for, considering that the two-wheeler’s performance is what drives or pulls down overall industry numbers.

RELATED ARTICLES

TVS Motor: The New King of India's Electric 2-Wheeler Market

January 2026 sees TVS Motor solidify its position with 34,558 units Bajaj struggles to keep pace.

Electric PV Sales Stabilize after GST Hit

Fresh FADA data shows January 2026 registrations surging 55% year-on-year, with Tata, JSW MG, and Mahindra all posting s...

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

13 Feb 2017

13 Feb 2017

30688 Views

30688 Views

Angitha Suresh

Angitha Suresh

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi