Subtle Steel Price Increases Add Fresh Pressure on Auto Costs

While finished steel prices are stable, rising iron ore and coking coal costs threaten to squeeze the margins gained from record production volumes.

While high-tech battery minerals often dominate the conversation, steel is experiencing a slow-burning price creep that demands executive attention. According to the December 2025 SIAM monitor, HR steel prices ranged between Rs 48,160 and Rs 50,000 per tonne, marking a 1% increase both year-on-year and month-on-month. Though these rates remain 9% below the April 2025 peak, stabilisation at these elevated levels is a critical factor for the industry. The automotive sector consumes nearly 9% of HR steel, the latest SIAM data reveal.

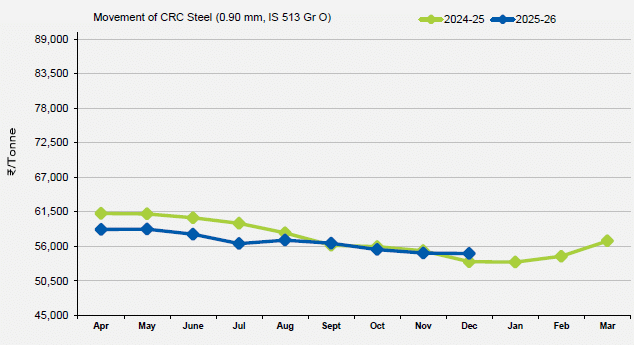

The situation for precision steel (CR steel) is slightly more pressurised, with December prices settling at Rs 53,880–Rs 55,860 per tonne, a 2% increase over the previous year. Conversely, alloy steels used in high-stress components such as gears and pistons offer a rare silver lining: 20MnCr5 and EN-8 varieties both dropped 8% year-on-year to roughly Rs 60,000 and Rs 59,000 per tonne, respectively. This has provided a vital financial buffer as gear production climbed 12.5%, even as axle manufacturing struggled with a 12.4% decline.

However, the raw material funnel suggests impending turbulence. Iron ore prices averaged $107 per tonne in December, up 3% from the previous month. More alarmingly, coking coal, a fundamental fuel for steelmaking, hit a 12-month high of $227 per tonne, climbing 6% month-on-month. With the Indian rupee depreciating to 89.52 against the US dollar, the cost of importing these essential inputs is rising significantly.

For automakers, this data highlights a divergent path. While finished steel prices are stable compared with the hyperinflation of rare earth elements, rising iron ore and coking coal costs threaten to squeeze the margins gained from record production volumes. In high-volume segments, every rupee added to the steel frame is a rupee lost from the bottom line.

RELATED ARTICLES

The Magnetic Squeeze: Rising Motor Costs Threaten the EV Value Chain

Production of traction motors declined by 7.2%, a sharp reversal from the 12.8% growth seen last year.

Cooling Rubber Prices Offer Margin Relief for Automakers

Rubber price trends in December 2025 offer a rare moment of cost relief for manufacturers facing margin pressures elsewh...

The "Clean Air" Premium: Why Your Next Car Might Cost Significantly More

As per the SIAM commodity tracker updates for the month of December 2025, the most aggressive inflation is found in exha...

By Shahkar Abidi

By Shahkar Abidi

21 Jan 2026

21 Jan 2026

355 Views

355 Views