India's Two-wheeler Industry Poised For 6–9% Growth In FY2026: ICRA

ICRA projects India's two-wheeler industry will grow 6–9% year-on-year in FY2026, driven by policy support, improving replacement demand, stable rural incomes, and recovery in urban consumption patterns.

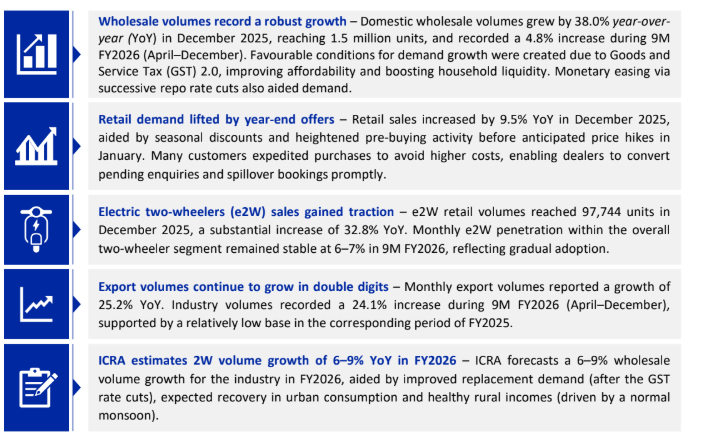

India's two-wheeler industry recorded a sharp rebound in December 2025, supported by year-end demand, policy-led affordability improvements and improving macro conditions. According to ICRA, the industry is expected to post a 6–9% year-on-year growth in domestic volumes in FY2026, driven by recovery in replacement demand, urban consumption and stable rural incomes.

Domestic Market Performance

Domestic wholesale volumes rose sharply by 38.0% year-on-year in December 2025 to around 1.5 million units, aided by a low base and inventory restocking ahead of the new calendar year. On a cumulative basis, wholesale volumes grew by 4.8% during 9M FY2026 (April–December), reflecting a gradual recovery over the fiscal year despite intermittent demand softness.

Retail Demand Trends

Retail volumes increased by 9.5% year-on-year in December 2025, supported by year-end discounts and pre-buying by customers ahead of expected price increases in January 2026. Improved affordability, better financing availability and higher showroom footfalls contributed to retail momentum, particularly in entry-level motorcycles and scooters.

FY2026 Growth Outlook

ICRA estimates domestic two-wheeler volumes to grow by 6–9% year-on-year in FY2026. The growth outlook is supported by GST rate cuts under the GST 2.0 framework, improved replacement demand after multiple years of subdued sales, recovery in urban discretionary spending and stable rural incomes, aided by a normal monsoon and continued government expenditure.

Export Momentum Remains Strong

Exports continued to be a key growth driver for the industry. Monthly export volumes rose by 25.2% year-on-year, while cumulative industry exports increased by 24.1% during 9M FY2026. The strong performance was supported by a low base in the corresponding period of FY2025 and improving demand across key overseas markets.

Electric Two-Wheeler Segment

Electric two-wheeler sales gained further traction in December 2025, with retail volumes reaching 97,744 units, marking a year-on-year growth of 32.8%. However, electric two-wheeler penetration remained stable at around 6–7% during 9M FY2026, indicating a phase of gradual adoption amid evolving consumer preferences and infrastructure readiness.

Policy and Macro Tailwinds

Demand conditions improved following the implementation of GST 2.0, which enhanced affordability and boosted household liquidity. Additionally, monetary easing through successive repo rate cuts supported demand growth by lowering borrowing costs and improving access to vehicle financing.

Overall Assessment

While December 2025 witnessed a sharp year-on-year rebound, the broader recovery in FY2026 is expected to remain steady and policy-supported, with exports and gradual domestic demand normalization playing a central role in sustaining industry growth.

RELATED ARTICLES

Subtle Steel Price Increases Add Fresh Pressure on Auto Costs

While finished steel prices are stable, rising iron ore and coking coal costs threaten to squeeze the margins gained fro...

The Magnetic Squeeze: Rising Motor Costs Threaten the EV Value Chain

Production of traction motors declined by 7.2%, a sharp reversal from the 12.8% growth seen last year.

Cooling Rubber Prices Offer Margin Relief for Automakers

Rubber price trends in December 2025 offer a rare moment of cost relief for manufacturers facing margin pressures elsewh...

By Sarthak Mahajan

By Sarthak Mahajan

21 Jan 2026

21 Jan 2026

468 Views

468 Views

Shahkar Abidi

Shahkar Abidi