Commercial Vehicle Sales Hit Record Q3 High with 21.5% Growth at 2.90 Lakh Units

Commercial vehicle segment posts 2.90 lakh units in Q3 2025-26 driven by GST 2.0 reform and increased freight activity.

The commercial vehicle segment in India recorded its highest ever third-quarter sales of 2.90 lakh units in Q3 of 2025-26, reflecting a growth of 21.5% compared to Q3 of 2024-25, driven by enhanced freight activity and consumer sentiment following the rollout of GST 2.0 reform.

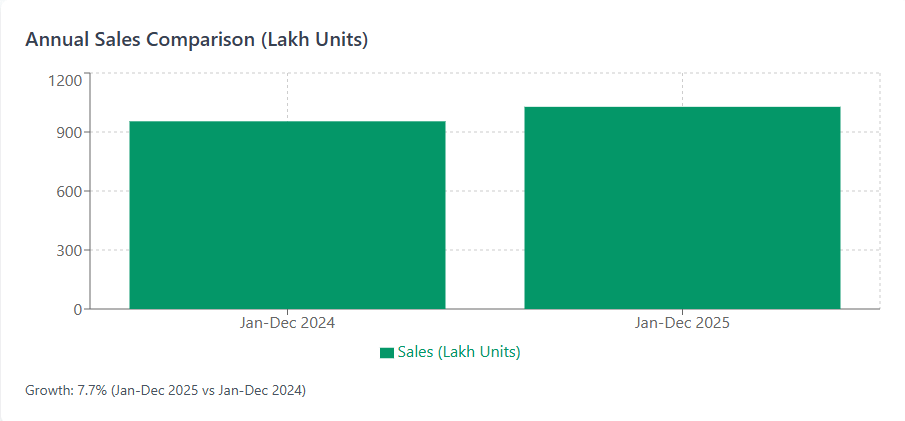

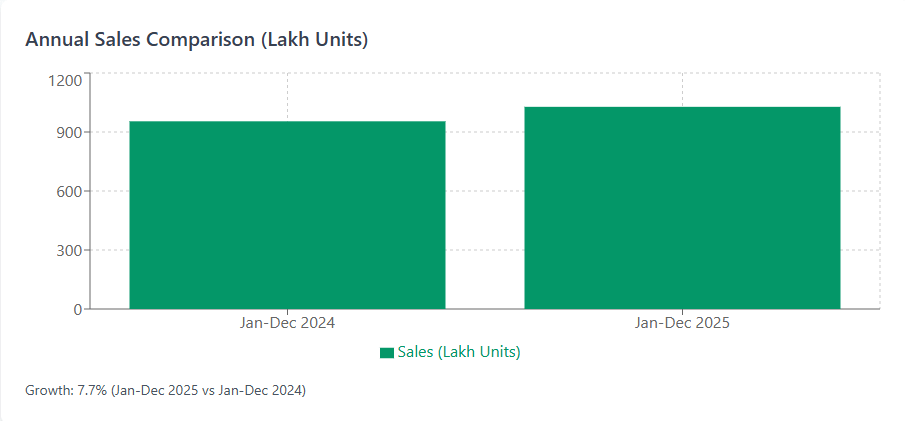

The segment also posted its highest ever sales for the January-December period with 10.28 lakh units sold in 2025, marking a growth of 7.7% compared to the corresponding period in 2024. This performance underscores the sustained momentum in India's logistics and transportation sector, which serves as a key indicator of overall economic activity and industrial output.

Domestic Market Dynamics

The commercial vehicle segment's robust Q3 performance represents a significant acceleration in growth, with the 21.5% increase indicating strong underlying demand across the logistics and transportation ecosystem. The third quarter typically benefits from festive season demand, and this year proved no exception, with heightened consumption patterns translating into increased movement of goods across the country.

The calendar year performance of 10.28 lakh units sold between January and December 2025 marks a new record for the industry, demonstrating the sector's resilience and its critical role in supporting India's economic expansion. Commercial vehicles form the backbone of the country's goods transportation network, facilitating the movement of raw materials, finished products, and consumer goods across vast geographical distances.

The segment encompasses various vehicle categories, including light commercial vehicles, medium and heavy commercial vehicles, and buses, each serving distinct transportation requirements across passenger and goods movement applications.

Policy Impact and Market Catalysts

The rollout of GST 2.0 reform has emerged as a significant catalyst for the commercial vehicle segment's strong performance. The reform has provided a substantial boost to consumer sentiment and contributed to an increase in overall consumption levels across the economy, which has led to increased freight activity.

This enhanced freight activity has translated into higher demand for commercial vehicles as businesses expand their logistics capabilities to meet growing transportation requirements. The reform's impact on consumption patterns has created a multiplier effect, with increased retail activity driving demand for efficient goods movement solutions.

The GST 2.0 reform has further enhanced freight-carrying intra-city logistics requirements, a segment that has seen particularly strong growth. Urban and peri-urban freight movement has intensified as e-commerce, quick commerce, and organized retail continue to expand their footprint across Indian cities. This has necessitated larger fleets of light and medium commercial vehicles to service last-mile delivery and distribution networks.

Beyond the festive demand pull during Q3, structural factors continue to support the commercial vehicle segment's growth trajectory. Industrial production expansion, infrastructure development projects, and the growing formalization of the logistics sector have all contributed to creating sustained demand for commercial vehicles.

Export Market Performance

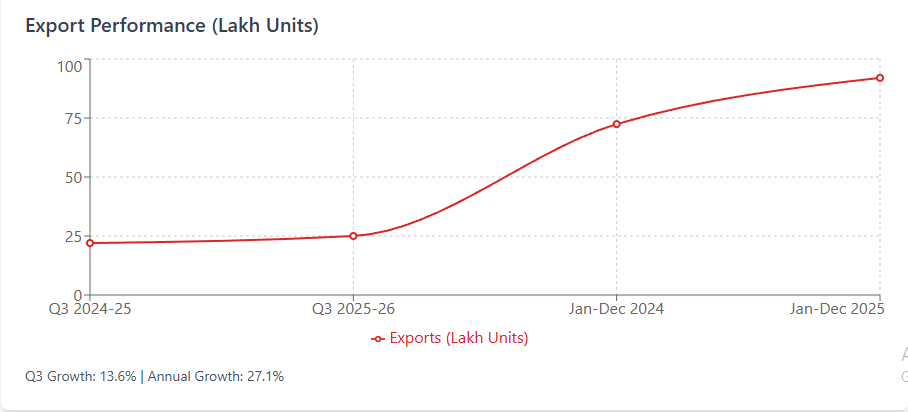

The export segment of commercial vehicles has shown steady growth, though at more modest levels compared to the domestic market. Commercial vehicle exports reached 0.25 lakh units with a growth of 13.6% in Q3 of 2025-26 compared to Q3 of the previous year.

For the full calendar year January-December 2025, commercial vehicle exports totaled 0.92 lakh units, registering a growth of 27.1% compared to January-December 2024. This strong annual export performance indicates expanding market opportunities for Indian commercial vehicle manufacturers in international markets.

Neighbouring countries and the Middle East have been steady markets for commercial vehicles manufactured in India. These regions value the combination of competitive pricing, robust build quality, and suitability for local operating conditions that Indian commercial vehicles offer. The geographical proximity of neighbouring countries reduces logistics costs and delivery times, while the Middle East represents a mature market with established distribution networks for Indian automotive products.

Industry Outlook

Calendar year 2025 has been characterized as a landmark year for the Indian automobile industry, supported by a series of structural policy reforms that have strengthened demand fundamentals and significantly boosted consumer confidence. The industry has benefited from coordinated policy interventions that have addressed multiple aspects of the automotive value chain.

The industry enters Q4 2025-26 with firm momentum after strong double-digit growth across all vehicle segments in late 2025. Industry stakeholders expect steady wholesale and retail volumes traction through the quarter, supported by multiple favorable factors.

The year-end sales push traditionally witnessed in the final quarter is expected to contribute to sustained volumes. A healthy pipeline of bookings indicates strong near-term visibility for manufacturers, while the full transmission of 2025 rate cuts into lending rates is expected to support demand by improving affordability for commercial vehicle buyers.

These factors point to continued growth into FY 2025-26, underpinned by stable macroeconomic conditions and supportive policy reforms of the Government of India. The policy environment has created a foundation for sustained expansion, with reforms addressing taxation, financing accessibility, and infrastructure development.

While remaining watchful of geopolitical developments that could impact global supply chains and export markets, the industry expects FY 2025-26 to close on a positive growth trajectory. Policy-led tailwinds are firmly in place, sustaining the robust performance witnessed in recent years and providing visibility for continued expansion in the commercial vehicle segment.

RELATED ARTICLES

Tata Motors PV Could Be Last Man Standing in India’s Hatchback Segment, Says Shailesh Chandra

Despite a fall in hatchback share in overall PV sales, Tata Motors believes a million-unit market still offers a substan...

ASG Eye Hospital Offers Free Eye Care to Commercial Drivers During Road Safety Week

Healthcare chain provides complimentary eye examinations and up to 1,000 free cataract surgeries for commercial drivers ...

CNH to Bolster 'Make in India' Portfolio Through New Greenfield Plant by 2026

Localization and capacity growth position CASE to ride India’s recovery.

By Shruti Shiraguppi

By Shruti Shiraguppi

13 Jan 2026

13 Jan 2026

411 Views

411 Views

Darshan Nakhwa

Darshan Nakhwa

Sarthak Mahajan

Sarthak Mahajan

Shahkar Abidi

Shahkar Abidi