Nexon helps Tata Motors grow UV market share four-fold

Surging demand for Tata Motors’ first-ever compact SUV helps the carmaker register robust numbers in first two months of FY2019; UV market share up to 7.78 percent from 1.90 percent a year ago.

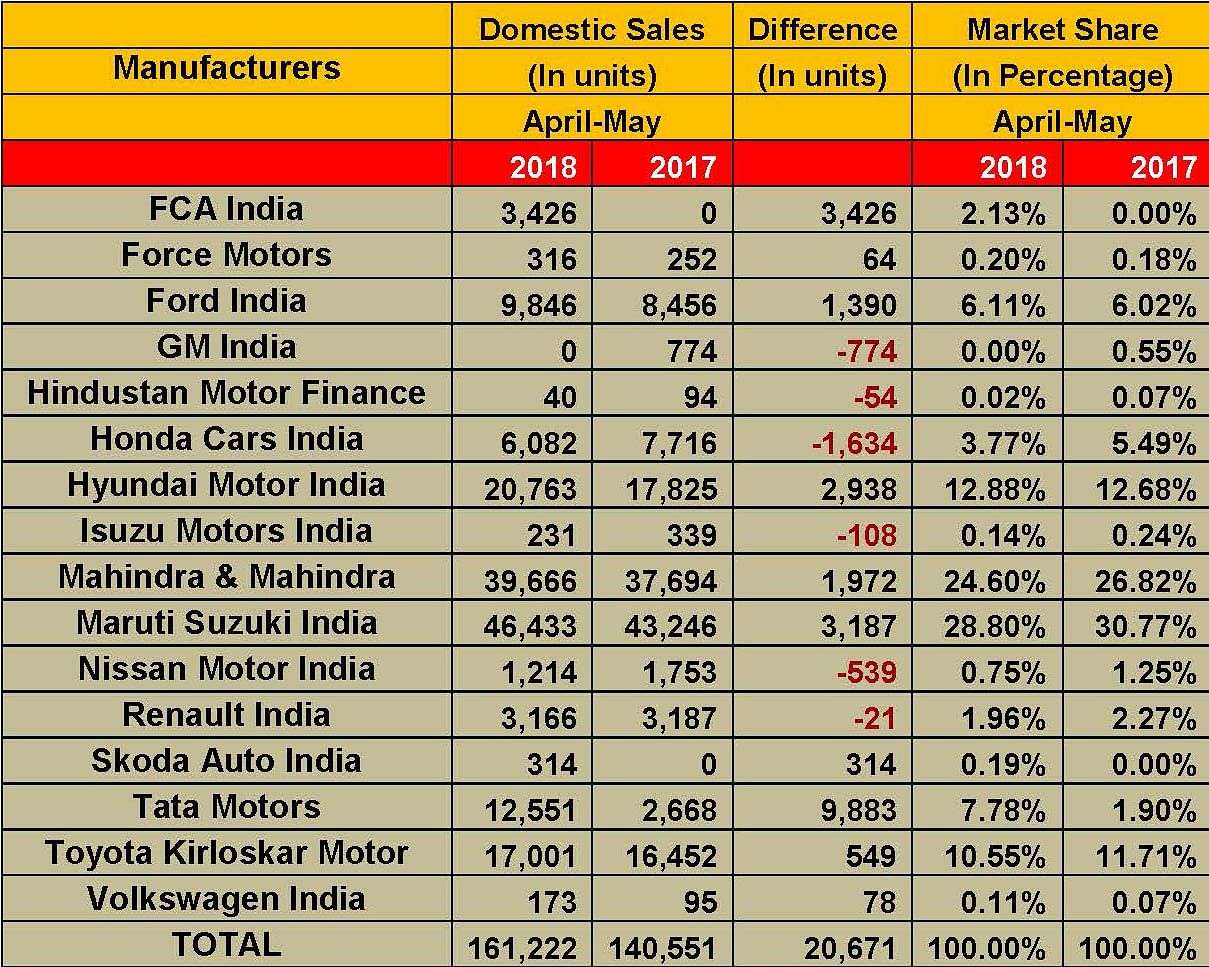

Even as utility vehicles (UVs) seemingly lift off the gas and come into comfortable cruising mode, their growth rate continues to be relatively high when compared to their passenger car siblings. However, where UVs were once accelerating hard with an overall growth rate of 20.97 percent and closed FY2018 with cumulative volumes of 921,780 units, the numbers over the first two months of FY2019 are not similar. UV sales stood at 161,222 units between April and May 2018, registering somewhat mellowed growth of 14.71 percent over April-May 2017.

While sharply rising fuel prices in the recent past are likely to have impacted car buyers’ purchase decisions, the industry has also seen a number of new model launches in the passenger car space since the Auto Expo in February.

The impact of the decline in UV demand could very well be seen in the market share statistics of key vehicle manufacturers in the industry, where even after some posting an uptick in their volumes, have seen a decline in their overall UV market share, hinting at a low margin of growth when compared to the numbers posted in FY2018.

The country’s leading carmaker Maruti Suzuki cumulatively sold 46,433 UVs between April and May, securing a 28.80 percent hold of the overall UV market. However, while its sales are up from the 43,246 units sold a year ago, Maruti’s UV market share in FY2018 stood at a considerably higher 30.77 percent, even as its pack of UVs including the Vitara Brezza, S-Cross, Gypsy and the Ertiga garnered total volumes of 25,629 units, up 13.36 percent over the 22,608 units sold in May 2017.

On the other hand, Tata Motors, which is primarily a UV player in the market, saw its market share surge almost 400 percent, albeit on a low year-ago base. What is giving the company a shot in the arm is the strong and surging demand for its Nexon crossover, which is slowly proving its worth of being a value-for-money package in the compact SUV space.

Compared to a year ago, Tata Motors has seen a dramatic 370 percent rise in its UV sales – for the April-May 2018 period, the company has sold 12,551 units, substantially up from the 2,668 units sold in April-May 2017.

The Nexon has been a primary driver of the company’s UV sales which, also aided by the Hexa SUV, have helped Tata Motors quadruple its market share from 1.90 percent in April-May 2017 to 7.78 percent in April-May 2018. Tata Motors has cumulatively sold 10,196 units of the Nexon in FY2018 until May, and with the option of an AMT in both its petrol and diesel trims also available now, expect sales to boost further, with increased demand for these variants coming in especially from urban India.

For the April-May 2018 period, UV major Mahindra & Mahindra has seen its market share drop from 26.82 percent in April-May 2017 to 24.60 percent in the first two months of FY2019, even though its total vehicle sales stand at 39,666 units, up from the 37,964 units sold between April and May 2017. In May 2018, the company saw its UV sales remain almost flat at 19,295 units, akin to the 19,331 units sold in May 2017.

Ford India maintains a consistent market share of 6.11 percent between April and May 2018, with overall UV sales of 9,846 units, up from the 8,456 units sold during April-May 2017 with its market share pegged at 6.02 percent. The company’s EcoSport compact SUV is on a revival spree, where after getting a minor facelift in November, Ford India is leaving no stone unturned to maintain its sales and recently upgraded the crossover with a host of new features with a limited edition variant, and also brought in a new engine option – the 1.0-litre turbocharged three-cylinder petrol – for the enthusiast buyers in the EcoSport S variant.

On the other hand, iconic American SUV marque Jeep is growing leaps and bounds with the success of the Compass SUV. The company has sold a total of 3,426 UVs in India between April and May 2018, clinching a 2.13 percent share of the UV pie. Launched in July 2017, the Compass went ahead to surpass the 20,000 mark in April 2018, with overall sales averaging 2,087 units over the 10-month period, or roughly 70 Compass SUVs sold every day.

With the demand for SUVs not fading away anytime soon, how the UV trend matures in the market would have to be watched closely in the coming months, particularly with fuel prices showing no inclination of coming down substantially.

Also, with new entrants of the likes of Kia Motors betting big on UVs to kick start their journey in the Indian market from 2019; perhaps, this could just be a slight breathing phase, before the segment shifts into top gear again.

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

15 Jun 2018

15 Jun 2018

10820 Views

10820 Views

Autocar Professional Bureau

Autocar Professional Bureau