Mahindra and Toyota best at keeping customers happy, says latest JD Power India study

While Toyota performs particularly well in the sales initiation factor, M&M performs highest in the paperwork factor.

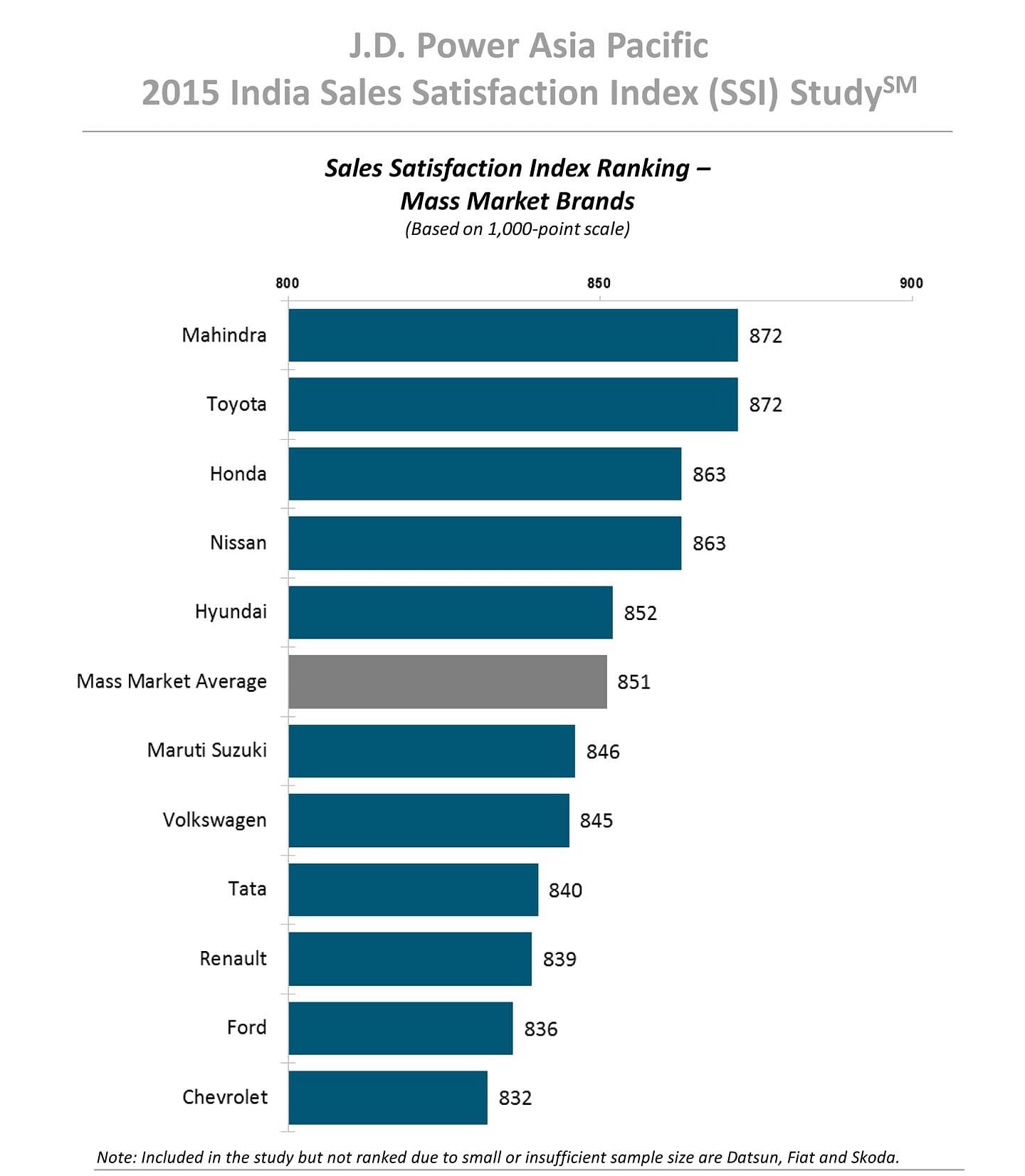

Mahindra & Mahindra and Toyota Kirloskar Motor have topped the JD Power Asia Pacific 2015 India Sales Satisfaction Index (SSI) Study. In a tie for the No. 1 spot, the two automakers have got a score of 872 each on a 1,000-point scale on which satisfaction is measured. While Toyota performs particularly well in the sales initiation factor, M&M performs highest in the paperwork factor.

Also, Nissan is ranked at joint-third position with Honda, scoring 863 on a 1,000 point scale. It is a big leap for Nissan as compared to last year where it was ranked ninth.

Speaking on the achievement, Guillaume Sicard, President Nissan India Operations, said, “I am delighted to see the results of the hard work and focus we put together towards being a customer centric organisation and this ranking confirms our consumer’s growing trust in the brand. India is poised to be the third largest market in the world by 2020 and we continue to monitor its progress closely to ensure our expanding product portfolio fits regional needs. We will continue to invest and support the “Make in India” initiative while catering to the domestic market and exploring more markets to augment our already strong exports numbers.”

The 2015 SSI Study is based on responses from more than 7,895 new-vehicle owners who purchased their vehicle between September 2014 and April 2015, and includes evaluations of more than 75 models within the mass market segment. The study was fielded from March to July 2015.

The study examines seven factors that contribute to new-vehicle owners’ overall satisfaction with their sales experience (listed in order of importance): delivery process, delivery timing, salesperson, sales initiation, dealer facility, paperwork and deal.

Overall sales satisfaction in the mass market segment is 851, a 6-point decline from 2014. Nearly one in five (18%) customers is dissatisfied with several critical aspects of the purchase process, including negotiations for their new vehicle, delivery commitments and the overall delivery process.

“Intense competition and pressure to maximise sales conversions has shifted focus from a customer-centric approach to a sales-driven approach for dealers, impacting customer satisfaction,” said Mohit Arora, executive director, J D Power Asia Pacific, Singapore. “Original equipment manufacturers (OEMs) and dealerships need to provide a pressure-free environment that is conducive to sales, which can lead to a positive and lasting impression of the brand and dealerships in the minds of customers.”

Study findings show that purchase reasons and shopping behaviour vary significantly across demographics. A larger proportion of younger buyers (30 years and younger) place a greater emphasis on vehicle design, performance and features as purchase criteria for their vehicle, compared with all other age groups combined (43% vs. 35%, respectively). Additionally, using the internet as a source of information for vehicle purchase is higher among younger buyers than among all other age groups combined (32% vs. 26%, respectively).

KEY FINDINGS OF THE 2015 STUDY

- Satisfaction with the delivery process and delivery timing declines the most year over year, dropping by 9 points in each factor.

- The average time for vehicle delivery has increased to 11 days after booking in 2015 from 9 days in 2014. Shoppers expect to be shown the same model variant that they intend to purchase. Currently, non-compliance on this aspect of the purchase process is 16 percent in the market in India, resulting in a 40-point decline in overall satisfaction.

- More than one-third (39%) of new-vehicle owners visited showrooms at least three times during their shopping process, up by 4 percent from 2014. Satisfaction among these owners is 25 points lower than among those who visited showrooms two or fewer times.

- Among new-vehicle owners who are highly satisfied with their purchase experience (sales satisfaction scores 922 and above), 82 percent say they “definitely will” recommend their purchase dealer to family and friends and 74 percent say they “definitely will” purchase the same vehicle make in the future. Conversely, only 41 percent of highly dissatisfied owners (scores 801 and below) say they “definitely will” recommend their purchase dealer to family and friends and 37 percent say they “definitely will” repurchase the same brand.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

31 Aug 2015

31 Aug 2015

5396 Views

5396 Views