New GST cess to hit luxury car sales in India

Just when the luxury passenger vehicle industry in India was beginning to see better traction, the latest sales speedbreaker has come in the form of the additional GST cess of 10 percentage points.

Just when the luxury passenger vehicle industry in India was beginning to see better traction and possibly achieve its real potential in one of the world’s fastest growing markets, the latest sales speedbreaker has come in the form of the additional GST cess of 10 percent, which hikes overall taxation to 53 percent. This effectively will mean a hike in vehicle prices and a resultant slowdown in sales.

While the Indian premium passenger vehicle market is still relatively small at around 34,000-35,000 units per annum, it is forecast to grow rapidly. Until now that is.

While the luxury passenger vehicle in India doubled between 2010 to 2015, sales had slowed down over the past couple of years as a result of the ban on sale of diesel cars in Delhi-NCR in December 2015 and a year later due to demonetisation.

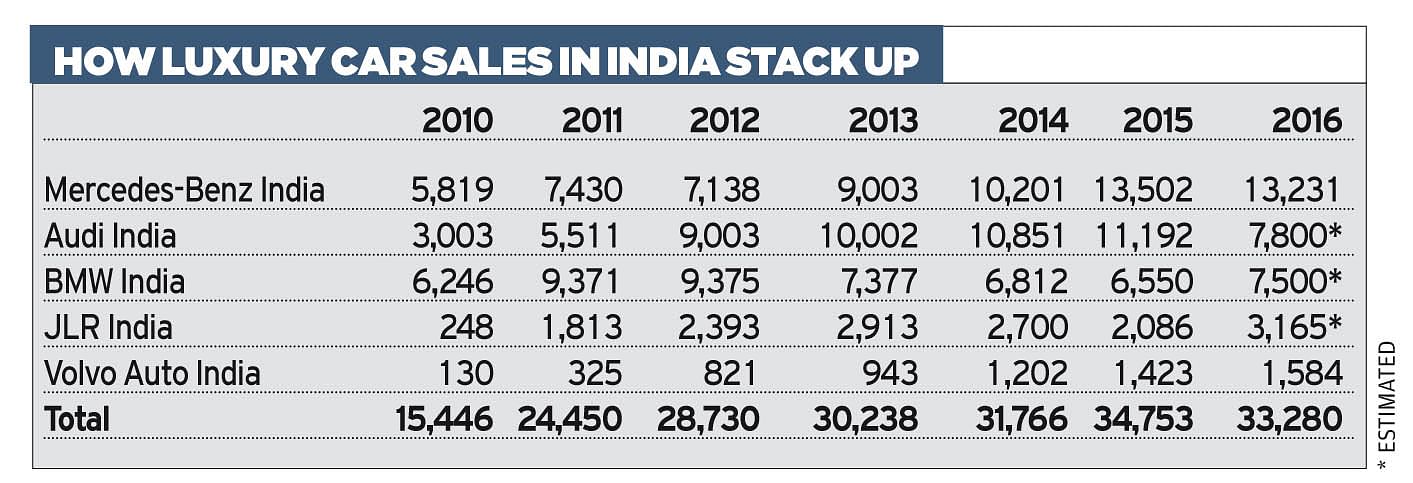

Autocar Professional's analysis of the luxury car market in India shows that sales grew at a rapid pace from 15,446 units in 2010 to 30,238 units in 2013, slowing down in 2014 and 2016.

The luxury car market, in developed economies, usually accounts for between 5-7 percent of the overall PV market. For India, sales of an estimated 33,280 units in CY2016 indicate it is around 1 percent of the 3-million PVs sold. The uptick in sales in the first quarter of FY2018 indicated that considerable potential was set to be tapped in the ongoing fiscal.

In 2017, with the economy showing all signs of being in good nick and consumer sentiment back on track, luxury vehicle sales were expected to accelerate. New momentum had also come in from GST rates, which had reduced taxation on luxury vehicles. As a result, luxury carmakers had expected the sector to record YoY growth in double digits in FY2017-18. That scenario now, overall, looks bleak. The proposed additional GST cess announced today has already drawn stiff criticism from luxury carmakers in India.

Market leader Mercedes-Benz India, which has been on a roll since the past couple of years, has clocked best-ever June, Q2 and H1 2017 sales. The German carmaker has sold 7,171 vehicles in the January-June 2017 period (+8.7 percent).

The latest GST missive as upset the company. Roland Folger, MD and CEO, Mercedes-Benz India, said: "We are highly disappointed with the decision. We believe this will be a strong deterrent to the growth of luxury cars in this country. As a leading luxury car maker, this will also affect our future plans of expansion under 'Make in India' initiative, which aims at making and selling world-class products in India, with the latest technology for end consumers. We feel deprived as the leading manufacturer of luxury cars in India, who has been championing ‘Make in India’. This decision will also reverse the positive momentum that the industry wanted to achieve with the introduction of GST. With this hike in cess, we expect the volumes of the luxury industry to decelerate, thus offsetting any growth in the potential revenue generation, that could have come with the estimated volume growth."

"This decision once again reiterates the need for a long-term roadmap for the luxury car industry, which has been at the receiving end of arbitrary policies. The constant shift in policy makes our long-term planning for the market highly risky, and we think this would only have an adverse impact on the country's financial ratings."

Folger further added, "One of the original benefits expected out of GST was rationalisation of tax rates. Luxury cars and SUVs are one of the segments that long required tax rationalisation, as this segment remains highly taxed. Further, in the pre-GST regime, the taxes to the final customer were varying widely from state to state depending on the VAT applicable in respective states. Also, one month is too short a period to consider an upward revision in rates. The market performance should have been watched for at least six months, before it was relooked. The current proposal of increase in cess clubbed with the increased road tax rates, will take the effective consumer price much above the pre-GST scenario level."

Commenting on the cess, Rahil Ansari, Head, Audi India, said: “The luxury car industry in India, while small in volumes, still contributes over 10 percent in value. The taxes on this industry were already very high and we expected the unfulfilled potential of this segment to increase after the implementation of GST and rationalisation of taxes. However, the proposal of further increasing the cess on the luxury car industry will dampen the spirits of not only the companies, dealers and customers but also workers and employees working in this industry. This proposed increase in cess will most definitely adversely impact the sales. We will be forced to re-evaluate our business plans in light of this development. This move unfortunately is against the spirit of liberal market dynamics and we can only request to reconsider this proposal."

Vikram Pawah, president of BMW Group India, said: “We strongly believe that long-term stability in tax reforms and regulations are of paramount importance to foster growth of any industry in the country. While BMW Group India welcomes the implementation of GST in India, immediate changes and fluctuations on motor vehicles cess will adversly affect the stability and growth of the automotive industry in India.”

Earlier this year, premium carmaker Volvo Cars confirmed plans to begin manufacturing operations in India, in Bangalore, later this year. The move to begin local assembly, essentially is to position the company for speedier growth in the fast-expanding premium car segment, comes 10 years after the Swedish carmaker entered the Indian market.

In an interview to Autocar Professional, Tom von Bonsdorff, managing director of Volvo Auto India, said: "Consistent rise in GDP, a stable government and growth potential helped us decide to make in India.” In a reply to a question about sales targets, he added, “Forecasting the size of the premium car market in India is difficult. In the last 10 years (at Volvo), all forecasts about this segment have been wrong! I can only guess, and this is subject to change as per the market scenario. In in 2016, the premium car market was around 32,000- 35,000 units, it could get to 40,000 units this year and may be 50,000 units in 2020. By then, we could be selling around 5,000 cars. But all these calculations depend on macroeconomic factors; for example, we had to deal with demonetisation recently.”

While the instability in governmental policy decisions is taking industry by surprise, the flip side is that there never was a better time than now to buy a luxury car or an SUV. That is, before the additional cess is added to the vehicle's sticker price.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

07 Aug 2017

07 Aug 2017

13941 Views

13941 Views