Not-so-august month for car and 2-wheeler OEMs , CVs notch double-digit growth

Even as passenger vehicle and two-wheeler OEMs felt the pressure of slowing sales in August 2018, the CV industry continues to march ahead with robust sales.

August turned out to be a not-so-August month for most passenger vehicle (PV) and two-wheeler manufacturers. And it's due to a combined effect of the devastating floods in Kerala, which is a sizeable PV and two-wheeler market, and the relatively high year-ago base effect.

Market leader Maruti Suzuki India itself felt the pressure and has reported total overall sales of 145,895 units in August 2018, down a considerable 3.6 percent (August 2017: 151,270). Other than the entry-level segment of the Alto and Wagon R and the new Ciaz, the company sees sales down in all its other segments, particularly felt in its UVs whose sales are down by 16.2 percent.

The Alto and Wagon R together sold 35,895 units, up 1.3 percent over year-ago sales (August 2017: 35,428), indicative of the fact that demand remains strong for these entry level hatchbacks, albeit in Tier 1 and 2 towns with urban India gradually making a shift to premium hatchbacks as their preferred entry models.

Maruti’s range of compact cars remains the key volume drivers, with the Maruti Swift and the Dzire running away in their respective segments. With the Ignis, Celerio and the Baleno included, the collective sales of these five models stood at 71,364 units last month, but 3.6 percent down on August 2017 sales (August 2017: 74,012). Expect the Dzire and the Swift to have contributed the bulk of the numbers, as they have for the past few months.

Maruti will be pleased with the initial market response to the Ciaz which has rolled out in a new avatar. In August 2018, the premium sedan went home to 7,002 buyers, up 8.4 percent (August 2017: 6,457), bringing a stop to the continually falling sales of the car for the past year.

Maruti will be somewhat concerned with the falling sales of its UVs. In July 2018, UV sales had dropped by 5 percent. Now in August, its UV portfolio, which comprises the quartet of the Gypsy, Ertiga, Vitara Brezza and the S-Cross, sold a total of 17,971 units (August 2017: 21,442).

The two Maruti vans, the Omni and the Eeco sold 13,663 units, down 1.9 percent (August 2017: 13,931).

While Maruti Suzuki still remains the king of the Indian PV market, its growth being driven by a handful of models out of an expansive line-up could be a cause of some serious concern over the longer term.

Hyundai Motor India, the country's No. 2 PV maker, too felt the pressure of slowing sales. Last month, the Chennai-based manufacturer sold 45,801 units, down 2.8 percent on year-ago sales (August 2017: 47,103).

Mahindra & Mahindra, which is launching its new Marazzo MPV today, sold a total of 19,758 units in August 2018, 1.81 percent up (August 2017: 19,406). Commenting on the monthly performance, Rajan Wadhera, president, Automotive Sector, M&M, said, “The auto industry remained subdued in August with low sentiments due to some external factorsWith the launch of the Marazzo, we hope to see buoyancy in our passenger vehicle numbers. With the upcoming festive season, we do expect a much improved traction for passenger and commercial vehicles alike”.

Tata Motors, which is riding a wave of demand for its PVs, continued its growth trend at 18,420 units sold in August 2018, higher by 28 percent (August 2017: 14,340). The company says the recently launched Nexon AMT is witnessing good traction in the market. While its passenger car sales registered a YoY growth of 9 percent, the UV segment grew by 93 percent. Cumulative sales of PV in the domestic market for the fiscal (April-August 2018) grew by 38 percent, at 88,436 units compared to 64,131 units for the same period, last fiscal.

Commenting on the sales in August 2018, Mayank Pareek, President, Passenger Vehicles Business Unit, Tata Motors, said: “Due to heavy rains across the country and floods in Kerala, consumer sentiment was muted. Despite a challenging month, we have recorded a growth of 28 percent. The demand for our new-generation vehicles has helped us maintain this consistent month on month growth. August also marked the milestone of the 50,000th Nexon rolling out of the Ranjangaon plant. We will continue to strive towards driving volumes and increasing our market share as part of our ongoing turnaround journey.”

Honda Cars India registered monthly domestic sales of 17,020 units in August 2018, down 1.98 percent (August 2017: 17,365). In the April-August 2018 period, Honda has sold 79,599 units which points to 9 percent YoY growth (April-August 2017: 73,012) . Rajesh Goel, SVP and director, Marketing and Sales, Honda Cars India, said, “There was an impact of Kerala floods and heavy rains in many parts of the country combined with GST-related high base effect of August 2017. We hope to recover quickly and keep growing strongly with rollout of attractive offers through the festive season ahead.”

Meanwhile, Toyota Kirloskar Motor sold 14,100 units in August 2018, which marks YoY growth of 17 percent (August 2017: 12,017). Commenting on the sales performance, N Raja, deputy managing director, Toyota Kirloskar Motor said, “We deeply regret the flood situation in Kerala and other parts of South India. Despite the impact of the flood condition, we have been able to overcome the challenge with complete support of other dealers across other regions. Kerala is a very important market for us and we will work hard to get this market back to normalcy.

The Innova Crysta and Fortuner have been performing consistently as segment leaders, attributing to TKM’s domestic growth. The Innova Crysta has seen a YoY growth of 13 percent in January-August 2018. Other models continue to sustain the positive customer demand. The recently launched Dual Tone Liva Limited Edition has received overwhelming response from customers across markets in India. With rains being plentiful, we expect the rural demand to pick up in the coming month and hope for a push in customer demand in the festive season.

Ford India’s domestic wholesales in August rose 3.42 percent to 8,042 vehicles as against 7,777 units in the same month last year. Exports grew to 12,606 vehicles compared to 7,963 units in August 2017.

KERALA FLOODS CAST SHADOW ON TWO-WHEELER SALES TOO

Initial sales performance reports from the major two-wheeler players suggest that the sector has grown by about 6 percent YoY in August 2018. While Honda Motorcycle & Scooter India (HMSI) and India Yamaha Motor are yet to disclose their sales data, cumulative sales from five manufacturers (Hero MotoCorp, TVS Motor, Bajaj Auto, Royal Enfield and Suzuki Motorcycle India) stand at 13,09,632 units, up 5.99 percent YoY in August 2018. These five OEMs had jointly recorded total sales of 12,35,622 units in August last year. Of this lot, baring Bajaj Auto and Suzuki Motorcycle, all others have posted flat growth YoY.

The floods in Kerala in mid-August are understood to have substantially dented demand for the two-wheeler market. Kerala, a key market for scooters and motorcycles, saw possibly the worst flood in its history, thereby uprooting many pockets and displacing the masses. While the impact is likely to continue to be felt in September, the industry is now looking forward to better times in the incoming festive season.

Industry leader Hero MotoCorp has reported sales (including exports) of 685,047 units last month, up 0.92 percent YoY, against 678,797 units sold in August 2017.

The company has commenced despatches of its new premium offering – the 200cc Xtreme 200R – to its dealerships across the country. The new 200cc motorcycle, priced at Rs 89,900 (ex-showroom, Delhi), targets price-sensitive customers keen to upgrade to bigger premium motorcycles. The Xtreme 200R is expected to further add to the expanding 200cc motorcycle category, which is driven by the multiple offerings from Bajaj Auto.

Hero MotoCorp is also understood to have planned the launch of its 125cc scooter variants. The new scooters will be aimed at providing a major boost to the overall scooter bookings during the festive period. The company has clearly mentioned in its official communication that it targeting double-digit growth during the festive months of October and November.

The company has also contributed a sum of Rs 1 crore to the chief minister’s distress relief fund addressing the Kerala floods.

TVS Motor Company sold 275,688 units in August 2018, up by a flat 1.90 percent YoY (August 2017: 270,544). TVS Motor’s overall scooter sales have grown by 11 percent from 114,354 units sold in August last year to 126,676 units last month.

The company has posted a YoY growth of 18 percent in its motorcycle sales, which increased from 111,927 units in August last year to 131,743 units in August 2018. It has not disclosed any details on its mopeds.

TVS Motor Company has also contributed about Rs 1 crore to the Kerala chief minister’s fund.

Bajaj Auto’s monthly performance is on an upswing, thanks to its aggressive market-cum-product strategies at play. The company has reported sales of 218,437 units last month, up a good 27.25 percent YoY (August 2017: 171,664). Among its top sellers are its entry-level 100cc commuter motorcycle variants – the CT 100 models along with the Pulsar umbrella. The Platina and the new Discover variants are also contributing well to its monthly sales.

Bajaj Auto has contributed Rs 2 crore to the cause of bringing life back to normal in the state of Kerala.

Royal Enfield’s dream run seems to have hit a roadblock as its YoY growth has come down to 1.71 percent in August 2018. The Eicher Motors-owned motorcycle brand has posted sales of 68,014 units last month as against the high base of 66,872 units sold in August last year. The company has recently launched the 350cc Classic Signals (two variants) with dual-channel ABS units. While the company is working to roll out the ABS-equipped Himalayan soon, it is also expected to soon launch its premium 650cc twins – first in the global markets followed by the launch in India.

Meanwhile, Suzuki Motorcycle India has reported its best-ever monthly sales in the domestic market, thereby posting a total of 62,446 units in August 2018. It has grown by an impressive 30.79 percent YoY and works as a critical contributor pulling up the overall two-wheeler sales volumes for the past month. It had sold 47,745 units in August last year. Suzuki’s growth can be attributed to its Access 125 scooter, which is also the leader in the surging 125cc scooter market.

Commenting on the company’s performance, Sajeev Rajasekharan, EVP, Suzuki Motorcycle India, said, “We owe this tremendous growth to our flagship brand Suzuki Access 125 and the newly launched Burgman Street 125, which have contributed to more than 55,000 units this month. The 125cc scooter segment is thriving in India, and as a market-leader in this segment, it augurs well for us. Not only have we managed to sustain a 41% growth this year, but with the festive season looming, we are confident of maintaining this growth curve in the coming days as well.”

The company is gunning to achieve cumulative sales of 700,000 units in the ongoing fiscal.

It is expected that as life will get return to normal in Kerala and the market demand is restored in September, OEMs will begin stacking their dealership networks across the country preparing for the festive months of October and November.

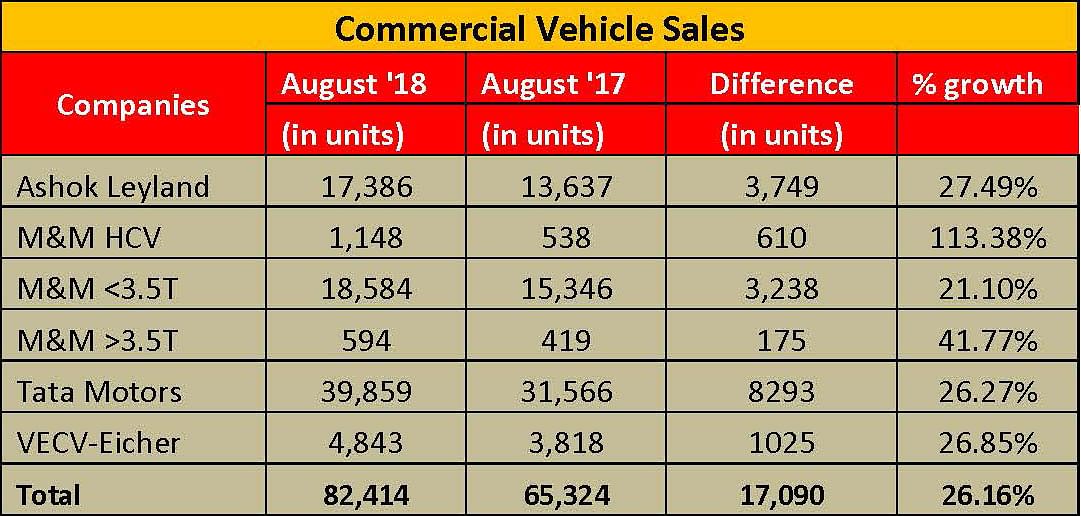

COMMERCIAL SALES REMAIN BUOYANT IN AUGUST

Compared to the PV and two-wheeler sectors, which felt the pressure of slowing sales and the impact of the Kerala floods, the commercial vehicle sector fared rather well in August 2018. What is helping the CV segment stay buoyant is the resilient Indian economy which has posted strong growth of 8.2 percent in Q1 FY2019. Factors such as a spurt in urban and rural consumption, e-commerce boom, higher infrastructure spend by the government, and growing demand for last-mile connectivity has led to a strong double-digit growth in the CV industry. Between April-July 2018, CV OEMs witnessed robust YoY growth of 45 percent with total sales of 306,592 units. While the M&HCV segment grew by 65 percent, the LCV segment grew by 35 percent during the same period.

Market leader Tata Motors sold 39,859 units in August 2018, higher by 26 percent (August 2017: 31,566). The M&HCV truck segment, which is directly linked to the generic economic activities of the country, maintained double-digit growth with the sale of 12,751 units (+16%). The company sold 5,269 ILCVs, which mark YoY growth of 36 percent. The recently launched Tata Ultra range further bolstered their sales in the rural markets and among the e-commerce sector.

Tata Motors’ cargo SCVs and pickups together recorded sale of 17,426 units (+ 37%). The demand for small vehicles for last-mile connectivity is largely due to high private consumption and the continuously evolving hub-and-spoke model. The company says that the newly launched Tata Ace Gold has also been gaining significant acceptance and contributing to the volume growth.

The company also sold 4,458 commercial passenger carriers (bus) (+9%), led by the demand for school buses and vans, ambulances and an uptick in the STU buying.

Ashok Leyland also maintained strong double-digit growth in its sales due to strong demand for its M&HCVs and LCVs. The company sold a total of 17,386 units, which constitutes YoY growth of 27 percent (August 2017: 13,637). While the company sold 13,158 M&HCVs (+24%), its LCVs recorded strong 38 percent YoY growth by selling 4,228 units. (August 2017: 3,067).

Mahindra & Mahindra’s overall CV sales were up by 25 percent to 20,326 units (August 17: 16,303). M&HCV numbers were up by a massive 113 percent, albeit on a small base of 1,148 units (August 2017: 538). The below-3.5T GVW segment grew by 21 percent YoY, selling 18,584 units (August 2017: 15,346), while those in the above-3.5T GVW segment registered a growth of 42 percent with the sales of 594 units (August 2017: 419).

VE Commercial Vehicles has also posted strong growth – 4,843 units up by 26.8 percent (August 2017: 3,818 units).

According to industry analysts, the CV sector is likely to remain bullish and factors such as rising rural income and government’s continued focus on the rural sector will drive the demand in the coming days. Going by last year’s record sales, the CV sector is predicted to record double-digit growth this year too.

RELATED ARTICLES

Kia clocks best-ever first-half global sales of 1.58 million, India share at its highest: 9%

Kia India’s wholesales of 142,139 vehicles in the domestic market between January and June 2025 give it an 8.95% share o...

Legacy e-2W OEMs keep startups at bay, capture 58% share in first-half CY2025

Legacy two-wheeler manufacturers TVS Motor, Bajaj Auto, Hero MotoCorp, Greaves Electric, Kinetic Green and Honda sell 35...

Hyundai India sells 132,259 vehicles in Q1 FY2026, SUV share at 68%

Demand for Hyundai passenger vehicles was tepid in April-June 2025 with sales down 12% YoY. SUVs, led by the Creta, cont...

03 Sep 2018

03 Sep 2018

7960 Views

7960 Views

Ajit Dalvi

Ajit Dalvi