Indian automakers sees flat growth in May

Overall industry numbers have dipped by 0.58 percent and cumulative April-May 2015 sales have plateaued out the Indian automotive industry performance to a flat 0.61 percent, according to the latest SIAM results.

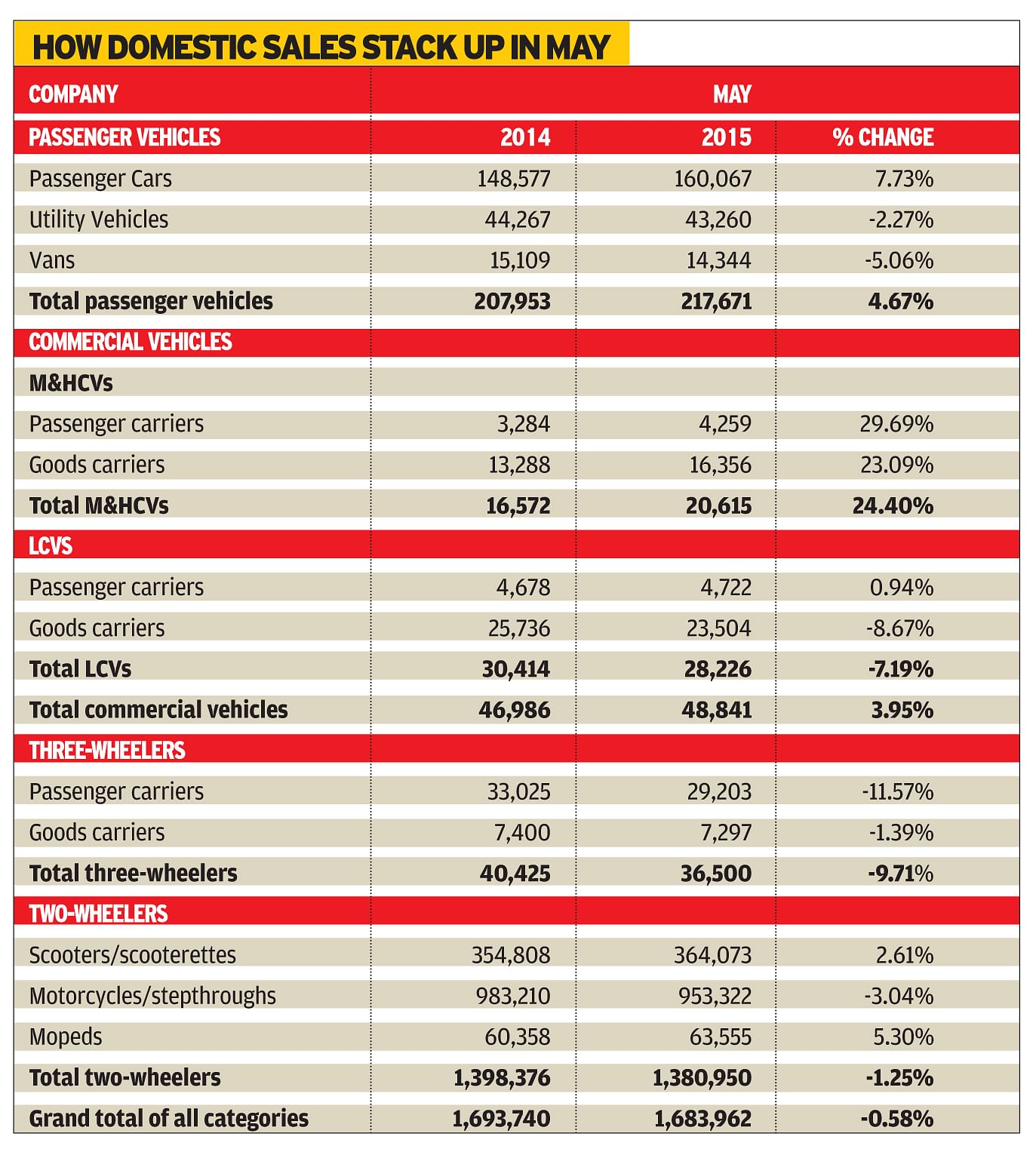

The current fiscal year 2015-16 that began on an optimistic note with 1.91 percent year on year growth in April 2015 has faltered in May. Overall industry numbers have dipped by 0.58 percent and cumulative April-May 2015 sales have plateaued out the Indian automotive industry performance to a flat 0.61 percent, according to the latest SIAM results.

May 2015’s de-growth comes after March 2015 (-0.15%) and October 2014 (-3.84%) and the lacklustre sales last month are indicative of the continuing slowdown in some regions of the country.

Exacerbating the situation is a delayed monsoon, which has impacted sales of light commercial vehicles and commuter motorcycles which are driven predominantly by rural markets. Disposable incomes of consumers in these regions are dependent on agriculture.

The only segments to buck the downtrend in May are passenger cars (+7.73%), medium and heavy commercial vehicles (+24.40%), scooters (+2.61%) and mopeds (5.30%).

In May 2015 car sales grew by 7.73 percent while M&HCVs rose 24.40 percent with passenger carriers growing 29.69 percent and goods carriers by 23.09 percent over the same period in 2014. For the LCV segment, passenger carriers moderated at 0.94 percent but goods carriers saw a decline of 8.67 percent with the total LCV segment down by 7.19 percent, pulling down total CV industry growth to 3.95 percent.

Start of infrastructure development activity and opening up of the mining sector has help speed up the growth of M&HCVs but interest rates for auto loans still remain high, affecting sales of LCVs and small CVs that are bought mainly by small businesses.

Abdul Majeed, head (Automotive Practice) PricewaterhouseCooper India, says that he is extremely skeptical about growth over the next 6-12 months on a sustainable basis as both the rural and urban economies are down.

Despite oil prices falling and inflation being reined in, rural markets which are the backbone of the economy are down. The minimum support prices for farmers that were expected to go up this year have not been hiked while the monsoon continues to play truant adding to the woes of the farming community.

On the other hand, investments in urban areas are still low and affecting purchases. The salaried class has seen only sub-optimal increments of 6-10 percent, placing less disposable income in their hands. Most corporates have not done well as they have made investments but are sitting with idle capacity. All this is affecting market demand.

Meanwhile, scooter sales were up 2.61 percent and mopeds by 5.30 percent while the overall two-wheeler category dipped by 1.25 percent during May. Three-wheelers struggled to stay relevant while facing a decline of 9.71 percent with passenger carriers facing the heat at 11.57 percent and goods carriers down by 1.39 percent.

For the first two months of the fiscal (April-May 2015), growth is a flat 0.61 percent. The passenger vehicle segment grew 9.98 percent of which passenger cars, utility vehicles and vans clocked growth of 12.70 percent, 2.16 percent and 6.11 percent respectively.

The overall CV industry rose 5.16 percent. M&HCVs led from the front at a 24.66 percent uptick while LCVs continued their decline by 5.59 percent.

Three-wheelers were a laggard, dipping 6.37 percent with both passenger carriers and goods carriers in the red at 7.63 percent and 1.22 percent.

Also read: INDIA SALES ANALYSIS MAY 2015Two-wheelers were no better with overall sales declining 0.73 percent during April-May over the same period in 2014. While scooters and mopeds grew by 3.94 percent and 7.48 percent, motorcycles dropped by 2.91 percent pulling down the overall performance.

Exports grew by 5.73 percent during April-May 2015 while in May exports were moderate at 3.99 percent. Exports of passenger vehicles, CVs and three-wheelers were up at 13.64 percent, 26.48 percent and 51.89 percent respectively while two-wheelers dropped by 3.04 percent during April-May 2015 over April-May 2014.

SIAM COMMENTS

According to Vishnu Mathur, director general of SIAM, the industry's performance has been pulled down by the poor showing of the two-wheeler segment which is a volume market. Almost 50 percent of the motorcycle sales come from the rural areas and that region is facing a problem currently due to unseasonal rainfall and crop damage.

"If the coming monsoon is good, then it will lead to better sales in the rural markets. The situation will be clear by August-September, otherwise recovery will get affected especially of the two-wheeler industry," he said.

“LCV sales have been impacted by three reasons – rural impact, financing is an issue as most of the NBFCs that were extending loans have now got very high non-performing assets and have cut back on loans. Also, LCV buyers are small players and individuals and are not able to make the purchases in the absence of funding.

“In the last two months (April-May 2015), demand has been slackening for all segments including scooters that are sold in urban areas. Even though M&HCVs are showing growth, it is over a low base of last year. In March 2011, M&HCVs sold 40,000 units in one month and now sales are at half the number in a month because of the slowdown over the last 2.5 to 3 years,” added Mathur.

Though SIAM has not made any forecast for FY'16, looking at the current scenario, it is expecting growth in the Indian auto industry to be in the range of 5-10 percent.

RELATED ARTICLES

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

Mahindra Thar Roxx and Tata Curvv best-selling new SUVs in FY2025

With over 125 models and a mind-boggling 1,000-plus variants, utility vehicle buyers in India are spoilt for choice. Whi...

Honda Unicorn outsells Bajaj Pulsar in 125-150cc segment in FY2025

With total sales of 282,536 units in FY2025, the Honda Unicorn 150 has gone ahead of Bajaj Auto, the segment leader in F...

10 Jun 2015

10 Jun 2015

3933 Views

3933 Views

Autocar Professional Bureau

Autocar Professional Bureau