INDIA SALES ANALYSIS: MAY 2015

Sales are a mixed bag for Indian automakers this May

The current fiscal year 2015-16 that began on an optimistic note with 1.91 percent year-on-year growth in April 2015 has faltered in May. Overall industry numbers have dipped by 0.58 percent and cumulative April-May 2015 sales have plateaued out the Indian automotive industry performance to a flat 0.61 percent, according to the latest SIAM results.

May 2015’s de-growth comes after March 2015 (-0.15%) and October 2014 (-3.84%) and the lacklustre sales last month are indicative of the continuing slowdown in some regions. Exacerbating the situation is a delayed monsoon, which has impacted sales of light commercial vehicles and commuter motorcycles which are driven predominantly by rural markets.

The only segments to buck the downtrend in May are passenger cars (+7.73%), medium and heavy commercial vehicles (+24.40%), scooters (+2.61%) and mopeds (5.30%).

According to Vishnu Mathur, director general of SIAM, the industry’s performance has been pulled down by the poor showing of the two-wheeler segment. Almost 50 percent of bike sales come from rural India, which is seeing tough times due to unseasonal rainfall and crop damage.

“If the coming monsoon is good, then it will lead to better sales in the rural markets. The situation will be clear by August-September, otherwise recovery will get affected especially of the two-wheeler industry,” he said.

“LCV sales have been impacted by three reasons – rural impact, financing is an issue as most of the NBFCs that were extending loans have now got very high non-performing assets and have cut back on loans. Also, LCV buyers are small players and individuals and are not able to make the purchases in the absence of funding.

“In the last two months (April-May 2015), demand has been slackening for all segments including scooters that are sold in urban areas. Even though M&HCVs are showing growth, it is over a low base of last year. In March 2011, M&HCVs sold 40,000 units in one month and now sales are at half the number in a month because of the slowdown over the last 2.5 to 3 years,” added Mathur.

Though SIAM has not made any forecast for FY’16, looking at the current scenario, it is expecting growth in the Indian auto industry to be in the range of 5-10 percent.

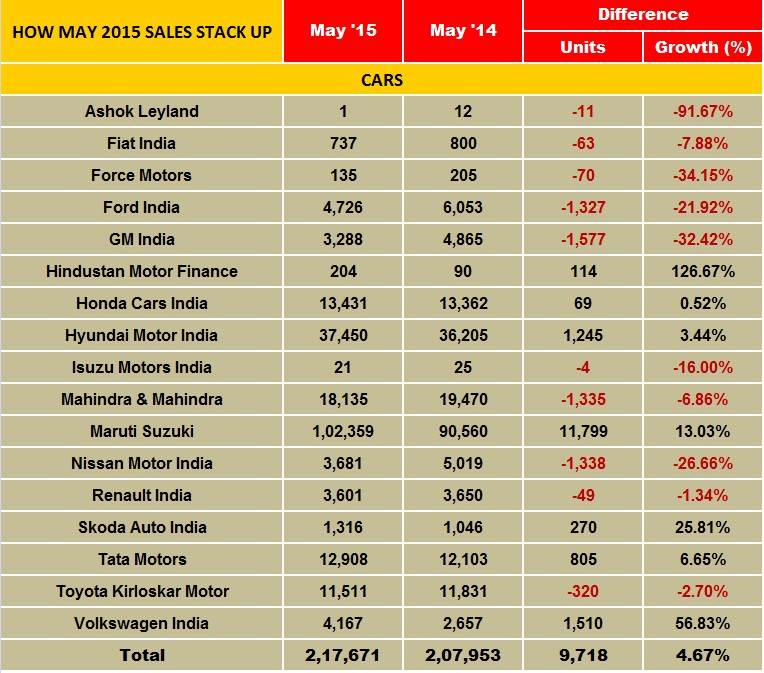

MARUTI SALES UP

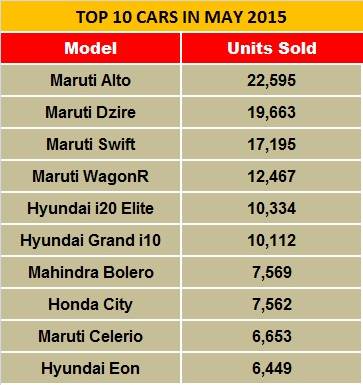

Maruti Suzuki India reported domestic sales of 102,359 units in May 2015, up 13% (May 2014: 90,560). This performance comes on the back of the 27% YoY growth it clocked in April (100,709), albeit on a lower sales base.

Providing a fillip to May 2015 sales were the entry level duo of the Alto and the Wagon R, which together sold 35,062 units (May 2014: 29,068). This somewhat helped buffer the 5.7% fall in the Swift-Ritz-Celerio-Dzire sales of 41,926 units (May 2014: 44,455). The Ciaz sedan sold over 5,000 units. In the UV category, the Ertiga sold the bulk of the 5,567 units (May 2014: 5,253), to post 6% growth. The Omni and Eeco continue to sell well and in May, sold a combined 11,602 units, up 7.7% (May 2014: 10,771).

Hyundai Motor India reported domestic sales of 37,450 units in May 2015 (May 2014: 36,205), up 3.4%. Commenting on last month’s sales, Rakesh Srivastava, senior VP (Sales and Marketing), HMIL, said, “In a market experiencing low growth with decreasing contribution of rural and diesel vehicles sales, Hyundai volumes grew to 37,450 units with the fourth consecutive month of more than 10,000 units of the Elite and Active.”

Mahindra & Mahindra’s passenger vehicle sales (which includes UVs, cars and vans) were down 6.86% at 18,135 units in May 2015 (May 2014: 19,470). Pravin Shah, president and chief executive (Automotive), Mahindra & Mahindra, said, “The auto industry has been showing signs of recovery and it is important that factors like an interest rate cut if considered, would accelerate growth.”

Honda Cars India posted flat growth in May with 13,431 cars going home to new buyers, up a marginal 0.52% (May 2014: 13,362). The model-wise split was Brio (873), Amaze (3,699), City (7,562), Mobilio (1,249) and CR-V (48).

Toyota Kirloskar Motor (TKM) sold 11,511 units in May 2015, down 2.70 percent (May 2014: 11,831). The all-new Camry launched on April 30, sold 107 units in May 2015, registering a YoY growth of 51% . N Raja, director and senior vice-president (Sales and Marketing) said, “The newly launched Camry has shown great success and acceptance by customers this month. The Camry Hybrid constitutes 91% of total Camry sales in May. The hybrid market though still at a nascent stage is beginning to gain popularity among Indian customers. The Camry is the first locally produced hybrid vehicle and as committed, the incentive of Rs 70,000 has been passed on to the customer.”

Volkswagen India announced a 57% increase in sales in May 2015 at 4,167 units (May 2014: 2,657). The company says this increase in sales comes on the back of the recent successful launch of the new Jetta and the Polo. In the premium hatchback segment, the Polo GT TSI is seeing good numbers.

Michael Mayer, director, Volkswagen Passenger Cars, Volkswagen Group Sales India, said: “We are happy to note that our sales have gone up by 57% in May 2015, on a year-on-year basis. This is a clear indication of the fact that, increasingly, car buyers in India now recognise and appreciate the key attributes of Volkswagen cars, which are best-in-class build quality and safety, efficiency and driving dynamics. We remain confident of continuing to improve our sales figures further over the coming months.”

N Raja, director and senior vice-president (Sales and Marketing) said, “The newly launched Camry has shown great success and acceptance by customers this month. The Camry Hybrid constitutes 91% of the total Camry sales in May. The hybrid market though still at a nascent stage is beginning to gain popularity among Indian customers. We would like to thank the customers for their response and also the government for the introduction of incentives under FAME. Camry is the first locally produced hybrid vehicle and as committed, the incentive of Rs 70,000 has been passed on to the customer.”

Volkswagen India announced a 57% increase in sales in May 2015 at 4,167 units (May 2014: 2,657). The company says this increase in sales comes on the back of the recent successful launch of the new Jetta and the Polo, the only hatchback in its segment that comes with a 4-star NCAP safety rating for adult occupants. In the premium hatchback segment, the Polo GT TSI, with its powerful turbocharged petrol engine and 7-speed DSG transmission, is seeing good numbers.

Michael Mayer, director, Volkswagen Passenger Cars, Volkswagen Group Sales India, said: “We are happy to note that our sales have gone up by 57% in May 2015, on a year-on-year basis. This is a clear indication of the fact that, increasingly, car buyers in India now recognise and appreciate the key attributes of Volkswagen cars, which are best-in-class build quality and safety, efficiency and driving dynamics. We remain confident of continuing to improve our sales figures further over the coming months.”

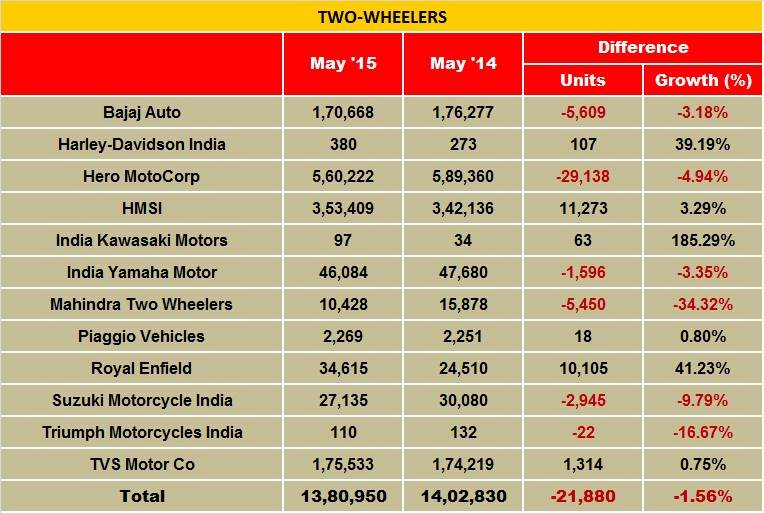

MOTORCYCLES HOLD BACK 2W SEGMENT GROWTH

Slowing sales in the commuter motorcycle segment have adversely affected the overall growth of the two-wheeler segment, which continues to witness decelerating growth still fuelled by the demand for scooters.

A drop in overall demand due to harsh weather conditions across India, slowing rural markets and delayed purchases stand as the key reasons for recording yet another month of drop in the sales of motorcycles. As per consolidated SIAM data for FY2014-15, the motorcycle segment stood close to 2.5 times of the scooter segment in terms of total annual sales volumes.

Due to the persistent drop in the motorcycle sales, industry leader and the largest motorcycle manufacturer, Hero MotoCorp witnessed a drop in its YoY sales for May 2015. Bajaj Auto and Honda Motorcycle & Scooter India (HMSI)’s motorcycle division too saw a downtrend in their sales for the month. On the other hand, TVS Motor Company, Suzuki Motorcycle India and Royal Enfield registered positive numbers.

Hero MotoCorp recorded yet another month of more than 500,000 unit sales. However, having sold 569,876 units during May 2015, the company sold 32,605 units fewer than its total sales of 602,481 units in May 2014 (-5.41%).

In a remarkable achievement, Hero had recently reported that it has cumulatively sold more than one million units of its HF Deluxe commuter bike in FY2014-15. The model has now become the third brand for the company, other than the Splendor and Passion range, to clock annual sales of a million units.

Growing strongly, Hero’s Splendor iSmart commuter motorcycle has already clocked cumulative sales of more than 350,000 units since its launch in Q4 FY2013-14.

Honda Motorcycle & Scooter India (HMSI) has registered total domestic sales of 353,440 units during May 2015, up by a marginal 3.3 percent over its May 2014’s sales of 342,136 units. While the company registered a good growth of 13.66 percent YoY in its scooter segment during May 2015, the same was negated by the degrowth recorded in the sales of its motorcycle portfolio, which was down by 9.54 percent. Honda sold 215,300 scooters and 138,140 motorcycles during May 2015 as against the sales of 189,422 scooters and 152,714 motorcycles in May last year.

According to an official release from HMSI, the company’s overall market share stood at 26 percent in the domestic two-wheeler market during the month.

Meanwhile, continuing to register falling sales, Bajaj Auto has recorded total sales (including exports) of 301,862 units during May 2015 as against 313,020 units sold in May last year, down by 3.56 percent YoY. As the company is ramping up the production capacity of its CT100 commuter model along with a slew of new models it has floated in the market, it is expected that it will soon start registering positive numbers.

TVS Motor Company has recorded a growth of 3.45 percent YoY as its monthly sales for May 2015 stood at 175,533 units. It had sold 169,671 units in May last year. TVS' scooter portfolio grew by seven percent, increasing from 51,010 units in May 2014 to 54,426 units in May 2015. Motorcycles sales, on the other hand, grew by eight percent YoY, increasing from 84,660 units in May 2014 to 91,344 units in May 2015.

Registering a handsome YoY growth of 41.23 percent during May 2015, Royal Enfield has reported sales of 34,615 as against the total sales of 24,509 units in May last year. Sources say that the company, which is working on at least two different engine platforms to fuel its growth in the coming years too, has readied a model on 375-400cc engine and is eyeing its commercial launch in Q4 CY2015 or Q1 CY2016. Royal Enfield’s parent company Eicher Motors is known to follow the calendar year for assessment and will shift to the April-March format by next year.

Siddhartha Lal, MD and CEO Eicher Motors, said: “Royal Enfield is working on new platforms and products that will fuel our growth in the coming years. It is also expanding its footprint in India and in key markets across the world, to build its presence globally. We will continue to make higher investments into brand, distribution and globally relevant products that will be essential for us to achieve global leadership in the mid-size motorcycle category.”

Suzuki Motorcycle India reported a marginal growth of 3.64 percent in its May 2015 sales. The company sold 33,287 units in May 2015 as opposed to 32,117 units in May 2014.

“Suzuki continues to experience positive growth in sales, even as the Indian economy struggles onto a recovery path. We have witnessed an upward growth trajectory since the launch of the Suzuki Gixxer and are confident that Suzuki will continue to experience this growth in the months to come,” said Atul Gupta, executive vice president, SMIL.

Mahindra Two Wheelers’ (MTWL) official release stated that the company had sold a total of 10,428 units in the domestic market for May 2015.

Overall, the industry is keeping its fingers crossed and hoping for a decent monsoon. Anything less will adversely impact sales of entry level cars, SUVs and commuter bikes across the country.

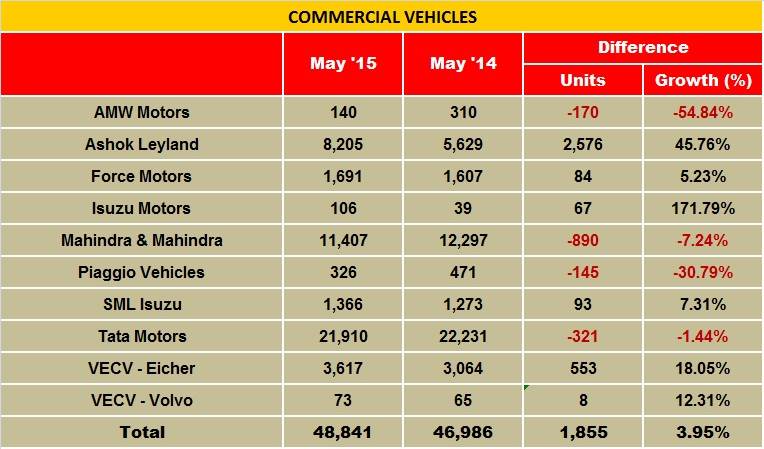

COMMERCIAL VEHICLE SALES RISE, THANKS TO M&HCVS

It finally looks like the green shoots of recovery in the critical medium and heavy commercial vehicle (M&HCV) segment in India are real.

All the big players have posted increased M&HCV sales in May 2015. After two years of a slowdown, M&HCV numbers turned positive in August 2014 and since then over the past 10 months have registered double-digit growth, month on month. This is a huge respite for the CV manufacturers and with increased economic and infrastructural activities across the country, the prognosis for future sales is good. Coming on the back of April 2015's 25% growth (19,277 units) for the M&HCV market, the May numbers are heartening.

Tata Motors, the biggest CV player, saw overall sales decline 1.44 percent in May with 21,910 units (May 2014: 22,231).

Ashok Leyland continues to sustain its good run and saw its sales increase 45 percent at 8,205 units last month (May 2014: 5,629 units).

VE Commercial Vehicles’ sales were up 18 percent in the month. In the domestic market in the 5-tonne and above category, the company sold 3,617 units (May 2014: 3,064 units).

Mahindra & Mahindra overall sales declined 7 percent at 11,407 units (May 2014: 12,297 units).

(Inputs from Amit Panday and Kiran Bajad)

Also read: Indian automakers sees flat growth in May

RELATED ARTICLES

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

By Autocar Pro News Desk

By Autocar Pro News Desk

02 Jun 2015

02 Jun 2015

28791 Views

28791 Views