India Sales – July 2017: Passenger Vehicles, Two-Wheelers and CVs headed for good times

GST-driven price reductions across vehicle segments, a gaggle of new models and a general uptick in consumer sentiment augur well for the fiscal.

The winds of change are here, in an era of GST. In the first month since the Goods & Services Tax was introduced, the automobile sector, one of the major beneficiaries due to reduced taxation in all vehicle categories other than hybrids, is seeing a smart uptick in demand. And in the run up to the festive season which begins in end-September, consumer demand is likely to burgeon.

The passenger vehicle (PV) segment, driven by the surging demand for SUVs which today account for 25 percent of the PV market, is set to notch a new high for the fiscal. Having crossed the 3-million mark for the first time in 2016-17, FY2018 should see overall numbers accelerate even more. The two-wheeler sector, particularly scooters, is recording handsome gains month on month and should ride past last fiscal’s 17 million units easily. The concern has been the CV sector but with July numbers indicating improved numbers for the critical M&HCV segment, even as the LCV market drives consistently in growth lane, augurs well for the fiscal.

In its growth outlook for the industry, announced earlier this year, apex body SIAM had forecast 7-9 percent growth for PVs, 9-11 percent for two-wheelers and 4-6 percent for commercial vehicles. Given the trend in July, it looks like this forecast will be revised. Here’s looking at how the individual vehicle segments performed last month.

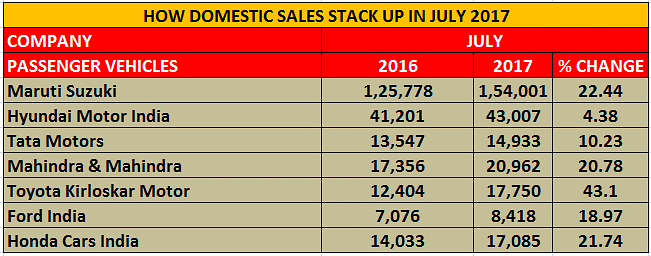

The first indication came in at 10.15am today when Maruti Suzuki India rolled out its sales numbers for the month – 153,298 units for July 2017, up 22 percent (July 2016: 125,264). With plenty of manufacturing capacity on hand, now that the Gujarat plant is humming away smoothly, the carmaker is firing on all cylinders feeding the domestic market with all it can absorb. If July numbers are any indication, then expect Maruti to keep crossing the 150,000 unit sales mark month after month.

Importantly, for the company, the sales growth is across all vehicle segments – cars, utility vehicles and vans. The entry level duo of the Alto and Wagon R sold a good 42,310 units, up 20.7 percent (July 2016: 35,051), indicating that demand for these two popular hatchbacks remains as strong as ever. The company’s six compact cars comprising the Swift, Ritz, Celerio, Ignis, Baleno and Dzire sold 63,116 units, up 25.3 percent (July 2016: 50,362). The Ciaz premium sedan, which is now sold only from the premium Nexa channel, sold a total of 6,377 units, up 41 percent YoY (July 2016: 5,162). The two vans – Omni and Eeco – sold 15,714 units, up 6.6 percent (July 2016: 14,748).

Sales of Maruti UVs (Gypsy, Ertiga, Vitara Brezza, S-Cross) crossed the 25,000-unit mark for the first time in a month, up 48.3 percent to 25,781 units (July 2016: 17,382). Like the other OEMs with SUVs, expect Maruti to continue riding the huge wave of SUV demand in the coming albeit with the upcoming entry of the Tata Nexon and Jeep Compass, some demand could go their way.

The premium Ciaz also found 41 percent more homes, selling 6,377 units (July 2016: 5,162). The sedan’s diesel mild-hybrid version, the SHVS, however, has been struck by the high taxation (43%) on hybrids under GST, and along with its MPV cousin, Ertiga SHVS, has fallen flat, with demand virtually diminishing, owing to the drastic price increment.

According to RS Kalsi, executive director (Marketing and Sales), MSIL, “The situation is grim for the mild-hybrid variants of the two models. While we have appealed to the GST Council through SIAM, we would wait for the government’s response and see how things turn out, before planning out anything further.”

Hyundai Motor India, the No. 2 carmaker, has registered sales of 43,007 units in July, up 4.4 percent year on year (July 2016: 41,201). Commenting on the numbers, Rakesh Srivastava, director (Sales and Marketing), said: “Hyundai with a growth of 14.5 percent month on month and 4.4 percent year on year, continued its growth momentum on the strength of strong performance by the Grand i10, Elite i20 and Creta. The higher growth momentum is due to lowering of prices on account of GST implementation and a good monsoon which will increase customer confidence and sentiment towards vehicle buying.”

The company is also set to introduce its next-generation Verna sedan in the market in the coming months, to take on a growth path in the segment.

UVs catapult growth

A 12 percent reduction in taxation is only fuelling the Indian consumer’s penchant for SUVs. While most manufacturers did announce drastic price cuts at the onset of July, new model launches, of the likes of the Jeep Compass, have also been able to take leverage of the lower tax rate and get priced aggressively.

Homegrown UV major, Mahindra & Mahindra (M&M) has reported sales of 20,962 vehicles in July 2017 from its PV business, registering strong 21 percent YoY growth (July 2016: 17,356). According to Rajan Wadhera, president, Automotive Sector, M&M, “We are happy with the overall performance in July 2017. The benefit of a good monsoon, the successful rollout of GST and a good run up to the festive season, starting from August, give us confidence of continuing a robust growth in Q2”.

The coming of GST and the huge taxation relief it gave to SUVs is benefiting manufacturers of utility vehicles in a big way.Toyota Kirloskar Motor, which had seen subdued sales in June, has bounced back with sales of 17,750 units in the domestic market in July 2017 – its best-ever performance for the seventh month of the year – registering over 43 percent year-on-year growth (July 2016: 12,404).

TKM’s sales, not surprisingly, have been driven by the massive consumer demand for the Innova Crysta MPV and new Fortuner SUV, both having clocked their highest ever unit sales since launch in May 2016 and November 2016 respectively.The recovery after GST has been strong as customers flocked to benefit from the massive price reductions of up to Rs 217,000 on the Fortuner, Rs 98,500 on the Innova Crysta, and up to Rs 92,500 on the Corolla sedan.

Commenting on the monthly sales, N Raja, director and senior VP (Sales & Marketing), Toyota Kirloskar Motor, said, “We are thankful to the government for the biggest indirect tax reform of the nation, which has helped us maintain the double-digit growth this month. In June, putting the dealers’ need ahead we had consciously taken the decision to lower the volumes of vehicles sold to them as we wanted to ensure that there is minimum burden on our dealer partners of any differential tax after GST. However, we are delighted that we have been able to achieve the milestone of best-ever July sales.”

“The Innova Crysta has seen impressive growth in July, with over 9,300 units sold. We are delighted that this month our MPV leader has achieved the milestone of highest-ever sales globally. The new Fortuner has also been a major contributor to overall growth with over 3,400 vehicles sold, which is the highest ever in India since the vehicle’s launch.

“Apart from the SUV segment, the Corolla, Platinum Etios and Etios Liva have also witnessed a positive growth momentum in the month of July.

“However, the customer demand for our strong hybrid product Camry Hybrid has seen a significant fall owing to the price hike as per applicable tax under the GST framework. We hope the government would reinstate the preferential (lower) tax rate in favour of clean and green technologies such as strong hybrids similar to the pre- GST era. This will greatly help improve the economic viability and hence aid the consumer in choosing this advanced technology over petrol/diesel vehicles,” concluded Raja.

Tata Motors too notched an improved performance with total PV sales of 14,933 units, up 10 percent YoY (July 2016: 13,547) due to continued strong demand for the Tiago and the Tigor. While the passenger car segment marginally de-grew by one percent at 12,125 units, the UV segment grew by 110 percent at 2,808 units due to strong demand for the Tata Hexa crossover which saw a reduction of up to Rs 217000 in prices post-GST, and drawing in new customers.

Speaking on the sales results, Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, said, ”With an improved customer buying sentiment post GST, we are delighted to record a growth of 10 percent in the passenger vehicle market, in July 2017. The Tiago continues to witness strong demand; the Tigor and Hexa have also witnessed strong traction in the market. We continue to maintain cautious optimism and will work towards turning around the business, in line with our well-defined strategy.”

Ford India registered an uptick in domestic sales by 18.97 percent, with numbers closing in at 8.418 units (July 2016: 7,076).

According to Anurag Mehrotra, managing director, Ford India, “While there will be short term administrative headwinds associated with GST and rising input costs, we believe a good monsoon, conducive financing rates and consumer confidence during festival season will provide a good impetus for the industry. At Ford, we remain committed to building a sustainable and profitable business based on our four strategic pillars of a strong brand, right products, competitive cost and effective scale.”

Honda Cars India has announced sales of 17,085 units in July 2017, up 22 percent (July 2016: 14,033). The Japanese carmaker has been maintaining strong sales momentum in the current fiscal year and has sold 55,647 units during the April-July 2017 period (+21%) as against 45,880 units in April-July 2016.

The WR-V has become Honda’s best-seller in India, driving past longstanding topper, the City. The WR-V sold 4,894 units to the City’s 4,854 units last month. The Jazz (2,971), Amaze (2,913), BR-V (1,042), Brio (396) and CR-V (15) were the other sales contributors.

Yoichiro Ueno, president and CEO, Honda Cars India, said: “We were able to post good growth in July with strong sales numbers across models. The post-GST price benefits, healthy monsoon and onset of festive season in many regions from August will give another boost to our sales.” We have increased the WR-V supply, which is reflected in the good numbers posted by the model in July.”

Hero MotoCorp stands out as the biggest volume gainer (91,156 units) followed by Honda Motorcycle & Scooter India (HMSI) which added 82,388 units to its July 2016’s performance. The good performance can be attributed to the revival in rural demand backed by above average rainfall, positive market sentiment, GST-driven price cuts and low channel inventory.

Like it has for the passenger vehicle segment, July 2017 has turned out to be a good month for the two-wheeler industry. Monthly sales data from six OEMs (Hero MotoCorp, Honda, TVS Motor, Bajaj Auto, Royal Enfield and Suzuki Motorcycle India) show cumulative sales at 16,22,714 units for the month. The year-on-year growth different amounts to 203,290 units, which accounts for an impressive YoY growth of 14.32 percent.

Hero MotoCorp: July is the third consecutive month for Hero MotoCorp reporting robust sales of over 600,000 units. The company recorded total sales of 623,269 units (including exports) last month, increasing its year-on-year sales by 91,156 units and clocking impressive YoY growth of 17.13 percent (July 2016: 532,113). According to the company, these numbers are despite the sluggish demand the market witnessed for the first few days of the month due to the transition to GST.

The company says it is confident of carrying forward this growth momentum into the upcoming festive season. As such, it has planned multiple product launches across motorcycles and scooters and is also aiming for the top spot in the 125cc executive commuter motorcycle segment with its popular Glamour model, which was beaten by Honda’s CB Shine in Q1 FY2018.

Senior company officials have attributed the subdued growth in the sales of its Glamour model (during Q1 this fiscal) to supply constraints. “With the supply constraints taken care of, we expect the Glamour to perform better in the market in the second quarter,” said a top company official.

Honda: The Hero Glamour’s arch-rival Honda CB Shine is also getting some marketing boost as HMSI has recently rolled out new campaigns promoting its 125cc bestseller. Honda reported total domestic sales of 511,939 units, recording YoY growth of 19.18 percent (July 2016: 429,551). This number comprises 343,878 scooters (up 40 percent YoY) and 168,061 motorcycles (up 11 percent YoY).

HMSI, which is aggressively chasing Hero MotoCorp, claims to have gained critical market share in July 2017 and in its year-to-date (YTD – April – July) sales. “Honda2Wheelers is the only manufacturer to gain 2 percent market share to 28.8 percent (domestic + exports), making Honda the highest market share gainer in July 2017. Interestingly, Honda is the only company to have gained 3 percent market share during April-July (YTD). With each passing month, Honda2Wheelers has sustained a market share of over 30 percent in the current financial year,” quotes the HMSI press release.

Notably, HMSI has also recorded its highest ever exports in a single month with shipment of 32,569 units (up by 34 percent YoY) in July 2017.

Commenting on the performance, Yadvinder Singh Guleria, senior vice-president – Sales & Marketing, HMSI, said, “Honda’s commitment to the market and its customers has helped us achieve double-digit growth. With aggressive network expansion and introduction of new products, we have not only created a lot of excitement among our consumers but also succeeded in reaching closer to the customers.”

Honda’s most affordable scooter model, the 110cc Cliq is expected to garner good numbers in the coming months.

TVS Motor Company: TVS reported total domestic sales of 219,396 units last month, registering conservative YoY growth of 6.19 percent. The company is riding high on the surging demand for its popular 110cc Jupiter scooter model, which is also the second bestselling scooter in India after the popular Activa.

For TVS, scooter sales rose 35.8 percent to 92,378 units and its motorcycle sales grew 15.1 percent to 109,427 units in July 2017.

Bajaj Auto: The Pune-based Bajaj Auto sold 164,915 motorcycles in July 2017, down 5.40 percent YoY (July 2016: 174,324). The company plans to add new models / variants to its existing brands to give a new fillip to its declining domestic sales. It is also betting on its recently launched model – NS160 – to its top-selling Pulsar umbrella.

Market analysts from HDFC Securities though remain optimistic on Bajaj Auto. “Although the company has shown a dismal performance in July 2017, we expect volumes to improve in H2, FY2018 led by festive demand. We are positive on Bajaj Auto based on its strong product portfolio and increasing portion of premium segment models (KTM, Pulsar, Avenger, Dominar) in overall volumes, and revival in export volumes. The management is confident of achieving double-digit growth in FY2018,” highlights one report.

Royal Enfield: Continuing its dream run, Royal Enfield has reported domestic sales of 63,157 motorcycles, up by 21.16 percent YoY (July 2016: 52,128). Recent news reports highlight that Royal Enfield has now surpassed Bajaj Auto and Hero MotoCorp in terms of its market capitalisation, which as of today stands more than Rs 83,939 crore (Eicher Motors is the parent company of the Royal Enfield brand). The company is known to be working on new motorcycle platforms and is aggressively gunning for several lucrative export markets.

Suzuki Motorcycle India: This subsidiary of two-wheeler manufacturer, Suzuki Motor Corporation, Japan, has reported sales of 40,038 units, a growth of 62.08 percent (July 2016: 24,703). Suzuki, which aims to sell 500,000 units this year, has also recorded a YoY growth of 40.6 percent for the YTD period of April-July in 2017. It has sold 166,456 units including the retail numbers of its big-bikes.

The company is working to expand its existing product portfolio, dealership networks and is also planning to boost its exports from India.

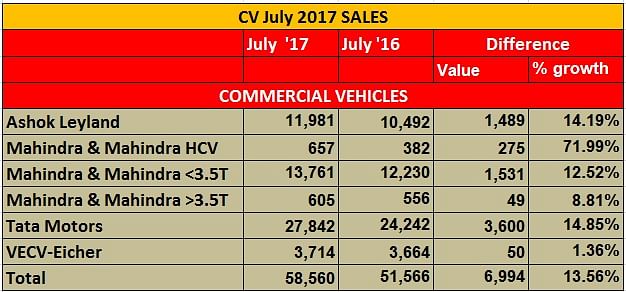

After reasonably tough Q1 (April-June 2017) when overall sales at 151,837 units were down 9.08 percent YoY, the commercial vehicle (CV) sector has recorded a sharp recovery in July driven by an uptick in the critical medium and heavy commercial vehicle (M&HCV) segment. After the steep declines in April (-22.93%) and May (-14.40%), CV manufacturers saw green shoots of recovery and entered growth lane (+1.44%).

For July, which opened the era of GST, all major CV manufacturers have registered higher growth across both the M&HCV and LCV segments. Market leader Tata Motors, which has seen a correction in its sales over the past three months, has returned to growth territory with overall sales up by 15 percent in July. Similarly, Ashok Leyland, the second largest CV player, which also saw sales fall in the first two months of FY2018, posted double-digit growth in July.

For industry, the strong comeback in the M&HCV segment signals the return of demand on the back of improving economic indicators, benefits of GST to the transportation sector due to vanishing check-points, and increasing freight and logistics efficiencies. These factors are also motivators for fleet operators to start looking at expanding their fleets.

According to Subrata Ray, senior group vice-president of ratings agency ICRA, “Despite a weak performance in the first quarter, the industry will find its momentum back aided by increased thrust on infrastructure and rural sectors in the recent Budget, potential implementation of fleet modernization or scrappage program and higher demand from consumption-driven sectors, especially for LCVs and intermediate commercial vehicles (ICVs). Given these considerations, the domestic CV industry is likely to register a growth of 6-8 percent in FY2018.”

According to ICRA, within the CV industry, the M&HCV (truck) segment will get support from pent-up demand with GST coming into force, higher budgetary allocation towards infrastructure and rural sectors, potential implementation of vehicle scrappage program and stricter implementation of regulatory norms especially related to vehicle length (for certain applications) and overloading norms. In addition, the National Green Tribunal’s (NGT) thrust on phasing out old diesel vehicles along with the government's proposed vehicle modernisation program would trigger replacement-led demand. Apart from favorable regulatory developments, resumption of mining activities in select states would also continue to support demand for tippers, a segment which has outperformed the industry during the current fiscal.

Truck rentals down in July

According to the Indian Foundation of Transport Research and Training (IFTRT) which tracks truck rentals in the country, “Retail parcel booking/part load freight charges in the first fortnight of GST witnessed an unprecedented slump in cargo movement. It was the key factor adversely impacting retail consignment booking and delivery charges. Instances of untaxed, wrong declarations and under-reported consignments have come down drastically on most interstate routes as MSMEs, wholesales and distribution businesses, in particular, are very hesitant and fearful to despatch untaxed cargo under the GST regime. Untaxed invoices dodging the tax authorities, for the time being, have virtually disappeared from the freight market, except for few inter-state destinations in Rajasthan, Madhya Pradesh, Bihar, Chattisgarh, Gujarat and parts of Maharashtra and North-East India.

How the OEMs fared in July

On the monthly sales front, Tata Motors’ overall CV sales rose 15 percent in July at 27,842 units (July 2016: 24,242) backed by the ramp-up of BS IV production, across segments.

While demand for its M&HCVs was up 10 percent in July 2017 at 8,640 units (July 2016: 7,879), the I&LCV truck segment grew by 28 percent at 3,354 units (July 2016: 2,626 units) on the back of a good market response to the new Ultra range and the new BS IV range in other products.

According to the company, “The M&HCV segment saw a rebound in July 2017 and witnessed a pick-up in demand and availability because of continued production ramp up. New models launched in the fastest growing segments of 49-ton and 37-ton categories have also gained strong traction in the market.”

Tata Motors’ passenger carrier sales (including buses) though saw a 15 percent decline to 4,472 units (July 2016: 5,233) largely due to supply constraints in the bus segment. The SCV cargo and pickup segment continued the growth momentum with sales of 11,376 units, up by 34 percent (July 2016: 8,504) due to good market demand for the Ace XL, Mega XL, Zip XL, and the new Tata Yodha.

Ashok Leyland registered double-digit growth, growing by 14 percent with sales of 11,981 units (July 2016: 10,492.) M&HCV sales rose 10 percent to 9,026 units (July 2016: 8,182) while LCVs posted strong 28 percent YoY growth at 2,955 units sold (July 2016: 2,310).

Mahindra & Mahindra’s total CV numbers were up by 14 percent to 15,023 units (July 2016: 13,186). Its M&HCV sales turned positive, growing 72 percent to 657 units albeit on a low year-ago base (July 2016: 382). The below-3.5T GVW segment grew 13 percent YoY, selling 13,761 units (July 2016: 12,230), while those in the above-3.5T GVW segment turned positive by growing 9 percent with sales of 605 units (July 2016: 556).

VE Commercial Vehicles’ domestic sales were up marginally by 1.4 percent with total sales of 3,714 units (July 2016: 3,664 units). The company will be looking to drive numbers with growing demand for its recently launched Pro 5000 Series of trucks.

RELATED ARTICLES

Electric 3W battle heats up: Mahindra and Bajaj separated by 131 units in April, TVS grabs 2% share

The electric three-wheeler industry has opened FY2026 with 62,533 units and 49% YoY growth. In a field of 550 players, l...

Legacy OEMs outsell Top 20 electric 2W startups, command 55% market share in April

With sales of 50,166 electric scooters in April 2025 and a 55% share of the 91,791 e-two-wheelers sold in April 2025, TV...

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

04 Aug 2017

04 Aug 2017

16872 Views

16872 Views

Autocar Professional Bureau

Autocar Professional Bureau