What needs to change to diversify the global supply chain, largely concentrated in China?

Why is the global automotive supply chain largely concentrated in China? China's s Li-ion battery production accounts for 50% to73% of global EV battery manufacturing capacity.

The global automotive supply chain is concentrated in China because of several inter-connected reasons:

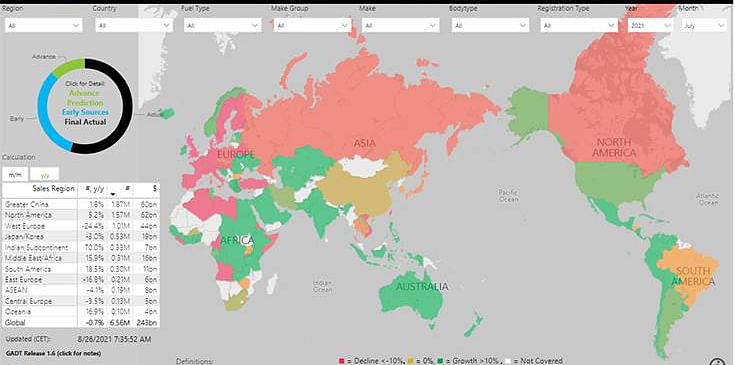

1. China is the world’s second-biggest automotive market – Light vehicle sales in China average around +20% YTD in 2021 compared to 2020, totaled 26.9 million car units vis-à-vis YTD light vehicle sales in the United States at 19.2 million units. The IHS Markit Global Auto Demand Tracker (Figure 1) shows that total sales in Greater China and the United States as of August 2021 YOY is US$ 60 billion and US$ 62 billion respectively.

Figure 1 Global Auto Demand Tracker

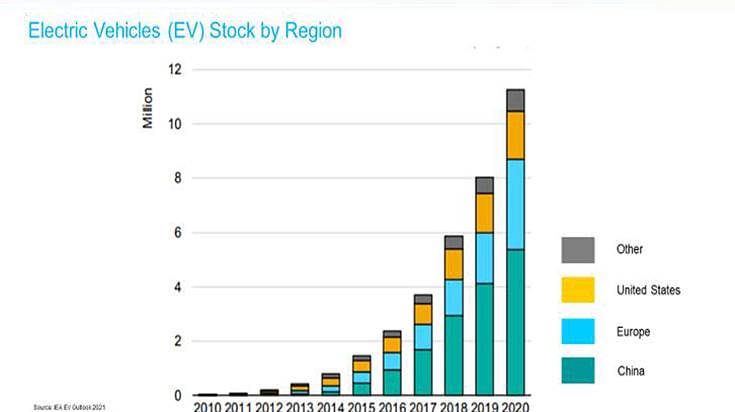

China is already the world’s largest market for electric vehicles by a clear margin when compared to Europe and the United States (Figure 2). The country‘s Li-ion battery production accounts for 50% to73% of global EV battery manufacturing capacity and half of the global production. The size of the market has attracted start-up companies to enter the country’s automotive industry. By the end of 2019, IHS Markit data showed that China had over 480 start-ups in the automotive sector by registration. Irrespective of the longevity of these start-ups, they contribute to the supply chain demand and innovation around it. In the new era of “AutoTech” – the merging of electric, autonomous vehicles with ride-hailing creates a radically different car economy over the next couple of decades. In-car software and semiconductor products are widely expected in the market to make up most car costs by 2030.

Figure 2: Electric Vehicles stock by region

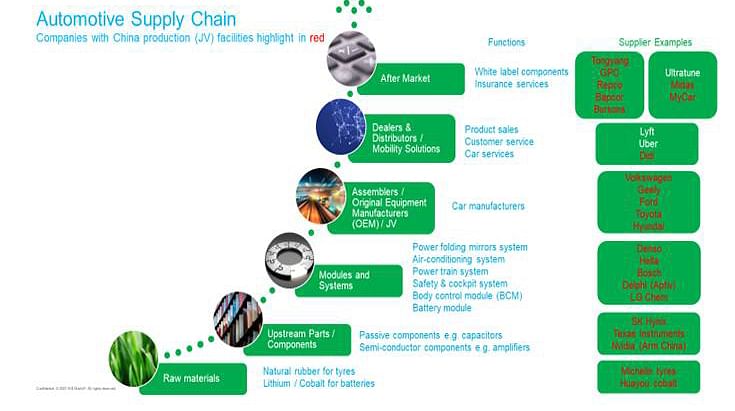

2. China has incentives and favorable policies for new energy vehicles (NEV) According to the U.S. International Trade Commission, China was the United States’ second-largest source of automotive parts imports (after passing Canada in 2017), accounting for nearly twice the share of U.S. auto parts imports (three times the value) that it accounted for in 2007. Many global automotive brands, upstream suppliers, components manufacturers, and aftermarket parts companies, including joint ventures, have research and development and production facilities in China – highlighted in red in Figure 3. Some have established business relationships dated back to the 1980s; others accelerated their local presence in the 2000s.

Figure 3: The Global Automotive Supply Chain

There are favorable policies even before US-China trade tension intensifies as China has made moving up the global manufacturing value chain a fundamental objective and has designated the automotive sector as a core strategic industry almost ten years ago. The Chinese government provided supportive policies and subsidies for research and development, and battery and components under the 2012-2020 New Energy Automobile Industry Development Plan.

Further, the 14th Five-Year Plan (2021-2025) emphasizes technology self-reliance and the environment as a priority, with China’s commitment to being carbon neutral by 2060. New automobile technologies—new energy vehicles (“NEVs”) and intelligent connected vehicles (“ICVs”) alongside smart city planning — sit at the intersection of these strategic priorities. Though not explicitly stated, chip-making is deemed a key focus in the next five years, as China seeks to build up its domestic capacity.

After production shutdowns during the first half of 2020 due to the COVID-19 pandemic, vehicle output in Asia resumed slowly initially, affected by new safety protocols and training in those measures, and acceleration of supply chain reorganization, some shifted back onshore e.g., to the US, some shifted to other manufacturing locations e.g., South East Asia.

By the end of 2020, disruptions to the supply of semiconductor chips to the automotive sector due to workers' absence from lockdown or ‘pingdemic’ started to emerge. At the time of publication of this article, supply shortage continues. This shall encourage China to become even more proactive in accessing materials that ensure components supply stability.

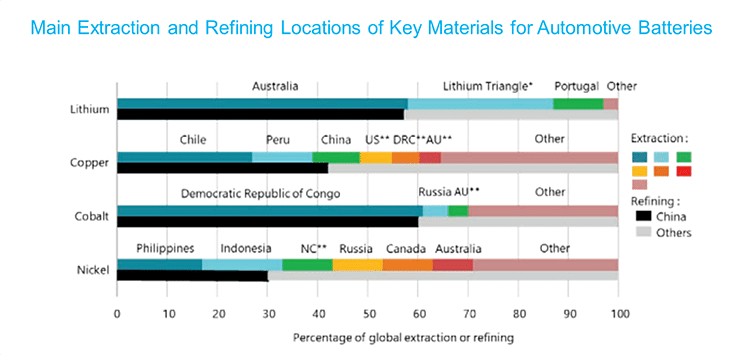

3. China is a dominant player in smelting and refining batteries

Despite extraction activities that took place in diverse geographies, China dominates the mid-stream processes crucial to preparing materials for EV production (Figure 4). In midstream, 80% of chemical refining is based in China, as well as 61% cathode and 83% anode production.

Figure 4: Main Extraction and Refining Locations of Key Materials for Automotive Batteries

Steelmaking and even natural rubber for tires

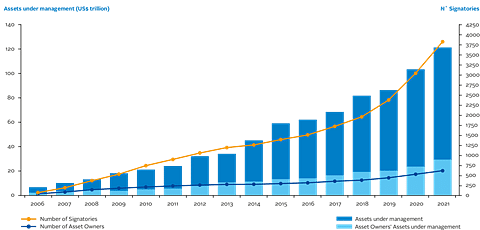

Over the last decade, investors committed to responsible investment have grown. The UN-backed Principles for Responsible Investment started in 2006, has grown to 3,800 signatories with US$ 121 assets under management in 2021 (Figure 5). Signatories committed to the Principles need to submit annual reports to demonstrate how they have integrated environmental, social, and governance (ESG) considerations in their investment and active ownership activities.

Figure 5: Growth of UN-backed Principles for Responsible Investment

In the auto sector, investors focus not only on corporate governance, climate change, cleantech capacity, product safety and quality, air pollution, water, and waste management in their immediate operations. Increasingly, investors are taking a life cycle assessment (LCA) approach, taking into consideration sustainability issues in the supply chain and end-of-life management. This leads to more automotive companies committing to circular-by-design to improve the recyclability of materials and to limit the impact of extracting raw materials from nature.

China accounts for at least 55% of global steel emissions. Blast furnaces that use iron ore and coke produce around 90% of China's steel. This needs to change. In August 2021, CA100+ investors published Investors Expectations for the Steel Industry. China has been building up its own scrap steel reserve as well as importing scrap steel, increasing the proportion of steel produced by the scrap-EAF process. This needs to accelerate.

About a fifth of all bovine leather produced globally is estimated to go into cars, with more than 60 million cars produced every year. As more farms cut down forests to raise cattle, the sustainability of natural leather production has been raised as an ESG issue in the auto industry by investors.

Natural rubber often receives less attention than other commodities (e.g. timber, soy, palm oil), due to the nature of its production, which tends to be by smallholders via small-scale plantations or agroforestry systems. These methods of production are thought to have lower social and environmental impacts than large-scale monocultures. However, poor management practices and associated low productivity can lead to negative social and environmental impacts, including pollution, health issues, and poverty.

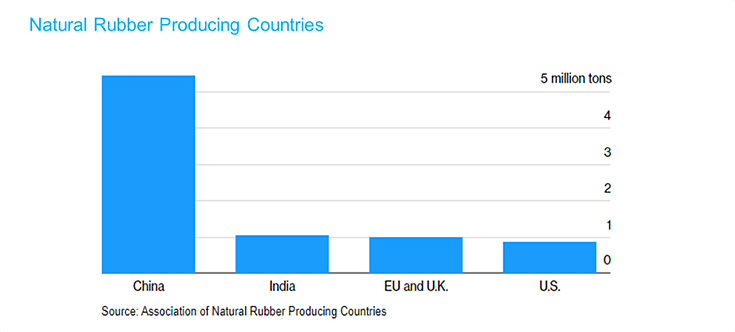

According to the Association of Natural Rubber Producing Countries, China was by far the world’s largest user of natural rubber in 2020 as original equipment manufacturers (OEMs) and after service manufacturers concentrate their production facilities in China (Figure 6)

Figure 6: Natural Rubber Producing Countries

Deforestation is not only linked to global climate adaption and mitigation, but also crucial to biodiversity and the the ecosystems, as well as to human rights in local communities, given that the auto sector is one of the top industries heavily reliant on natural rubber, palm oil, and leather products, which are the key drivers of global deforestation.

COP15 UN Convention on biological diversity, which has been delayed by a year due to the COVID19 pandemic, is expected to take place in October 2021 in Kunming, China. Stakeholders of the biodiversity ecosystems have been working on improving the sustainable supply chain to support China’s leadership in these areas.

In 2017, two years before the Forest Stewardship Council (FSC) published a position statement for companies that wish to source sustainable natural rubber, the China Chamber of Commerce of Metals, Minerals, and Chemical (CCCMC) had already been working with global partners such as the Organisation for Economic Co-operation and Development (OECD), World Resources Institute (WRI) and Global Reporting Initiative (GRI) and published a 62-page Guidance for Sustainable Natural Rubber. As nature-based solutions become more mainstream for manufacturers and investors, an early mover in ensuring sustainable rubber is used in tires presents an advantage for companies with production in China both for the OEMs and after-service markets.

Meanwhile, we are delighted to see that innovative approaches to producing alternative materials for bovine leather have been successful e.g. vegan leather. With net zero and/or carbon neutral targets on the national agenda of global markets, including that of China, we expect increasing demand for automotive companies to offer more options that minimize the carbon footprint of the lifecycle of the auto sector.

Conclusion

As highlighted in this article, the global dominance of China’s auto supply chain is the outcome of a combination of the size of the market, the range of choice of service providers, and favorable policies that sustain the long-term demand and prosperity of the industry.

China has been focusing on smart city and charging infrastructure building as well as technology enhancement that increased automation, and hence reduce reliance on the labor force in automotive manufacturing processes as labor supply reduces and costs pick up. Geopolitical uncertainty and COVID19 may have encouraged companies to diversify their supply chain, either onshoring back to the United States or Europe, or split offshoring to South East Asia markets. This is likely to continue as a good practice for business risk management, but we expect China’s dominance in the EV market to continue in the short to medium term.

We are now a month away from COP15 biodiversity conference and two months away from COP26 climate change conference. We expect China to play a leading role in driving the NDC agenda together with other top emissions countries. Greener supply chain management will accelerate the progress to China’s 2060 carbon neutral target, and ultimately the goal of sustainable development.

RELATED ARTICLES

Telematics: The Route to India’s Next-Gen Logistics

As India's logistics sector races toward its 2030 efficiency targets, fleet managers are discovering that real-time tele...

Software Ages Faster Than the Car: The Bill Nobody Budgeted For

The Promise Was Longevity. The Invoice Is Just Arriving.

India’s Auto Boom Is Outpacing Road Safety: Why Road Safety Isn’t Scaling with Vehicle Growth

Even as roads improve and vehicles become safer, India records some of the highest road crash fatalities globally: aroun...

14 Sep 2021

14 Sep 2021

9555 Views

9555 Views

Autocar Professional Bureau

Autocar Professional Bureau

Arunima Pal

Arunima Pal