Tata Motors targets 1.0-1.2 million sales by FY30, eyes 18-20% market share

Tata Motors expects the Indian passenger vehicle market to grow to 6 million units by the end of this decade and is targeting a share of over 18-20% by FY30.

Tata Motors expects the Indian passenger vehicle market to grow to 6 million units by the end of this decade and is targeting a share of over 18-20% by FY30.

A back-of-the-envelope calculation suggests that if the company attains its goals, it could sell over 1-1.2 million vehicles by FY30.

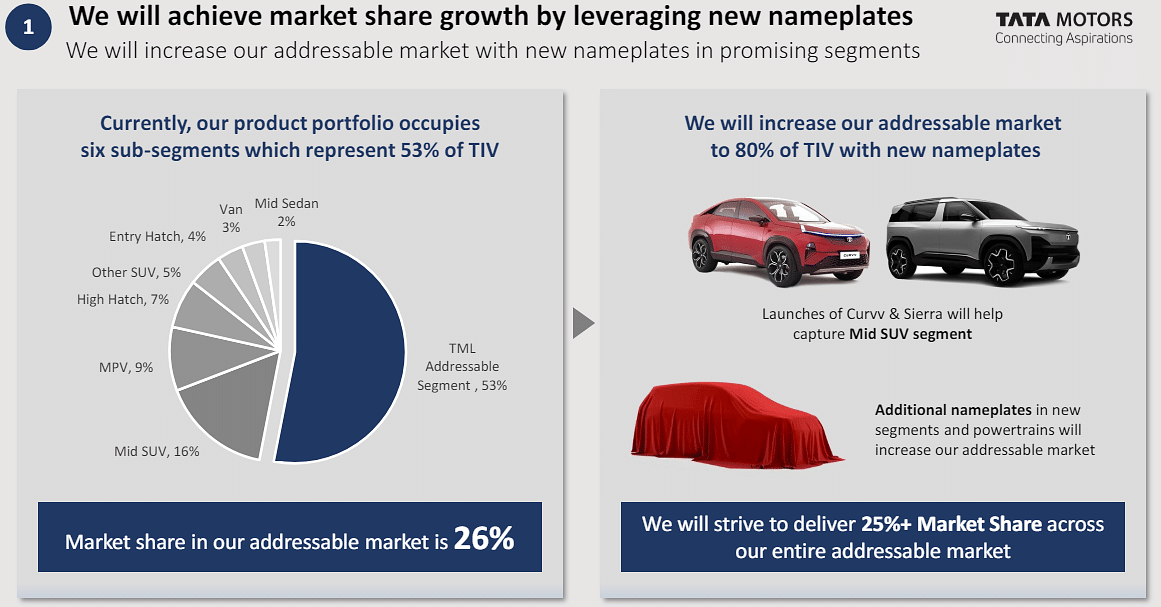

To this end, Tata Motors plans to add more products and nameplates and expand its addressable market to 80% in the coming decade from the current 53% market it caters to.

“We will achieve market share growth by leveraging new nameplates. We will increase our addressable market with new nameplates in promising segments,” stated a presentation scheduled to be delivered by Shailesh Chandra, MD, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, on the company's investor day on Tuesday.

At the end of FY24, Tata Motors was the third largest passenger vehicle maker, with a market share of 14%. In the next three years, the company expects its market share to grow to 16%, before rising another 3-4 percentage points by FY30.

“Our market share in our addressable market is 26% (at present). We will strive to deliver 25%+ market share across our entire addressable market. We will target 18% to 20% market share with our endowments. We will grow faster than the industry leveraging new nameplates and powertrain shifts,” added the presentation.

The presentation slide from the MD of Tata Motors' car business noted that the launches of Curvv and Sierra will help the company capture the mid-SUV segment, and the additional nameplates in new segments and powertrains will increase our addressable market.

The company has identified five key strategic pillars for TMPV (ICE business) and TPEM (EV business) - increase the addressable market by introducing new nameplates, strengthen its multi-powertrain strategy to leverage industry powertrain shifts, proactively grow the EV market in India and maintain market leadership, leverage technology to augment products in line with customer demands and finally enhance the profitability through scale benefits, improving mix, and optimisation of cost and capex.

RELATED ARTICLES

SWITCH Mobility Launches Electric Double Decker Bus Sightseeing Route in Delhi

The 'Dekho Meri Dilli' initiative deploys India's first electric double decker AC bus on a heritage sightseeing route, c...

Indonesia Postpones 105,000-Vehicle Import Plan From India, Bloomberg Reports

Citing senior officials, Bloomberg reported that Indonesia is reassessing its import plan over concerns about the domest...

INDEX Group Opens Bangalore Technology Center to Expand India Market Presence

The German CNC machine manufacturer has established a new branch with a showroom and demonstration facility near Bangalo...

11 Jun 2024

11 Jun 2024

9742 Views

9742 Views

Sarthak Mahajan

Sarthak Mahajan

Arunima Pal

Arunima Pal