Tata Motors Cedes Ground to MG and Mahindra in Electric PV Market

MG and Mahindra command more than 53% of the electric PV market, a dramatic reversal from a year ago, when Tata alone held the lion’s share

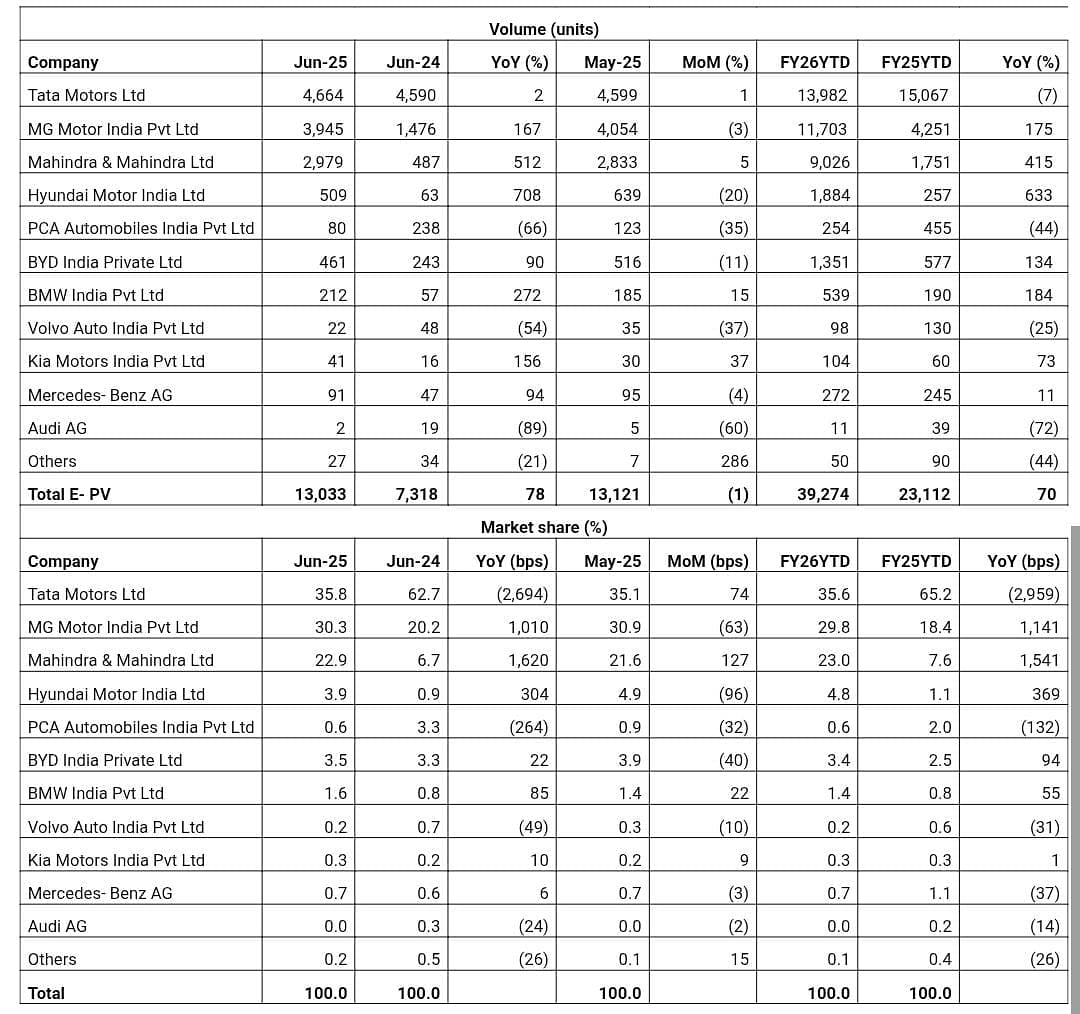

India’s electric passenger vehicle market is entering a pivotal phase, with the once-dominant Tata Motors steadily ceding ground to a new generation of electric players. In June 2025, e-PV registrations touched 13,033 units—an impressive 78% year-on-year jump over June 2024. EV penetration for the month is estimated at around 4%, underscoring the growing momentum for electrified mobility, even as the segment still accounts for a small slice of overall PV sales.

Tata Motors, which had spearheaded India’s early EV transition with ICE-derived models like the Nexon EV and Tiago EV, retained its position as the top-selling brand in June with 4,664 units. However, while volume remained steady, its market share continued to slide, falling to 35.8%, a significant drop from 62.7% in June 2024. This steep decline signals that newer, more focused rivals now threaten Tata’s first-mover advantage.

MG Motor India has emerged as the biggest disruptor. The company recorded sales of 3,945 units in June, marking a 167% year-on-year increase. While the ZS EV and Comet laid the groundwork, MG’s recent surge is led by Windsor, its mid-size electric SUV. Positioned as a well-balanced package in terms of performance, practicality, and price, Windsor has resonated strongly with the Indian EV buyer, particularly in metro and urban centers. MG now holds a 30.3% share of the E-PV market, narrowing the gap with Tata to less than six percentage points.

Matching that growth trajectory is Mahindra & Mahindra, which clocked 2,979 EV registrations in June, a staggering 512% jump over the same month last year. The company’s new-age, electric-first approach, driven by the INGLO platform has helped it carve a distinct identity in the market. With a growing portfolio of purpose-built electric SUVs and a robust design-technology strategy, Mahindra now holds a 22.9% share, emerging as the third strong pillar in India’s high-growth E-PV space.

MG and Mahindra command more than 53% of the electric PV market, a dramatic reversal from a year ago, when Tata alone held the lion’s share. Their rapid scale-up, product freshness, and platform focus have rewritten the competitive narrative in a segment moving quickly from experimentation to mainstream adoption.

Other players have delivered mixed results. Hyundai posted 509 units, up sharply from 63 units a year ago, but down monthly. BMW (212 units) and BYD (461 units) remain consistent in the premium category, while European marques like Citroën, Audi, and Volvo struggle with either relevance or scale in India’s value-sensitive landscape.

In the first quarter of FY26, India’s electric PV segment recorded sales of 39,274 units, growing 70% YoY. While MG and Mahindra have already surpassed their H1 FY25 volumes in just three months, Tata Motors has seen a 7% dip in its April-June numbers, down to 13,982 units, a clear sign that its early portfolio is approaching saturation.

However, Tata Motors isn’t standing still. The company is betting on its next-generation EV portfolio to counter the rising threat and regain its lost share. It continues to invest in building acceptance for its coupe design with the Curvv EV, the aggressively priced Harrier EV, deliveries of which are starting this month, and the much-awaited Sierra EV, which is being readied for market launch in the coming quarters.

Built on a more evolved architecture and equipped with a longer range, improved tech stack, and more premium positioning, these models are expected to broaden Tata’s EV appeal well beyond the compact SUV and hatchback segments.

The company has publicly stated its ambition to capture a 50% share of India’s e-PV market, and these new products will be critical in achieving that target. For Tata, the next phase will be about defending its base and creating fresh pull through newer body styles, segment entries, and deeper localisation.

RELATED ARTICLES

Bajaj Auto Lines Up Product Blitz to Rebuild Premium Segment Share

Seven products launched since Diwali and eight more planned as Bajaj sharpens focus on strengthening the Pulsar franchis...

Bajaj Auto Approves Rs. 12 Crore Investment in Clean Energy Project

The renewable power will be supplied to Bajaj's plants located at Akurdi and Chakan in Pune, Maharashtra.

Bajaj Auto Sees Steady Two-Wheeler Demand in Coming Months After GST Boost

Bajaj Auto sees near-term domestic two-wheeler demand staying firm after GST rationalisation, with seasonality and uptra...

01 Jul 2025

01 Jul 2025

8249 Views

8249 Views

Darshan Nakhwa

Darshan Nakhwa

Arunima Pal

Arunima Pal