SUV vs Hatchback: Is the Tide Finally Beginning to Turn?

The trend towards rebalancing is visible in two ways – a slowdown in the sales of SUVs, and a stabilization in the sales of the compact hatchback cars.

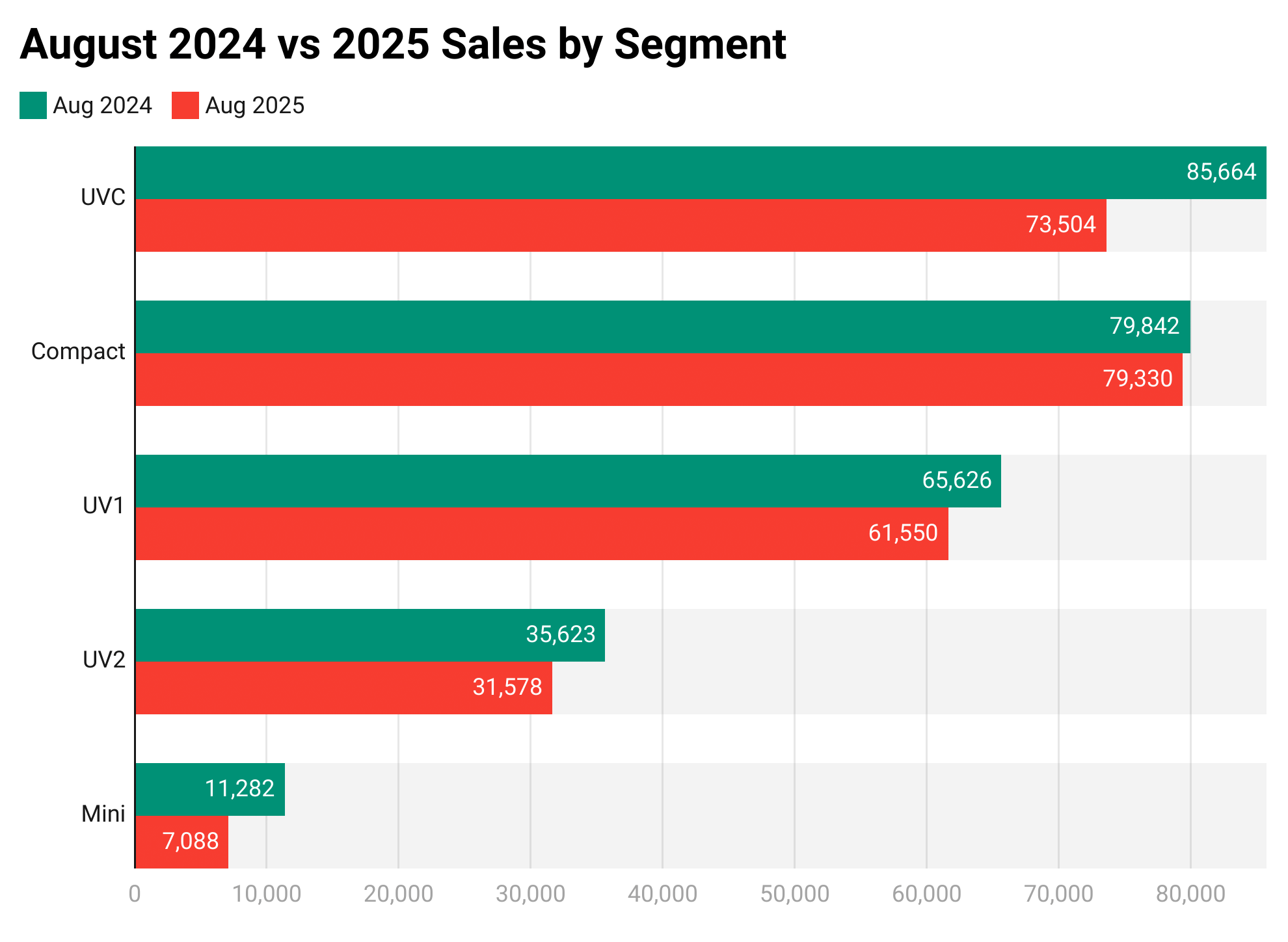

India's yearslong shift toward sport utility vehicles hit a wall this summer, with SUV sales declining for three consecutive months while the beleaguered small-car segment showed signs of recovery ahead of tax cuts that take effect this weekend.

Data from the Society of Indian Automobile Manufacturers (SIAM) reveals a notable reversal in buying patterns that have favored larger, more expensive vehicles for the better part of a decade. The shift comes as the government prepares to slash taxes on small cars by 10 percentage points, but the trend predates the tax move, going by the data.

The trend towards rebalancing is visible in two ways – a slowdown in the sales of SUVs, and a stabilization in the sales of the compact hatchback cars.

Slowing SUV Sales

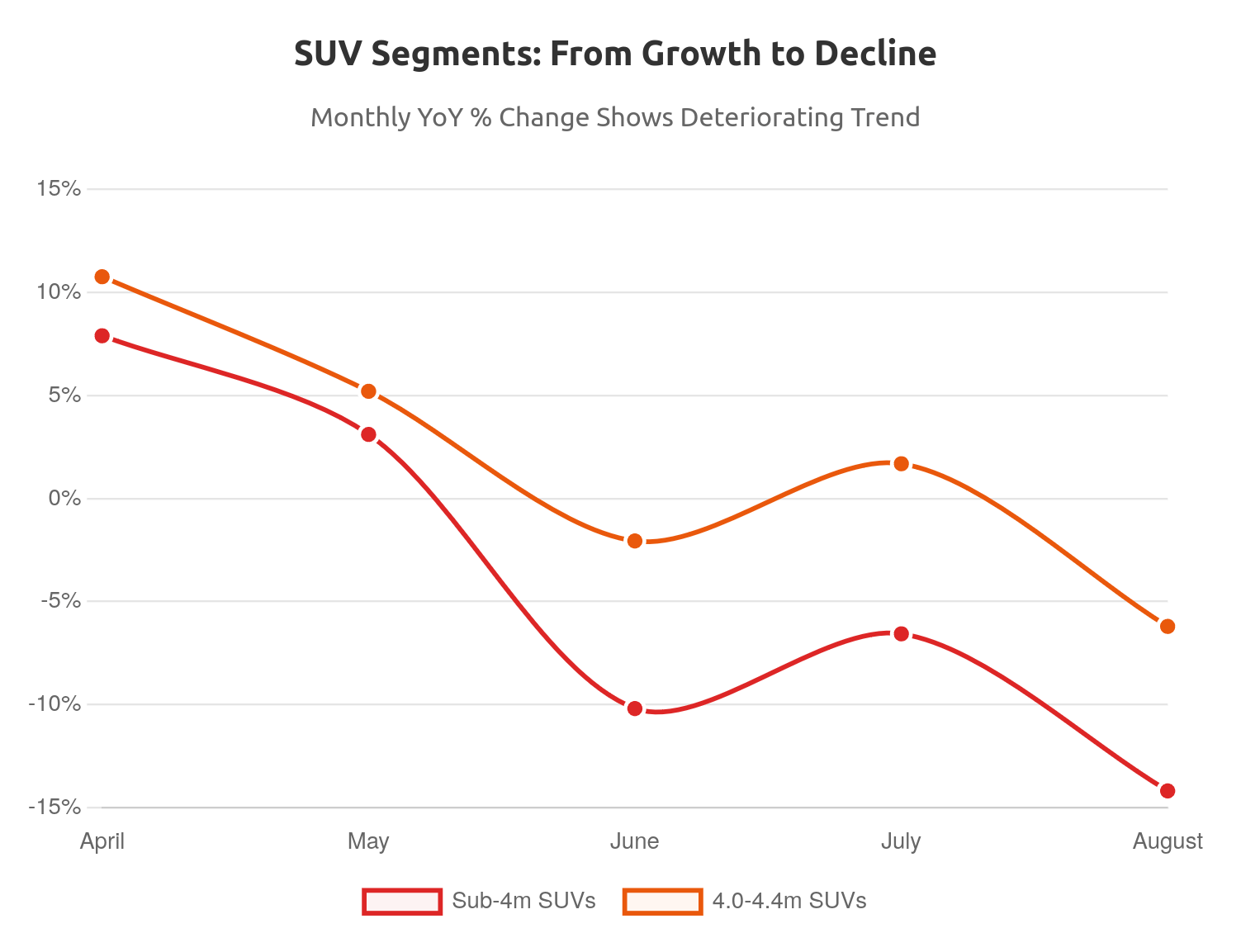

Within the SUV segment, the slowdown is more stark in the lower-priced categories, such as the sub-4m and 4.0-4.4m segments.

For example, in the sub-4m category, which includes popular models like the Maruti Suzuki Brezza and Tata Nexon, sales have swung from year-on-year growth at the beginning of the financial year to a pronounced decline as the year progressed.

In the first month of the year, April, the segment posted a growth of 7.9% in wholesales. This fell to 3.1% in May. However, since then, the segment has posted YoY declines. June saw sales shrink by 10.2%, while they fell 6.6% in July. August, the last month for which data is available, saw the sharpest decline of all — 14.2%.

The scene is not very different in the next size band – 4.0-4.4m, which can be described as the core of the true SUV segment in India and is home to heavy hitters such as the Hyundai Creta. This segment, accounting for nearly 35% of the total SUV sales in the country, also started the year off on a strong note, with sales rising 10.77% in April. However, the situation worsened with each passing month, with May seeing the growth rate halve to 5.21%. Like in the case of the sub-4m segment, June saw a slip into the negative territory, with sales falling year-on-year by 2%. This was followed by a slight relief in July, when sales came back into the green with a 1.7% increase. But the situation has continued to worsen, with August posting a sharp 6.2% decline.

Even the larger, more premium segments have not been completely immune to the slowdown. For example, the 4.4-4.7 meter category, which includes models like Alcazar and Safari and had been defying gravity with 25-27% growth during the first four months of the financial year, finally succumbed to the pressure in August with a 11.4% decline.

Economic Headwinds

The reversal in the fortunes of the SUV segment – which has almost singlehandedly been driving PV sales in India – has industry observers worried. Even though the trend is only for a few months, some market experts believe the slowdown is part of a larger slowdown in the PV market. They attribute it to a variety of causes, such as purchase postponements, supply-chain issues, affordability issues and growing buyer confusion over technology.

Kranthi Bathini, Equity Strategist at WealthMills Securities Pvt Ltd., points out one of the reasons potential buyers are holding back "is the interest rates."

He explains that with inflation cooling, buyers expect rate cuts from the RBI, which is significant for these high-value purchases.

Another reason is supply-side bottlenecks, particularly for the most popular models. Somewhat paradoxically, many key models, such as Toyota Hyryder, have waiting periods running up to 8 months. "Too many purchasers are chasing a few models. Everybody wants the ZX (Top Model)," points out Bathini.

Tech Confusion

Beyond macroeconomic factors, there are also non-economic factors that may be driving the slowdown. One such is the growing dilemma over which powertrain technology to invest in—traditional internal combustion (ICE), hybrid, or electric (EV). "There is a kind of an overhang, whether to go for hybrid, ICE or for pure EV," says Bathini. He adds that with limited hybrid options, which only Toyota and Maruti Suzuki cater to, "has created a dichotomy" that is contributing to the slowdown in decision-making.

Adding to all this has been speculation about GST cuts, which started doing the rounds around August 20. This, points out Hitesh Thakurani of HDFC Securities, may have prompted OEMs to go slow in pushing inventory to their dealers.

Meanwhile, in somewhat of a departure from the situation existing in the UV market, the compact segment, comprising hatchbacks like the Wagon R and the Swift and sedans like Dzire and Amaze, has been showing signs of stability.

While the SUV segments went from growth to decline during the first five months of FY26, the compact car segment has been going in the other direction – transitioning from decline to stability over the same period.

Outlook

The government's decision to reduce the goods and services tax on small cars to 18% from 28%, effective September 22, comes at a critical time. The cut applies to cars with engines smaller than 1,200 cc for gasoline models or 1,500 cc for diesel, and shorter than 4 meters in length.

The next three months will be crucial for determining whether the recent trends represent a temporary pause or a more fundamental shift in Indian car buyers' preferences. The period coincides with India's festival season, when car sales typically surge, and the first full quarter of lower taxes on small cars.

For an industry that spent years chasing bigger and more expensive vehicles, the compact car's tentative recovery suggests that affordability still matters in one of the world's most price-sensitive auto markets.

RELATED ARTICLES

Spinny Partners with Tesla to Facilitate Electric Vehicle Adoption in India

The collaboration offers exchange benefits totaling up to ₹3.25 lakh to help Indian customers transition from convention...

LeafyBus and Eicher to Deploy 100 Electric Intercity Sleeper Buses

Indian electric bus operator partners with Volvo-Eicher venture to introduce clean mobility on major national routes.

Suzuki Motorcycle India Adds ABS Variant to Access Scooter Range

Two-wheeler manufacturer introduces single-channel Anti-Lock Braking System across Access lineup with pricing starting a...

By Anurag Chaturvedi

By Anurag Chaturvedi

17 Sep 2025

17 Sep 2025

5489 Views

5489 Views

Shristi Ohri

Shristi Ohri