Small Cars Buck India's Auto Downturn with Rare Stability

After losing nearly half their market share to SUVs, small cars stabilize ahead of government tax cuts, offering a glimmer of hope for a category.

India's battered compact car segment is showing unexpected signs of resilience, with sales stabilizing after months of sharp declines, offering a glimmer of hope for a category that has lost significant ground to sport utility vehicles over the past five years.

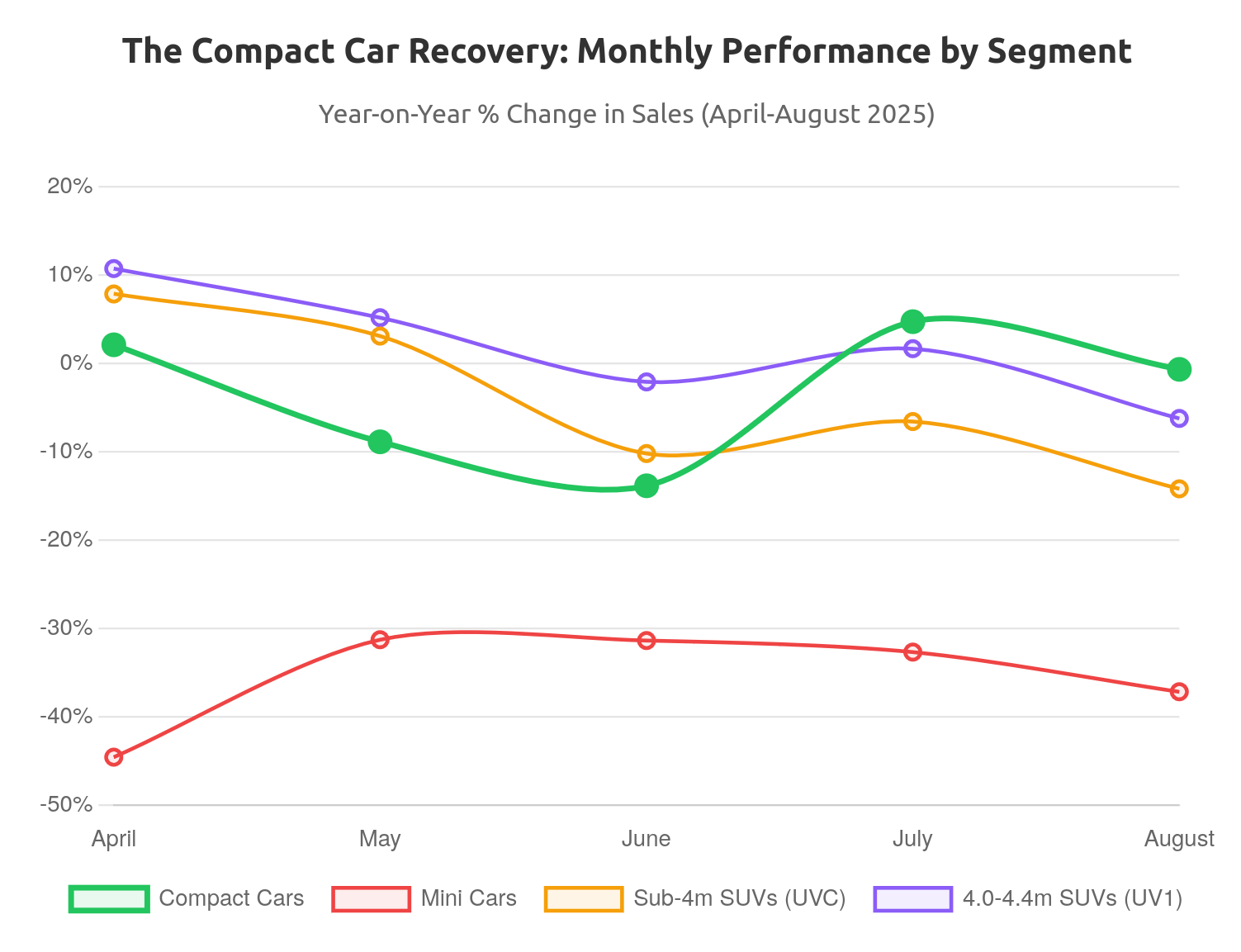

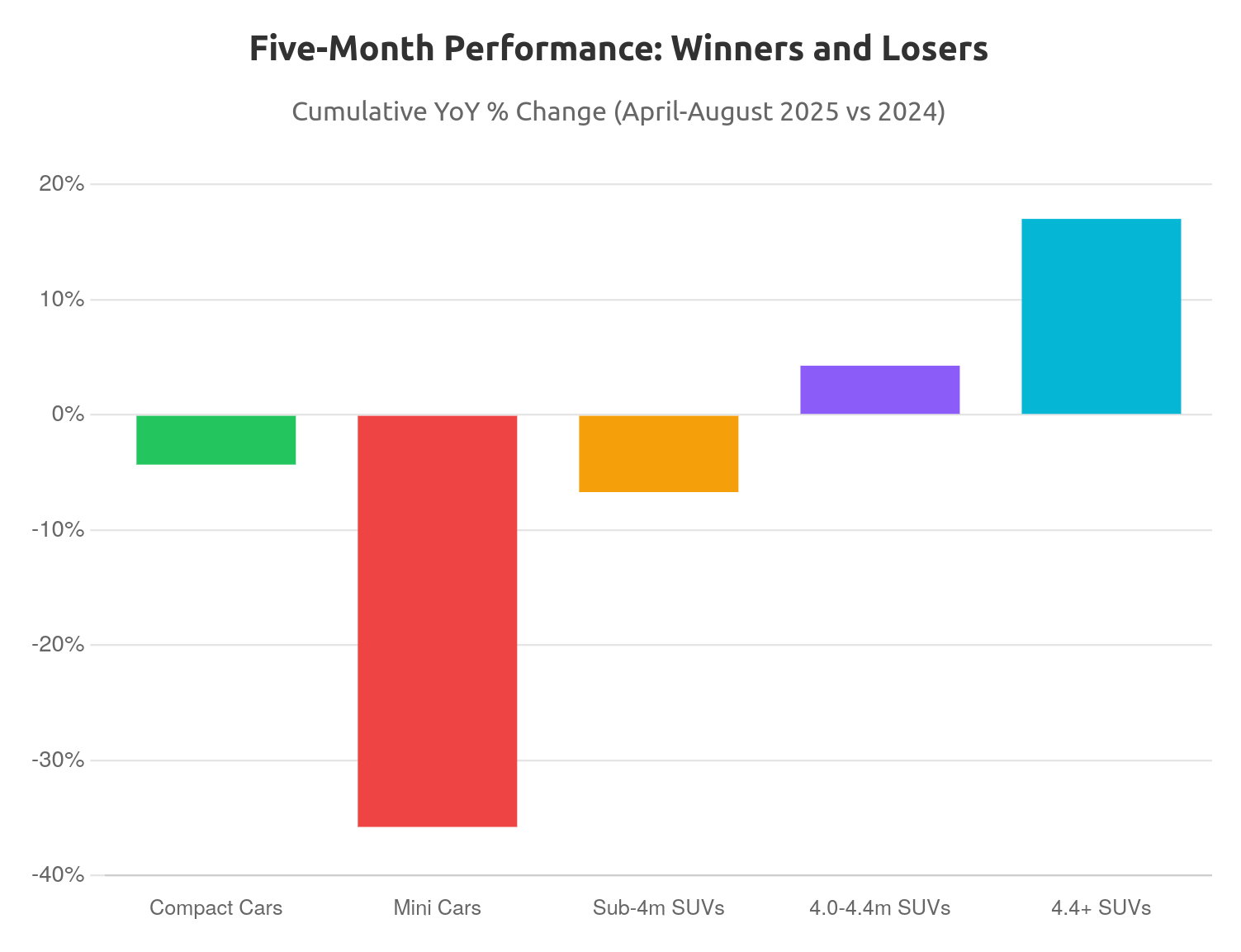

Data from the Society of Indian Automobile Manufacturers (SIAM) reveals that compact cars—including popular hatchbacks like the Maruti Swift and Wagon R, and compact sedans like the Dzire and Amaze—appear to have bottomed out after a brutal first quarter. After steep drops of 8.9% in May and 13.8% in June, sales of these vehicles rose 4.8% in July and fell just 0.6% in August.

This recovery stands in sharp contrast to the continued struggles of the mini segment and the deteriorating performance of the SUV category. The mini segment, which includes ultra-small cars like the Alto, Espresso, and Kwid, has remained in deep distress throughout the fiscal year, posting severe declines of over 30% in each month—from a 44.6% drop in April to a 37.2% fall in August.

Meanwhile, the once-hot SUV segments have shifted from growth to decline. Sub-4 meter SUVs (UVC category) started the year with 7.9% growth in April but plummeted to a 14.2% decline by August. Similarly, the 4.0-4.4 meter SUV segment (UV1), home to popular models like the Hyundai Creta, began with robust 10.8% growth in April but slipped to a 6.2% decline in August.

This stabilization represents a potential turning point for a segment that has watched its share of India's passenger vehicle market plummet to 23.4% in the 2025 fiscal year from 46.5% in 2020, as buyers increasingly gravitated toward SUVs that project status and offer higher seating positions.

The Affordability Crisis

The compact car's struggles stem largely from a growing affordability gap that has priced out many middle-class buyers. The Maruti Swift, India's bestselling hatchback, cost about 5.8 lakh rupees in 2015 but now sells for 7.6 lakh rupees—a 31% increase. The Wagon R, another volume seller, jumped 35% over the same period.

"Salaries and wages of consumers have not gone up in line with vehicle inflation," said Hitesh Thakurani of HDFC Securities. Stricter emissions standards, safety regulations, and general vehicle costs have created "an affordability gap" that has pushed buyers toward used cars or delayed purchases altogether.

The entry-level car price point has shifted dramatically from the pre-COVID range of Rs 3.5-4.0 lakh to Rs 5.5-6.5 lakh today, driven by raw material cost inflation and mandatory safety features like airbags. This price surge has pushed many traditional small car buyers to consider second-hand SUVs instead, particularly as small cars are increasingly seen as "out of fashion."

Tax Boost

The government's decision to reduce the goods and services tax on small cars to 18% from 28%, effective September 22, comes at a critical juncture for the segment. The cut applies to cars with engines smaller than 1,200 cc for gasoline models or 1,500 cc for diesel, and shorter than 4 meters in length—specifications that cover most of India's popular compact models.

Thakurani notes that speculation about these GST cuts, which started circulating around August 20, may have prompted OEMs to go slow in pushing inventory to their dealers, potentially affecting recent sales patterns.

The compact car's tentative recovery comes against the backdrop of a broader slowdown in India's passenger vehicle market, particularly affecting the price-sensitive 5-15 lakh rupee segment.

The Way Forward

Interestingly, the stabilization trend is visible specifically in the compact segment—including both hatchbacks and compact sedans—but not in the mini segment, which houses ultra-small cars like the Alto, Espresso, and Kwid. This suggests that the recovery, while encouraging, is selective and may reflect a sweet spot where affordability meets aspirational value.

The next three months will prove crucial for determining whether the recent stabilization represents a temporary pause or a more fundamental revival. The period coincides with India's festival season, when car sales typically surge, and marks the first full quarter of lower taxes on small cars.

For an industry that spent years chasing bigger and more expensive vehicles, the compact car's tentative recovery suggests that affordability still matters in one of the world's most price-sensitive auto markets. Whether the upcoming tax cuts can bridge the affordability gap sufficiently to restore the segment to its former glory remains to be seen, but the recent data offers the first real hope in years for India's embattled small car manufacturers.

RELATED ARTICLES

Gulf Oil, Mahindra Tractors Renew Multi-Year Partnership

Gulf Oil to continue to supply lubricants to Mahindra’s tractor division and hold the largest share of business for the...

Punch EV Pushes Closer to the Mainstream With 355 km Real-World Range: Anand Kulkarni

Tata Motors says the upgraded Punch.ev, with higher real-world range, faster charging and its new Acti.ev platform, is a...

Tata Motors PV Expects 30–50% Jump in Punch.ev Volumes After New Launch

Automaker bets on higher range, faster charging, and accessible pricing to lift EV adoption in the entry segment.

By Anurag Chaturvedi

By Anurag Chaturvedi

17 Sep 2025

17 Sep 2025

3473 Views

3473 Views

Arunima Pal

Arunima Pal

Darshan Nakhwa

Darshan Nakhwa