M&M's Q2FY25 results get a boost from automotive segment

Mahindra & Mahindra's automotive division delivered strong growth in the second quarter of fiscal year 2025, while the farm equipment sector faced some headwinds in international markets.

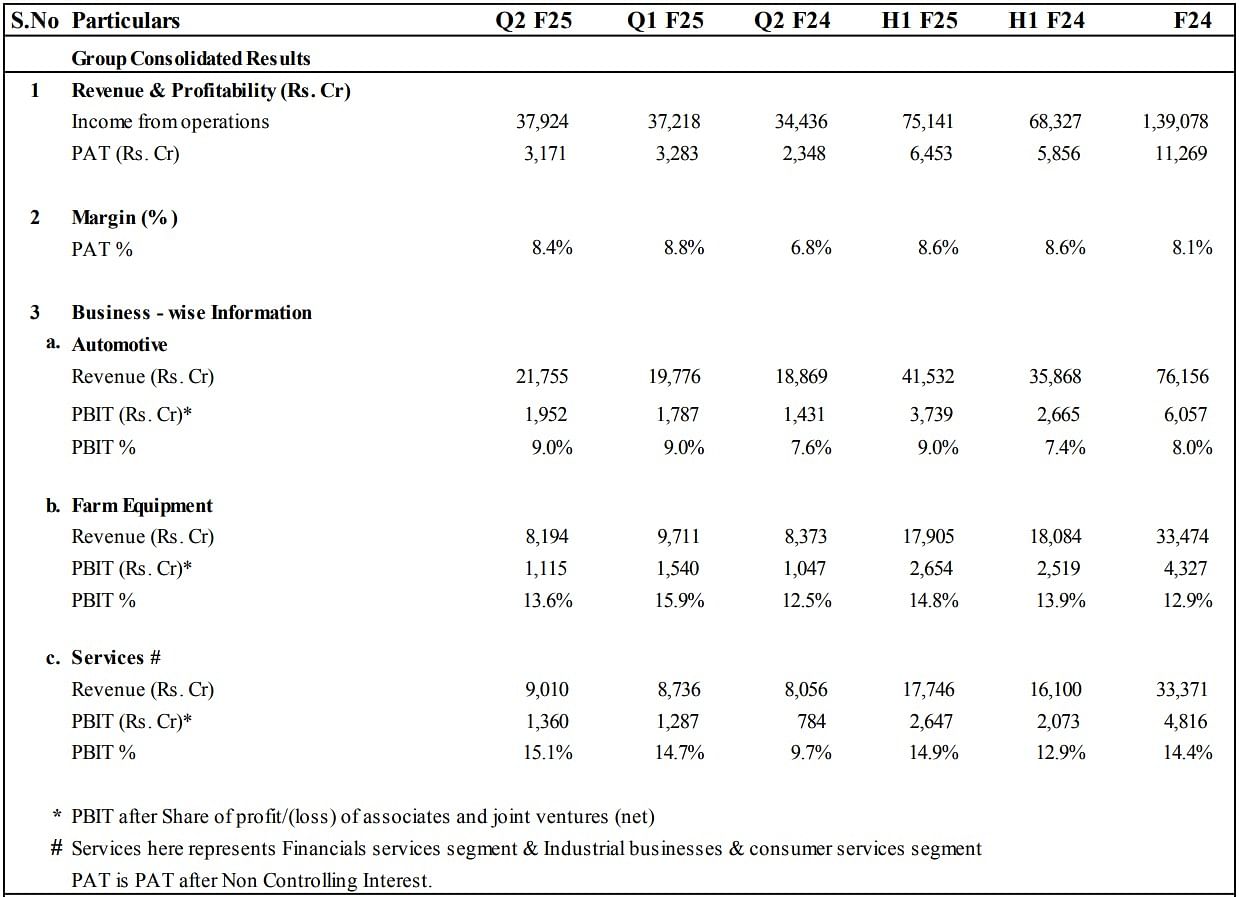

Consolidated revenue for M&M’s automotive segment grew 15% to Rs 21,755 crore in Q2 FY25, compared to Rs 18,869 crore in the same quarter last year. The division's consoliadted profit before interest and tax (PBIT) showed robust growth, rising to Rs 1,952 crore from Rs 1,431 crore, with PBIT margins expanding to 9.0% from 7.6% year-over-year.

M&M’s auto business recorded its highest-ever quarterly volumes at 231,038 units, marking a 9% increase year-over-year.

The company maintained its leadership position in the SUV segment with a revenue market share of 21.9%, an increase of 190 basis points. The recent launch of the Thar Roxx contributed to this success, with SUV volumes growing 18% compared to the same quarter last year. The company has also increased its SUV production capacity to 54,000 units, up 10% from the end of FY24.

In the light commercial vehicle (LCV) segment, Mahindra strengthened its market leadership in the sub-3.5-tonne category, achieving a market share of 52.3%, up 260 basis points year-over-year.

The farm equipment sector faced challenges, particularly in international markets. Despite achieving its highest-ever Q2 domestic market share at 42.5%, with volumes at 92,382 units (up 4%), the division's consolidated revenue declined 2% to Rs 8,194 crore from Rs 8,373 crore in Q2 FY24. However, the segment's PBIT rose to Rs 1,115 crore from Rs 1,047 crore, with margins improving to 13.6% from 12.5% in the same quarter last year.

The farm machinery business showed promising growth, with Q2 revenue increasing by 14% to Rs 253 crore. However, the farm equipment sector's consolidated profit remained flat due to macroeconomic headwinds in international farm markets.

Dr. Anish Shah, Managing Director & CEO, M&M Ltd., noted, "Our businesses have delivered a solid operating performance this quarter. Auto and Farm continued to strengthen market leadership by gaining market share and expanding margins."

Looking at the half-yearly performance, the automotive division's consolidated revenue for H1 FY25 rose significantly to Rs 41,532 crore, compared to Rs 35,868 crore in H1 FY24. The farm equipment sector's revenue showed a slight decline to Rs 17,905 crore from Rs 18,084 crore in the same period, reflecting the continued challenges in international markets.

On a consolidated basis, Mahindra & Mahindra reported a robust performance for the second quarter of fiscal year 2025, with consolidated profit after tax surging 35% to Rs 3,171 crore, driven by strong growth across its automotive, farm equipment, and services businesses.

The divergent performance of the two divisions highlights Mahindra's strong execution in the automotive segment, particularly in SUVs and LCVs, while the farm equipment business demonstrated resilience in domestic markets despite international headwinds. With increased production capacity and successful new launches in the automotive segment, Mahindra appears well-positioned to maintain its growth momentum in the domestic market, though international farm equipment markets may continue to pose challenges in the near term.

Consolidated Results

The Mumbai-based conglomerate saw its consolidated revenue rise 10% to Rs 37,924 crore in the quarter ended September 30, 2024, compared to Rs 34,436 crore in the same period last year. The company maintained its market leadership position across several key segments, including SUVs, light commercial vehicles, and tractors.

The services portfolio demonstrated remarkable growth, with Mahindra Financial Services Ltd (MMFSL) reporting a 20% increase in Assets Under Management (AUM) and improved asset quality with GS3 at 3.8%. Tech Mahindra showed significant improvement with EBIT margins expanding by 490 basis points and PAT growing 2.5 times compared to the previous year.

The services segment's consolidated revenue grew 12% to Rs 9,010 crore, while its consolidated PAT increased 1.8 times compared to Q2 FY24.

Other businesses within the group showed mixed results. Mahindra Lifespaces reported residential pre-sales of Rs 397 crore, down 13%, while Club Mahindra's total income increased 12% to Rs 371 crore. Mahindra Logistics saw an 11% growth in revenue to Rs 1,521 crore.

RELATED ARTICLES

Hero Motocorp Stops Using ‘AERA’ Trademark After Trademark Dispute With Matter Motor

Delhi High Court accepts undertaking by Hero MotoCorp to stop using AERA marks, following trademark dispute with electri...

Gulf Oil, Mahindra Tractors Renew Multi-Year Partnership

Gulf Oil to continue to supply lubricants to Mahindra’s tractor division and hold the largest share of business for the...

Punch EV Pushes Closer to the Mainstream With 355 km Real-World Range: Anand Kulkarni

Tata Motors says the upgraded Punch.ev, with higher real-world range, faster charging and its new Acti.ev platform, is a...

By Arunima Pal

By Arunima Pal

07 Nov 2024

07 Nov 2024

7320 Views

7320 Views

Mukul Yudhveer Singh

Mukul Yudhveer Singh