Maruti Suzuki Reports Modest 7.6% Revenue Growth in Q1 FY26

Net profit remained virtually flat at ₹3,792 cr compared to ₹3,760 cr in Q1 FY25, highlighting rising costs as the entry-level and hatchback segment continues to languish.

Maruti Suzuki India Limited reported first quarter revenues of ₹38,605 cr for the period ended June 30, 2025, representing a 7.6% increase over the same quarter last year. However, net profit remained virtually flat at ₹3,792 cr compared to ₹3,760 cr in Q1 FY25, highlighting rising costs as the entry-level and hatchback segment continues to languish.

The country's largest carmaker by volume continues to face headwinds from declining demand in its traditional stronghold of entry-level cars and hatchbacks, and its growth rate has trailed those of SUV-focused competitors like Mahindra and Toyota, which have been posting growth rates of 15-20% annually.

Product sales for the June quarter stood at ₹36,624 cr, up 8.1% from ₹33,876 cr in in the corresponding quarter last year. However, sequential performance showed weakness, with sales declining 4.6% from ₹38,842 cr in Q4 FY25. Other operating revenues remained stable at ₹1,981 cr.

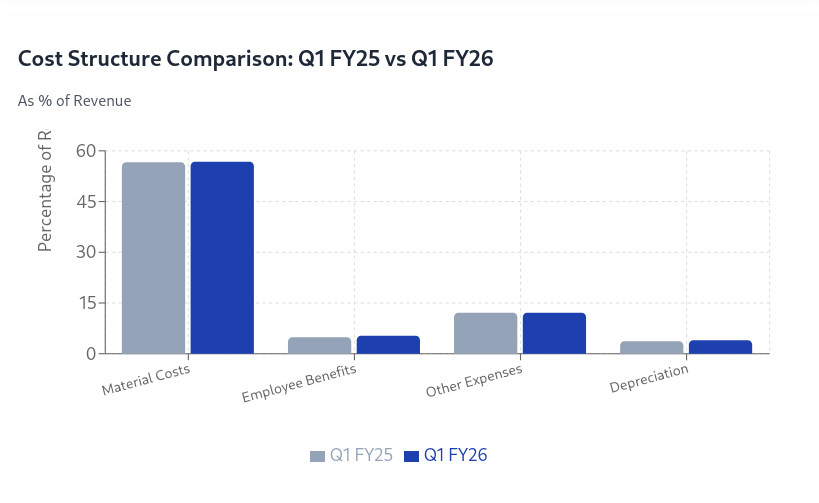

The pressure on profitability was evident across multiple cost categories. Material costs increased to ₹21,937 cr, representing 56.8% of revenues compared to 56.6% in the previous year. Employee benefit expenses rose to ₹2,048 cr from ₹1,758 cr, while other expenses climbed to ₹4,662 cr from ₹4,323 cr, reflecting higher marketing and distribution costs associated with the company's SUV push.

Profit before tax improved marginally to ₹49,435 million from ₹48,357 million, translating to a PBT margin of 12.8%. After accounting for tax expenses of ₹11,511 million, the company's net profit showed minimal growth of 0.9% year-over-year.

The financial results underscore the challenges Maruti faces in repositioning itself in the Indian automotive market. Maruti must overcome its budget-car image while establishing credibility in the higher-margin SUV segment. This brand perception challenge has resulted in lower pricing power and higher customer acquisition costs in the SUV market.

The company's purchases of stock-in-trade decreased to ₹57,038 million from ₹61,636 million in the previous quarter, indicating cautious inventory management as it navigates the product mix transition.

On the positive side, Maruti's financial health remains robust. Finance costs were minimal at ₹468 million, reflecting strong cash generation and low leverage. Other income surged 78% to ₹18,882 million from ₹10,605 million, providing some cushion against operating margin pressures. This increase suggests strong treasury management and higher cash reserves.

Depreciation and amortization expenses held steady at ₹15,560 million, indicating no major capacity additions during the quarter as the company focuses on maximizing utilization of existing assets.

The results come at a time when the Indian automotive market is experiencing a fundamental shift in consumer preferences. First-time car buyers are increasingly opting for used vehicles or two-wheelers, while those who can afford new cars are bypassing the small car segment entirely in favor of SUVs. Rising interest rates have further dampened demand in the budget segment, traditionally Maruti's core market.

RELATED ARTICLES

JK Tyre to Invest Rs 1,130 Crore to Expand Capacity by FY28

Expansion across TBR, LTBR and passenger car radial tyres to come on stream by Q2 FY28.

JK Tyre Reports 3.7-Fold Surge in Q3 Profit Amid Strong Demand and Margin Expansion

India's leading tyre manufacturer posts Rs 209 crore net profit for Q3 FY26, driven by robust domestic growth, premium p...

Olectra Greentech Appoints Suhas Athma as VP-Human Resources

Olectra Greentech Limited has appointed Suhas Athma as Vice President-Human Resources, effective February 6, 2026, bring...

By Autocar Professional Bureau

By Autocar Professional Bureau

31 Jul 2025

31 Jul 2025

3206 Views

3206 Views

Darshan Nakhwa

Darshan Nakhwa

Sarthak Mahajan

Sarthak Mahajan