Made in India electric vehicles ready to hit global markets

Electric vehicle exports are expected to constitute 25-30 percent of all vehicles shipped from India, despite domestic EV penetration projected to be around 10-15 percent.

At a time when global electric vehicle major Tesla is set to announce its big-bang entry into the Indian market this month, the world’s third largest passenger vehicle market is set to take a big leap into electric vehicle exports, with the Make in India tag well proven over the last couple of decades.

While Tesla aims to use the manufacturing base predominantly to serve the international markets, Autocar Professional learns that about 12-18 models are under development across major car manufacturers to not only cater to the growing domestic market but also use India as a base to ship vehicles to different parts of the world.

There are all kinds of models, from hatchback, sedan, SUVs and MPVs with an electric powertrain are under works — clearly indicating the transition is gathering pace. This diversification indicates a broadening product portfolio to cater to different consumer preferences and market segments across global markets. Long seen as the small car exports hub amongst the global car makers, India, has successfully transitioned into a mid-size vehicle export over the last decade. As the shift to electric vehicles gathers pace, India has once again come in the reckoning for major multinational corporations to serve the global needs. What's more, the new age EV players like Tesla, VinFast and Foxconn are seeing the country as key node for shipping vehicles around the world. It is estimated that Rs 1 lakh crore will be invested in the EV business in India by 2030 by various carmakers.

India may be a net EV exporter

Industry sources say that the exports from India are likely to breach the annual mark of about 1 million units in the next four to five years. By then, electric vehicle exports are likely to account for 25-30 percent of all the vehicles shipped from the country, even as the domestic penetration of EVs may only cross 10-15 percent. According to several people in the know, almost every mainstream vehicle maker right from Maruti Suzuki to MG Motor India, Hyundai Motor India to Citroen or even Jeep, including the homegrown car makers have set sight on exporting vehicles overseas.

One of the five people in the know of Maruti Suzuki’s electric vehicle plans said, the market leader has already firmed up plans to produce over 2.5 lakh units of electric vehicles by 2027, of which almost 60-70 percent will be exported to key global markets including Japan. The same vehicles are likely to be badge engineered by Toyota Kirloskar Motor, who is also likely to exports EVs from India back home and other parts of the world.

“Tata Motors has already taken the lead on EVs and M&M has an ambitious roadmap, the Japanese vehicle makers know if they want to participate in this fast-emerging electric vehicle race — they can’t do with just India volumes alone. Hence all the Japanese brands — Suzuki, Toyota, Honda, Nissan have lined up electric vehicles for India which will be made in India for the world,” said the second of the five people cited above requesting anonymity.

Honda Cars India, which has already announced plans of making an electric vehicle based on its new mid-size SUV platform, is readying a project internally called as Asian Compact Electric (ACE-EV). Starting 2026-2027, the maker of the popular City sedan is likely to ship about 30,000-50,000 units of its EVs to Japan and other parts of the world, said sources.

An email sent to Maruti Suzuki did not elicit any response on the specific volumes and projects.

“As a policy we cannot comment on any future product and its business strategy due to confidentiality,” said the spokesperson from Honda Cars India. However, Rahul Bharti, Executive Director, Corporate Affairs at Maruti Suzuki in an earlier interaction with Autocar Professional had said that since the volumes were not sufficient to ensure the viability of a battery plant, the company would rely on exports to build scale for EVs. “We thought the obvious choice was exports. When we launch our EV, it will be on the back of domestic and export volumes also, because of which the battery and cell manufacturing could become viable,” he added.

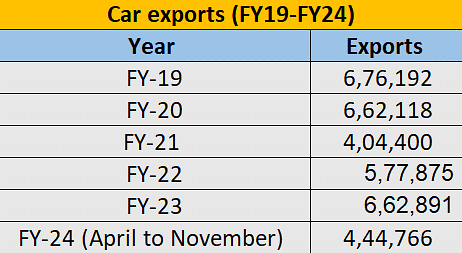

Source: SIAM

Suzuki has already announced plans for half a dozen electric vehicles by the end of the decade, which will be across segments and price points to cater to a wide addressable market. Hyundai Motor Group’s sister brand Kia is coming out with a compact RV, which is likely to be shipped across the world. The likes of Renault Nissan Alliance and Skoda Auto Volkswagen have already firmed up their EV plans which have a critical exports component.

Gaurav Vangaal, Associate Director, Light Vehicle Forecasting at S&P Global Mobility says the exports from India should rapidly increase from 2025. The strong revenue posted by carmakers and suppliers in the last couple of years has bolstered the Indian market among global players. “Today, almost every carmaker in India is strategising to utilise India as an export hub, a trend we have also noticed with capacity expansion. India is going to add multiple new vehicles, new EVs and new destinations to its exports in this decade. We anticipate Indian LV exports to reach over 1 million units by 2031,” added Vangaal. He said that entrants like Tesla, VinFast and Foxconn will further enhance the contribution in the years ahead, once they enter the Indian LV production.

Govt PLI scheme supports Make in India for the world

The Production Linked Incentive Scheme can become a big enabler for production and exports of EVs as it offers a much-needed thrust for manufacturing electric vehicles in the country. The Government of India has already rolled out the Production Linked Incentive (PLI) scheme, for both automobiles and the automotive component industry. It has a budgetary outlay of Rs 25,938 crore, providing financial incentives to boost domestic manufacturing of Advanced Automotive Technology products including electric vehicles and their components. The scheme provides incentives of upto 18 percent of eligible sales of electric vehicles and their related components.

Additionally, there is also incentive for producing battery cells locally under PLI for Advanced Chemistry Cells (ACC), which had an outlay of Rs 18,100 crore. The scheme incentivises the establishment of Giga scale ACC manufacturing facilities in the country for 50 Giga Watt hour (GWh). These ACCs will be used in batteries which are aimed at promoting the widespread adoption of EVs.

OEMs line up significant investment for EVs

OEMs such as Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra have already announced investment in excess of Rs 10,000 crore for EVs for the future. Even the smaller players in the Indian market like Renault-Nissan, Skoda-Volkswagen have either committed fresh investment in India or are in the process of defining the exact quantum of investment. Such was the response to the scheme that the auto and component manufacturers together have proposed to invest Rs 74,850 crore in the country over a period of five years from 2022 to 2027. While the 20 automakers approved under the scheme have proposed to invest Rs 45,016 crore, the 75 component makers approved under the Component Champion Incentive Scheme have proposed to invest an added Rs 29,834 crore.

Alliance and collaborations to drive scale

François Bailly, SVP and Chief Planning Officer for the AMIEO region at Nissan Motor Corporation says that the role of India is going to bigger for the company in the future. The Japanese car maker has committed to come out with A-segment entry EV model for India. “One thing, I want to emphasise is the cost performance of India. If you deeply localise in the country, then the role of India for Nissan gets bigger globally. The plan is to make an EV product for India by India,” added Bailly. Since the scale is going to be critical, in an era of EVs, there are likely to be many more collaborations happening. While Renault-Nissan will leverage its global alliance for the Indian market, so will Skoda Auto Volkswagen in India who have explored a partnership with homegrown vehicle maker Mahindra & Mahindra. Thomas Schafer, CEO of Europe’s largest car maker Volkswagen says the brand's transition to EV in India will happen regardless of alliance outside or not. “I think India cannot stay behind, while the rest of the world goes electric. It also has to jump on this wagon and go along with technology and use the leadership to further this. There are some really good messages from India on moving towards electrification. We are obviously looking into further investments and they will mainly be in the electric space,” he added. On the potential of exports of EVs from India, Klaus Zellmer, global CEO of Skoda Auto, which is leading the brand's manufacturing initiatives in India, says exports is a very critical pie, which will bring in the much-needed volumes to build the scale and reduce cost and even EVs are part of the thought process. “Export is a business model that we’re really looking into. Will it be with EVs? We haven’t made a decision on the platform, on the exact car. Let’s see whether those fit somewhere else. But then if I look at production cost, India is in a very good spot. It’s in the scope,” said Zellmer.

Meanwhile, Stellantis Group has plans of exporting vehicles for both Citroen and Jeep eventually and more recently JSW-MG SAIC alliance which has a strong EV plan at the core of their partnership wants to cater to global markets from India, say people in the know.

EVs to offer opportunity for Indian brands

Experts say the learning curve is much shorter for developing an EV than an ICE vehicle. Hence the gap on the quality and performance parameters between legacy players and new age players is narrowing — a point that is well proven by Tesla. That gave confidence to new age players like Vietnam’s VinFast, US-based Lucid and Fisker to look beyond China. Given the experience of global conglomerates who have been making ICE vehicles for over five to eight decades, the likes of M&M and Tata Motors, the two leading two Indian OEM brands, are still young. Much like Vinfast and Fisker, they too have global business ambitions. M&M intends to enter the European market with its BEVs post 2027, while Tata Motors with the support of Jaguar Land Rover’s EMA architecture has also started nurturing its bigger global ambitions.

Make in India to challenge Chinese EV makers

Chinese car makers have made huge inroads globally and they are posing a stiff challenge to vehicle makers in US and Europe in their home turf. The only base around the world that offers a scale and cost advantage beyond China is India. Global car makers are defining a critical base in India, which may not only offer a big domestic market potential but also be a tool to compete strongly in the zero-emission space.

Way forward

Clearly, India, which grabbed the podium from Japan in 2023 is entering its next phase of automotive evolution. The Government of India has already announced its intent to make the country a strong base for EV exports and has backed it up with supportive policies. The intent is fast translating into action on ground zero and global vehicle makers are taking critical decisions, which is likely to put India as a strong challenger in the global EV race.

This feature was first published in Autocar Professional's January 1, 2024 issue.

RELATED ARTICLES

Nissan exports from India to cross 1 lakh cars in 2026-27

The automaker’s product portfolio in India will have 4 models in FY27, including the mid-size SUV Tekton and a new 7-sea...

Global Automotive Leaders to Converge on Vienna for 47th International Motor Symposium

More than 1,000 engineers, executives, and policymakers from over 20 nations will gather at Vienna's Hofburg Palace from...

Nissan India's 2026 Plans - 3 New Products, Retail Network Expansion

Over the next one year, Nissan plans a portfolio of four products, addressing the Rs 6–20 lakh segment.

13 Jan 2024

13 Jan 2024

23593 Views

23593 Views

Kiran Murali

Kiran Murali

Sarthak Mahajan

Sarthak Mahajan