BUDGET 2025: No Change in Effective Duty on Import of Cars

Although the headline customs duty has been reduced on cars priced more than $40,000 and was exempted from Social Welfare Surchage, an Agriculture Infrastructure and Development Cess (AIDC) has been introduced , leaving the effective overall import tariff unchanged. However, there has been a reduction in the effective duty on motorcycles.

The recent Union Budget brought joy to those looking to import cars to India, as the basic customs duty (BCD) on import of cars was reduced by way of exempting them from the Social Welfare Surcharge (SWS). However, a closer look at the budget document shows that an Agriculture Infrastructure and Development Cess (AIDC) has been added to the duty structure.

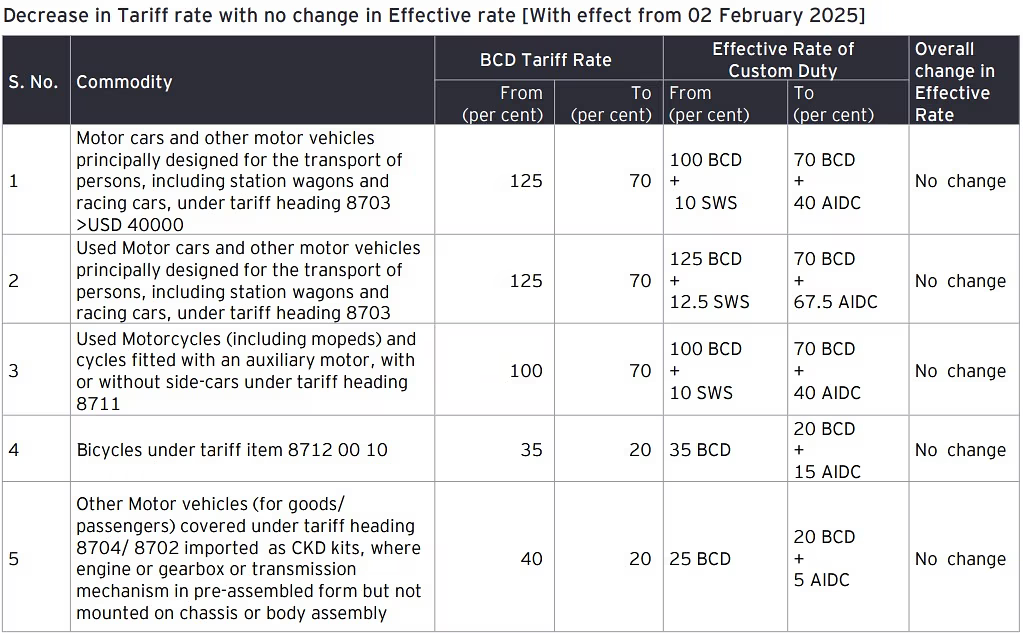

The BCD on certain motor cars and other motor vehicles costing more than $40,000 has been reduced to 70% from 125%. Also, the import of those cars has been exempted from the SWS, which was 10%. But a 40% AIDC has been introduced. This AIDC cancels the impact in the reduction in headline customs duty and exemption from SWS, leaving the effective import tariff on such cars unchanged.

AIDC was first proposed in the Union Budget a few years back to improve agricultural infrastructure. On the customs side, AIDC was initially applied on items such as gold, silver, alcohol beverages and crude palm oil.

With the introduction of AIDC on cars, the government basically moved certain duties from basic customs duty to AIDC. Previously, there was no AIDC on vehicles, and hence now, AIDC must be factored in when calculating the effective duty rate.

This shift in taxation lcan be seen as a structural change to increase the central government's revenue. BCD is shared between the centre and state governments. However, the AIDC is a central government levy, which goes exclusively to the centre.

Source: EY LLP

Source: EY LLP

Meanwhile, there has been a reduction in the effective duty on motorcycles. The BCD on the import of motorcycles, including complete built units (CBUs), semi-knocked down (SKD) and completely knocked down (CKD) units, has been cut. Also, the AIDC has not been introduced on the import of motorycles, unlike in the case of cars.

For motorcycles with engine capacity not exceeding 1600 CC, the duty on CBUs has been reduced to 40% from 50%, while those on SKD units has been decreased to 20% from 25% and CKD units to 10% from 15%. For larger motorcycles with engine capacity exceeding 1600cc, the reductions are higher. Duty on CBUs will be slashed from 50% to 30%, while SKD units will see a reduction from 25% to 20%, and CKD units from 15% to 10%, as per the budget documents.

The duty reduction on motorcycles comes at a time when Donald Trump is once again the president of the United States. A few years ago, Trump had criticized India for its high tariffs, using the duty on Harley-Davidson motorcycles as a key example.

The reduction in the duty on imported motorcycles will reduce the cost of those models in the Indian two-wheeler market, which has witnessed a shift in consumer preference towards premium models. This will give a boost to sales numbers of global premium motorcycle brands such as Harley Davisdson, Triumph, Norton, Suzuki and Honda.

RELATED ARTICLES

Ather Prepares For Commodity Headwinds As Profitability Comes Into View

CEO Tarun Mehta noted that while some materials appear to be facing structural demand-supply gaps, others seem driven by...

Honda Motorcycle & Scooter India Sales Rise 29% YoY in January 2026

Of the total volumes, domestic sales accounted for 5,19,579 units, while exports stood at 54,832 units.

Ather’s EL Signals a Shift From Fixing Margins to Scaling the Business

"EL is a lower-cost architecture for us,” Tarun Mehta told analysts during Ather Energy’s Q3 FY26 earnings call, a remar...

By Kiran Murali

By Kiran Murali

03 Feb 2025

03 Feb 2025

41308 Views

41308 Views

Arunima Pal

Arunima Pal

Mukul Yudhveer Singh

Mukul Yudhveer Singh