Auto Sales Momentum Post GST 2.0 Prompts Elara Capital Forecast Upgrade

Brokerage upgrades PV, CV and tractor outlook as post-GST demand rebounds sharply.

India’s automobile industry is seeing a broad-based demand recovery following the rollout of GST 2.0, prompting Elara Capital to raise its volume growth estimates for most vehicle segments for FY26 and FY27.

In its latest sector note, the brokerage said festive-season demand and December 2025 sales data surprised positively, leading it to revise growth assumptions upward for passenger vehicles (PVs), medium and heavy commercial vehicles (MHCVs), light commercial vehicles (LCVs) and tractors. Growth estimates for two-wheelers, however, remain unchanged.

Elara Capital attributed the upgrade to a sharp acceleration in retail sales after the GST overhaul, improving affordability, easing interest rates, low inventory levels and stronger-than-expected rural demand. It now expects FY26 volume growth of around 8% for passenger vehicles, 9% for MHCVs, 11% for LCVs and a robust 19% for tractors.

Acceleration Post GST 2.0

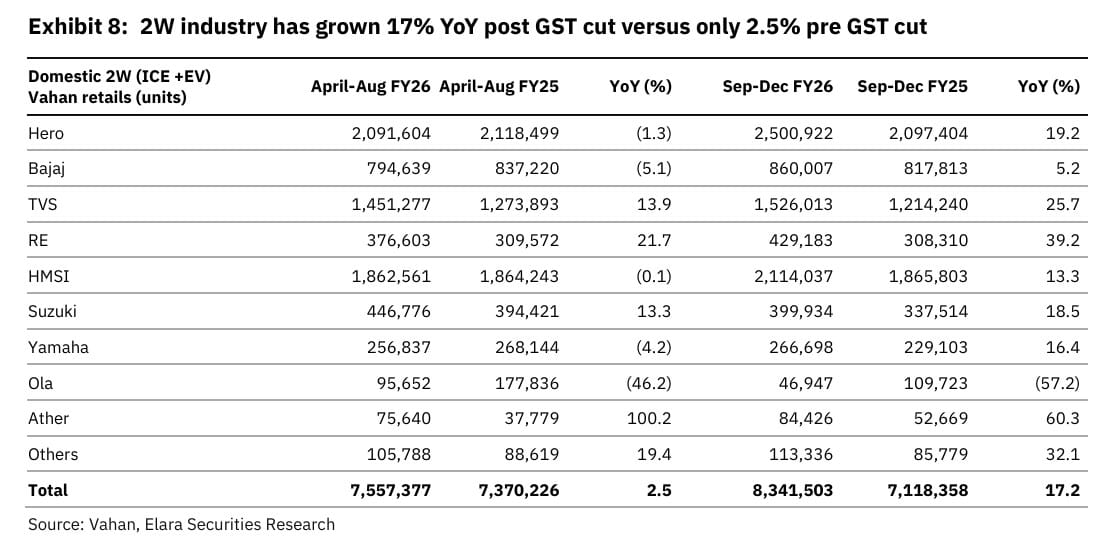

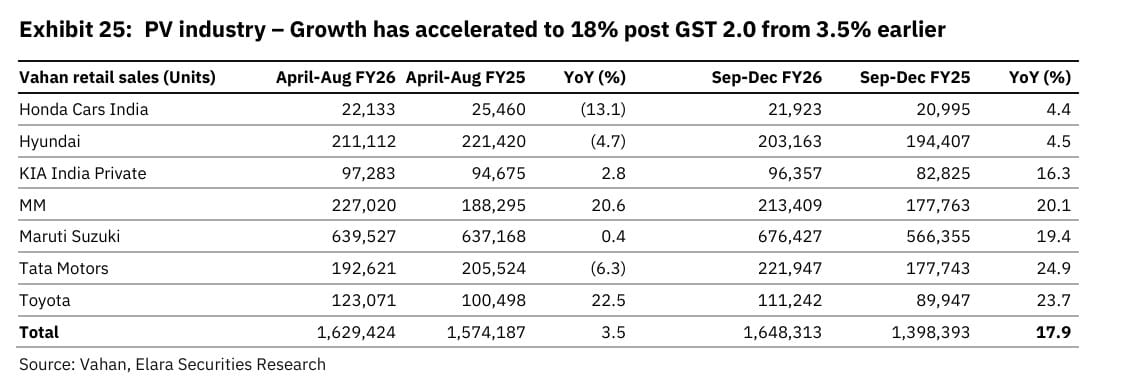

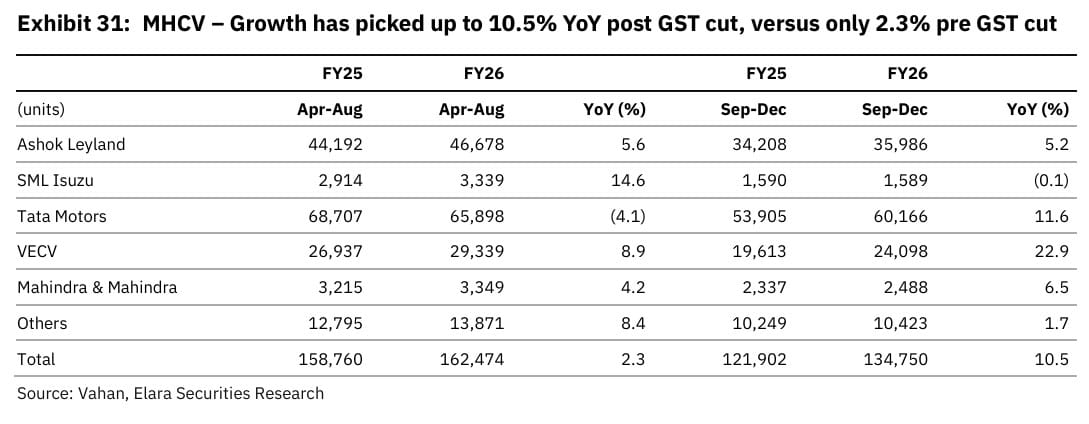

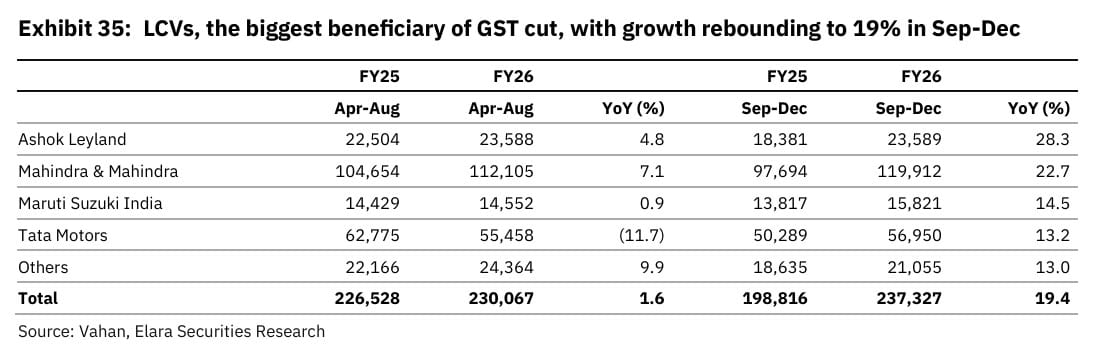

The brokerage highlighted a clear divergence between industry performance before and after the GST reforms. Between April and August 2025, growth across major auto segments remained muted due to weak consumer sentiment and a high base. During this period, PVs grew just 3.5% year-on-year, two-wheelers 2.5%, MHCVs 2.3% and LCVs 1.6%. Following the GST 2.0 rollout, however, industry momentum improved sharply. Sales growth during September-December 2025 jumped to 18% for PVs, 17% for two-wheelers, 11% for MHCVs and 19% for LCVs.

Elara Capital noted that dealer inventory levels remain comfortable across segments and are particularly thin for passenger vehicles, suggesting limited risk of demand being artificially inflated by channel stuffing.

Tax Rationalisation

Under GST 2.0, tax rates were reduced on several high-volume vehicle categories, including small cars, two-wheelers below 350cc, tractors, buses and trucks, lowering acquisition costs meaningfully.

According to Elara Capital’s estimates, the combined impact of GST cuts, income-tax rebates announced in the Union Budget and RBI rate reductions has boosted effective household income by 4.5-7% across key income brackets. The brokerage also said the affordability index (GDP per capita increase divided by vehicle car price increase) for cars has improved to above pre-Covid levels, while total cost of ownership has fallen back to around March 2023 levels.

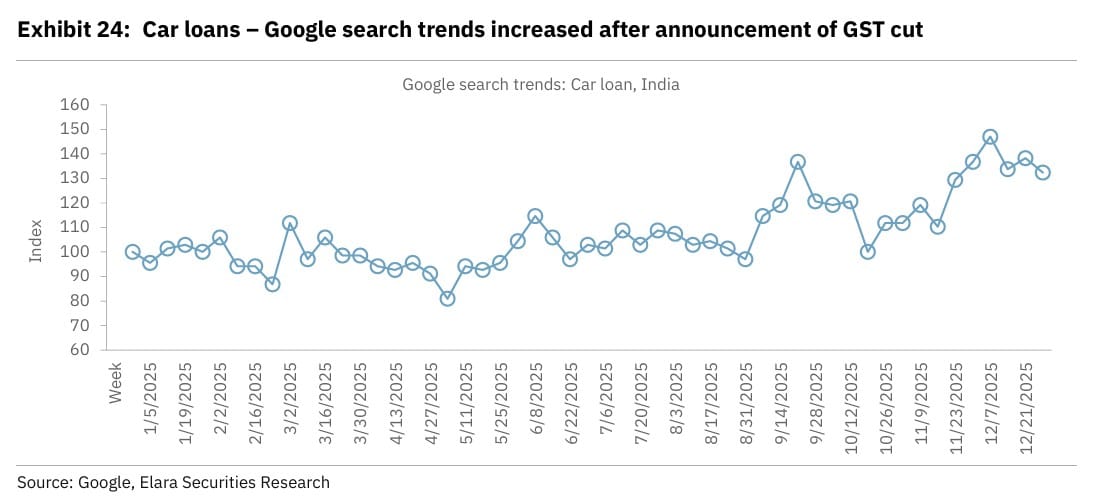

These factors, the brokerage said, are already translating into higher showroom walk-ins and stronger retail conversions.

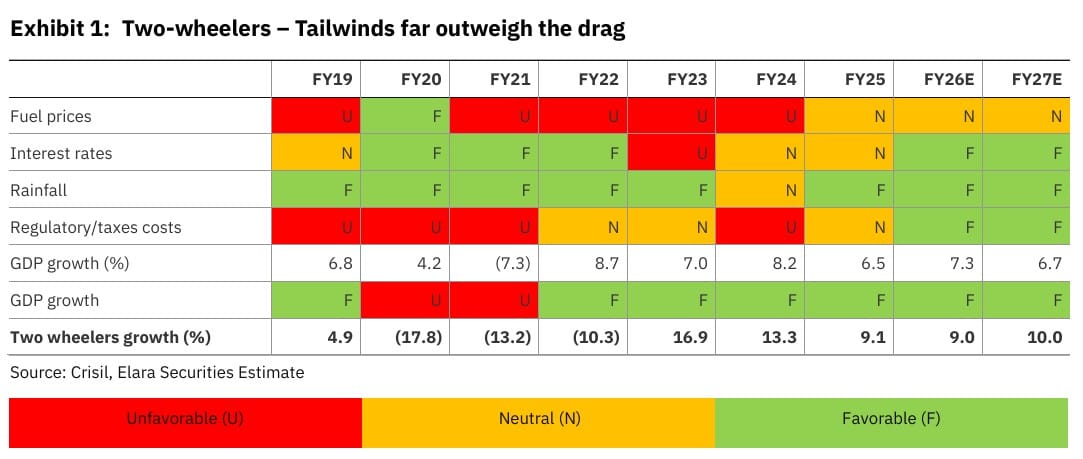

Two-wheelers

Elara Capital expects two-wheeler volumes to grow 9% in FY26, 10% in FY27 and 7% in FY28, with the industry likely returning to its FY19 peak in the ongoing financial year.

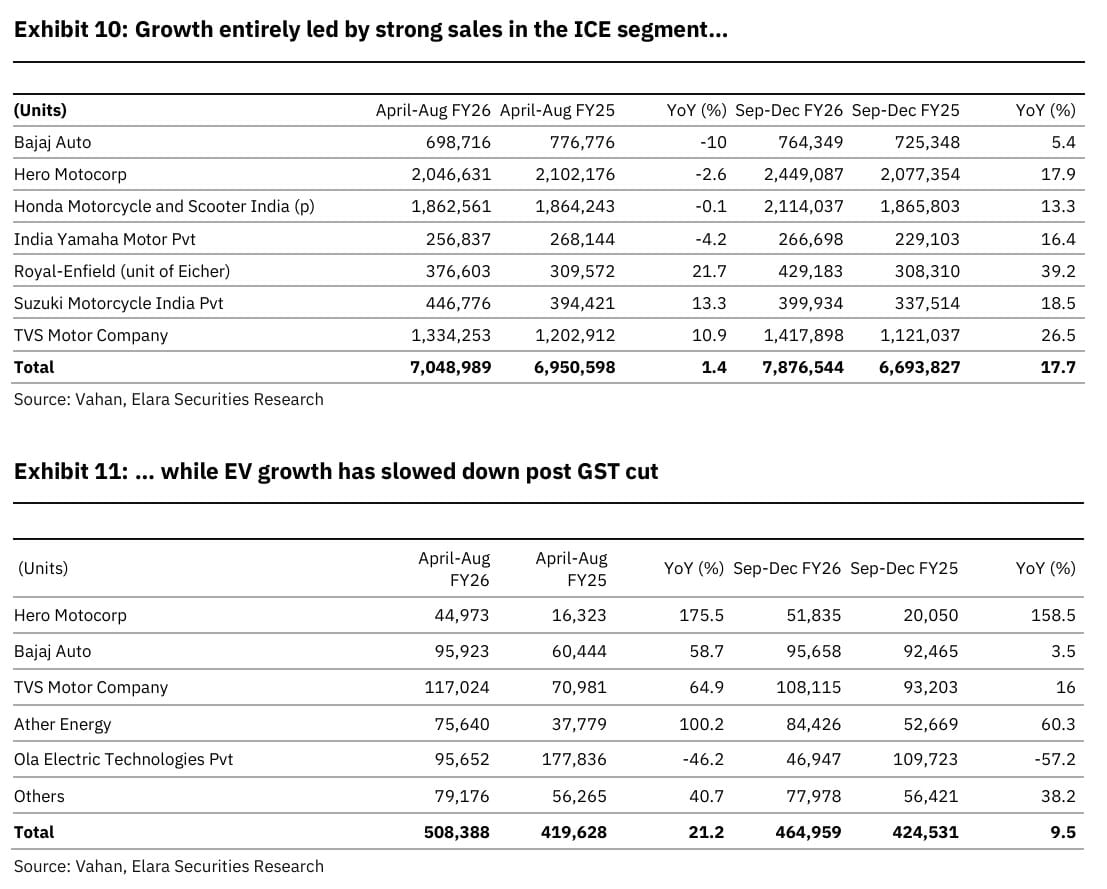

The two-wheeler volume growth rebounded sharply to 17% year-on-year in September-December 2025, compared with just 2.5% during April-August. The recovery has been driven almost entirely by ICE models, which grew around 18% post GST 2.0 compared with just 2.5% growth in April-August, while EV growth slowed to 9.5% from 21% earlier.

The brokerage said the GST cut on sub-350cc ICE motorcycles narrowed the price gap with electric two-wheelers, leading to a drop in EV penetration to 5.5% from 6.7%. Among manufacturers, TVS Motor Co and Royal Enfield continued to gain market share, while Hero MotoCorp clawed back some share after the tax reset.

Economic revival and good rainfall are expected to be the tailwinds to trigger a recovery in rural demand for two-wheelers, which is likely to outperform urban demand in FY26, according to the report. “Going forward though, we monitor the sentiments in some parts of rural India given crop damage due to unseasonal rains and depressed Kharif crop price,” the brokerage said.

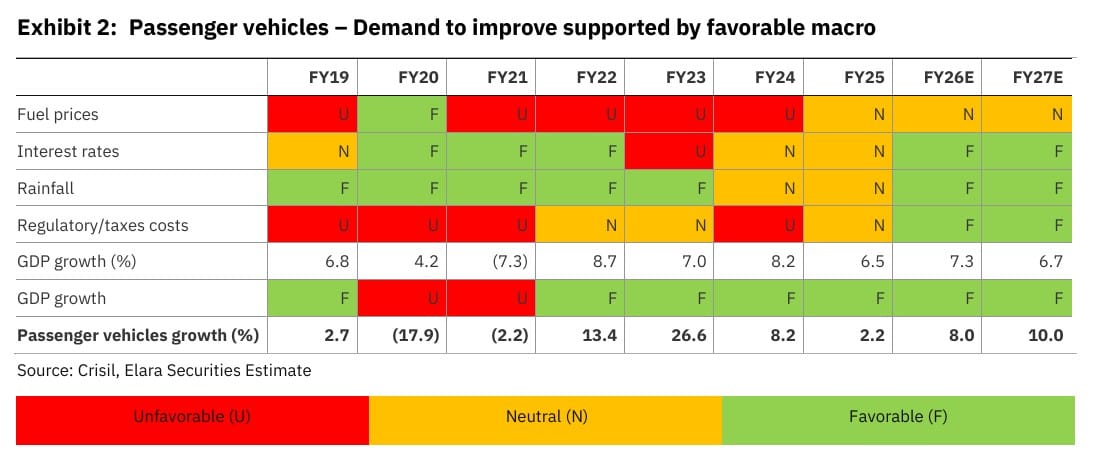

Passenger vehicles

For passenger vehicles, Elara Capital raised its FY26 growth estimate to 8%, with growth expected to accelerate further to 10% in FY27 before moderating to 6% in FY28.

“We see macros improving, led by good monsoons, improving consumer sentiment, better affordability due to GST cut, reduced interest rates, and tax benefit announced in the last budget. We estimate that all these measures will boost average household income by 4.5% for the INR 0.5 million income level, 6% for the INR 1 mn income group and 7% for the INR 1.2mn income level,” the brokerage said in the report.

The PV retail growth rebounded from 3.5% year-on-year in April-August to 18% in September-December after the GST cut. Market share data shows Maruti Suzuki, Mahindra & Mahindra and Tata Motors PV gained share post-GST 2.0, while Hyundai Motor India and Kia India ceded some ground. Among states, Tamil Nadu, Kerala and Bihar were among the biggest growth drivers post-GST 2.0, while Haryana lagged.

Medium and Heavy Commercial Vehicles

Elara Capital now expects MHCV volumes to grow 9% in FY26, 6% in FY27 and 2% in FY28. Growth improved to around 10.5% year-on-year post-GST reforms, compared with just 2% earlier. Within that, bus segment growth slowed to 4% post-GST reforms from 24% earlier, while truck demand picked up to 12% YoY in September-December versus 2.6% degrowth in April-August. Within trucks, growth has been strongest in the 7.5-12 tonne ILCV category, which could dilute industry margins due to an adverse mix.

The brokerage cautioned that structural factors continue to cap growth. “With the recent GST cut for commercial vehicles and lower interest rates, industry volume is seeing some recovery, though partially offset by a gradual shift towards higher tonnage vehicles and negative impact due to dedicated freight corridors. Also, since absolute tonnage sold has already surpassed the FY19 peak, growth in tonnage is likely to remain muted,” the brokerage noted.

“We are also monitoring potential regulation-led price increases over the next 12-18 months– such as the draft mandate for automatic emergency braking–which could weigh on industry growth in FY28, while resulting in pre-buying in FY27.”

Light Commercial Vehicles

The LCV segment has emerged as the biggest winner from GST 2.0, according to Elara Capital. Volumes surged to 19% year-on-year in September-December, from just 1.6% in April-August.

The brokerage now expects LCV volumes to grow 11% in FY26 and 9% in FY27, supported by consumption recovery, e-commerce expansion and lower financing costs.

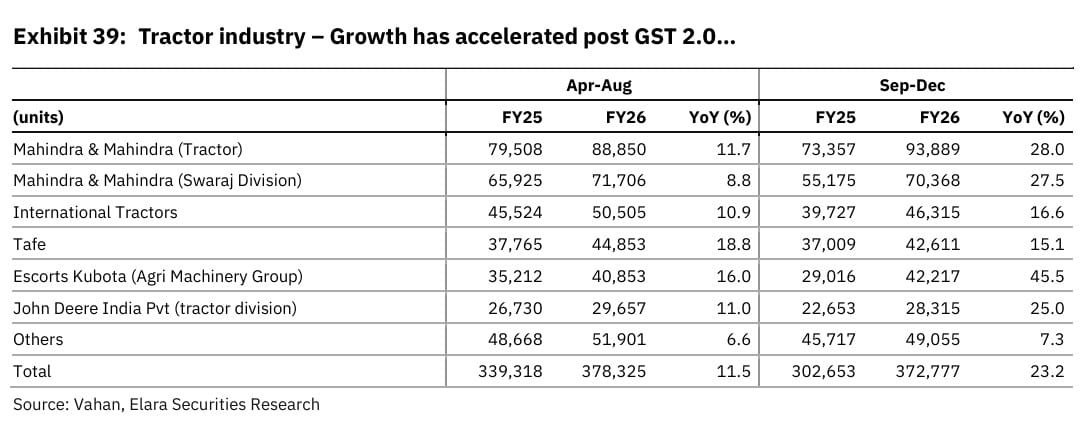

Tractors

Elara Capital raised its FY26 tractor growth forecast to 19%, citing strong monsoons, improving farm incomes, supportive government policies and GST-led price relief.

After peaking in FY23, the tractor market corrected in FY24 before returning to growth in FY25. The brokerage expects a domestic tractor CAGR of 8.4% between FY25 and FY28, with Maharashtra emerging as a key incremental growth state.

RELATED ARTICLES

Weekly News Wrap: EV push intensifies with Maruti’s eVitara pricing, Tata Punch.ev, Valeo India bet

Maruti Suzuki and Tata Motors launch new electric models as foreign suppliers and domestic manufacturers commit fresh ca...

India EV Sales Seen Topping 200,000 in FY26 as PV Market Nears 4.6 Million Units

As adoption in higher-priced segments remains strong, the next leg of growth will hinge on accelerating electrification ...

Hero Motocorp Stops Using ‘AERA’ Trademark After Trademark Dispute With Matter Motor

Delhi High Court accepts undertaking by Hero MotoCorp to stop using AERA marks, following trademark dispute with electri...

By Darshan Nakhwa

By Darshan Nakhwa

07 Jan 2026

07 Jan 2026

1745 Views

1745 Views

Autocar Professional Bureau

Autocar Professional Bureau

Mukul Yudhveer Singh

Mukul Yudhveer Singh