A Week of Strategic Shifts, Global Ambitions & EV Resets

From Tesla’s symbolic entry and rare-earth urgency to Hero’s European play and Ola’s cautious EV pivot—India’s auto sector is navigating opportunity and disruption in equal measure.

The past week in India’s auto industry brought a mix of symbolic milestones, strategic pivots, and long-term planning. Tesla finally entered the Indian market—but more with a whisper than a roar. Meanwhile, domestic players like Hero MotoCorp and Tata Motors sharpened their global ambitions.

The industry also saw new pressures—from rare-earth shortages impacting EV plans to signs of softening consumer demand in Q1 FY26. But amidst these headwinds, optimism still shines through: CEAT and Landmark Cars reported strong topline growth, exports remained buoyant, and India’s status as a manufacturing and aftermarket powerhouse continued to solidify. Here's a complete wrap of the week’s key headlines, insights, and trends.

Tesla’s India Move: Symbolic, Not Disruptive

Tesla has launched the Model Y in India (₹60 lakh) and opened its first showroom in Mumbai. But with premium pricing and limited volumes, its entry is seen more as symbolic than game-changing.

🔗 Read More

Maharashtra Aims to Be India’s EV Capital

At the Tesla showroom launch, CM Devendra Fadnavis announced Maharashtra's ambitions to become India’s largest EV manufacturing hub, citing rapid investments and infrastructure readiness.

🔗 Read More

Electric Car Sales Forecasted to Hit 7% Market Share by FY28

According to CareEdge, India’s electric car market is projected to cross 7% share by FY2028, a jump from 0.3% in FY21—fueled by policy support and consumer interest.

🔗 Read More

AMP 2047: India’s Long-Term Automotive Vision Takes Shape

The Ministry of Heavy Industries has kicked off work on Automotive Mission Plan 2047, a roadmap aligning with the ‘Viksit Bharat @2047’ vision and aiming to elevate India’s global auto standing.

🔗 Read More

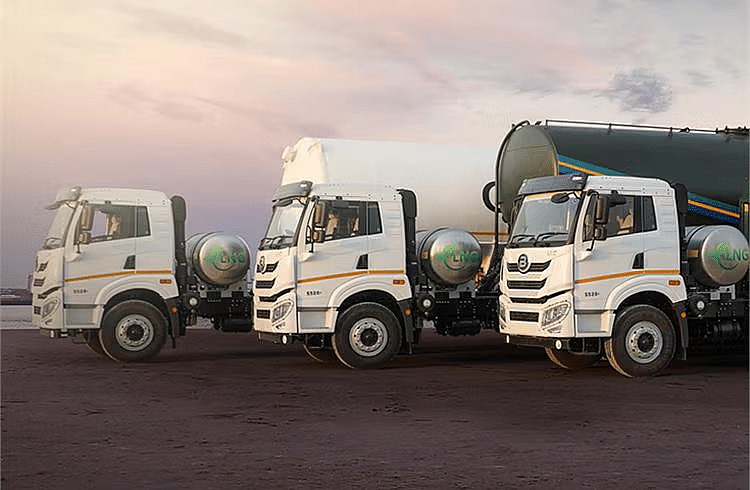

Clean Freight Future: LNG & EVs Key to Long-Haul Decarbonization

India’s trucking sector, which accounts for ~40% of road CO₂ emissions, is turning to LNG and EVs as key pathways to reduce emissions and meet 2070 net-zero targets.

🔗 Read More

Honda Eyes Expansion in 100cc Bike Segment

Following the success of Shine 100, Honda is evaluating new models in the entry-level motorcycle space to strengthen its presence.

🔗 Read More

Hero MotoCorp to Enter UK and Europe by Q2 FY26

Hero MotoCorp will launch operations in the UK and select European markets by September 2025—marking a major leap in its global growth journey.

🔗 Read More

Tata Motors in Talks to Buy Iveco Stake from Exor

Tata Motors is exploring a potential acquisition of Italy’s Iveco Group (excluding defence), in talks with Agnelli family's Exor—potentially expanding its global footprint.

🔗 Read More

JLR to Cut 500 UK Roles Amid US Sales Slump

JLR will trim 500 managerial roles in the UK following a 15.1% global sales drop and weakening US demand, largely due to Trump-era tariffs.

🔗 Read More

Ola Electric Slows Down Cell Expansion Plans

Ola Electric is delaying its cell capacity expansion to 5 GWh (vs planned 20 GWh) till FY29, potentially affecting PLI scheme timelines amid slow EV market growth.

🔗 Read More

Kinetic Green Targets Global Growth with e-Golf Carts

With Lamborghini’s Tonino as JV partner, Kinetic Green is set to launch e-golf carts in 25 countries, targeting $300M revenue over five years.

🔗 Read More

ZF Bets on India Amid European Slowdown

ZF is banking on India as its aftermarket growth engine, aiming for double-digit expansion, while Europe sees softening demand.

🔗 Read More

CEAT Approves ₹450 Cr Capex to Boost Tyre Output

CEAT will invest ₹450 crore in its Chennai plant to ramp up PCUV tyre production capacity by 35%, signalling bullish long-term demand.

🔗 Read More

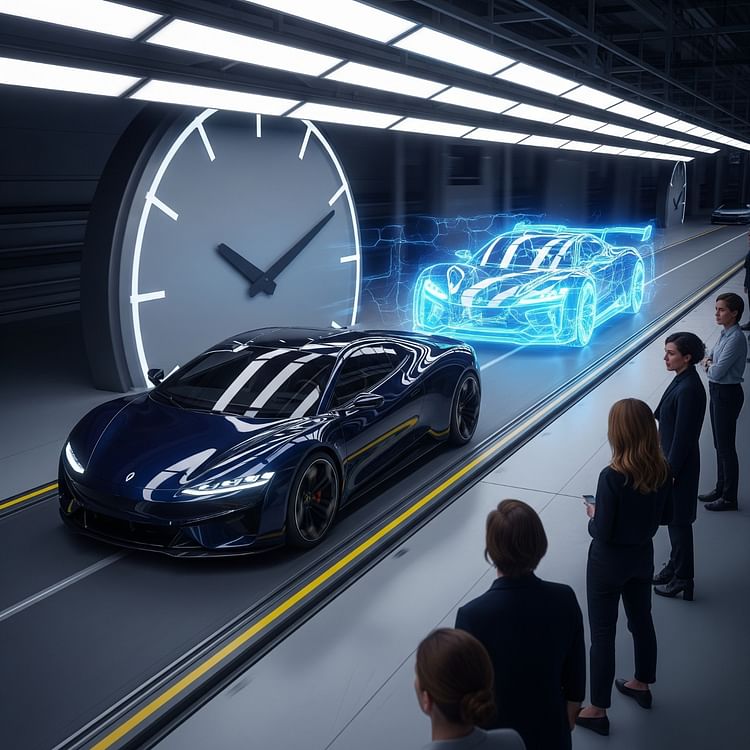

Creativity Reimagined: Auto Design in the Age of AI

Automotive design is undergoing a radical shift as artificial intelligence reshapes creativity and development timelines. Pratap Bose, Chief Design Officer at Mahindra & Mahindra, highlights the growing pressure to stay ahead of disruption: “You’re one product away from a competitor making yours obsolete.” Designers now face tighter timelines, constant iteration, and the threat of rapid irrelevance in a fast-evolving landscape.

Automotive design is undergoing a radical shift as artificial intelligence reshapes creativity and development timelines. Pratap Bose, Chief Design Officer at Mahindra & Mahindra, highlights the growing pressure to stay ahead of disruption: “You’re one product away from a competitor making yours obsolete.” Designers now face tighter timelines, constant iteration, and the threat of rapid irrelevance in a fast-evolving landscape.

🔗 Read More

AI & SDVs: Rewriting the DNA of Indian Auto Industry

India’s auto industry is transitioning from hardware-driven engineering to software-defined vehicles (SDVs), with AI at the core. This isn’t just tech evolution—it’s a complete reinvention of how vehicles are conceived, built, and experienced. SDVs are reshaping everything from R&D to customer engagement, creating both massive opportunity and unprecedented complexity for Indian OEMs.

India’s auto industry is transitioning from hardware-driven engineering to software-defined vehicles (SDVs), with AI at the core. This isn’t just tech evolution—it’s a complete reinvention of how vehicles are conceived, built, and experienced. SDVs are reshaping everything from R&D to customer engagement, creating both massive opportunity and unprecedented complexity for Indian OEMs.

🔗 Read More

Rare Earth Crunch

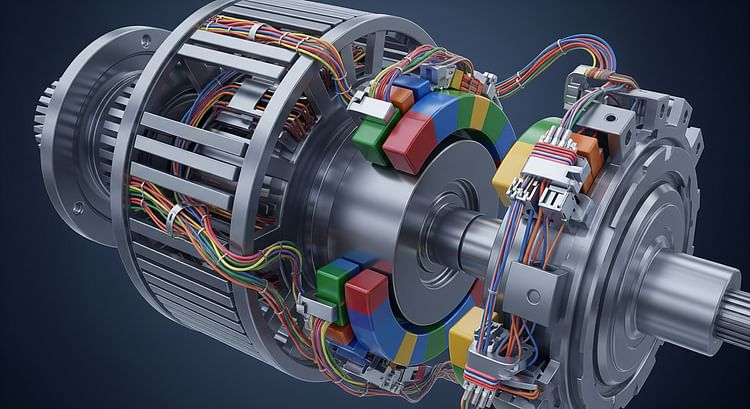

Magnets of Disruption: How China’s Grip on Rare Earths Is Stalling India’s EV Dreams

Rare-earth magnets are the invisible drivers of electric motors, and China controls more than 80% of global supply. For India’s EV players, this overreliance has become a looming risk, threatening to stall growth and innovation.

🔗 Read more

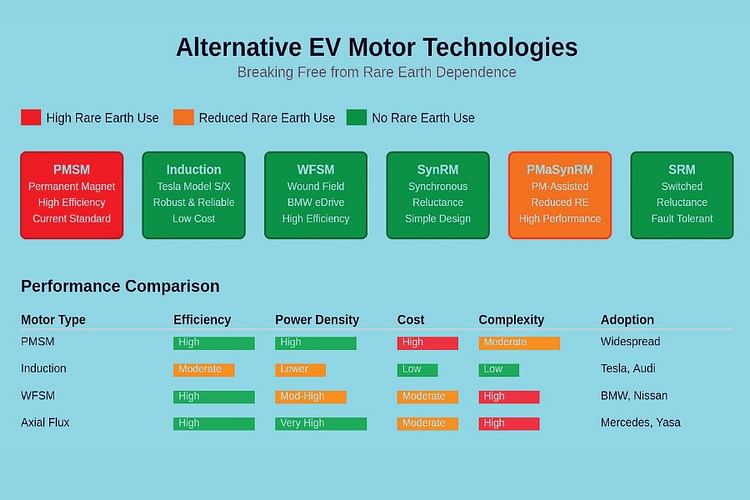

Motor Makeover: India’s Search for Rare Earth Alternatives Intensifies

Electric vehicle manufacturers are stepping up efforts to adopt alternatives to rare-earth permanent magnet motors, as concerns over China's supply chain dominance, cost volatility, and environmental risks continue to grow. Although permanent magnet synchronous motors (PMSMs) still power over 80% of EVs due to their high efficiency and power density, new motor technologies are gaining momentum.

Ola Electric to Launch Rare-Earth-Free Motors by Q3 FY26

Taking a lead among Indian OEMs, Ola Electric will debut rare-earth-free motors in its two-wheelers starting October–December 2025. The move is part of the company’s broader plan to de-risk its supply chain and localize critical EV components.

🔗 Read more

Indian OEMs See Uneven Impact from Rare Earth Shortages

The rare earth crisis is hitting automakers differently. While some have secure stockpiles, others are close to halting production. This uneven turbulence highlights the urgent need for diversified sourcing strategies and local alternatives.

🔗 Read more

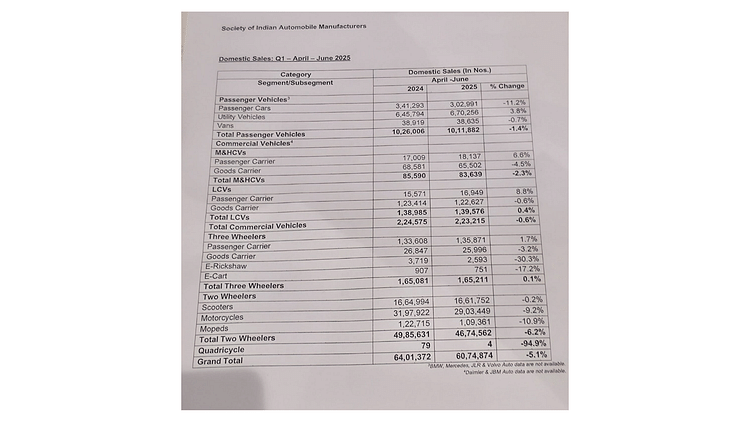

Q1 FY26 Sales

Post-COVID Growth Streak Ends: India’s Auto Sales Drop 5.1% in Q1 FY26

India’s domestic auto sales declined 5.1% YoY in the April–June quarter, falling to 60.75 lakh units from 64.01 lakh a year earlier. The slowdown was led by weak demand in the two-wheeler and entry-level PV segments, marking the first decline since the COVID era.

🔗 Read more

Mahindra Overtakes Hyundai in PV Sales; Tata Slips to 4th in Q1 FY26

In a reshuffle of the passenger vehicle leaderboard, Mahindra & Mahindra surged to the No.2 position in Q1 FY26, displacing Hyundai and Tata Motors. With its highest-ever PV market share, Mahindra’s SUV-led strategy appears to be paying off.

🔗 Read more

Motorcycle Sales Down 9% in Q1; 7 of 10 OEMs Impacted

The country’s largest two-wheeler segment faced a sharp 9.2% YoY drop in Q1 sales, dampening momentum after a healthy FY25. The slump in rural demand and high base effect seem to be key contributors.

🔗 Read more

Exports Shine Amid Weak Domestic Market: Shailesh Chandra

Tata Motors’ Shailesh Chandra expects a robust double-digit export growth across categories, driven by healthy global demand despite supply chain constraints. Exports are likely to continue outpacing domestic momentum.

🔗 Read more

Earnings Report Card

Muted Outlook: Ola Electric Braces for Flat FY26

Despite previous quarter growth, Ola Electric expects FY26 volumes and revenues to remain largely flat. The company has forecasted volume growth between -9.5% and +4.4%, with revenue growth hovering in a narrow band of -9.5% to +1.2%. Industry watchers see this as a sign of cooling momentum in India’s electric two-wheeler space.

CEAT Sees Revenue Climb but Profit Slides

CEAT Ltd clocked ₹3,529 crore in consolidated revenue in Q1 FY26, marking a 10.5% YoY increase. But net profit dipped by 27.2% to ₹112.3 crore due to higher input costs and macroeconomic challenges. The EBITDA margin stood at 10.9%, underlining a cost-sensitive quarter for the tyre maker.

Volvo Group Faces 5% Q2 Revenue Decline

Volvo Group’s Q2 2025 net sales dropped to SEK 122.9 billion, reflecting a 5% decline YoY (adjusted for currency). The company attributed the downturn to demand stabilization in Europe and ongoing buyer uncertainty in North America—both key markets for its heavy commercial vehicles and equipment.

Landmark Cars Accelerates with 21.5% Revenue Growth

Landmark Cars Ltd, a major automotive retail chain, reported robust growth in Q1 FY26, with revenue rising to ₹1,415 crore from ₹1,164 crore a year earlier. The 21.56% jump signals strong dealership performance and high demand across its portfolio of luxury and premium brands

Landmark Cars Ltd, a major automotive retail chain, reported robust growth in Q1 FY26, with revenue rising to ₹1,415 crore from ₹1,164 crore a year earlier. The 21.56% jump signals strong dealership performance and high demand across its portfolio of luxury and premium brands

RELATED ARTICLES

Gulf Oil, Mahindra Tractors Renew Multi-Year Partnership

Gulf Oil to continue to supply lubricants to Mahindra’s tractor division and hold the largest share of business for the...

Punch EV Pushes Closer to the Mainstream With 355 km Real-World Range: Anand Kulkarni

Tata Motors says the upgraded Punch.ev, with higher real-world range, faster charging and its new Acti.ev platform, is a...

Tata Motors PV Expects 30–50% Jump in Punch.ev Volumes After New Launch

Automaker bets on higher range, faster charging, and accessible pricing to lift EV adoption in the entry segment.

20 Jul 2025

20 Jul 2025

2418 Views

2418 Views

Arunima Pal

Arunima Pal

Darshan Nakhwa

Darshan Nakhwa