Uptick in July retail sales, FADA releases retail market share for first time

Green shoots seen in rural region, tractor, small commercial vehicles and motorcycle sales positively impacted.

The automotive retail sales continue to remain a concern for the industry. The Federation of Automobile Dealers Associations (FADA) today released its monthly vehicle registration data for July 2020.

The overall automotive retail sales in July (2W, 3W, PVs, CVs and tractors) stood at 1,142,633 units, which is 36 percent lower compared to same period last year. However, compared to the previous month, the retail sales improved 16 percent.

According to FADA's retail sales numbers for the previous months, rural India seems to be the growth engine. Commenting on the sales data, Ashish Harsharaj Kale, president, FADA said, “As India continues to open up, the month of July saw better registrations compared to June, though on a YoY basis auto sector recovery is yet to be seen anywhere near normal. Current market conditions are still not indicative of the actual demand situation on an all India level and retails continue to de-grow in huge double-digit despite the low base of last year. Rural market though continues to show strong growth as monsoon continues its good spell. Tractor, small commercial vehicles and motorcycle sales positively impacted with the monsoon progress and spread.”

On the other hand, Kale states that Banks and NBFCs though flush with high liquidity are still having “a cautious approach towards funding auto retail”, which is affecting the demand revival especially in CV, 3W and 2W segments. FADA notes that vehicle funding percentage has fallen by 10-15 percent in many segments increasing the initial contribution beyond reach of many customers, despite having the intent to buy.

The dealer federation has appealed to the government to announce demand boosting policies as this will ensure speedier revival. FADA says the auto industry is eagerly awaiting incentive based scrappage policy and this will provide the much-needed fillip to the medium and heavy commercial vehicles sales.

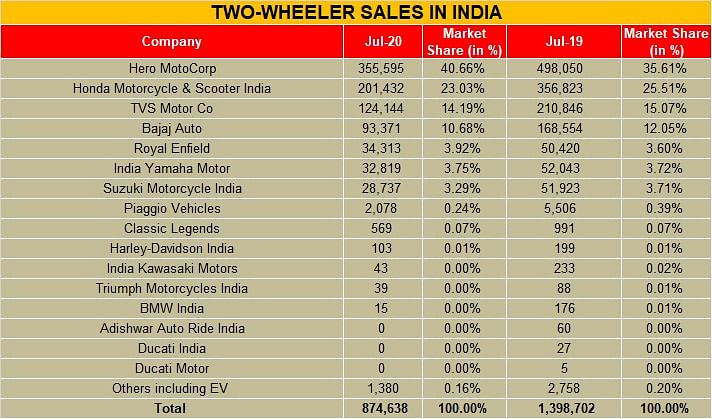

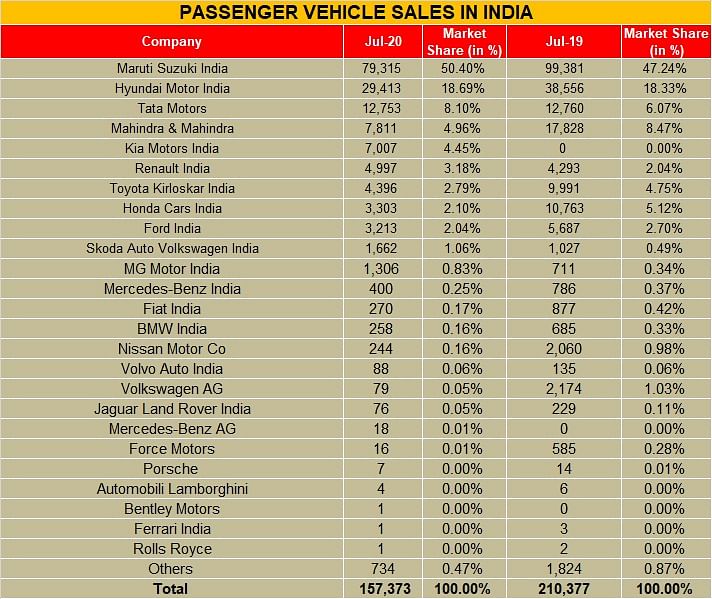

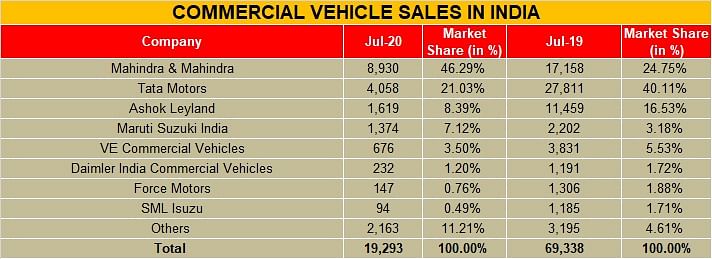

Bringing further transparency in auto retails, FADA Institute of Automobile Marketing & Research has for the first time released vehicle registration-based OEM market share. The auto retail body says this will not only shift market share calculation from wholesale to actual retails, which is the global practise, but will also bring further clarity in OEM-wise inventory at dealerships. In addition, it will also help all the stakeholders – suppliers, OEMs, banks/NBFC and dealers get real-time demand status thus helping them in better planning.

“FADA Institute of Automobile Marketing & Research will now be regularly bringing in deeper analysis on various aspects of Auto Retail in India. In times to come, it will also bring OEM wise market share at State Level thus bringing in more transparency,” added Kale.

Optimistic outlook from festive season

He further states that with no further lockdowns expected, especially in auto manufacturing hubs, the outlook for the month is positive in comparison to July. In addition, the month of August which also marks the beginning of long festival season. “With Onam and Ganesh Chaturthi in next few days, FADA hopes that Auto Industry will start its recovery journey in a linear manner.”

On the other hand, FADA states that extreme caution is required by OEM’s towards “wholesale billing being in tune with retail sales to avoid dealer inventory build-up.”

FADA says retail sales are still at just 60-70 percent levels compared to same period last year, despite the low base of last year. This has led to dealers battling on many fronts to navigate through this unprecedented crisis and disproportionate inventory. The excessive interest cost could further put many on the border of business survival.

For the full year outlook FADA continues to remain negative with a projected de-growth in retail sales in the range of 15-35 percent across various segments, except tractors, which looks set to clock a positive annual growth.

Also read: FADA pins hopes on rural demand for growth but urges Centre for scrappage policy

India Auto Inc stuck in a deep rut, urgently needs GST cut, scrappage policy

National Green Tribunal pulls up MoRTH over delay in vehicle scrappage policy

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

10 Aug 2020

10 Aug 2020

14402 Views

14402 Views