FADA pins hopes on rural demand for growth but urges Centre for scrappage policy

The auto retail body states that the overall weak economic sentiments along with the rising number of Covid-19 patients has led to weak consumer confidence especially in Tier – 1 cities.

A week after apex automobile industry body SIAM released its wholesales numbers for June and Q1 FY2021, the Federation of Automobile Dealers Associations (FADA) today released its monthly vehicle registration data for June 2020.

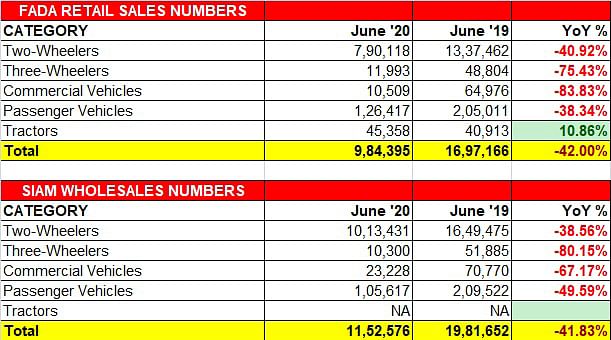

Look at the data tables below and it is amply clear that the Indian automobile sector is in trouble. SIAM’s wholesale numbers for the April-June 2020 period show that overall wholesales are 75% down year on year. However, June sales offered a semblance of hope that market conditions are on the mend, albeit slowly.

According to FADA's retail sales numbers for June 2020, it looks like growing demand from rural India is giving some hope of better times to the industry. Overall sales were 984,395 units (-42%), comprising sales of 790,118 two-wheelers (-40%), 11,993 three-wheelers (-75%), 10,509 commercial vehicles (-83%), 126,417 four-wheelers (-38%) and 45,358 tractors (10.86%).

According to Ashish Harsharaj Kale, president, FADA (Federation of Automobile Dealers Association of India), the 'Unlock 1.0' coupled with increase in demand from rural marketz gave a boost to retail sales last month compared to May 2020.

“At the end of June, Almost 100 percent of dealership outlets (showroom and workshops) were operational across the country, barring a few cities and towns which have once again implemented stringent Lockdown. June registrations, although better than May is still not Indicative of the actual demand situation as Lockdown woes continue in some parts and supply side is far from its complete potential,” added Kale.

The auto retail body states that the overall weak economic sentiments along with the rising number of Covid-19 patients has led to weak consumer confidence especially in Tier 1 cities, as customers stopover from concluding their purchase as fear of community spread and therefore a return of complete lockdown persists.

On the other hand, the rural market led by a robust crop situation of previous harvest and timely arrival of monsoons has witnessed demand recovery in comparison to urban areas, therefore leading surge in retail sales of tractors as well as positively impacting two-wheelers and small commercial vehicles.

Kale believes that the positive rural sentiment “if backed with demand boosting measures by the government can ensure the quickest return to normalcy of the auto industry, amongst all core industries, thereby impacting the overall consumer sentiment positively.”

FADA says it urges the government for urgent introduction of an attractive incentive-based vehicle scrappage policy, which is one of the dire needs for the revival of the commercial vehicle sector and especially M&HCV’s, as the sector faces major headwinds in demand revival.

FY2021 to see sales decline of 15-35% across segments

Kale expects that with an assumption of no further lockdown and continued reopening measures, vehicle registrations will see somewhat similar trends and mostly will better the June numbers, with further green shoots of demand in newer geographies and segments.

The FADA president is of the opinion that overall demand continues to be a challenge coupled with supply side constraints as well constraints in retail lending from NBFCs. Normalcy in demand still seems quite distant and not before the festive season which is around November 2020.

Nonetheless, despite the positive trends in the rural markets, the annual outlook currently continues to be grim with projected sales to witness a de-growth range of 15-35 percent across various segments in FY2021, except for the tractor segment, which looks set to clock a positive annual growth.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

21 Jul 2020

21 Jul 2020

7700 Views

7700 Views