Strong CV industry sales in November bode well for FY2018

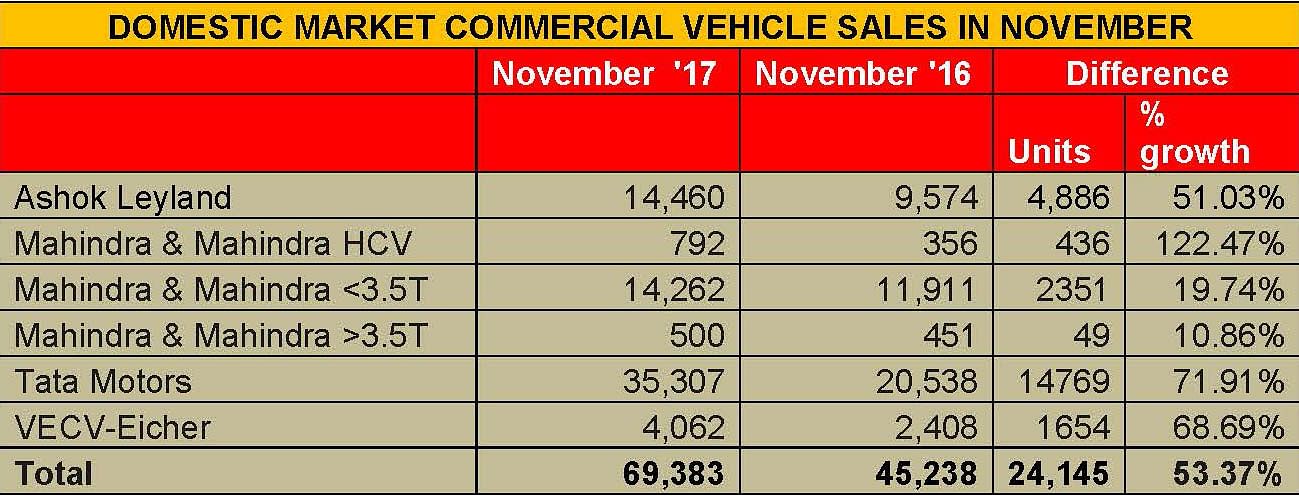

Led by market leaders Tata Motors and Ashok Leyland, which recorded their biggest monthly gain in recent years, the commercial vehicle sector has reported robust numbers for November 2017.

In a manner similar to the passenger vehicle segment, the commercial vehicle (CV) market numbers have notched handsome sales albeit the numbers have to be seen in the background of the demonetisation strategy which adversely impacted sales in November 2016.

Nevertheless, November 2017 has turned out to be a cracker of a month for the commercial vehicle (CV) segment as overall sales made a strong comeback after a tepid October 2017. Both medium and heavy commercial vehicle (M&HCV) and light commercial vehicle (LCV) sales have recorded a sharp increase in year-on-year sales and all the manufacturers in the Indian market have notched remarkable gains.

Tata Motors and Ashok Leyland, the biggest players in the M&HCV segment, have seen their numbers grow 88 and 54 percent respectively, their biggest monthly gain in recent years. Mahindra & Mahindra (M&M) and VE Commercial Vehicles have also registered smart upticks with YoY growth of 22 and 68 percent respectively. The growing demand in the M&HCV segment indicates buyers are now finally taking on the vehicle price increases brought about by the upgrade to BS IV, while also benefiting from GST-driven gains.

The CV industry in India has experienced a turbulent year in the first two-quarters of FY2017-18. Q1 sales were down 9 percent due to BS IV implementation as fleet buyers made heavy purchases in March before truck prices rose from April 1. With the BS IV impact somewhat stabilising, Q2 saw a marginal revival in sales what with the festive season also giving a fillip to sales. As a result, overall CV sales in April-October 2017 turned positive and grew by 6.04 percent to 423,135 units comprising 154,843 M&HCVs (-5.38%) and 268,292 LCVs (+13.97%).

Tata Motors & Ashok Leyland hit monthly highs

Tata Motors, which is having a good run in the passenger vehicle market with its clutch of new cars like the Hexa, Tiago, Tigor and the Nexon, has dominated news in the CV world since the past few months. Tata Motors’ sold a total of 35,307 units, up a massive 72 percent compared to 20,538 units in November 2016. The M&HCV trucks segment is up 88 percent YoY with total sales of 12,851 units. According to the company, “The sales growth was largely driven by the success of our SCR (Selective Catalytic Reduction) technology, which has been well accepted by customers. Increased demand for the new tonnage vehicles, infrastructure development led by government funding and a keen focus on customer requirements have helped to revive the M&HCV performance.”

Tata’s I&LCV sales grew by 76 percent at 3,984 units on the back of better performance of new product introductions and continued demand. Its pickups also saw demand grow with sales up by 53 percent to 4,685 units; the recently launched Xenon Yodha continues to gain acceptance and volumes across markets. Its small CV sales at 10,265 units are up 77 percent over year-ago sales as a result of strong market acceptance of the Ace Mega XL range. Tata’s commercial passenger carrier segment (including buses) sales were 3,520 units in November 2017, up by 36.5 percent over last year.

According to Tata Motors, “The commercial sector has bounced back strongly after the initial disruption in the market surrounding demonetisation and the BS IV transition that largely affected the transport industry last year. Consumption-driven sectors have shown an uptick in sales since July 2017 and continue even after the festival season. The increased demand for vehicles across segments and production ramp-up of the new range of BS IV vehicles has given a strong boost to overall sales growth.”

Like the market leader, Ashok Leyland also registered massive gains in sales last month with total sales of 14,460 CVs, up by 51 percent. (November 2016: 9,574). Its M&HCV numbers have bounced back, growing 54 percent to 10,641 units (November 2016: 6,928) while LCVs too posted strong 44 percent YoY growth at 3,819 units sold (November 2016: 2,646).

November also saw Mahindra & Mahindra notch considerable growth; with overall CV sales of 15,554 units, its YoY growth was 22 percent (November 2016: 12,718). The company sold 792 M&HCVs, up 122 percent albeit on a low year-ago base (November 2016: 356). The below-3.5T GVW segment numbers were up by 20 percent YoY, at 14,262 units (November 2016: 11,911), while those in the above-3.5T GVW segment grew by 11 percent with sales of 500 units (November 2016: 451).

VE Commercial Vehicles’ domestic sales were up by 68.7 percent with total sales of 4,062 units (November 2016: 2,408 units).

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

04 Dec 2017

04 Dec 2017

8321 Views

8321 Views

Autocar Professional Bureau

Autocar Professional Bureau