Rising CNG prices could slow down growth story for car and 3W OEMs

Three price hikes in five months and a total of four in the year to date mean CNG prices have risen by as much as 28%.

If high petrol (Rs 109.98 a litre) and diesel (Rs 94.14 a litre) prices are not enough, motorists will now have to contend with fast-rising prices of CNG (Compressed Natural Gas). From midnight of November 26, Mahanagar Gas Ltd (MGL), one of India’s leading gas distribution companies, has hiked CNG prices to Rs 61.50 per kg.

It is understood that the latest hike is due to MGL sourcing additional market-priced natural gas to meet growing demand of the CNG and PNG (piped natural gas) market in India. Also, global prices of nautal gas have increased, leading to MGL’s recent hikes.

Mumbai prices

This is the third price increase in five months and its fourth this year. The November 26 hike constitutes a 7% increase from the Rs 57.54 per kg price on October 4, and is an 18.31% increase from the Rs 51.98 per kg on July 13, 2021. The previous hikes this year were on February 8 to Rs 49.40 per kg from Rs 47.90 (when CNG prices were reduced on October 5, 2020). This means in the calendar year to date, CNG prices (in Mumbai) have risen by as much as 28%, causing much concern to personal transport owners as well as commercial vehicle operators. And it’s not good news for CNG vehicle manufacturers either.

CNG car and three-wheeler sales on the upswing this fiscal

Given CNG’s considerable price difference to petrol and diesel, it is not surprising there is a consumer shift to the greener fuel. A glance at the data table for sales of passenger vehicles and three-wheelers reveals the smart rise in demand for CNG vehicles.

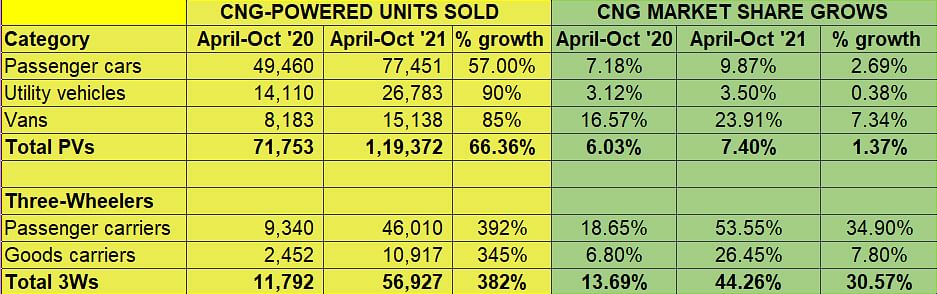

Sales of CNG-powered PVs have clocked 66% year-on-year growth to 119,372 units in the first seven months of FY2022. While cars with 77,451 units posted 57% growth and accounted for 65% of total sales, UVs with 26,783 units notched 90% YoY increase and accounted for 22% of the share; vans with 15,138 units (up 85%) made up the rest with a 12.6% share. The much-improved performance of all three sub-segments is reflected in the growing CNG market share in the overall PV segment: cars to 9.87%, UVs to 3.50% and vans to 24%. Overall, the CNG share in the PV market has grown to 7.40% from 6.03% a year ago.

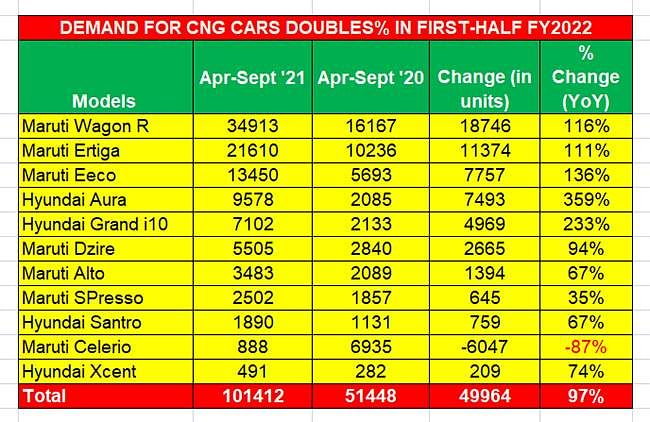

Both Maruti Suzuki and Hyundai India are extreme;ly bullish on CNG vehicle sales. Of the 11 models on sale, Maruti Suzuki India, with its seven models – Alto, S-Presso, Celerio, Wagon R, Dzire, Ertiga and Eeco – accounts for 82,351 units or 81% of the total 101,412 units sold in H1 FY2022. The other CNG player, Hyundai Motor India, with 4 models – Grand 10, Santro, Aura and Xcent – sold the remaining 19,061 units. While Maruti Suzuki had notched 80% YoY growth (H1 FY2021: 45,817 units), Hyundai Motor India has done even better – 238% YoY growth (H1 FY2022: 5,631 units), albeit on a lower year-ago base than the overall PV market leader. Tata Motors, which is on a roll in the PV segment with a strong showing month after month, doesn’t have a CNG vehicle in its portfolio yet. But its entry into the CNG segment is imminent.

It’s a similar story with CNG-powered CVs, where the bulk of the demand is for passenger-transporting vehicles. With India back on the move and demand returning in droves for people movement, a total of 46,010 units were sold, which marks near-400% YoY growth and a sharp increase in market share to 53% (from 18.65%) in the sub-segment. Goods carriers, with 10,917 units, saw 345% YoY growth and market sharer increase to 26.45% (from 6.80% in April-October 2020)).

Growth outlook

While it is difficult to say whether CNG prices will keep moving upwards consistently, given the growing demand for the fuel in India both for motoring and household usage, the fact remains that CNG vehicle running costs are significantly lower compared to petrol or diesel as a CNG vehicle inherently gives better fuel economy when driven on CNG.

A few challenges remain though. Refuelling takes longer due to a fewer number of CNG stations and highway driving requires additional planning in terms of trying to take a route with a CNG station. But car buyers, who have heavy day-to-day, usage find that it makes wallet sense in choosing the CNG fuel option.

There's also the electric vehicle option. With the Central and state governments putting their shoulder to the EV wheel with a host of subsidies and sharpened focus on improving EV charging infrastructure, it is likely the CNG sector's loss could be the EV segment's gain.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

28 Nov 2021

28 Nov 2021

28853 Views

28853 Views

Autocar Professional Bureau

Autocar Professional Bureau