Revised GST cess will hit luxury market growth in 2017: Mercedes-Benz India

Having withstood the challenges in the macro-economic environment, Mercedes-Benz India is looking to increase its share of the India luxury car pie, even if the pie doesn’t grow this year.

The Indian luxury car market did not have a good run in 2016, mainly due to the impact demonetisation that affected the overall automotive industry. Roland Folger, MD and CEO, Mercedes-Benz India, fears that this year too may be a similar story especially for the luxury car industry, thanks to the upward revision of GST cess on luxury cars and SUVs.

When asked if the segment, where Mercedes-Benz is the leader, will grow this year, Folger says: “Where should that growth come from? Where is that incentive for growth? We would have had a chance in the second half of the year, presently with the GST in place. As long as there is flip-flopping and no clear indication, where should the growth come from? It’s another lost year just like 2016, for different reasons.”

Folger, one of the outspoken CEOs in the Indian industry, is not new to policy changes in the Indian industry. Ever since Folger took over his current role in October 2015, he has witnessed one “disruption” after another – the ban on diesel vehicles through to demonetisation and the recent upward revision of GST cess.

Folger says, “As much as I understand that they are for the betterment of the country in total, this short-term pain for long-term gains is a concept that’s sometimes a little difficult, especially when you have to explain to the headquarters.”

Having withstood the challenges in the macro-economic environment, Mercedes-Benz India is looking to increase its share of the India luxury car pie, even if the pie doesn’t grow this year. Mercedes-Benz ended 2016 with a market share of 40 percent. “We have been able to increase our share in 2016 (in a flat market). That’s our internal success, because we believe it could have been much worse for us,” says Folger.

Powered by 10 new launches so far this year, Mercedes-Benz India would look at tiding over the challenges and sustain its growth and leadership position. Under its performance brand AMG, the company launched its latest set of models, the GT R and the GT Roadster in New Delhi today. These flagship halo models apart will attract a few high net worth Indians. It is estimated that 500-600 customers buy such performance cars in India every year. The company is also banking on them to pull more people to the showrooms, if only to admire them but buy any of the other Mercedes-Benz model. Mercedes-Benz India currently has 25 models in its portfolio.

Additional GST cess takes the mojo out of luxury car sales

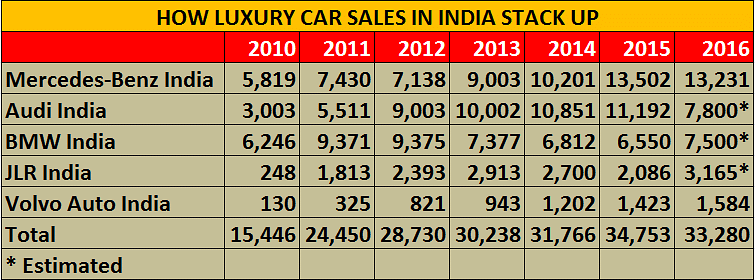

Autocar Professional's analysis of the luxury car market in India shows that sales grew at a rapid pace from 15,446 units in 2010 to 30,238 units in 2013, slowing down in 2014 and 2016.

The luxury car market, in developed economies, usually accounts for between 5-7 percent of the overall PV market. For India, sales of an estimated 33,280 units in CY2016 indicate it is around 1 percent of the 3-million PVs sold. The uptick in sales in the first quarter of FY2018 indicated that considerable potential was set to be tapped in the ongoing fiscal.

In 2017, with the economy showing all signs of being in good nick and consumer sentiment back on track, luxury vehicle sales were expected to accelerate. New momentum had also come in from GST rates, which had reduced taxation on luxury vehicles. As a result, luxury carmakers had expected the sector to record YoY growth in double digits in FY2017-18. That scenario now, overall, now looks bleak. The proposed additional GST cess has taken the mojo out of the luxury car segment and has drawn stiff criticism from all luxury carmakers in India.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

21 Aug 2017

21 Aug 2017

5793 Views

5793 Views

Autocar Professional Bureau

Autocar Professional Bureau