M&M's SUV revenue crosses a record Rs 50,000 crore in FY2023

A stellar performance in FY2023 sees Mahindra & Mahindra grab No. 1 SUV maker position in revenues and emerge second biggest in volumes, just 300 units lower than Tata Motors; the company is currently sitting on a US$5 billion or Rs 40,000 crore order book.

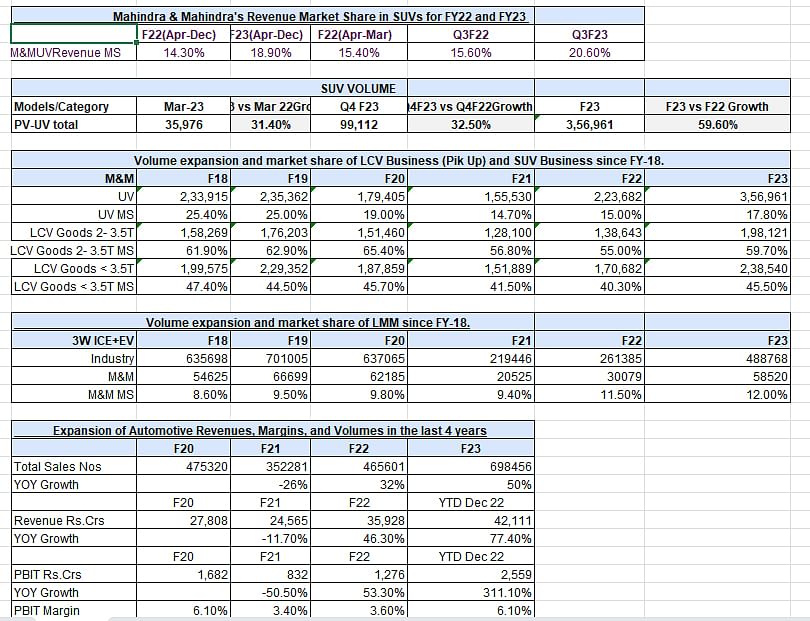

Mahindra & Mahindra (M&M) has grabbed the No. 1 SUV maker position in terms of revenue in FY2023, and it was just 300 units shy of the lead in terms of volumes behind arch rival Tata Motors. FY2023 has turned out to be a record-breaking year for M&M on almost all parameters.

In what has been a story of a remarkable turnaround, a journey that started with the Thar at the peak of Covid in 2020, has sustained well into FY2023. With sustained demand for the XUV700 and Scorpio N, the company has posted its highest-ever SUV, pick-up truck and last-mile mobility sales.

Autocar Professional estimates that M&M’s SUV revenue crossed Rs 50,000 crore for the first time ever, and the company garnered over 21% in the revenue market share at the end of FY2023. What's more, the company continues to sit on US$ 5 billion of order-book, or Rs 40,000 crore with 266,000 units of pending bookings.

Declining to share the specific financials citing a 'silent period', Veejay Ram Nakra, President of the automotive division at Mahindra & Mahindra, says, “It has been a story of transformation. I think in FY2023, everything played out together. Be it a success of new launches, better management of semiconductor chips, increased output for SUVs as well as pick-ups and even getting the channel evolved, all these factors contributed to this growth.”

M&M's emerging last-mile mobility division also made significant inroads into the fast growing zero emission vehicle market.

M&M's emerging last-mile mobility division also made significant inroads into the fast growing zero emission vehicle market.

Democratised growth

While the company has reinforced its position in the small commercial vehicle and pick-up truck segment, led by the sharper focus and a dedicated team, the emerging last-mile mobility division also made significant inroads into the fast growing zero emission vehicle space. The struggling Mahindra Trucks and Bus division too has rebounded well.

While the overall automotive business volumes grew 60% to 700,000 units, SUV sales were up 50% at 357,000, the small commercial vehicle and pick-up truck segment grew 40% to 220,000 units and even the last-mile mobility business posted a growth of 60-70% with sales of about 80,000 units.

The truck and bus division broke into five-digit sales with the company achieving its short-term target of selling 1,000 units a month in the last quarter of FY2023.

The Mahindra brand has undergone a major change. The profile of consumers who bought Mahindra products in FY2023 is very different from that of traditional buyers. Consumers across price points want to consider Mahindra as a brand starting from Rs 200,000 to the Rs 50 lakh bracket, ranging from a last-mile zero emission three-wheeler to the rural workhorse Bolero Neo, to the high-tech XUV700 and through to large trucks. M&M has a significantly higher share of urban sales than it ever had in the past.

In the commercial vehicle segment below 3.5 tonnes, Mahindra had a market share of 45% and with the revamped Bolero pick-up launched last month, it aims to strengthen its position further.

Sharpened focus on customer insight

Coming off the string of failures in the past decade, the effort behind the blockbuster launches of Thar, Scorpio N and XUV700 began almost 4-5 years ago. Nakra attributes this rise to M&M's ability to translate customer insight into product truth and brand essence and experience. Mahindra & Mahindra, on its part, restructured the organisation in different divisions and ensured sharper focus on each of the segments with a dedicated P&L.

Even within the SUV segment, the company took a tough call to exit a few segments, deciding to move back to its core of true-blue, high-performing SUVs as against volume soft-roaders. The shift towards the new emission and safety norms ensured that M&M corrected the majority of mistakes committed in the past decade of 2010 to 2020.

Along with the new direction, the company also rolled out a new brand identity to reinforce the fact that its products, starting with the Thar and XUV700, belonged to the new breed of SUVs. This was well backed up by the new customer interface at the showrooms, which saw a marked revamp. SUVs and pickups were no longer sold alongside each other and had a dedicated setup to cater to their individual customer needs. “Product, visual identity, customer experiences right with showrooms across the country, all these things played out well,” claims Nakra.

According to Nakra, “What changed from 2020 was that the product launches came with a myriad of options on engines, transmissions, features across multiple points. We had an appropriate powertrain with a complete bouquet of offerings at multiple price points – it was an all-out approach to give power of choice to customers and it paid off.”

'Every Selling Proposition' for evolving Indian market

The Indian market was rapidly evolving and one of the big shifts in the marketplace that M&M spotted was the need to change from USP or unique selling proposition to ESP or ‘Every Selling Proposition’, a term coined by Mahindra. Also, since all its recent products were based on new platforms and engine, M&M went all out with an attractive value proposition, claims the company president.

“Consumers today, at Rs 600,000, want their products to have the technology, touch-screen, Apple CarPlay-Android Auto; at Rs 12-13 lakh, they want ADAS. Customers want everything – a good design, all the features, technology. They want safety, they want mileage, they want everything,” he adds for good measure.

Instead of loading features only on the top-end variant, which limits the potential, Nakra says with endeavour to democratise technology, M&M started offering some key high-end features like ADAS, sunroof and connectivity features from mid-trims, which improved the aspirational quotient around its products and in turn enhanced the value proposition multi-fold.

Experts say the value proposition in the recent launches has been spot-on and the company has been able to significantly outpace the overall market, despite a multitude of options from the rivals. Gaurav Vangaal, Associate Director, at S&P Mobility says M&M has set a new benchmark on value proposition with the Thar, XUV700, and Scorpio N. The company has done an impressive job of translating luxury or premium features at an accessible price and that too with profit.

“Not only have the product quality and fit and finish improved significantly with new-generation products but the ability to wean away buyers from already established SUV brands from the Koreans and Tata Motors. The fact that the majority of prospective buyers are willing to wait and pay a premium for an Indian badge over established brands, speaks about a significant transformation of the brand in the market,” said Vangaal.

The S&P analyst, however, added that the frustration among waiting consumers is increasing as M&M is still unable to clear the order backlog and it may not be good for any organisation from a long-term perspective.

FY2023 saw M&M take a critical call to not only expand its core but also prepare an ambitious roadmap of getting into the EV segment. It also announced a big-ticket Rs 10,000 crore investment in EVs, which will go into setting up of new capacity and a portfolio of close to half-a-dozen EVs.

M&M's SUV manufacturing capacity will stand augmented to 600,000 units per annum by end-FY2024.

M&M's SUV manufacturing capacity will stand augmented to 600,000 units per annum by end-FY2024.

The company has already expanded its SUV manufacturing capacity from 29,000 units per month to 39,000 units by December 2022 and plans to further increase it to up to 49,000 units in the current financial year or 600,000 units per annum.

Despite the signs of a slowdown, Mahindra is well placed to capture fresh growth. While the overall market is likely to slip to single-digit growth, the SUV category is likely to continue to grow in double digits. It helps that growth is faster at the top end of the market, where M&M’s majority of portfolio is positioned.

The impact of headwinds is going to be higher on cars as compared to SUVs, says Nakra and, despite the economic headwinds, M&M continues to have a high order backlog of 266,000 units with fresh bookings and inquiries holding steady with low cancellations.

Raghunandhan, equity analyst at Nuvama Institutional Equities, says FY2023 was a perfect year for M&M with a strong resurgence in the automotive sector. He expects the good performance to continue in FY2024. “We are building in revenue/core earnings of 9-15% CAGR between FY2023 to FY2025 for Mahindra. There is a potential upturn in PVs and market share gains and the margins too will be aided by better net pricing and scale,” added Nandan.

ALSO READ:

Mahindra Last Mile Mobility breaks ground on new EV plant in Zaheerabad

Mahindra Research Valley granted 210 patents in last six quarters

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

26 Apr 2023

26 Apr 2023

10748 Views

10748 Views

Autocar Professional Bureau

Autocar Professional Bureau