Low consumer sentiment, tight liquidity hamper industry sales in November: SIAM

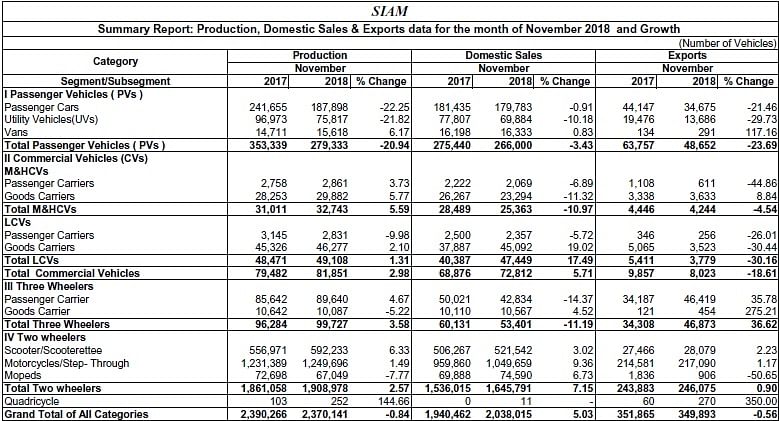

The key passenger vehicle and medium and heavy commercial vehicle are down by 3.43 percent and 10.97 percent respectively, indicating a slowdown that could well run in the new year.

This year's festive season didn't give the Indian automobile industry much reason for cheer. After some softening of sales in October 2018, the wholesale figures for November indicate a slowdown in the market.

The key segments of passenger vehicles and medium and heavy commercial vehicles (M&HCVs) are down by 3.43 percent and 10.97 percent respectively for month of November. Sales in the three-wheeler segment also fell by 11.19 percent. Apex industry body Society of Indian Automobile Manufacturers (SIAM) cites low consumer sentiment and tight liquidity as the key reasons for the slowdown.

The silver lining in last month's market performance is the two-wheeler segment's 7.15 percent growth. Overall, six of the 12 sub-segments saw a decline in sales last month. Most crucial among them are utility vehicles (UV) – the key growth driver of the PV market – and the M&HCV segment – the barometer of the country’s economy.

The fall is sales during November could also be due to inventory build-up in certain segments as a result of lower-than-expected retail sales during the September-November festive season. Also, with the end of the year approaching, OEMs' retail channels would look at liquidating the 2018 model year stock.

During November, 266,000 PVs were despatched by OEMs to dealers, which is 3.43 percent less than the same period last year. Within PVs, UV sales stood at 69,884 units, a 10.18 percent YoY drop. In the M&HCV market, sales goods carriers fell 11.32 percent to 23,294 units and sales of buses dropped by 6.89 percent to 2,069 units. Sales of light buses also dropped by 5.72 percent to 2,357 units but light trucks posted a sales growth of 19 percent with 45,092 units being shipped to dealers. It’s a similar story in the three-wheeler segment where the goods carrier sub-segment grew 4.52 percent with sales of 10,567 units and a drop of 14.37 percent in passenger carrier sub-segment which saw sales of 42,834 units.

The key segment of two-wheelers was a silver lining in the industry's performance during November. Sales of scooters grew 3 percent, though a much slower growth of 12.59 percent in October, to 521,542 units. Growth of motorcycle sales stood at 9.36 percent, against 20.14 percent in October, with sales of 1,049,659 units. The humble moped continues to find customers. This sub-segment grew 6.73 percent with sales of 74, 590 units in November.

According to Vishnu Mathur, director general, SIAM, “After the end of November, we now have a better idea about how the festive season went – a muted one for the industry.”

“While we have seen most segments including the PV and HCV show de-growth in November, we have also seen a good positive growth coming in from LCVs and two-wheelers. Largely, it is a situation where the industry is doing inventory correction by reducing the production because the festival season was muted and dealers have leftover stock with them. Moreover, as we near the end of the calendar, the industry would like to minimise the inventory that is being held by the dealers at this point in time,” he added.

In terms of CVs, Mathur explained that the liquidity crunch in the market has impacted their sales, along with the rising fuel prices and rising interest rates also casting their impact. “So, while the demand is there, operators are postponing their purchases,” he said.

Sugato Sen, deputy director general, SIAM added, “The performance of HCVs (above 16T) is concerning as these are the barometers of the economy. To some extent this could be because of the NBFCs having a problem with liquidity, but, hopefully it's only a passing phenomenon and not a structural one, and we should be able to recover from it over the next few months.”

For the month of December, some amount of pre-buying triggered by news of price hikes in January 2019 will help the PV dealers. The market will also see extra incentives to help reduce, if not exhaust the market inventory. Keep watching this for next month's market performance update.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

10 Dec 2018

10 Dec 2018

4415 Views

4415 Views

Autocar Professional Bureau

Autocar Professional Bureau