Indian two-wheeler owners report rise in quality issues in first 6 months: JD Power

The study, fielded from September 2016 to December 2016 in 45 cities across India, includes 87 two-wheeler models from 10 makes and examines 138 problem symptoms covering seven categories.

A recent study by global consulting firm J.D. Power has revealed that Indian two-wheeler manufacturers need to sharpen their focus on quality of critical parts and of overall models.

As per the findings of the J.D. Power 2017 India Two-Wheeler Initial Quality (2WIQS) Study released yesterday, a number of two-wheeler owners have reported a rising incidence of quality issues in the first two to six months of their vehicle ownership.

The 2017 2WIQS is based on evaluations from 9,570 vehicle owners who purchased a new vehicle between March 2016 and October 2016. The study, fielded from September 2016 to December 2016 in 45 cities across India, includes 87 two-wheeler models from 10 makes. It examines 138 problem symptoms covering seven categories (listed in order of frequency of reported problems): engine; brakes; gauges and controls; fit and finish; lights/ electricals; ride and handling; and transmission.

The problem areas

Problems, as reported by the vehicle owners, under each of the seven categories, in accordance of their prominence, were:

- Excessive fuel consumption by the engines

- Noisy and ineffective rear braking

- Inaccurate display by instrument panels under faulty gauges and controls

- Inferior quality paint job under fit and finish

- Dim lighting by headlamps under lights and electricals

- Excessive vibration under ride and handling

- Noisy chain sets under transmission systems

The study covered models produced by 10 two-wheeler manufacturers including Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), TVS Motor Company, Bajaj Auto, KTM, India Yamaha Motor, Royal Enfield, Suzuki Motorcycles India, Piaggio Vehicles India and Mahindra Two Wheelers. Among all different models studied, ones with more than 100 samples were reported in the JD Power 2WIQS findings.

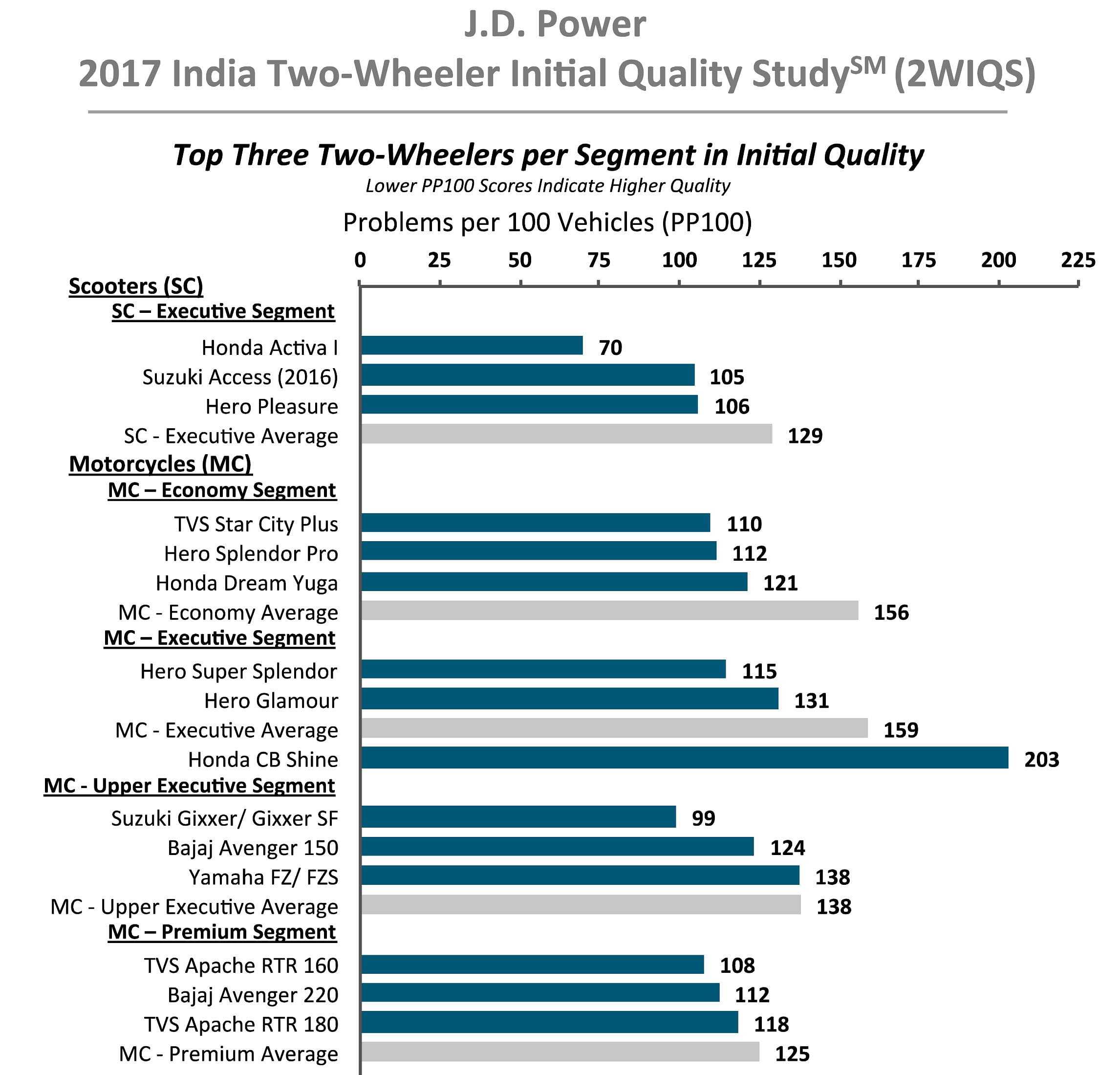

All problems are summarised as the number of problems per 100 vehicles (PP100). Lower PP100 scores indicate a lower rate of problem incidence and therefore higher initial quality.

The study finds that among two-wheeler owners in the six-month ownership period, those who accumulated mileage of more than 3,000 kilometres (50 percent) reported significantly more initial quality problems than buyers who accumulated 3,000 kilometres or fewer (159 PP100 vs. 126 PP100, respectively).

“Quality deterioration and rapid increase in initial quality problems during the first six months of ownership can impact the customer’s perception of the product and the OEM for the entire ownership period,” said Kaustav Roy, director at J.D. Power, Singapore.

“Facing deteriorating quality early on in the ownership period not only detracts from good word-of-mouth recommendations, but can also influence a customer’s repurchase decision at the end of the ownership period. OEMs can thus gain a competitive advantage by establishing a consistent and sustained performance as a brand differentiator,” he added.

The study reveals that both components of quality – design quality and manufacturing quality – deteriorate sharply as the two-wheelers are ridden more. Owners having ridden more than 3,000 kilometres report 62 PP100 instances of problems with design quality, compared with 50 PP100 among those who have covered less than 3,000 kilometres. With respect to manufacturing quality, the owner group with higher mileage reported 96 PP100 problems, compared with 75 PP100 reported by owners having covered 3,000 kilometres or less.

“The harsh weather and road conditions, coupled with the fact that nearly two-thirds of owners in India generally ride with a pillion on-board, does put a lot of stress on the vehicle systems and can lead to premature wear and tear of parts,” said Rajat Agarwal, two-wheeler industry expert at J.D. Power, Singapore. “Given that two in three owners of a two-wheeler intend to keep their current vehicle for five years or more, it would be prudent for automakers to focus on the initial quality and ensure that quality is sustained over the product lifecycle,” he added.

KEY FINDINGS OF THE STUDY

Overall two-wheeler quality influences loyalty: Owners who experience fewer problems than expected (52 percent) are more than two times as likely to recommend their two-wheeler model to family and friends as those who experience more problems than expected (8 percent).

Initial quality improves in both scooter and motorcycle segments: Overall initial quality averages 129 PP100 for scooters and 150 PP100 for motorcycles, an improvement of 8 PP100 and 9 PP100, respectively, from 2016. Among vehicle systems, the greatest year-over-year improvement is in the brake category.

Initial advice by the salesperson during vehicle delivery helps: Nearly three-fourths (72 percent) of buyers were advised by the salesperson about the vehicle dos and don’ts during vehicle delivery. These owners report significantly fewer instances of initial quality problems than those who were not advised of the same (119 PP100 vs. 205 PP100, respectively).

First-time buyers report fewer initial quality problems: More than three-fourths (77 percent) of two-wheeler owners are first-time buyers, and they report fewer problems than those with previous ownership experience (123 PP100 vs. 212 PP100, respectively). The difference is largely influenced by problems in the engine and ride and handling categories. Buyers with prior experience of riding / owning two-wheelers are understood to be more sensitive to quality issues, they have increased expectations with their new model(s) and tend to compare.

Younger buyers report facing higher initial quality problems: Young buyers —30 years old or younger (57 percent of total lot surveyed)— report facing higher initial quality issues than mature buyers who are 31 years old or older (150 PP100 vs. 135PP100, respectively). The difference is largely influenced by problems in the ride and handling and brake categories.

Two-wheeler models which notched good results

The study's award recipient segments include scooters (executive) and motorcycles (economy, executive, upper executive and premium).

For scooters, the Honda Activa i (70 PP100) ranks highest among executive models.

For motorcycles, the TVS Star City Plus (110 PP100) ranks highest among economy models, while the Hero Super Splendor (115 PP100) ranks highest among executive models.

The Suzuki Gixxer / Gixxer SF (99 PP100) ranks highest among upper executive models, and the TVS Apache RTR 160 (108 PP100) ranks highest among premium models.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

09 Mar 2017

09 Mar 2017

14011 Views

14011 Views

Autocar Professional Bureau

Autocar Professional Bureau