Indian OEMs benefit from fall in commodity prices, build up stock

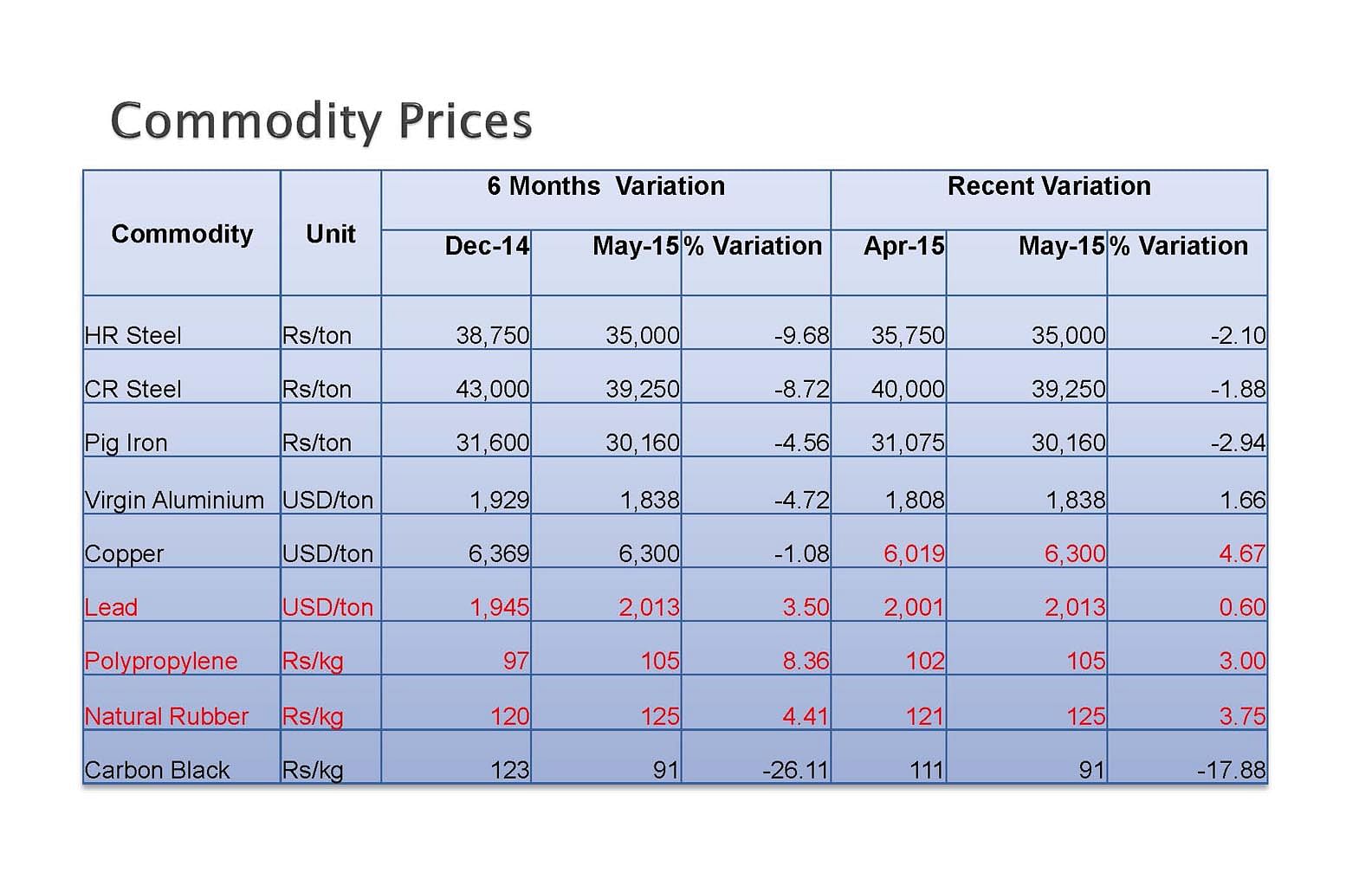

With domestic sales staying flat, and exports declining, OEMs seem to have made a tactical move to take advantage of the drop in commodity prices and build up stock while input costs remain low.

The Society of Indian Automobile Manufacturers (SIAM) has just published its quarterly report on the state of the Indian automobile industry. While the report indicates that the industry, as a whole, is on a growth trajectory, the figures for certain segments are a cause for concern.

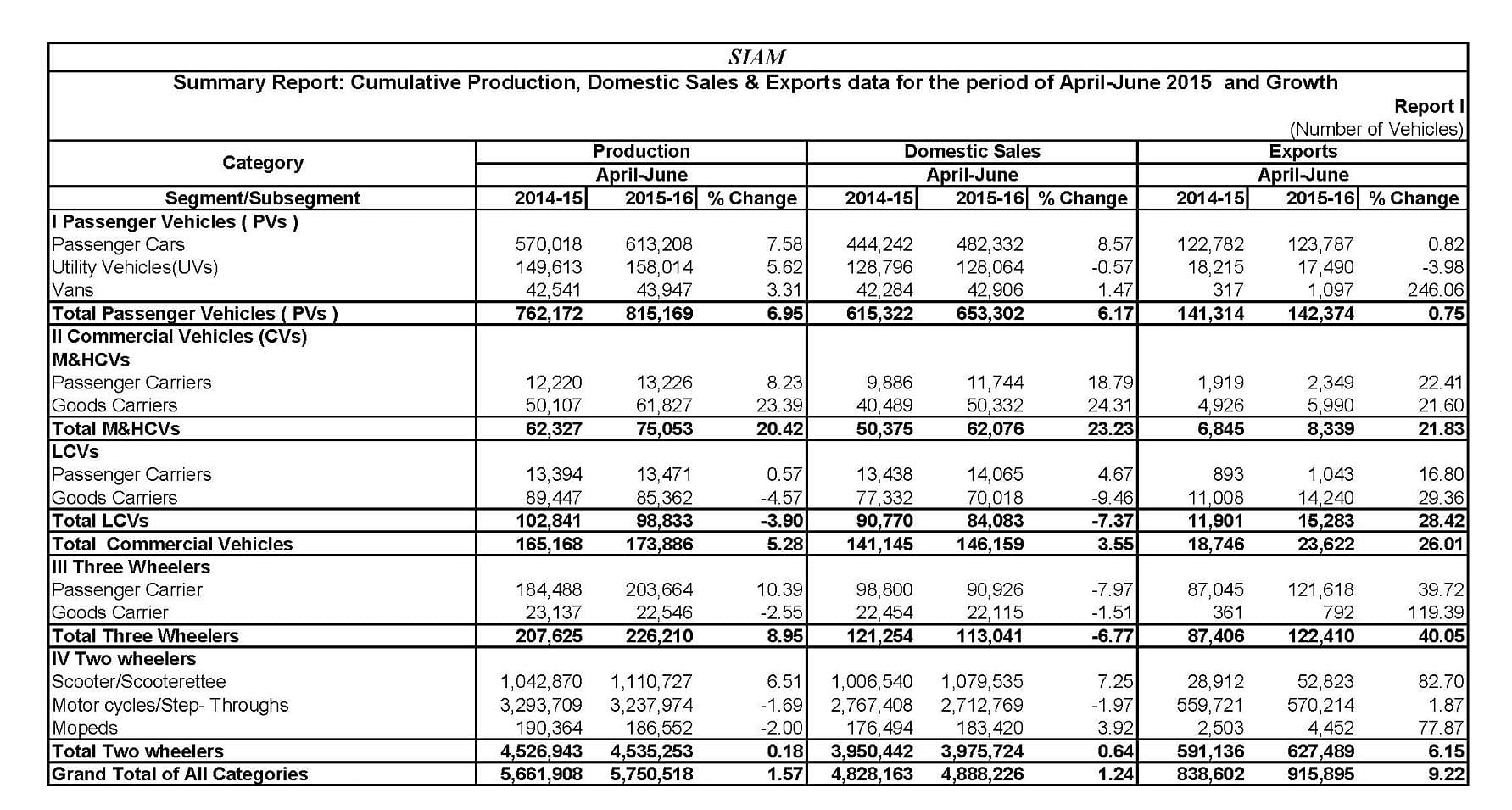

The passenger vehicles (PV) segment, which comprises passenger cars, utility vehicles and vans, has grown 6% during April ’15-June ’15 compared to the same period last year. A year-on-year analysis for the month of June indicates that the production of PVs was up 10% compared to 2014. Given that total domestic sales remained flat, and exports have, in fact, declined by 21% from June 2014, this seems to be a tactical move by manufacturers to take advantage of the drop in commodity prices and build up stock while input costs remain low.

Two-wheeler sales during Q1 FY2015-2016 saw only a marginal increase of 1%, compared to the same quarter last year. The shift in demand from motorcycles to scooters continued, with the latter growing at a much higher pace than the former. In June ’14, 328,639 scooters were produced, which increased to 369,982 units in June ’15, an increase of about 12.5%. Motorcycle production, on the other hand, increased by only 0.5% to 1,055,873 units.

Amidst low rural demand, sales of 3-wheelers declined sharply by about 7% compared to Q1 FY2014-2015. Increasing competition from small commercial vehicles such as the Tata Ace and Mahindra Maxximo further contributed to the fall in demand.

Uncertainty about the monsoons also led to the plummeting of sales of Light Commercial Vehicles (LCV) by 7% vis-à-vis Q1 FY2014-2015. The Medium & Heavy Commercial Vehicles segment, on the contrary, witnessed a surge in demand on the back of government policies encouraging industrialization. Quarterly year-on-year growth was 23%, with a steady increase in monthly sales in April, May and June this year.

Across the entire industry, quarterly domestic sales increased by 1.3% year-on-year, while quarterly exports increased by 9%. With a slew of new launches slated for Q2, including Maruti Suzuki S-Cross, Hyundai Creta and Honda Jazz, the prospects for the passenger vehicles segment seem positive. The overall industry sentiment has considerably improved in the past year. Analysts also foresee a drop in interest rates and a further reduction of about 2-3% in fuel prices, which would aid growth in all the segments.

A weak monsoon, however, does have the potential to play spoilsport and curtail rural growth, before the start of the festive season. It remains to be seen which of these factors will predominate and shape the state of the Indian automotive industry this quarter.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

09 Jul 2015

09 Jul 2015

4419 Views

4419 Views

Autocar Professional Bureau

Autocar Professional Bureau