India to be among top 5 markets for hybrids and EVs by 2023

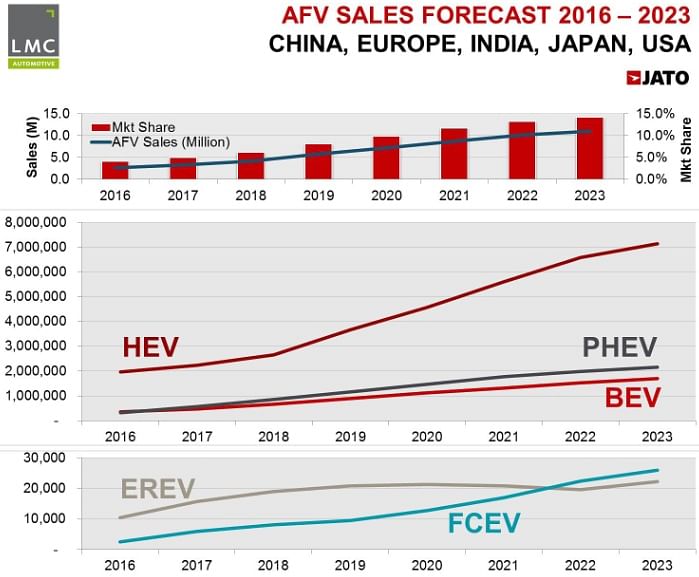

With sales of AFVs predicted to top 11 million units across China, India, Japan, the USA and Europe by 2023, this relatively young vehicle type is set to be one of the most important sources of growth in the next decade.

As the awareness of electric vehicles (EVs) grows globally and they begin to replace conventionally fuelled vehicles, manufacturers from across the world are now investing heavily in promoting green motoring.

With a barrage of various hybrids and EVs being developed, the roads of tomorrow – in developed and developing economies – will see much cleaner alternatives being used for mobility. Expect the use of petrol and diesel vehicles to fall drastically in the next decade.

Amidst the imminent evolution of the automotive industry, India is likely to play a key role as it will emerge as the fifth largest market for alternate fuel vehicles (AFVs) by 2023, claims a recent study by research agency JATO Dynamics.

According to JATO’s forecast partner LMC Automotive, sales of all AFVs combined in China, India, Japan, USA and Europe will exceed 11 million units by the year 2023 – accounting for 14.2% of global passenger car sales in those markets, a rise of more than 10 percentage points compared to the share these cars had in the first eight months of 2016.

Despite starting from a low base, new technologies, a growing sense of consumer responsibility for the environment and diesel’s reputational problems are giving a welcome boost to sales of EVs and hybrids, the study reveals.

According to JATO Dynamics, global demand for EVs has grown by 22.8% during the first eight months of this year alone – the highest percentage increase of all fuel types available in the market. Even the global drop in oil prices hasn’t dampened demand, and the encouraging targets set by both manufacturers and governments suggest that this growth will only accelerate over the next 10 years. The Volkswagen Group alone is expecting to sell between 2 and 3 million EVs by 2025 through 30 new models.

How markets stack up at present

EV and hybrid cars still have a relatively small market share globally, but sales are growing fast, driven by China in particular. Although the low cost of oil remains a challenge to sales, particularly in the USA, global figures still forecast that the category is heading towards another year of record growth.

Three quarters of the 74.7 million passenger cars sold in the world during the first eight months of 2016 were fuelled by petrol engines, meaning that AFVs still only make up a very small fraction (3.5%) of the total global market, which is dominated by petrol passenger cars (75.5%) and diesel (14.8%). But EV and hybrid passenger cars are gaining ground fast, having recorded the highest percentage of year-on-year growth, with sales jumping from 1.46 million units in January-August 2015 to 1.79 million units in the corresponding first eight months of 2016.

Their rapid growth is even more impressive in the five largest markets for EVs and Hybrids – China, India, Japan, USA and Europe – where their sales totalled 1.69 million units in the first eight months of 2016, up by 22.3% year-on-year, and accounting for 3.9% of the total market. LMC Automotive predicts that by the end of 2016 their market share could reach 4.1% -- the highest share ever achieved.

Japan is the world leader in terms of volume of AFVs sold, perhaps helped by its strong position as the world’s biggest Hybrid (HEV) manufacturer. AFV sales in Japan accounted for 52% of the total sold across these five largest markets in the first eight months of 2016, and 49% of the global sales total.

Yet it is China – where demand soared by 160% between January-August 2016, taking its total volume to 206,000 units – that is currently the biggest source of growth in the category. This is in part due to the government’s goal of having 5 million units of pure EVs and plug-in Hybrids on the roads by 2020.

These ambitious electrification plans still face big challenges. So far government subsidies – including exemption from China’s licence plate lotteries, to get EV cars to buyers quicker – haven’t been enough to counter perceived problems such as infrastructure weakness, and demand still lags behind the country’s targets.

The popularity of SUVs amongst Chinese consumers, and low oil prices, are also big challenges to the growth of the AFV category. SUVs, mostly powered by gasoline engines, sold 5.2 million units in the first eight months of 2016, representing 34% of China’s total market, compared to AFVs’ 1.3% share of total passenger car sales. Like their American and European counterparts, Chinese consumers want SUVs and, as long as there are no competitively priced electric or hybrid SUV models, and oil prices remain low, that is unlikely to change.

Challenges to AFV sales in China mirror what has happened in USA. With almost 307,000 units sold, the USA remains second in the global rankings despite a fall of 9.4% in volumes in the first eight months of 2016 compared to the same period last year

This decrease can be attributed to the stagnation of the overall market (which only grew by 0.5% from January to August 2016) and the ongoing popularity of SUVs which made up only 14 of the 67 alternative fuel models available in the USA in this period. This makes gasoline models the easier choice for consumers in the market for an SUV and removes AFVs from their consideration set.

Elsewhere, Europe is closing its gap on the USA after a 26.5% year-on-year increase in sales volumes of AFVs for January – August 2016. Total registrations during this same period were 295,700 units – or 2.6% of total market.

The UK, France and Norway were the largest markets in Europe during this period, and part of the 21 European countries that posted positive growth. Only The Netherlands, Turkey, Croatia and Russia registered a decline. It appears that despite various government incentives, including tax exemptions, European consumers are still opting for traditional fuels over electric and hybrid passenger cars due to a lack of choice and competitive pricing.

Other key markets include Canada, posting a 32% increase – and South Korea which beat its 2015 full year sales figure in the first eight months of 2016 with growth of 63%. Israel has also already surpassed its 2015 full-year sales figure, with more than 8,200 units sold from January-August 2016, up by 59%, and exceeding the 7,200 cars sold during 2015. EV and Hybrid sales in Mexico had reached 4,200 units by August 2016, far outstripping the 1,800 sold during the same period in 2015.

The India scene

Even in India, the push by the government to leapfrog to BS VI emissions by April 2020 hints at the commitment towards reducing harmful emissions and the ongoing FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme, which provides incentives for sales of hybrid and EVs, is helping the proliferation of such vehicles in the country.

However, despite incentives and awareness, India still has a long way to go before we can see EVs become a norm here. At present, the challenges to the more widespread use of EVs is the high cost of EV/hybrid ownership, a poor EV charging infrastructure, range anxiety on the part of EV owners, and limited models.

Growth to come mainly from Europe and China

Globally, the accelerated growth is expected to come mostly from Europe and China, leaving the US market lagging behind, Japan stalled and India expected to post only moderate increases. Sales in India are predicted to rise to 5.6% over the same period.

By 2023, Japan will continue to lead AFV market penetration globally, with 29.9% of all of its passenger car sales forecast to be EVs and Hybrids, whilst in the same period AFV sales in Europe are expected to grow to account for 19.4% of the total, or 3.91 million units, becoming the largest market, the report predicts.

Uptake is expected to be much more restrained in the USA, where the AFV market share is forecast to grow comparatively modestly from 2.9% in FY 2016 to reach 11.2% by the end of 2023. Demand in China is predicted to follow a similar trend with EVs and hybrids forecast to represent 12.1% of total passenger car sales by 2023. According to LMC Automotive, hybrids will continue to dominate the AFV market even if they lose some of their market share. Demand for these cars in the five markets analysed will total 7.14 million units by 2023, up from the 1.97 million cars expected to hit the roads by the end of this year. In seven years’ time, hybrids will count for two of every three AFVs sold. But in contrast to the current situation, Japan will no longer be the main market, as growth is expected from Europe and China, representing 31% and 30% of 2023 sales respectively.

Plug-in hybrids to outsell BEVs

Plug-in hybrids will outsell the pure electric cars (BEV) from 2017 and by the end of 2023, they will account for 20% of AFV total sales in these five markets. The biggest market for plug-in hybrids will continue to be Europe with almost half of the sales coming from the region. Europe will be followed by China (36% of sales) and the USA (with only 14% of market share).

China will become the largest market for BEVs, but Europe will grow faster and will more than double the sales volume of the US market over this period, the report says.

It is common sense that the proliferation of alternate fuel vehicles will happen at different rates according to each market and its regulatory policies. Nevertheless, the future of efficient travel now depends on how well governments, carmakers and consumers agree on the importance of the next generation of such vehicles. The opportunity to provide a much greener and better future for the coming generations is out there for the taking and our choices today will define their tomorrow.

You may like:

- Electric Vehicle sales in India touch 22,000 in 2015-16

- What’s holding big-time migration to EVs in India?

- E-mobility, BSVI and young buyers to reshape India's two-wheeler industry

RELATED ARTICLES

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

New ZF SELECT e-drive platform gives EV makers a choice in 100 to 300 kW range

Modular e-drive platform optimally matches 800-volt overall system and components such as the electric motor and power e...

Daimler India CV and BharatBenz deliver 200,000th truck

Daimler India Commercial Vehicles' portfolio includes truck models ranging from 10 to 55 tonnes for a wide variety of ap...

By Shourya Harwani

By Shourya Harwani

21 Nov 2016

21 Nov 2016

15381 Views

15381 Views

Autocar Professional Bureau

Autocar Professional Bureau