India Component Inc’s revenue drops 34% in H1 FY2021, but exports higher than imports

Supply to OEMs slides 42 percent while exports shrink by 33 percent due to global slump in demand. Exports at US$ 5.2 billion, for the first time, higher than imports in the April-September 2020 period but that’s due to domestic industry contracting by 34% YoY.

The Indian auto components sector is the driving force behind the country’s automobile industry, which is pegged as the No. 4 passenger vehicle market in the world. However, the unprecedented onslaught of the Covid-19 pandemic has impacted all businesses, including automotive, badly. The all-India lockdown in April 2020 was a particularly dismal start to the onset of the new fiscal (FY2021) in the form of zero production and zero revenue.

While things did begin moving gingerly about a month later with the economy gradually opening up with the easing off of restrictions earlier imposed on movement and large gatherings of people, including workers in factories, the overall outlook for this year still remains in the danger zone.

ACMA report 34% decline in H1 FY2021

Apex supplier body, the Automotive Component Manufacturers Association of India (ACMA) today held its virtual press conference to announce the performance results for the first half of FY2021 for the six-month period between April and September 2020. As expected, the Covid-induced loss of sales has hit hard.

Overall revenues have declined 34 percent on a year-on-year basis to reach Rs 119,529 crore (US$ 15.9 billion), compared to Rs 182,313 crore (US$ 26.2bn) earned in H1 FY2020. The nationwide lockdown put a spoke in the wheel of growth of the entire automotive value chain which is still some distance away from attaining maximum capacity utilisation as well as seeing a drop in general demand due to the financial backlash caused by the pandemic. ACMA data also shows that supplies to OEMs during this period slumped to Rs 87,120 crore, a 42 percent drop over last year’s quantum of Rs 150,743 crore.

Exports drop 33%

On the export front too, there has been a considerable drop of 23.6 percent owing to the global slump in demand for automobiles, especially during the initial rough period of 2020which saw total lockdowns becoming a key strategy for various governments across the world to contain the spread of the coronavirus.

From Rs 51,028 crore in H1 FY2020, the export turnover came down to Rs 39,003 crore in H1 FY2021. Europe at 31 percent, followed by North America at 30 percent, respectively are the top two regions accounting for maximum exports from India. Asia stands at the third position with a 29 percent share.

While exports have been a saving grace as some Indian companies took to meeting their commitments of part supply immediately after the lockdown was eased, the cumulative volumes to the top 5 countries have all reported a decline.

Exports to the US, which has the largest 28 percent share of Indian auto components, declined 25 percent on a year-on-year basis, while Germany reported a 20 percent drop, followed by Thailand (-34%), Turkey (-12%) and the UK (-40%) in the order of their business volumes with India.

Net exports overshadow imports

While the situation so far may be grim, the H1 numbers do bring along some good news for India Component Inc. The exports at a cumulative US$ 5.2 billion, for the first time, have overcome imports into India which stand at US$ 5 billion for the said period.

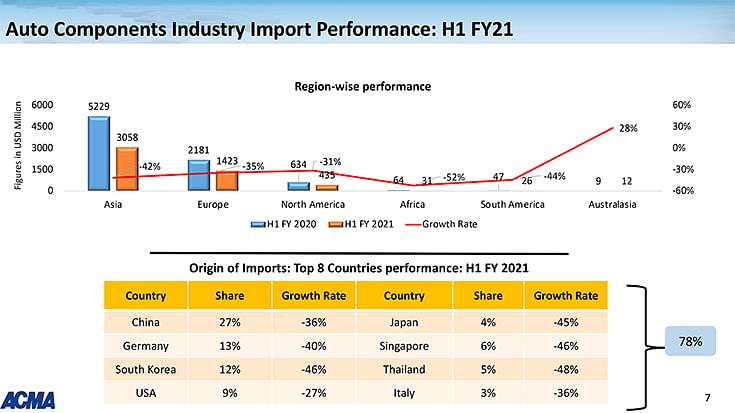

Import performance dropped 32.7 percent on a year-on-year basis to reach Rs 37,710 crore in value, compared to last year’s Rs 56,066 crore. According to Deepak Jain, president, ACMA, “While we are happy that there is an import deficit or an export surplus in the H1 FY2021, it is also largely due to the fact that the domestic industry has contracted by 34 percent. Going forward, the industry does aspire to have a sustainable export situation and reduce imports by enhancing localisation, which is being aided by government initiatives such as the PLI scheme.”

Unfortunately, imports from China, which is allegedly the epicentre of the Covid-19 pandemic and drew huge tensions with the global business ecosystem, remained the highest exporter of automotive components to India, comprising a 27 percent share. However, Chinese imports were down 36 percent, with that from Germany (-40%), South Korea (-46%), the US (-9%) and Japan (-45%), following suit in their respective order of business volume.

Aftermarket slows down

The impact of the Covid-19 pandemic was so strong that the aftermarket supplies of India Component Inc also registered a 15 percent year-on-year decline in H1 of FY2021, to land a net contribution to turnover of Rs 31,116 crore against Rs 36,607 brought in during the same period last year.

According to Vinnie Mehta, director general, ACMA, “The aftermarket segment was particularly impacted due to the lockdown, owing to the short supply of working capital with the small distributors and retailers controlling this space. Having said that, the segment came to pre-Covid levels as early as June because of the resurging demand for replacement parts in the repair market.”

Optimistic about second half FY2021

Even though the industry started this fiscal year with zero revenue and a weak momentum, the outlook for the overall FY2021 looks optimistic. The second half is likely to be better, thus, reducing the net de-growth for the entire fiscal. Also, according to an internal industry-wide survey conducted by ACMA, companies are bullish about demand sustaining in the near term and hence, intensifying their plans for capital expansion in the new year.

“Barring headwinds such as constraints in raw material availability as well as concerns of commodity price hike, the overall sentiment remains positive in the automotive components space. H2 is likely to be better and after two consecutive harsh years, we expect a state of recovery in the next financial session,” remarked Jain.

Sharing his insights on the performance of the auto component industry, Jain said, “In the backdrop of the pandemic and the lockdown, the automotive industry faced unprecedented challenges in the first-half of FY 2020-21. The auto component industry, through agility, flexibility and financial discipline, has displayed remarkable resilience and has comeback strongly with the unlocking of the economy. I am thankful to the OEMs for their support and for the timely intervention by the government, especially in addressing the supply side challenges."

He added, "Going forward, whilst the performance of the industry during the festive season has been heartening, there are indications that the vehicle demand, in the coming months, will be sustained. This, together with the increased focus by the auto industry on deep-localisation and the recent announcement of PLI schemes for the automotive sector and cell/battery manufacturing by the Government, augur well towards making the auto-component industry a self-reliant one. We are also hopeful that the Government would consider PLI or appropriate manufacturing schemes for auto-electronics and xEV components as well.”

Elaborating on the mood of the industry and outlook for the near to mid-term future, Jain commented, “According to the recent ACMA-PwC joint survey of ACMA leadership, despite concerns of another wave of pandemic, the industry is cautiously optimistic about the prospects of the Indian economy and the automotive sector for FY2021-22. Companies have mostly recovered and are back to moderate financial health, post the lockdown. Financially healthy and growth focused companies are also actively focusing on CAPEX and acquisition / merger opportunities. While increased visibility and commitment to new program timelines from OEMs is a key industry expectation, at an organizational level, focus on employee productivity and organization structure consolidation will be the key thrust areas.”

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

16 Dec 2020

16 Dec 2020

7302 Views

7302 Views

Autocar Professional Bureau

Autocar Professional Bureau