India Auto Inc in festive mood, all segments in growth mode

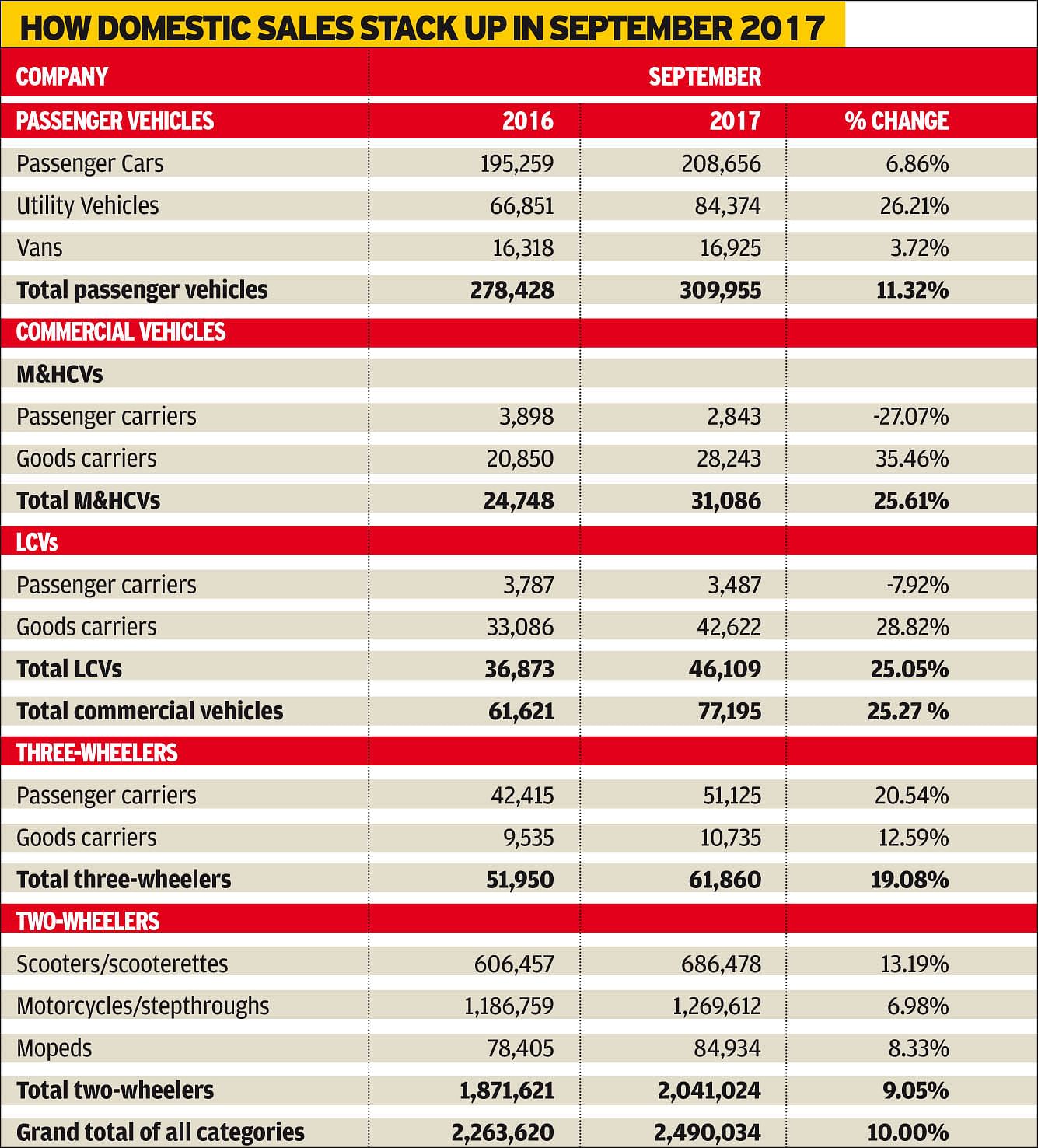

All segments – PVs (309,955 / +11.32%), CVs (77,195 / +25.27%), three-wheelers (61,860 / +19.08%) and two-wheelers (2,041,024 / +9.05%) – have posted robust growth. And October with Diwali should provide new fireworks.

Diwali seems to have come early for the Indian automobile industry as overall numbers for September 2017 show 10 percent year-on-year growth. However, it is important that the sales pace is sustained through the rest of the fiscal year and beyond.

Official industry sales data for September 2017, revealed today by apex body SIAM, shows all vehicle segments put together have closed in on the 2.5 million mark. In fact, at 2,490,034 units sold, it is barely 9,966 units short of the landmark. Importantly, all segments – passenger vehicles (309,955 / +11.32%), commercial vehicles (77,195 / +25.27%), three-wheelers (61,860 / +19.08%) and two-wheelers (2,041,024 / +9.05%) – have posted robust growth.

What the September 2017 sales numbers indicate is that demand has bounced back, particularly from rural India. A combination of new vehicle launches, a bountiful monsoon in most parts of the country translating into demand for PVs, small CVs and two-wheelers, as well as a boost in consumer demand from the nine-day Navratri festival and Dussehra, which is seen as an auspicious day to buy vehicles, have helped automakers post robust numbers.

Cumulative numbers for the half-year or April-September 2017 period also point to industry being firmly in positive territory. At 12,751,143 units, industry sales across the four vehicle segments in H1 FY2018 are a smart 9.40 percent YoY growth. Leading the charge are the PV (1,630,945 /+9.16%) and two-wheeler (10,507,308 / +10.14%) segments and followed by CVs (353,342 / +5.96%). The three-wheeler industry is the sole one still with negative growth – 259,548 / -9.89% – but as September 2017 numbers show, this segment is already seeing the green shoots of recovery.

The sub-segments showing the smartest YoY growth are, not surprisingly, utility vehicles (440,010 / +17.81%) and scooters (3,577,421 / +17.26%), as also LCV goods carriers (201,031 / +19.70%). The blistering growth in the UV and scooter segments has helped boost overall numbers in the PV and two-wheeler segments even as demand for last-mile transportation and e-retail goods has given a fillip to LCV goods carriers.

L-R: Rajan Wadhera, vice-president, SIAM; Dr Abhay Firodia, president, SIAM; and Vishnu Mathur, director general, SIAM at the media meet in New Delhi today.

Still challenging times

Dr Abhay Firodia, president, SIAM and chairman of Force Motors, said, "The Indian automotive industry went through a lot of hurdles in the last fiscal, starting with demonetisation and then, the BS III to BS IV transition.

“The thing to note is that the industry was already making BS IV vehicles for a long time, and so we weren't deliberately interested in prolonging BS III vehicles. Many Tier 2 and Tier 3 regions continued to see the demand for BS III vehicles and while we were allowed to manufacture vehicles until March 31, it was the court's orders, which came in abruptly to cease registration of BS III vehicles from April 1, 2017, and brought in the chaos.

“For FY2018, the country's switch to GST is a hugely welcome step, and the little gremlins until now are just a part of a learning curve on this larger journey."

According to Rajan Wadhera, vice-president, SIAM, "We have definitely seen some disruptions in the recent past. However, growth looks good for H1 FY2018, and with October having the festivals of Dhanteras and Diwali, we expect good numbers. Overall, the environment looks conducive for growth."

The domestic PV sales in Q2 of FY2018 have been on the positive trend, with an overall 13 percent growth over the Q2 of FY2017 and 18 percent over that of FY2016. Comparing domestic sales with other global markets, India lead the pack and sold a total of 2,124,173 units over the first eight months of CY2017 between January and August, posing a growth of 9.57 percent (Jan-August 2016: 1,938,692), followed by Japan, which grew by 8.99 percent, selling 2,703,901 units (Jan-Aug 2016: 2,480,817) in the same period.

While Brazil and China sold 1,351,168 units (+3.75%) and 14,807,400 units (+2.24%) respectively, the UK and the US saw negative growth, selling 1,640,241 units (-2.41%) and 4,131,044 units (-12.15%) respectively between January to August 2017.

FY2018 outlook

With a myriad of factors playing a part, the business environment looks positive for FY2018. Interest rates on car loans have come down with nationalised banks offering 9.5 percent in September 2017, a 0.6 percent drop from the 10.10 percent rate prevalent in the same month last year.

Commodity prices too have come down over the past six months, with major elements, including steel and natural rubber seeing a drop of 7.23 percent and 12.67 percent respectively from March until August 2017. While steel prices have gone down, prices of aluminium, copper and lead have seen a surge between 10-13 percent over the last six months, which is quite substantial.

On the other side, critical factors affecting the automotive industry showed a mixed trend, with a 5.7 percent drop in economic growth in Q1 of FY2017 at one end, along with a drop in CPI inflation to 4 percent for this fiscal (FY2017: 4.5%) due to control in food inflation. IIP growth too dropped to 1.2 percent in July 2017, as against 4.5 percent in July 2016, due to poor performance by manufacturing sector, especially the capital goods.

India's GDP is estimated to grow by 7% in FY2018 (FY2017: 7.1%) and industrial GDP is pegged to grow by 6.3 percent (FY2017: 5.6%).

Oil prices are expected to be higher in CY2017 and hover between $ 50-55 per barrel, as compared to $ 42 per barrel in CY2016, projecting higher cost of ownership.

With a strong rising trend in consumer patterns, UVs are set to score higher this fiscal.

Abrupt policy changes, including the recently rejigged compensation cess on luxury vehicles under GST, continue to create an environment of uncertainty for the industry.

The onset of the festive season and improved demand due to the implementation of the 7th Pay Commission in a few states are also going to be a driving force for sales in the coming future.

GST concerns

While the much-needed tax reform in the country has been opined to be as one of the most positive transformations ever for the industry, some areas still leave a bitter taste. The recent increase in cess cap for vehicles from 15 to 25 percent hints towards the lack of stability from government's end.

10-13 seater vehicles, which come under 87.02 standards, attract the highest GST rate which is 28 percent (and 15% cess), which was not the case with the previous regime. Ambulances based on such platforms also fall under the same category.

According to Dr Abhay Firodia, "India is the only country in the world where the harmonised code is disrupted to create a 10-13-seater category. Otherwise, all across the world, all vehicles above 10 seats are considered under public transport and are given tax relief. School buses plying in rural areas, which do not need to be of a high seating capacity, also fall into this category and this fundamental issue needs to be addressed immediately."

"Another important element is that road tax is also not subsumed under the GST, even though taxes like the octroi were subsumed", he addd.

Tax on used cars is again a major problem, wherein these cars now attract same tax rates as a new car. While the GST council has agreed to levy the tax only on the value added portion of a car's net worth, the rate of tax is still pretty high, encouraging more private P2P trading, enhancing the fuelling the un-organised sector.

Electrification and the 2030 target

Speaking about government's push for total electrification by 2030, Dr Firodia said, "While the auto industry wholeheartedly welcomes the prospect of electro-mobility, the question is that we need to bring everybody – industry, government and the academia – in the country to a single platform. It will take years, but that doesn't mean we have a lot of time at hand."

"The government has to establish a sense of clarity towards electro-mobility. A lot of development has to happen, including development of batteries, platforms and charging infrastructure. We accept this direction and are positive about it," he concluded.

(With inputs from Mayank Dhingra)

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

09 Oct 2017

09 Oct 2017

4832 Views

4832 Views