Honda breathes down Bajaj's neck as battle for No. 2 bikemaker intensifies

Barely 20,832 units separate the Japanese bikemaker from the home-grown major in FY2018.

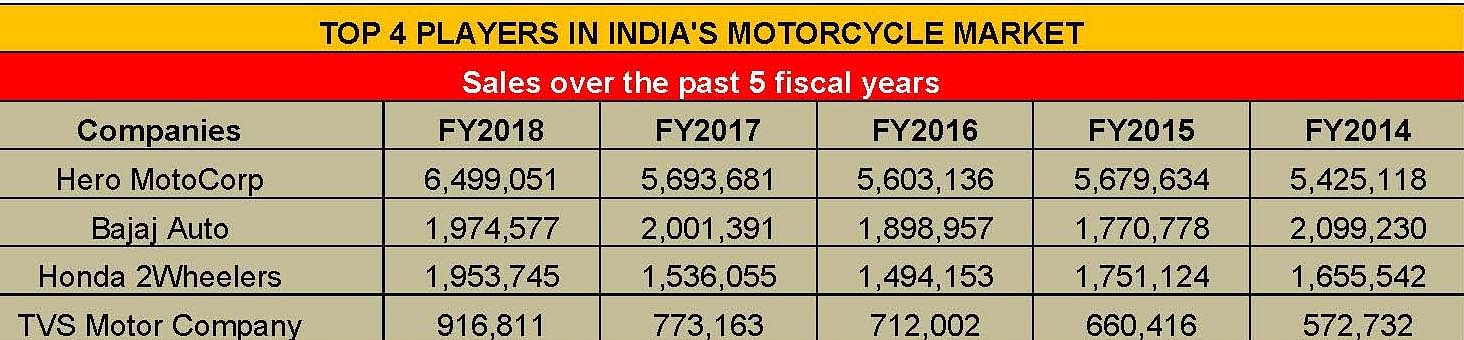

Honda Motorcycle & Scooter India (HMSI), India’s second largest two-wheeler company and also the largest scooter retailer, has had a good run in FY2017-18. The company’s domestic motorcycle sales have jumped from 1,536,055 units in FY2017 to 1,953,745 units in FY2018, recording impressive YoY growth of 27.19 percent.

The rate of amassing additional motorcycle volumes in the domestic market has brought Honda within arm’s distance of Bajaj Auto. Bajaj is India’s second largest motorcycle maker with potentially the industry-best EBIDTA margins in the business.

Bajaj Auto has more of a serious presence in the executive and premium commuter motorcycle segment (150cc and bigger) when compared to the entry-level mass commuter (100cc-110cc) category, which is dominated by Hero MotoCorp, India’s largest two-wheeler company.

In FY2018, the Pune-based Bajaj Auto has recorded domestic motorcycle sales of 1,974,577 units, down by 1.34 percent YoY. While Honda’s motorcycle market share has increased from 13.85 percent (FY2017) to 15.49 percent in FY2018, Bajaj Auto’s share declined from 18.04 percent (FY2017) to 15.65 percent in the last fiscal.

An Autocar Professional analysis of India’s top four motorcycle manufacturers, which together command a notable share of about 90 percent in the domestic motorcycle market (89.94 percent for FY2017-18), underlines a few interesting observations.

Barring FY2015-16, which appears to have been a hiccup in the domestic motorcycle sales performances of Hero MotoCorp and Honda, the sales growth has been linear over the last five years. Bajaj Auto has been an exception to this trend as its retail performance had breached the two-million unit mark twice during this period: once each in FY2014 and FY2017. However, the domestic retail performance appears to be sporadic instead of recording a linear growth YoY.

Meanwhile, the retail performances by the other three top players – Hero, Honda and TVS Motor – show linear YoY growth in their respective numbers.

Honda pumps up the 110cc-160cc model volume

Honda’s motorcycle portfolio across 110cc to 160cc categories has registered YoY growth during the last fiscal. For example, at the entry-level where Honda retails 110cc commuter models (Dream series, Livo), it has recorded sales of 559,888 units in the last fiscal, up by 18.74 percent YoY.

In the 125cc motorcycle category, where Honda is the industry leader through its CB Shine models, it has sold 987,271 units in FY2018. This marks YoY growth of 27.11 percent. In the bigger motorcycle category of 126cc- 150cc engine displacement, Honda has retailed 245,516 units, recording YoY growth of 53.94 percent. It primarily sells the 150cc CB Unicorn model in this category.

In the slightly more premium 160cc domain, where Honda sells the CB Unicorn 160, CB Hornet 160R and the recently launched X-Blade, it has recorded retail sales of 1,60,813 units. This marked a growth of 28.33 percent YoY.

Notably, Honda appears to have found its own hold in the 150cc - 160cc motorcycle segment, which once had only Bajaj Auto (via its Pulsar brand) and India Yamaha Motor (via its FZ series) as the only dominating players.

Over the years, the 150cc-160cc segment has expanded with the growing aspirations of the urban commuters. The category, although still dominated by Bajaj Auto, now has more potent rivals than ever before. TVS Motor Company, with its entry-level and largest selling Apache model – the RTR 160 variants, and Suzuki Motorcycle India with its Gixxer and Intruder 150 models are other two strong players in this space.

Meanwhile, a look at the motorcycle portfolio of Bajaj Auto clearly underlines that the company has not grown across its vast 100cc- 375cc motorcycle portfolio.

At the entry-level (100cccc-110cc), it has sold 951,530 units in FY2018, all thanks to the strong contribution from the CT100 and the Platina models. It grew by 13.78 percent YoY in this category.

Nevertheless, Bajaj Auto’s retail performance was down in 110cc-125cc and 125cc-150cc categories. It reported sales of 515,821 units in the 125cc-150cc category, its primary stronghold where its yearly performance shows a decline of 30.63 percent YoY. It is understood that this decline is caused by the flattening sales of the 150cc models (Avenger 150, V15) in correspondence with their peak sales immediately after their respective launch in the market.

On the other hand, in the premium 150cc-200cc category, the company has grown by almost 100 percent with sales of 2,13,428 units in FY2017-18 (FY2016-17: 1,07,450 units).

The demand for Bajaj-make motorcycles in the 200cc-250cc contracted with the company reporting sales of 148,076 units in this category. This is down by 11.26 percent YoY.

The retail sales of Dominar and KTM 390 variants together fetched 29,159 units to the company during the last fiscal. (FY2016-17: 15,860 units).

It can be estimated that the recent new additions such as the Discover 110, the Discover 125 and the Avenger Street 180 have helped the company continue to have an upper hand to Honda’s strong performance. Nevertheless, it is clear that Bajaj Auto has to move fast in terms of defining the future roadmap of its ageing brands such as the Pulsar, Avenger and Discover while consolidating the V portfolio and making the Dominar achieve the desired customer acceptance to continue being the second largest motorcycle player in India.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

13 Apr 2018

13 Apr 2018

5849 Views

5849 Views

Autocar Professional Bureau

Autocar Professional Bureau