Higher fuel taxes to dent motorists’ savings from lower oil prices globally

Covid-19 outbreak worries led to a 50 percent decline in crude price internationally but increased taxes on petrol and diesel by Rs 3 per liter and subdued mobility may take the cheer away from fuel retailers and automobile users in India.

The crude prices recovered some ground after days of sharp slides, possibly stoked by indications of economic stimulus being considered by several countries globally to tackle the impact of the Covid-19 impact. Oil prices have fallen by more than 50 percent since the start of the 2020. But Indian automobile users are unlikely to benefit much given the excise duty levy on petrol and diesel.

The Brent crude prices gained a little over $2 per barrel in early Thursday trade after continued downturn for close to a week. However, analysts expect the surge to be short term as there are enough indicators of it tumbling down further. Sentiment got a further dent after Saudi Arabia and UAE declared an increase in oil production April onwards following Russia’s fallout with rest of with OPEC.

Attempt to shore up gains by the Government

But the impact could be significantly lower for Indian automobile users. This is because the government has increased taxes on petrol and diesel by Rs 3 per liter each, a move that is aimed to shore up the government coffers. The special excise duty has been hiked by Rs 2 per liter, road-cess was increased by Rs 1 per liter on the fuels, according to a notification issued by the Central Board of Indirect Taxes and Customs (CBIC). After the latest hike, the excise duty on petrol has gone up to Rs 22.98 per liter from Rs 19.98 per liter and that on diesel to Rs 18.83 per liter from Rs 15.83 per liter.

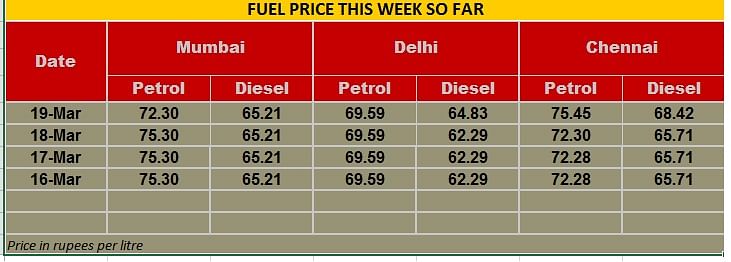

The petrol prices on Thursday stood at Rs 69.59 in Delhi and at Rs 72.29, Rs 72.30 and Rs 75.45 in Kolkata, Mumbai, and Chennai respectively.

Importance of taxes on petro-products

Excise duty has contributed around 83%, 77% and 76% during FY18, FY19 and FY20(9M) to the total tax/ duties on crude oil and petroleum products and around 68%, 62% and 67% of the total contribution to central exchequer (which includes dividend paid the Government/ Income tax etc.) in the same period, according to a CARE Ratings report.

Prior to the increase in excise duty on these transportation fuels a month ago (as of February 16), the Central and the individual state governments were collecting around 107% taxes, (Excise Duty and VAT) on the base price of petrol and 69% in the case of diesel. Now the government will be collecting around 134% taxes, (Excise Duty and VAT) on the base price of petrol and 88% in the case of diesel.

However, analysts at CARE Ratings claim that they do not expect the Central government to collect a sizable amount from this excise duty revenue given the current economic situation and subdued consumption of petrol and diesel due to the limited mobility in the wake of the Covid-19 outbreak. Consumption of petrol and diesel has been around 8.2% and 1.1% (April-February) as compared with it being 8.1% and 3.2% in the corresponding period a year ago.

RELATED ARTICLES

VinFast’s second plant in Vietnam goes on stream ahead of India factory

Vietnamese EV maker’s second plant in its home market, which has a 200,000 EVs-per-annum capacity, will focus on produci...

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

New ZF SELECT e-drive platform gives EV makers a choice in 100 to 300 kW range

Modular e-drive platform optimally matches 800-volt overall system and components such as the electric motor and power e...

19 Mar 2020

19 Mar 2020

4068 Views

4068 Views

Autocar Professional Bureau

Autocar Professional Bureau