GST: SUVs and luxury cars gain but others don’t lose . . . much

The overall impact of the final GST rates on the automobile sector is positive. While there will be a marginal price rise for small cars, the big beneficiaries will be SUVs and large cars, which see reduced taxation between 5-7 percent.

The impact of Goods & Services Tax (GST) in the automotive sector is getting clearer now. Earlier today, the GST Council fixed the final rates for over 1,200 items including automobiles. As a single indirect tax for the whole nation, GST essentially is only one tax from the manufacturer through to the consumer, making the taxation process transparent and India into one unified common market.

Contrary to industry expectations, there are no hiccups; instead, the overall impact on the automotive sector seems to be on the positive side with the major gainer being the SUV and luxury car segments. Speaking to Autocar Professional, Binaifer F Jehani, director, Industry & Customised Research, CRISIL Research, said: “We were expecting GST to benefit mainly the consumer goods segment but three segments have seen the maximum benefit – soaps, hair oils and surprisingly SUVs. We expect benefits to the SUV segment in the range of 5% which will further improve sales of SUVs in the passenger vehicle segment.”

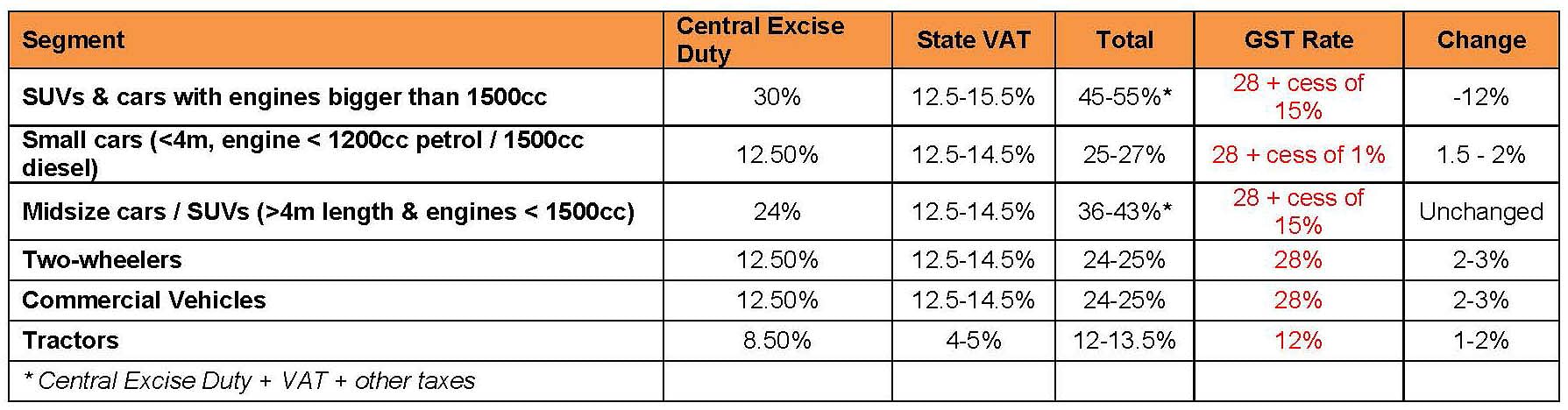

The SUV segment, which has seen handsome growth of 29.91% in FY2017, is currently subjected to a heavy tax structure of around 55 percent – SUVs and large cars with engines bigger than 1500cc. Now, implementation of GST will effectively reduce this to 43 percent – 28 percent GST plus 15 percent cess. Clearly, this will act as a huge fillip to SUV as well as luxury car sales.

Marginal impact on Passenger Vehicles

Mid-segment cars (sedans and SUVs with engines less then 1500cc), which are already taxed at around 43 percent, will not be impacted greatly due to the implementation of GST.

With two-wheelers, three-wheelers and small cars set to see a marginal increase of 1-2% tax (28% GST + 1-3% Cess), the impact is expected to be negligible. Effect on consumer sentiments is expected to be negligible as dealers and OEMs usually tend to offer benefits to the consumer in the range of 1-2 percent.

Negligible impact on Commercial Vehicle sector

The Commercial vehicle segment, which currently is taxed at around 12.5 percent excise plus 12.5-14.5 percent State VAT, will see a flat GST tax of 28 percent. The difference of 1-2 percent ies estimated to have little or negligible impact on the segment.

Hybrids attract highest rate slab

According to Sarika Goel, Tax Partner, EY India, GST on electric vehicles (EVs) and tractors has been kept at the lower rate band of 12 percent. However, the manufacturers of such vehicles would face an inverted duty structure with major inputs liable to GST at either 18 or 28 percent. Though refund of excess input GST would be available, there could be significant working capital blockage for such sectors.

Also, hybrid vehicles are proposed to be taxed at the highest GST rate bracket of 28 percent plus a cess of 15 percent. This could act as a dampener for OEMs proposing to invest in hybrid technology and adversely impact sale of such vehicles, unless a subsidy is separately given by the government to offset such tax incidence.

Components taxed at 28 percent

Automotive components are proposed to be taxed at 28 percent GST. This could push up cost of aftersales service and maintenance of vehicles, coupled with a possible increase in tax rate for services as well from 15 to 18 percent.

SIAM welcomes new GST rates

Apex industry body, Society of Indian Automobile Manufacturers (SIAM) has welcomed the new GST rates on automobiles. “The rates are as per the expectations of the industry and almost all segments of the industry have benefitted by way of a reduced overall tax burden in varying degree. This will pave the way for stimulating demand and strengthening the automotive market in the country, paving the way for meeting the vision laid down in the Automotive Mission Plan 2016-26,” said Vinod Dasari, president, SIAM.

“The government has done well to ensure stability in taxation while at the same time moderating the taxes wherever they were too high,” he added. “Differential GST for electric vehicles will also help electric mobility to gain momentum in India. We would have liked to see a similar differential duty on hybrid vehicles to continue."

“The government has encouraged environmentally friendly technologies and with the current focus on reducing emissions of greenhouse gases and reducing carbon footprint, one would have expected the lower taxation to continue on such vehicles in a technology agnostic manner," said the SIAM president.

“The inclusion of 10-13-seater vehicles used mainly for public transport in the same tax bracket as luxury cars with a 15 percent cess is also unexpected and may merit a review,” concluded Dasari.

RELATED ARTICLES

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

New ZF SELECT e-drive platform gives EV makers a choice in 100 to 300 kW range

Modular e-drive platform optimally matches 800-volt overall system and components such as the electric motor and power e...

Daimler India CV and BharatBenz deliver 200,000th truck

Daimler India Commercial Vehicles' portfolio includes truck models ranging from 10 to 55 tonnes for a wide variety of ap...

19 May 2017

19 May 2017

10168 Views

10168 Views

Autocar Professional Bureau

Autocar Professional Bureau