Festive October uplifts mood at India Auto Inc but full recovery some time away

Domestic passenger vehicle sales registered a 14 percent uptick with two-wheelers growing by 17 percent. Numbers for the troubled CV sector not released.

With the global economy and business ecosystem trying to regain normalcy after the body blow of the Covid-19 pandemic, any move that spurs positive sentiment is good news. October 2020, which marked the beginning of the festive season in India, was one such month that seems to have helped uplift the mood especially for the auto industry. Even if they happen to be a high level of OEM despatches to their dealers as compared to the on-ground retail market situation.

With Navratri, Dussehra and Eid being celebrated last month, albeit in a low-key manner, OEMs despatched a healthy number of newly-built vehicles from factories to dealers, anticipating good demand to break the dampened market sentiment prevalent over the last few months.

A number of vehicle manufacturers also executed their strategic plans of introducing new models at attractive price points to compel buyers to visit their showrooms. Some examples include the Kia Sonet launched on September 18, Mahindra Thar on October 2, and the HondaH'ness CB350 launched on October 8.

Hyundai's all-new third-generation i20 and Royal Enfield's Meteor 350 are also just in time for the mega Diwali festival coming this weekend.

Passenger vehicle sales up 14%

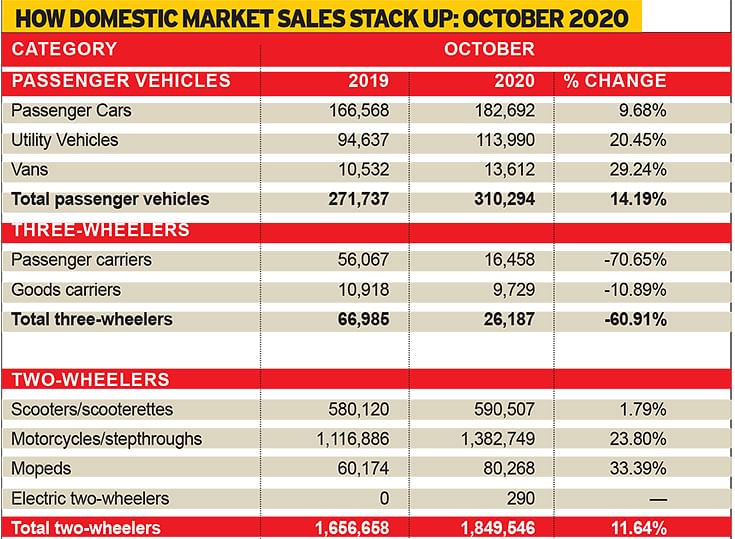

As per the consolidated industry data released by apex industry SIAM (see detailed table below), passenger vehicle sales registered a 14.19 percent year-on-year (YoY) uptick in October 2020 at 310,294 units (October 2019: 271,737).

Of this, the number of passenger cars despatched to dealers stood at 182,692 units (166,568 / +9.68%). The utility vehicle segment, which is currently firing on all cylinders, grew substantially to 113,990 units (94,637 / +20.45%). Vans brought up the rear with a noticeable growth of 29.24 percent.

Two-wheeler desptches grow 17%

With the need for affordable personal mobility at an all-time high and the rural economy swinging back into action on account of a good harvest, demand for two-wheelers is expected to take the fast lane to growth, particularly commuter motorcycles.

As a result, at 2,053, 814 units (1,757,180 / +16.88%), the two-wheeler segment recorded a strong uptick. Motorcycle despatches from two-wheeler manufacturers to dealers at 1,382,749 units (1,116,886 / +23.80%), formed a sizeable chunk of the overall vehicle sales across segments last month.

With urban India yet to start ticking consistently, demand for scooters is still to pick up. Reason enough to know why the scooter segment posted marginal 1.79 percent growth at 590,507 units (October 2019: 580,120).

Moped sales registered a significant YoY uptick of 33.39 percent at 80,268 units (60,174), clearly showing the resurgence of the rural economy.TVS Motor Co is the sole moped manufacturer in the country, which releases its monthly sales numbers.

According to Rajesh Menon, director general, SIAM, “The month of October saw continuity in sales growth trajectory, drawing on from the previous month. There were marked improvements witnessed across certain segments due to very good festive demand."

Retail’s a different tale

All the numbers detailed above are wholesale figures, which have brought smiles to OEMs who are pointing out the green shoots of recovery. However, the on-ground situation with respect to actual vehicle retails tells a different story.

According to Vinkesh Gulati, president, FADA, “October continues to see positive momentum on a month-on-month basis but on a yearly basis the negative slide continues to increase. The nine-day Navratri period witnessed robust vehicle registrations but could not save October to go in red as compared to last year when both Navratri and Diwali were in the same month.”

The statement of the automobile dealer association's president comes on the back of a slump in new vehicle registrations, which, at 1,413,549 units, dipped a significant 23.9 percent last month, despite OEMs being optimistic and despatching high volumes to their retail partners.

While PV registrations at 249,860 units were down 8.80 percent (October 2019: 273,980), two-wheelers dropped 26.82 percent to record 1,041,682 vehicles getting registered (1,423,394).

Cumulative April-October sales down 30%

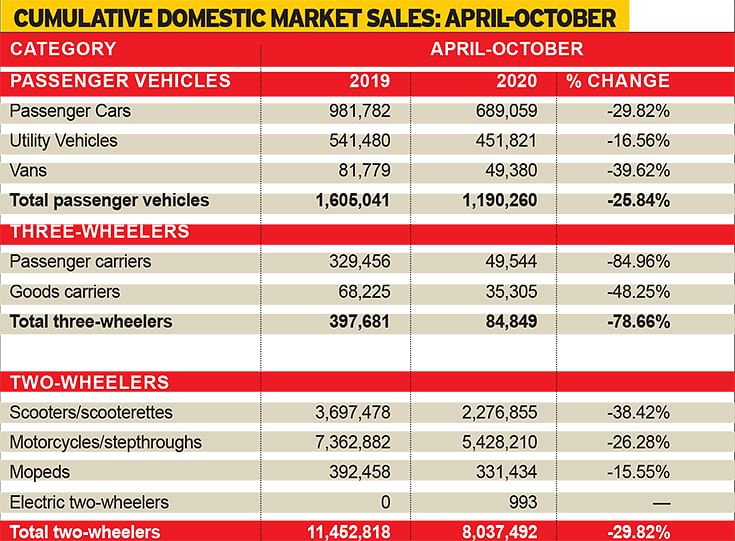

The reality of a sales decline resonates in the mid-term, seven-month April-October 2020 sales performance numbers of the industry, which depict an overall drop of 25.84 percent in total passenger vehicle sales at 1,190,260 units (April-October 2019: 1,605,041).

Of this, passenger cars dipped 30 percent to 689,059 units (981,782) while UVs were slightly better at a 17 percent de-growth to push their tally to 451,821 units (541,480) – driven by new launches such as the Hyundai Creta and Kia Sonet.

On the two-wheeler front, the segment recorded overall sales of 8,037,492 units (April-October 2019: 11,452,818 / -29.82%). While scooters registered a near-40 percent drop to reach total sales of 2,276,855 units (3,697,478), motorcycles were lesser impacted to go home to 5,428,210 buyers (7,362,882 / -26.28%).

The trend matches with what Gulati says that while new launches are pulling continued demand in the PV space, the entry-level motorcycles witnessed lean demand in the two-wheeler segment.

So, coming to a conclusion, even though the festive mood has rejuvenated buyer sentiment, giving a glimmer of hope to the industry, the recovery is still some time away. According to Tarun Garg, director, Marketing and Sales, Hyundai Motor India, who spoke at the recent launch of the new Hyundai i20, “Even though demand is there, it could largely be pent-up from postponed purchases from March when the Covid-19-induced nationwide lockdown was enforced, shutting business activities throughout the country. It is estimated that about 10 lakh people postponed their car-buying decision between March and June 2020, which will bring continued market demand through to end-March 2021.”

“However, it would be too early to say that the industry has fully recovered and we would need to be monitoring the market and the economy for a longer time,” the marketing expert had explained.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

12 Nov 2020

12 Nov 2020

5259 Views

5259 Views

Autocar Professional Bureau

Autocar Professional Bureau