FADA voices concern about industry de-growth in festive season

Unexpected dip in sales during Dussehra and Diwali erases strong growth achieved till September 2018; apex dealer body worried about consumers delaying purchase decisions and growing inventory levels particularly of PVs and two-wheelers.

The slowdown in vehicle sales over the past couple of months, particularly for passenger vehicles and two-wheelers, has got India Auto Inc worried. Changing market and consumer dynamics, the advent of shared mobility, high fuel prices and bank interest rates as well as insurance premium are impacting sales.

FY2018 was a good year for the industry, what with overall numbers falling a tad short of the 25 million mark – 24,972,788 units (+14.22%) – with passenger vehicles (3,287,965 / +7.89%), CVs (856,453 / +19.94%), three-wheelers (635,698 / +24.19%) and two-wheelers (20,192,672 / +14.80%) all recording robust growth.

Seven months down the line, the scenario is rather different. For the April-October 2018 period, the pace of growth has slowed down: 16,655,740 (+11.64%). The impact is more for PVs and two-wheelers. PVs (2,028,529 / +6.10%), CVs (574,463 / +31.97%), three-wheelers (423,762 / +31.97%), two-wheelers (13,628,823 / +11.14%).

While captains of industry have already said that given the current trend, India could be looking at single-digit growth in FY2019, now the Federation of Automobile Dealers Associations (FADA) has voiced its concern over the dampened festive season and the de-growth which the Indian automobile Industry is currently staring at.

PV sales down by 14%, 2Ws by 13% in festive season

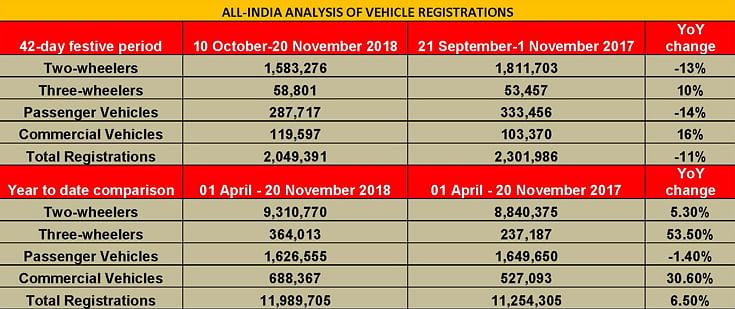

The apex dealer body today released sales trends, based on vehicle registration figures from Navratri to 15 days after Dhanteras due to the time lag of 10-12 days between delivery and registration, for the first time. This data, collated from its members and other sources, indicates vehicle registration trends during the festive season and covers almost 80 percent of the country.

The study data reveals that during the 42-day festive period and on YoY basis, total vehicle registrations fell by 11%, two-wheelers fell by 13 percent and PVs were down by 14%. However, three-wheelers and CV sales bucked the trend and grew by 10 percent and 16 percent respectively.

For the current fiscal (up to November 20, 2018 and YoY basis), total vehicle registrations have grown by around 6 percent, two-wheelers by 5 percent, three-wheelers by 53 percent and CVs by 30 percent. PV registrations have de-grown by more than 1 percent.

Here’s the big worry: Inventory levels before the festivals began were at around 60 days and 50 days for two-wheelers and PVs respectively; this came down to around 50 and 45-days after the festive season and remains higher than normal at present.

Commenting on the Navratri and Diwali festival sales, FADA president Ashish Harsharaj Kale said, “We have not seen such a dull festive season in the past few years. Many negative factors came into play during this season, which weakened consumer sentiment and postponed their purchase decision. It is a matter of deep concern for our dealership community. Higher de-growth was seen in the Navratri and Dussehra festivals, especially in the two-wheeler and passenger vehicle segments. With fuel prices starting their downward trend in end-October, the Diwali season saw a sales pptick, especially in 2Ws, but overall, we have seen unusual de-growth during the combined festive period, both in 2Ws and PVs. Dealer inventory levels in both these segments have risen substantially as a result of this and is a matter of great concern. Commercial vehicle sales, which have been growing at a very good rate, still remained positive in their sales growth but some demand softening could be seen in CVs too as the growth percentage has come down during this period.”

Kale further added, “The ongoing NBFC liquidity issue also is a concern for all vehicle segments. We have seen a cautious approach from NBFCs to the 2W and CV segments during and after Diwali season. FADA hopes that with the recent liquidity measures taken by the RBI and the government, auto NBFCs and banks would be better placed to continue their strong support to auto retails, which contributed majorly for the industry to grow at a healthy rate from April-September. We request the government and the RBI for further ease of liquidity for auto NBFCs, as they are one of the key growth drivers in auto retail and are also operating in a less riskier business environment than infra and housing NBFCs due to the short repayment cycle of auto loans and the mobility of the assets.”

Concluding on a positive note, the FADA president said, “We remain hopeful of recovery as overall inquiries during the festive period were robust, and postponement of purchase was the main reason for muted sales. With positive policy measures, the possibility of consumer sentiment turning positive is quite strong as the agriculture produce is now coming to the markets, fuel prices are coming down substantially and infrastructure growth is still going strong as well as positive liquidity measures are being taken.”

Also read: Tepid Q2 impacts H1 sales, OEMs look to ride on festive season demand

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

23 Nov 2018

23 Nov 2018

8396 Views

8396 Views