FADA cautions about rising 2W, CV inventory levels

While passenger vehicle inventory is down to a healthy 21 days, dealers stocking two-wheelers and commercial vehicles are saddled with much higher inventory. FADA calls upon OEMs to regulate wholesale billing.

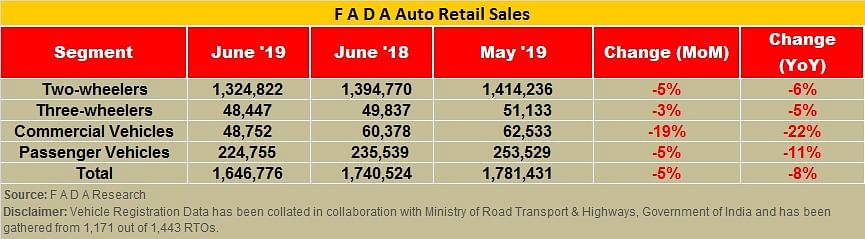

The Federation of Automobile Dealers Associations (FADA) has released the monthly vehicle registration data for June 2019, which saw overall auto sales at 1,646,776 units, a decline of 5.4 percent YoY and 7.6 percent on a month-on-month basis.

Commenting on the dealer industry’s June 2019 performance, Ashish Harsharaj Kale, president, FADA said, “Despite starting the month with a positive outlook, monthly sales ended in de-growth due to continued liquidity tightness and a much-delayed monsoon. Even though enquiry levels were reasonably strong, retail sales got affected as consumer sentiment continued to be weak and purchase postponement was seen across all segments.”

In terms of retail sales for Q1 FY2020, overall numbers were 5,116,718 units, a drop of 6 percent YoY, that saw CV sales taking the maximum hit (175,304 units in Q1 FY2020 vs 203,823 units in Q1 FY2019). This was followed by two-wheeler sales at 4,064,903 units (-6.4%) and PVs at 728,785 units (-1%).

PV inventory levels reducing, 2Ws and CVs stock worrying

The retail body says that PV manufacturers continued to reduce wholesale billing to dealers as well as regulated production in June, which helped dealers to address their high inventory levels. With the trend continuing for a couple of more weeks, inventory in PVs will for the first time since the downturn will come down to healthy levels of around four weeks across many markets and will be at the FADA-recommended level of 21 days or three weeks, which will help dealers in managing their viability and profitability better.

However, FADA has called upon two-wheeler and commercial vehicle manufacturers to regulate wholesale billing to get dealer inventory levels to 21 days, as both inventories have risen to alarming levels. Two-wheeler dealers, especially, have been challenged by a sustained high stock situation from September 2018, which also marked the start of the downturn. With the ongoing market pressure and premium on dealer working capital coupled with falling sales, FADA says the on-ground situation could take a turn for the worse if OEMs do not take correction action speedily.

Near-term outlook remains negative

According to the FADA president, due to the delay in monsoon in June and uneven spread in the first half of July, the near-term outlook (4-6 weeks) remains negative as weak consumer sentiment and tight liquidity conditions persist. He said that FADA will once again engage with policymakers, calling for urgent measures to support the auto industry to return to growth path. These include partial or temporary reduction of GST, an attractive scrappage policy and, most importantly, liquidity easing.

Kale said: "We will pursue its implementation, putting forward our logic for these measures to government. FADA believes that with easier liquidity and the positive steps taken in Budget 2019 along with an average monsoon will get back stability in auto sales towards by end-August. And as we head towards the festive season, the industry will return to its growth trajectory."

Liquidity issues continue to dog industry

According to Kale, liquidity still continues to vex dealers, both at the retail front as well as for dealer working capital. With NBFCs and banks still in cautious mode, normalcy in lending is required if industry has to return to growth road.

"We hope that with the recapitalisation of nationalised banks announced in Budget 2019 as well as the Rs 1 lakh crore funding window opened up for stable NBFCs, we will see the over-cautious approach diminish.”

Long-term growth story intact

The FADA president says the long-term outlook remains positive. “With a vehicle penetration of less than 30 cars per thousand, the growth story of Indian auto sales will continue for the next decade and beyond. Asian markets like Malaysia, Indonesia, Thailand, Philippines and Sri Lanka, which have similar or lower economic growth than India, have a far higher vehicle penetration and their auto sales are still growing. India’s ever-growing road network that connects every corner of our country to the mainstream backed by continued infrastructure growth will mean the Indian automobile story will continue to flourish as would auto dealerships, which are the delivery arm of this growth. The current situation, despite being worrisome, is temporary and the fundamentals of India continue to remain strong.”

Key findings of online FADA member survey

On current sentiments of the industry: 56 percent dealers rated it as Bad (43% in May 2019), while 39 percent rated it as Neutral (54% in May 2019).

On liquidity in the market: 46 percent dealers rate it as Neutral (57% in May 2019), while 46 percent rated it as Bad (36% in May 2019).

Current inventory: Average inventory for PVs ranges from 30–35 days (35-40 days in May 2019)

Average two-wheeler inventory: From 60–65 days (55-60 days in May 2019)

Average CV inventory: From 55-60 days (45-50 days in May 2019).

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

16 Jul 2019

16 Jul 2019

9944 Views

9944 Views