CV sales record sharp decline in May, may drive in slow lane till September

If the PV sector is seeing a marked downturn, what’s worrying is that commercial vehicles, seen as the barometer of the economy, are bearing the brunt of a slowing GDP.

The alarm bells are ringing loud and clear for India Auto Inc. If the passenger vehicle (PV) segment is feeling the heat of a slowing GDP, rural market distress, poor consumer sentiment and the impact of shared mobility in urban India, then the commercial vehicle sector, considered the barometer of the economy, looks to be breaking into a sweat.

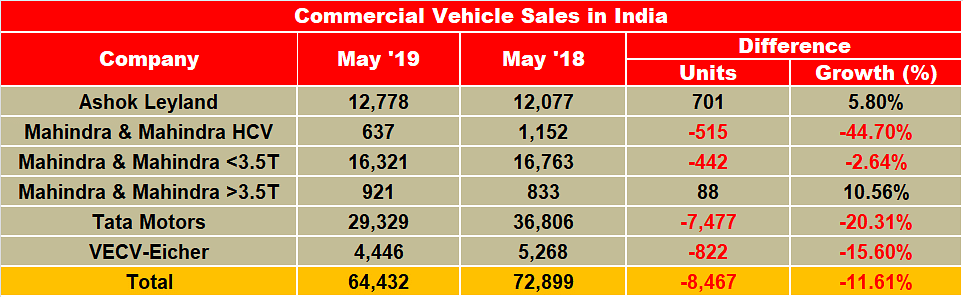

Having crossed the million units sales mark for the first time ever in FY2019, with YoY growth of 17.55 percent and the best performance of all the vehicle segments in the last fiscal, it was felt the CV sector would maintain its numbers and keep its head above water. But the first month of FY2020 – April 2019 – with sales of 68,680 units (-5.98%) gave a glimpse of upcoming slow growth. And, from the first sales figures released by CV makers for the month of May 2019, the decline is even sharper.

The medium and heavy commercial vehicle (M&HCV) segment is the worst hit with the steep sales decline indicating slower activity in the economy. The government data, released a couple of days ago, estimates that the January-March quarter of FY2019 recorded 5.8 percent of GDP growth, the lowest in the past five years and putting the brakes on the overall economy. Clearly, the economy and the auto industry needs a fiscal stimulus from the new government.

IFTRT, which tracks the truck movement of goods across 75 key truck routes across India, says truck rentals continued to slide in May between 11-15 percent despite the peak summer fruit, vegetables, wheat, and other crops harvesting season. “Due to the gradual slump in factory output, checkered working in the infrastructure sector and exports, the freight market is flushed with over-supply of cargo vehicles in the open freight market, resulting in a fall in heavy truck sales. In May, ICV and LCV sales turned negative; truck sales, despite soft funding options, may remain benign till H1. What’s more, there is a possibility of delinquency in payment of EMIs by truck owners, a position that may gather steam leading to high repossession of defaulting heavy goods carriers,” observes IFTRT in its monthly report.

According to CV market leader Tata Motors, “The market sentiment remains weak due to depressed freight rates and underutilisation of truck(s). The slowing economy and stagnant industrial output have also dragged down CV sales in recent months. The demand for M&HCV trucks continues to be weak on the back of excess freight-carrying capacity of MHCV parc, which got increased by more than 20 percent after the revised axle load norms without the commensurate increase in freight availability.”

How the OEMs fared in May

Tata Motors’ overall sales in the domestic market were down 20 percent at 29,329 units (May 2018: 36,806). The key M&HCV truck segment has come under pressure and yet again corrected by a massive 38 percent in the month to a new low of 7,683 units (May 2018:12,424). Even the tipper segment, which has thus been seeing good growth, has dropped by 22 percent to 2,539 units compared to the year-ago period.

The Intermediate LCVs (ILCVs) have also come under pressure, dropping by 2 percent to 4,043 units. ILCVs, for whom E-commerce and discretionary consumption have been the two main drivers, are relatively less impacted by the revised axle load norms.

The new products introduced in the fast-growing 15-16 tonne segment and CNG products have been well accepted by the customers and now contribute to over 10 percent of volumes for Tata Motors. Sales of cargo SCVs and pickups are down by 18 percent to 12,695 units in May 2019. The company has now introduced the new Intra compact truck to take on the competition, in a bid to revive its position in the fast-growing small CV cargo segment. If Tata has something to smile about, then it is the commercial passenger carrier (bus) segment sales, which recovered after a high drop in April and sold 4,908 units in May 2019 (+4%). This uptick is due to the demand for school buses, with the new academic year having begun across India.

Commenting on the sales in May 2019, Girish Wagh, president, Commercial Vehicles Business Unit, Tata Motors said, “Tata Motors’ CV business sales in the domestic market in May registered a drop of 20 percent. M&HCV sales have taken the maximum hit, declining by 38 percent, at 7,683 units, essentially due to higher capacity after increased axle load, not yet matched by commensurate freight growth. The commercial passenger carrier segment sales was higher by 4% over last May. The school season has pushed up demand and is expected to be positive in the next month too. We are expecting an improvement in the economic conditions in the coming months and look forward to an improved buying sentiment.”

Ashok Leyland registered 6 percent growth in its overall domestic sales in the month to 12,778 units (May 2018: 12,077). Its overall M&HCV sales are down 4 percent to 8,635 units; while truck numbers are down marginally by 2 percent, bus sales saw de-growth by 12 percent. The good news for the company is its popular Dost trucks continue to see demand. They sold a total of 4,143 units, up by 34 percent YoY (May 2018: 3,101).

Mahindra & Mahindra’s overall CV sales are down by 5 percent to 17,879 units (May 2018: 18,748). The company’s M&HCV sales dropped sharply by 45 percent to 637 units. While the below-3.5T GVW segment sold 16,321 units and down 3 percent YoY (May 2018:16,763), those in the above-3.5T GVW segment sold 921 units (+11%).

According to Rajan Wadhera, president, Automotive Sector, Mahindra & Mahindra, “While consumer sentiment and demand continued to be subdued during the pre-election phase, our focus has been on correcting the channel inventory. Now, with a stable government at the centre and the forecast of a near-normal monsoon, we hope to see an improvement in consumer sentiment over the next few months.”

VE Commercial Vehicles' sales declined by 15.6 percent in the month. The company sold 4,446 units in the domestic market (May 2018: 5,268 units).

The coming months, which will see the onset and spread of the monsoon, will be crucial to the fortunes of CV makers. While there doesn't seem to be much hope of an immediate uptick in sales, OEMs would be looking forward to a fiscal stimulus from new finance minister Nirmala Sitharaman. All said and done, the CV industry, which is already engaged in the big technology shift to BS VI, will look to ride out the slowdown and hope sales traction returns by the time the festive season of Diwali comes up in October.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

04 Jun 2019

04 Jun 2019

21429 Views

21429 Views

Autocar Professional Bureau

Autocar Professional Bureau