Car sales slump in May amid slowing GDP, OEMs bank on fiscal stimulus to revive growth

High liquidity crisis, GDP down to a five-year low of 6.8%, rural market distress and the rise of shared mobility is hitting passenger vehicle OEMs hard. With a stable government at the Centre, industry hopeful of demand returning.

The third month of fiscal year 2020 has opened and it looks to be a tough year ahead for the passenger vehicle (PV) industry. The sector had closed FY2019 on a tepid note with total sales of 2,218,549 units (+2.09%). FY2020 opened on a poor note with April 2019 sales down 17.07 percent year on year to 247,541 units. Now, from the looks of it, May 2019 numbers could plunge even lower.

A combination of growth-impacting factors is at play and it could be a while before decent sales traction is achieved again. India's GDP growth has slowed down, pushing it behind China (+6.4%) in the fourth quarter of FY2019. Provisional estimates point to GDP growth in Q4 FY2019 to be 5.8 percent, which is a 20-quarter low. In comparison, GDP growth in Q4 FY2018 was 6.6 percent and a robust 8.1 percent in Q4 FY2017.

Clearly, the country's economy is slowing down and the impact is being felt in automobile sales. Paucity of jobs across the country, lower tractor sales, which is a clear pointer to slowing sales in rural India, and the speedy rise of shared mobility in urban India are all sales speedbreakers.

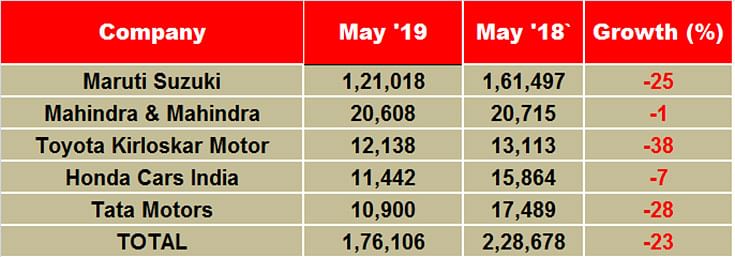

The barometer of India's PV industry is market leader Maruti Suzuki India. With a decidedly poor performance, for the second month in a row, the alarm bells are ringing loud and clear for the overall industry. In May 2019, the company sold a total of 121,018 units, down a substantial 25 percent over year-ago sales of 161,497 units. All PV sub-segments are in the red and consumer demand for the UV model line-up is also flagging now. Maruti's recent announcement to discontinue making diesel-engined cars from April 2020 is not helping consumer sentiment either, albeit it will bolster the competition to rev up its diesel car program.

Mahindra & Mahindra (M&M), with passenger vehicle sales of 20,608 units, posted de-growth of 1 percent (May 2018: 20,715). Commenting on last month's sales, Rajan Wadhera, president, Automotive Sector, M&M, said, “While consumer sentiment and demand continued to be subdued during the pre-election phase, our focus has been on correcting the channel inventory. Now, with a stable government at the centre and the forecast of a near-normal monsoon, we hope to see an improvement in consumer sentiment over the next few months.”

Toyota Kirloskar Motor sold a total of 12,138 units in the domestic market, which indicates a year-on-year sales decline of 7.43 percent. N Raja, deputy managing director, Toyota Kirloskar Motor, said, “Customer demand had witnessed a continued slowdown before the election results. Customers have been cautiously spending which has led to sluggishness in domestic auto sales. Added factors like liquidity tightening, high insurance costs, and increase in fuel costs have also weakened the retails. However, with the formation of a stable government now at the Centre, there is an increase in customer walk-ins after the election results announcement which would brighten the sales in upcoming months."

"We are excited about the upcoming launch of Toyota Glanza on June 6, it would mark our entry into the premium hatchback segment to cater to the growing demands of our existing and prospective customers. We are confident the Glanza backed by Toyota’s unique sales and service efficiency will create a new benchmark in the industry in customer delight.”

Honda Cars India reported despatches of 11,442 units in May 2019, down 27.87 percent. The carmaker though says last month's numbers have to be seen in the light of a higher base of May 2018 when the second-generation Amaze sedan was launched.

Rajesh Goel, senior vice-president and director, Sales and Marketing, Honda Cars India, said, “The market continues to be tough for the auto industry with two consecutive months of such a high de-growth. It is unprecedented in the last two decades. After elections, we were expecting an upswing which has not yet come. Factors like liquidity that is affecting capital to auto sector along with increase in fuel prices have remained a challenge to revive consumer sentiments. We are still hopeful that demand will revive due to pent up demand, favourable indicators on monsoon and expected actions by the new government.”

Tata Motors, which has had a good run in the PV marketplace for sometime now, too has been hit hard. In May 2019, the company despatched 10,900 units, down 38 percent YoY (May 2018: 17,489).

Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, said, " In view of higher vehicle stocks in network, our strategy was to focus on retails. While the market sentiments continued to be muted, our exciting products and micro segmenting strategy helped in improving retails. In May 2019, our retail sales have shown a growth of 11 percent over May 2018. Despite this challenging environment, our UV segment continues to grow at 13 percent on the back of a strong UV portfolio. We expect that post-election, industry will start improving gradually. In the months to come, we are positive to bounce back with our robust product line-up and strive towards driving volumes and increasing our market share as part of our ongoing turnaround journey."

Stable government in place, new finance minister takes charge

With the Narendra Modi government getting an overwhelming mandate to govern the country, India Auto Inc is hopeful of a growth stimulus coming its way. Nirmala Sitharaman, previously defence minister, has taken charge as the new finance minister. Sitharaman has her task cut out, of re-energising the economy, resolving the liquidity crisis which has bogged down growth and increasing governmental spend on developing infrastructure and reviving rural demand. Captains of industry are hopeful of her facilitating a fiscal stimulus to combat the slowdown.

It is something the Indian auto industry, which is currently grappling with multiple challenges in terms of upcoming BS VI emissions norms, meeting improved vehicle safety mandates and also fast-changing consumer preferences, will be looking forward to. Nonetheless, given the current state of sales in the auto industry, growth will continue to be in the slow lane for the next 4-5 months. This means little will change in the first half of FY2020 (April-September 2019). The first signs of revival of growth in the industry and the green shoots of recovery could happen around October, which also heralds the festival of Diwali. Will there be sales fireworks then? Watch this space.

Also read: Car sales in EU finally stabilise in April

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

01 Jun 2019

01 Jun 2019

11903 Views

11903 Views

Autocar Professional Bureau

Autocar Professional Bureau