British suppliers bullish on prospects in India’s aftermarket industry

Along with China, the world’s largest automotive market, India is the next big bet for the UK. India’s vehicle population is expected to double over the next 5-7 years to more than 50 million cars.

The British automotive aftermarket industry – read component suppliers – is very optimistic on business opportunities on emerging markets like China, India and the Middle East.

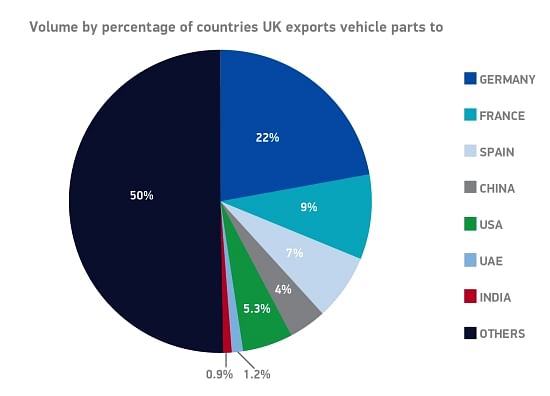

While it is well known that exports of the British-built cars are now seeing record levels, what’s less known is that its components are also in increasing demand. The UK exports around £4.6 billion (Rs 45,277 crore) worth of vehicle parts annually and now is looking to grow that business significantly. In 2015, UK-based suppliers shipped original equipment as well as aftermarket parts for all types of vehicles – from passenger cars to heavy trucks and equipment.

The size of the domestic automotive aftermarket is £21.1 billion (Rs 207,687 crore) and estimated to grow to £28 billion (Rs 275,604 crore) by 2022. The global aftermarket parts business is worth £500 billion (Rs 4,921,500 crore) which is why leading component suppliers from all over the world including India are currently at Automechanika Frankfurt, the world’s largest automotive aftermarket trade fair, to actively network and conduct business.

The Society of Motor Manufacturers and Traders (SMMT), which supports and promote the interests of the UK automotive industry at home and abroad, has released a report ‘International Opportunities for UK Aftermarket Companies ‘ today which charts out international opportunities for UK aftermarket companies in China, India and the Middle East (Saudi Arabia, United Arab Emirates, Bahrain, Qatar, Oman and Kuwait).

The report shows that international markets and in particular emerging markets, offer the biggest potential for growth. It shows that suppliers exporting to these regions can grow their businesses at rates four to five times higher than the annual 3% they can expect in the UK.

Commenting on the potential in China, India and the GCC region of the Middle East in his preface to the report, chief executive Mike Hawes says: “Together, these three aftermarkets are worth some £54 billion (Rs 531,522 crore), and with UK suppliers currently accounting for a market share of just 0.2%, the potential for growth is phenomenal. In fact, as this report finds, UK aftermarket companies could, even by just keeping pace with the market’s natural growth in these regions, double their income to £195 million (Rs 1,919 crore) over the next seven years.”

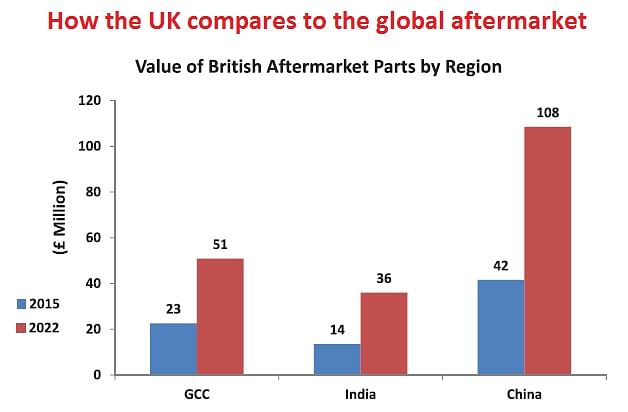

According to the report, China offers the biggest opportunity for British aftermarket firms. Home to 151.6 million cars and light commercial vehicles, it is set to surpass the US as the world’s largest vehicle parc within the next decade. UK suppliers produced parts worth some £41.5 million (Rs 408 crore) for the Chinese in 2015 and with the right conditions Frost & Sullivan estimates that British companies could grow their business here by 15% every year.

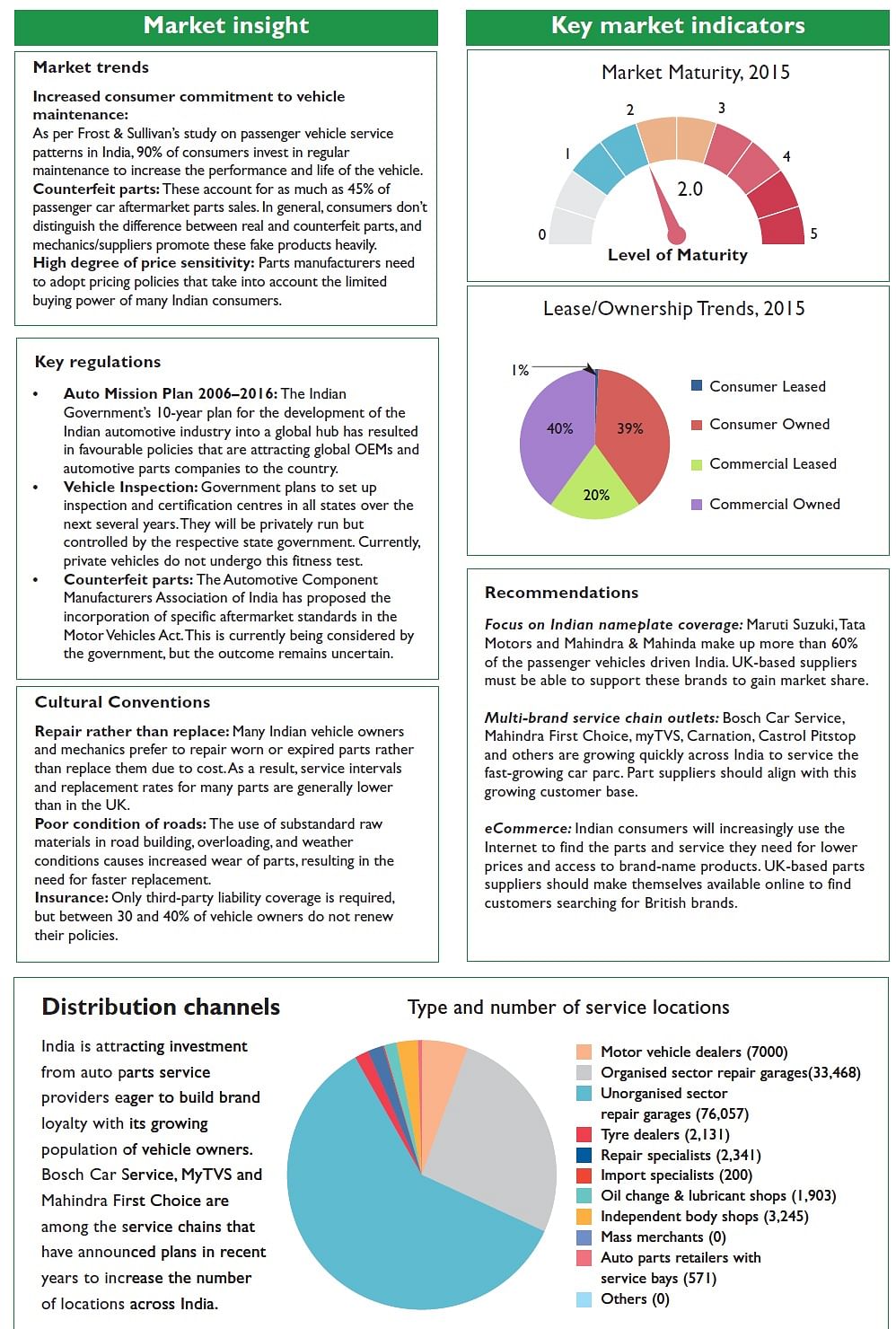

India, where quality UK-made parts are particularly sought after, also offers growth potential, with UK suppliers currently accounting for £14 million (Rs 137 crore) of the £6.7 billion (Rs 65,948 crore) market. Similarly, in the Middle Eastern GCC, where car owners are almost completely dependent on imported parts, there is scope for significant expansion to meet regional demand, estimated to be around £5.8 billion. To take advantage of these opportunities, UK-based suppliers, the report says, must navigate the unique cultural and regulatory aspects of these markets.

The report points out that with the vehicle population rising quickly in China, India and the Middle East,

British companies should seize opportunities to provide more of the spare parts needed to keep these cars on the road. Consumers in China and India are keen to gain access to high quality aftermarket parts as an alternative to poor quality counterfeits and the perceived high cost original equipment. In the Middle East, vehicle owners are almost completely dependent on imports for everything from brakes and filters to collision parts, under-the-bonnet components and accessories.

“British suppliers have considerable opportunities to build loyalty with a new and large group of potential customers throughout Asia and the Middle East. With proper research and planning, UK-based aftermarket companies can play a key role in modernising the automotive aftermarket industry in emerging regions and enjoy high growth rates for doing so,” says the study.

Why India?

Along with China, the world’s largest automotive market, India is the next big bet for the UK. India’s vehicle population is expected to double over the next 5-7 years to more than 50 million cars.

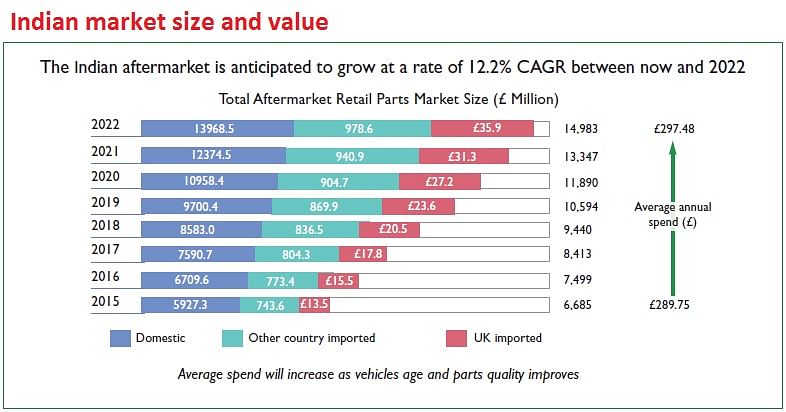

Frost & Sullivan expects parts sales of UK-based companies to India will grow by as much as 15% annually over the 2016-2022 period, or about five times more than the domestic British aftermarket.

Total parts revenue will grow from an estimated £6.69 billion to £14.98 billion over the 2015-2022 period, with tyres, lubricants and other parts replaced early in the vehicle lifecycle driving much of the growth.

UK suppliers sold parts worth about £14 million to the Indian aftermarket in 2015 – less than 1% of the country’s £6.69 billion consumption.

A unique feature of the Indian aftermarket, the report points out, is the strong presence of motorcycles and scooters as the primary mode of personal transportation. There are more than 150 million two-wheelers registered for use across India, compared with just 23.1 million cars.

Conclusion

The report concludes that the world’s total car and light commercial vehicle population is predicted to grow 25% from 1.11 billion in 2015 to 1.38 billion in 2022. A large majority of these extra vehicles will be driven in China, India and the Middle East, where increasing GDP and rising incomes will allow millions of people access to private automotive mobility for the first time.

“This means there will be a corresponding increase in demand for parts and services to keep these vehicles in operation. British companies can play a key role in helping consumers in these regions navigate the often-confusing automotive aftermarket and build a loyal base of new customers.

“Demand for alternatives to original parts, which may cost more than aftermarket products, and low-quality counterfeits continue to grow in the emerging regions of China, India and the GCC region. The door is open for UK-based suppliers to offer the value consumers deserve.

“UK-based parts suppliers are already supplying a wide range of products – including brakes, transmissions and electronic components – to emerging regions. However, British companies capture less than 1% (£78 million in 2015) of the aftermarket parts sold in China, India and the UK. But with average industry growth rates in the 10-15% range, there is the potential for suppliers to double their revenue over the next five to seven years just by keeping pace with the market as a whole. Suppliers exporting parts to emerging regions are seeing annual growth rates that are four to five times higher than the 3% they can expect in the UK.

To take advantage of these opportunities, UK-based suppliers will need to understand the unique cultural and regulatory aspects of these markets. This often means finding a local partner and, unsurprisingly, hiring employees able to speak the local language.”

Recommended: Strong Indian presence at Automechanika Frankfurt as suppliers seek new export markets

RELATED ARTICLES

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

New ZF SELECT e-drive platform gives EV makers a choice in 100 to 300 kW range

Modular e-drive platform optimally matches 800-volt overall system and components such as the electric motor and power e...

Daimler India CV and BharatBenz deliver 200,000th truck

Daimler India Commercial Vehicles' portfolio includes truck models ranging from 10 to 55 tonnes for a wide variety of ap...

By Autocar Professional Bureau

By Autocar Professional Bureau

14 Sep 2016

14 Sep 2016

5338 Views

5338 Views